Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

Finance articles from across Nature Portfolio

Latest research and reviews.

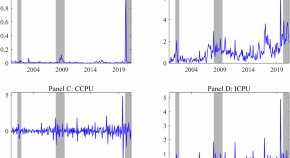

Modelling and forecasting crude oil price volatility with climate policy uncertainty

- Yaojie Zhang

Corporate social responsibility disclosure in Saudi companies: analysing the impact of board independence in family and non-family companies

- Ameen Qasem

- Bazeet Olayemi Badru

- Adel Ali Al-Qadasi

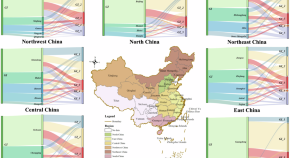

Role of green finance in regional heterogeneous green innovation: Evidence from China

Regional cultural inclusiveness and firm performance in china.

- Guangfan Sun

- Changwei Guo

Does the supply of tax information affect financial restatements? Evidence from the launch of Taxation Administration Information System III in China

- Ningzhi Wang

The impact of entrepreneurs’ wives participating in corporate management on company risk-taking

- Zengji Song

News and Comment

Hunger, debt and interest rates

Financial imperatives to food system transformation

Finance is a critical catalyst of food systems transformation. At the 2021 United Nations Food Systems Summit, the Financial Lever Group suggested five imperatives to tap into new financial resources while making better use of existing ones. These imperatives are yet to garner greater traction to instigate meaningful change.

- Eugenio Diaz-Bonilla

- Brian McNamara

Central bank digital currencies risk becoming a digital Leviathan

Central bank digital currencies (CBDCs) already exist in several countries, with many more on the way. But although CBDCs can promote financial inclusivity by offering convenience and low transaction costs, their adoption must not lead to the loss of privacy and erosion of civil liberties.

- Andrea Baronchelli

- Hanna Halaburda

- Alexander Teytelboym

ESG performance of ports

An article in Case Studies on Transport Policy quantifies the environmental, social, and governance performances of three ports.

- Laura Zinke

Venture capital accelerates food technology innovation

Start-ups are now the predominant source of innovation in all categories of food technology. Venture capital can accelerate innovation by enabling start-ups to pursue niche areas, iterate more rapidly and take more risks than larger companies, writes Samir Kaul.

Challenges for a climate risk disclosure mandate

The United States and other G7 countries are considering a framework for mandatory climate risk disclosure by companies. However, unless a globally acceptable hybrid corporate governance model can be forged to address the disparities among different countries’ governance systems, the proposed framework may not succeed.

- Paul Griffin

- Amy Myers Jaffe

Quick links

- Explore articles by subject

- Guide to authors

- Editorial policies

The American Finance Association

Publishers of the Journal of Finance

The Journal of Finance

The Journal of Finance publishes leading research across all the major fields of finance. It is one of the most widely cited journals in academic finance, and in all of economics. Each of the six issues per year reaches over 8,000 academics, finance professionals, libraries, and government and financial institutions around the world. The journal is the official publication of The American Finance Association, the premier academic organization devoted to the study and promotion of knowledge about financial economics.

AFA members can log in to view full-text articles below.

Volume 79: Issue 4 (August 2024)

Browse forthcoming articles, top 25 recent articles, top 50 articles of all time.

View past issues

Search the Journal of Finance:

Search term(s), date range (first published).

Journal of Economics and Finance

The Journal of Economics and Finance is the official journal of the Academy of Economics and Finance. It publishes theoretical and empirical research papers in economics and finance. Its primary focus is on empirical studies utilizing recent advances in econometrics with an emphasis on the policy relevance of the findings. Journal of Economics and Finance is currently published by Springer US, New York.

Societies and partnerships

Latest issue

Volume 48, Issue 1

Latest articles

Merger reasons and their impact: evidence from the credit union industry.

- Steven E. Kozlowski

- M. Kabir Hassan

- Michael R. Puleo

Herding behavior and digital trading during the crisis

- Zhang Hongxia

Does uniqueness matter for community banks?

- Eduardo G. Minuci

- Zachary Rodriguez

The relative CEO to employee pay for luck

- Chien-Ping Chen

- Yingxu Kuang

REITs board gender diversity: the spillover effect of the Big Three campaign

- Douglas Cumming

Journal information

- Australian Business Deans Council (ABDC) Journal Quality List

- Emerging Sources Citation Index

- Google Scholar

- OCLC WorldCat Discovery Service

- Research Papers in Economics (RePEc)

- TD Net Discovery Service

- UGC-CARE List (India)

Rights and permissions

Editorial policies

© Academy of Economics and Finance

- Find a journal

- Publish with us

- Track your research

arXiv's Accessibility Forum starts next month!

Help | Advanced Search

Quantitative Finance (since December 2008)

For a specific paper , enter the identifier into the top right search box.

- new (most recent mailing, with abstracts)

- recent (last 5 mailings)

- current month's listings

- specific year/month: 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 all months 01 (Jan) 02 (Feb) 03 (Mar) 04 (Apr) 05 (May) 06 (Jun) 07 (Jul) 08 (Aug) 09 (Sep) 10 (Oct) 11 (Nov) 12 (Dec)

- Catch-up: Changes since: 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 01 (Jan) 02 (Feb) 03 (Mar) 04 (Apr) 05 (May) 06 (Jun) 07 (Jul) 08 (Aug) 09 (Sep) 10 (Oct) 11 (Nov) 12 (Dec) 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 , view results without with abstracts

- Search within the q-fin archive

- Article statistics by year: 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008

Categories within Quantitative Finance

- q-fin.CP - Computational Finance ( new , recent , current month ) Computational methods, including Monte Carlo, PDE, lattice and other numerical methods with applications to financial modeling

- q-fin.EC - Economics ( new , recent , current month ) q-fin.EC is an alias for econ.GN. Economics, including micro and macro economics, international economics, theory of the firm, labor economics, and other economic topics outside finance

- q-fin.GN - General Finance ( new , recent , current month ) Development of general quantitative methodologies with applications in finance

- q-fin.MF - Mathematical Finance ( new , recent , current month ) Mathematical and analytical methods of finance, including stochastic, probabilistic and functional analysis, algebraic, geometric and other methods

- q-fin.PM - Portfolio Management ( new , recent , current month ) Security selection and optimization, capital allocation, investment strategies and performance measurement

- q-fin.PR - Pricing of Securities ( new , recent , current month ) Valuation and hedging of financial securities, their derivatives, and structured products

- q-fin.RM - Risk Management ( new , recent , current month ) Measurement and management of financial risks in trading, banking, insurance, corporate and other applications

- q-fin.ST - Statistical Finance ( new , recent , current month ) Statistical, econometric and econophysics analyses with applications to financial markets and economic data

- q-fin.TR - Trading and Market Microstructure ( new , recent , current month ) Market microstructure, liquidity, exchange and auction design, automated trading, agent-based modeling and market-making

Finance and Financial Data

- Analyst Reports

- Earnings Call Transcripts

- Private Companies & Startups

- Stocks & Bonds

- Deals and M&A

- Commodities

- ESG / Sustainability

- Real Estate This link opens in a new window

- Finding Financial Data

- Top-Ranked Finance Journals

Ask a Librarian

You will be connected with a business specialist first, if available.

A Selection of Top-Ranked Finance Journals

- Accounting Review

- Financial Analysts Journal

- Journal of Banking & Finance

- Journal of Corporate Finance

- Journal of Finance

- Journal of Financial Economics

- Journal of Portfolio Management

- Quantitative Finance

- Review of Financial Studies

Search NYU's Electronic Journal Subscriptions by Title

- Search by E-Journal Title

Resources for Finding Finance Scholarship

- ABI/INFORM This link opens in a new window ABI/INFORM features full-text journals, dissertations, working papers, key business, and economics periodicals. Researchers can locate country- and industry-focused reports, and its international focus provides a picture of companies and business trends around the world.

- Business Source Complete This link opens in a new window Business Source Complete is a full text database of articles from popular, scholarly, and trade publications. Subjects covered include management, economics, finance, accounting, international business. Dates of coverage: 1886 to present.

- Google Scholar This link opens in a new window Google Scholar is a central search for scholarly literature. It covers disciplines and sources, peer-reviewed papers, theses, books, abstracts and articles, from academic publishers, professional societies, preprint repositories, universities and other scholarly organizations.

- << Previous: Finding Financial Data

- Next: FAQs >>

- Last Updated: Aug 14, 2024 1:19 PM

- URL: https://guides.nyu.edu/finance

FinancialResearch.gov

Publications.

Our publications help promote a better understanding of the financial system and potential risks to financial stability

Our job is to shine a light into the dark corners of the financial system to uncover risks, assess their level of threat to financial stability, and provide policymakers with in-depth research and analysis so they can work to mitigate any issues discovered. The publications our research team produces include briefs, working papers, and more, and they help to promote a better understanding of financial markets and risks that may impair financial stability. Our analysts and researchers have a wide range of expertise that they draw on to provide analysis, briefings, and other products for the Financial Stability Oversight Council, its member agencies, and other stakeholders. Our publications may be quoted without additional permission.

Meet our research team

Papers in this series are designed for a broad audience and to explain the financial stability implications of recent developments in financial markets and financial institutions, as well as the effects of regulatory policies on the financial system. Comments and suggestions for improvements to these papers are welcome and should be directed to the authors. Views and opinions expressed are those of the authors and do not necessarily represent official positions or policy of the OFR or Treasury.

Our reports provide insights into financial stability and the OFR. Several fulfill statutory requirements to report annually to Congress on the state of the U.S. financial system. We also periodically publish other reports, either at our own initiative or at the request of the Financial Stability Oversight Council.

Staff Discussion Papers

Papers in this series cover a broader range of themes related to financial markets, financial institutions, and financial data – topics that are the building blocks of financial stability analysis. The papers in this series are works in progress and subject to revision. Comments and suggestions for improvements to these papers are welcome and should be directed to the authors. Views and opinions expressed are those of the authors and do not necessarily represent official positions or policy of the OFR or Treasury.

Viewpoint Papers

This series offers the views of the OFR. Viewpoint papers are designed for a broad audience and discuss our research, financial stability policies, and data initiatives.

Working Papers

Papers in this series are designed to disseminate findings from research that advances understanding of financial stability. The papers are in a format intended to generate discussion and critical comments. They are works in progress and subject to revision. Comments and suggestions for improvements to these papers are welcome and should be directed to the authors. Views and opinions expressed are those of the authors and do not necessarily represent official positions or policy of the OFR or Treasury.

You are now leaving the OFR’s website.

You will be redirected to:

You are now leaving the OFR Website. The website associated with the link you have selected is located on another server and is not subject to Federal information quality, privacy, security, and related guidelines. To remain on the OFR Website, click 'Cancel'. To continue to the other website you selected, click 'Proceed'. The OFR does not endorse this other website, its sponsor, or any of the views, activities, products, or services offered on the website or by any advertiser on the website.

Thank you for visiting www.financialresearch.gov.

Research Topics & Ideas: Finance

120+ Finance Research Topic Ideas To Fast-Track Your Project

If you’re just starting out exploring potential research topics for your finance-related dissertation, thesis or research project, you’ve come to the right place. In this post, we’ll help kickstart your research topic ideation process by providing a hearty list of finance-centric research topics and ideas.

PS – This is just the start…

We know it’s exciting to run through a list of research topics, but please keep in mind that this list is just a starting point . To develop a suitable education-related research topic, you’ll need to identify a clear and convincing research gap , and a viable plan of action to fill that gap.

If this sounds foreign to you, check out our free research topic webinar that explores how to find and refine a high-quality research topic, from scratch. Alternatively, if you’d like hands-on help, consider our 1-on-1 coaching service .

Overview: Finance Research Topics

- Corporate finance topics

- Investment banking topics

- Private equity & VC

- Asset management

- Hedge funds

- Financial planning & advisory

- Quantitative finance

- Treasury management

- Financial technology (FinTech)

- Commercial banking

- International finance

Corporate Finance

These research topic ideas explore a breadth of issues ranging from the examination of capital structure to the exploration of financial strategies in mergers and acquisitions.

- Evaluating the impact of capital structure on firm performance across different industries

- Assessing the effectiveness of financial management practices in emerging markets

- A comparative analysis of the cost of capital and financial structure in multinational corporations across different regulatory environments

- Examining how integrating sustainability and CSR initiatives affect a corporation’s financial performance and brand reputation

- Analysing how rigorous financial analysis informs strategic decisions and contributes to corporate growth

- Examining the relationship between corporate governance structures and financial performance

- A comparative analysis of financing strategies among mergers and acquisitions

- Evaluating the importance of financial transparency and its impact on investor relations and trust

- Investigating the role of financial flexibility in strategic investment decisions during economic downturns

- Investigating how different dividend policies affect shareholder value and the firm’s financial performance

Investment Banking

The list below presents a series of research topics exploring the multifaceted dimensions of investment banking, with a particular focus on its evolution following the 2008 financial crisis.

- Analysing the evolution and impact of regulatory frameworks in investment banking post-2008 financial crisis

- Investigating the challenges and opportunities associated with cross-border M&As facilitated by investment banks.

- Evaluating the role of investment banks in facilitating mergers and acquisitions in emerging markets

- Analysing the transformation brought about by digital technologies in the delivery of investment banking services and its effects on efficiency and client satisfaction.

- Evaluating the role of investment banks in promoting sustainable finance and the integration of Environmental, Social, and Governance (ESG) criteria in investment decisions.

- Assessing the impact of technology on the efficiency and effectiveness of investment banking services

- Examining the effectiveness of investment banks in pricing and marketing IPOs, and the subsequent performance of these IPOs in the stock market.

- A comparative analysis of different risk management strategies employed by investment banks

- Examining the relationship between investment banking fees and corporate performance

- A comparative analysis of competitive strategies employed by leading investment banks and their impact on market share and profitability

Private Equity & Venture Capital (VC)

These research topic ideas are centred on venture capital and private equity investments, with a focus on their impact on technological startups, emerging technologies, and broader economic ecosystems.

- Investigating the determinants of successful venture capital investments in tech startups

- Analysing the trends and outcomes of venture capital funding in emerging technologies such as artificial intelligence, blockchain, or clean energy

- Assessing the performance and return on investment of different exit strategies employed by venture capital firms

- Assessing the impact of private equity investments on the financial performance of SMEs

- Analysing the role of venture capital in fostering innovation and entrepreneurship

- Evaluating the exit strategies of private equity firms: A comparative analysis

- Exploring the ethical considerations in private equity and venture capital financing

- Investigating how private equity ownership influences operational efficiency and overall business performance

- Evaluating the effectiveness of corporate governance structures in companies backed by private equity investments

- Examining how the regulatory environment in different regions affects the operations, investments and performance of private equity and venture capital firms

Asset Management

This list includes a range of research topic ideas focused on asset management, probing into the effectiveness of various strategies, the integration of technology, and the alignment with ethical principles among other key dimensions.

- Analysing the effectiveness of different asset allocation strategies in diverse economic environments

- Analysing the methodologies and effectiveness of performance attribution in asset management firms

- Assessing the impact of environmental, social, and governance (ESG) criteria on fund performance

- Examining the role of robo-advisors in modern asset management

- Evaluating how advancements in technology are reshaping portfolio management strategies within asset management firms

- Evaluating the performance persistence of mutual funds and hedge funds

- Investigating the long-term performance of portfolios managed with ethical or socially responsible investing principles

- Investigating the behavioural biases in individual and institutional investment decisions

- Examining the asset allocation strategies employed by pension funds and their impact on long-term fund performance

- Assessing the operational efficiency of asset management firms and its correlation with fund performance

Hedge Funds

Here we explore research topics related to hedge fund operations and strategies, including their implications on corporate governance, financial market stability, and regulatory compliance among other critical facets.

- Assessing the impact of hedge fund activism on corporate governance and financial performance

- Analysing the effectiveness and implications of market-neutral strategies employed by hedge funds

- Investigating how different fee structures impact the performance and investor attraction to hedge funds

- Evaluating the contribution of hedge funds to financial market liquidity and the implications for market stability

- Analysing the risk-return profile of hedge fund strategies during financial crises

- Evaluating the influence of regulatory changes on hedge fund operations and performance

- Examining the level of transparency and disclosure practices in the hedge fund industry and its impact on investor trust and regulatory compliance

- Assessing the contribution of hedge funds to systemic risk in financial markets, and the effectiveness of regulatory measures in mitigating such risks

- Examining the role of hedge funds in financial market stability

- Investigating the determinants of hedge fund success: A comparative analysis

Financial Planning and Advisory

This list explores various research topic ideas related to financial planning, focusing on the effects of financial literacy, the adoption of digital tools, taxation policies, and the role of financial advisors.

- Evaluating the impact of financial literacy on individual financial planning effectiveness

- Analysing how different taxation policies influence financial planning strategies among individuals and businesses

- Evaluating the effectiveness and user adoption of digital tools in modern financial planning practices

- Investigating the adequacy of long-term financial planning strategies in ensuring retirement security

- Assessing the role of financial education in shaping financial planning behaviour among different demographic groups

- Examining the impact of psychological biases on financial planning and decision-making, and strategies to mitigate these biases

- Assessing the behavioural factors influencing financial planning decisions

- Examining the role of financial advisors in managing retirement savings

- A comparative analysis of traditional versus robo-advisory in financial planning

- Investigating the ethics of financial advisory practices

The following list delves into research topics within the insurance sector, touching on the technological transformations, regulatory shifts, and evolving consumer behaviours among other pivotal aspects.

- Analysing the impact of technology adoption on insurance pricing and risk management

- Analysing the influence of Insurtech innovations on the competitive dynamics and consumer choices in insurance markets

- Investigating the factors affecting consumer behaviour in insurance product selection and the role of digital channels in influencing decisions

- Assessing the effect of regulatory changes on insurance product offerings

- Examining the determinants of insurance penetration in emerging markets

- Evaluating the operational efficiency of claims management processes in insurance companies and its impact on customer satisfaction

- Examining the evolution and effectiveness of risk assessment models used in insurance underwriting and their impact on pricing and coverage

- Evaluating the role of insurance in financial stability and economic development

- Investigating the impact of climate change on insurance models and products

- Exploring the challenges and opportunities in underwriting cyber insurance in the face of evolving cyber threats and regulations

Quantitative Finance

These topic ideas span the development of asset pricing models, evaluation of machine learning algorithms, and the exploration of ethical implications among other pivotal areas.

- Developing and testing new quantitative models for asset pricing

- Analysing the effectiveness and limitations of machine learning algorithms in predicting financial market movements

- Assessing the effectiveness of various risk management techniques in quantitative finance

- Evaluating the advancements in portfolio optimisation techniques and their impact on risk-adjusted returns

- Evaluating the impact of high-frequency trading on market efficiency and stability

- Investigating the influence of algorithmic trading strategies on market efficiency and liquidity

- Examining the risk parity approach in asset allocation and its effectiveness in different market conditions

- Examining the application of machine learning and artificial intelligence in quantitative financial analysis

- Investigating the ethical implications of quantitative financial innovations

- Assessing the profitability and market impact of statistical arbitrage strategies considering different market microstructures

Treasury Management

The following topic ideas explore treasury management, focusing on modernisation through technological advancements, the impact on firm liquidity, and the intertwined relationship with corporate governance among other crucial areas.

- Analysing the impact of treasury management practices on firm liquidity and profitability

- Analysing the role of automation in enhancing operational efficiency and strategic decision-making in treasury management

- Evaluating the effectiveness of various cash management strategies in multinational corporations

- Investigating the potential of blockchain technology in streamlining treasury operations and enhancing transparency

- Examining the role of treasury management in mitigating financial risks

- Evaluating the accuracy and effectiveness of various cash flow forecasting techniques employed in treasury management

- Assessing the impact of technological advancements on treasury management operations

- Examining the effectiveness of different foreign exchange risk management strategies employed by treasury managers in multinational corporations

- Assessing the impact of regulatory compliance requirements on the operational and strategic aspects of treasury management

- Investigating the relationship between treasury management and corporate governance

Financial Technology (FinTech)

The following research topic ideas explore the transformative potential of blockchain, the rise of open banking, and the burgeoning landscape of peer-to-peer lending among other focal areas.

- Evaluating the impact of blockchain technology on financial services

- Investigating the implications of open banking on consumer data privacy and financial services competition

- Assessing the role of FinTech in financial inclusion in emerging markets

- Analysing the role of peer-to-peer lending platforms in promoting financial inclusion and their impact on traditional banking systems

- Examining the cybersecurity challenges faced by FinTech firms and the regulatory measures to ensure data protection and financial stability

- Examining the regulatory challenges and opportunities in the FinTech ecosystem

- Assessing the impact of artificial intelligence on the delivery of financial services, customer experience, and operational efficiency within FinTech firms

- Analysing the adoption and impact of cryptocurrencies on traditional financial systems

- Investigating the determinants of success for FinTech startups

Commercial Banking

These topic ideas span commercial banking, encompassing digital transformation, support for small and medium-sized enterprises (SMEs), and the evolving regulatory and competitive landscape among other key themes.

- Assessing the impact of digital transformation on commercial banking services and competitiveness

- Analysing the impact of digital transformation on customer experience and operational efficiency in commercial banking

- Evaluating the role of commercial banks in supporting small and medium-sized enterprises (SMEs)

- Investigating the effectiveness of credit risk management practices and their impact on bank profitability and financial stability

- Examining the relationship between commercial banking practices and financial stability

- Evaluating the implications of open banking frameworks on the competitive landscape and service innovation in commercial banking

- Assessing how regulatory changes affect lending practices and risk appetite of commercial banks

- Examining how commercial banks are adapting their strategies in response to competition from FinTech firms and changing consumer preferences

- Analysing the impact of regulatory compliance on commercial banking operations

- Investigating the determinants of customer satisfaction and loyalty in commercial banking

International Finance

The folowing research topic ideas are centred around international finance and global economic dynamics, delving into aspects like exchange rate fluctuations, international financial regulations, and the role of international financial institutions among other pivotal areas.

- Analysing the determinants of exchange rate fluctuations and their impact on international trade

- Analysing the influence of global trade agreements on international financial flows and foreign direct investments

- Evaluating the effectiveness of international portfolio diversification strategies in mitigating risks and enhancing returns

- Evaluating the role of international financial institutions in global financial stability

- Investigating the role and implications of offshore financial centres on international financial stability and regulatory harmonisation

- Examining the impact of global financial crises on emerging market economies

- Examining the challenges and regulatory frameworks associated with cross-border banking operations

- Assessing the effectiveness of international financial regulations

- Investigating the challenges and opportunities of cross-border mergers and acquisitions

Choosing A Research Topic

These finance-related research topic ideas are starting points to guide your thinking. They are intentionally very broad and open-ended. By engaging with the currently literature in your field of interest, you’ll be able to narrow down your focus to a specific research gap .

When choosing a topic , you’ll need to take into account its originality, relevance, feasibility, and the resources you have at your disposal. Make sure to align your interest and expertise in the subject with your university program’s specific requirements. Always consult your academic advisor to ensure that your chosen topic not only meets the academic criteria but also provides a valuable contribution to the field.

If you need a helping hand, feel free to check out our private coaching service here.

thank you for suggest those topic, I want to ask you about the subjects related to the fintech, can i measure it and how?

Please guide me on selecting research titles

I am doing financial engineering. , can you please help me choose a dissertation topic?

I’m studying Banking and finance (MBA) please guide me on to choose a good research topic.

I am studying finance (MBA) please guide me to choose a good research topic.

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Print Friendly

Featured Topics

View the Entrepreneurship Working Group page.

Econometrics

Microeconomics, macroeconomics, international economics, financial economics, public economics, health, education, and welfare, labor economics, industrial organization, development and growth, environmental and resource economics, regional and urban economics, more from nber.

In addition to working papers , the NBER disseminates affiliates’ latest findings through a range of free periodicals — the NBER Reporter , the NBER Digest , the Bulletin on Retirement and Disability , the Bulletin on Health , and the Bulletin on Entrepreneurship — as well as online conference reports , video lectures , and interviews .

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Biden Economy

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds Rates

- Top Mutual Funds

- Options: Highest Open Interest

- Options: Highest Implied Volatility

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Stock Comparison

- Advanced Chart

- Currency Converter

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Credit Card Offers

- Best Free Checking

- Student Loans

- Personal Loans

- Car insurance

- Mortgage Refinancing

- Mortgage Calculator

- Morning Brief

- Market Domination

- Market Domination Overtime

- Asking for a Trend

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Financial Freestyle

- Capitol Gains

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

- S&P 500 5,634.61 +1.15%

- Dow 30 41,175.08 +1.14%

- Nasdaq 17,877.79 +1.47%

- Russell 2000 2,218.70 +3.19%

- Crude Oil 74.96 +2.67%

- Gold 2,548.70 +1.27%

- Silver 29.86 +2.80%

- EUR/USD 1.1194 +0.72%

- 10-Yr Bond 3.8070 -1.42%

- GBP/USD 1.3216 +0.95%

- USD/JPY 144.3670 -1.28%

- Bitcoin USD 63,997.93 +5.04%

- XRP USD 0.61 +1.37%

- FTSE 100 8,327.78 +0.48%

- Nikkei 225 38,364.27 +0.40%

Longtime investor fears Tesla's 'best days' are in rear-view mirror

Tesla investors have a lot coming at them, making it harder to be a believer in Elon Musk's electric vehicle maker.

Stocks rise as Powell declares 'time has come' for interest rate cut

There goes new Starbucks CEO's 'messiah' status

Apple targets Sept. 10 debut for new iPhones

Subway sets new footlong price as it enters value menu wars, investors price in 4 rate cuts after powell signals 'ample room', hidden reason ai costs are soaring—and don't blame nvidia, why some economists are ignoring recession signals, tech bundles turn to age-old upselling ploy: french fries, fed's bostic: september or november rate cut 'in play', takeaways from ap's report on federal policies shielding information about potential dam failures, conflicting federal policies may cost residents more on flood insurance, and leave them at risk, china regulates bond market based on market principles, state media says, japan’s leadership contenders and their key policy positions, csx adds more union agreements, diamond sports will continue to broadcast nhl, nba games through upcoming season, ns, bnsf reach early contracts with unions, peloton's risky move could hurt declining membership, trump will soon be free to tank his own stock, can you guess what percent of people actually retire with a $2 million nest egg here's a hint – aim really low, if warren buffett's son didn't sell his 90k berkshire hathaway inheritance 47 years ago to 'buy time,' he would have this much today, kamala harris supports tax on unrealized capital gains: what it means for wealthy households, prediction: wall street's next stock split announcement will come from a company that's gained 150,000% since its ipo, analyst report: national grid plc, altria boosts its dividend for the 55th straight year. yield is now nearly 8%, the fed is not behind the curve: fmr. cleveland fed pres..

Federal Reserve Jerome Powell's speech from the Kansas City Fed's Jackson Hole Economic Policy Symposium has Wall Street abuzz. Powell strongly indicated the central bank is about to start a rate-cutting cycle. The question now focuses on the magnitude of those cut rates. Former Cleveland Fed President Loretta Mester sits down with Yahoo Finance Federal Reserve Reporter Jennifer Schonberger to discuss Powell's speech and how she views the Fed's position moving forward. Mester thinks "the case is pretty strong" for the Fed to start cutting rates, describing it as "reducing the degree of restrictiveness." Mester believes the Fed is right to start with a 25 basis point cut, claiming its been on the right trajectory with its policies considering inflation is moving towards its target goal of 2%: "I think a reasonable sort of baseline would be doing 25. I wouldn't want to start with a 50 because I think that is really a signal that maybe the Fed is behind the curve and I don't believe the Fed is. I think the Fed has been very careful about really focusing in on the price stability mandate when that was the dominant focus." She thinks the "desirable path" would be doing a series of 25 basis point cuts. Watch Federal Reserve Chair Jerome Powell's full speech here. For more expert insight and the latest market action, click here to watch this full episode of Wealth! This post was written by Nicholas Jacobino

Powell speech affirms Fed's data-dependency: Strategists

Fed's Harker explains why a 25bps cut is more likely than a 50

Recession is not in my outlook: Atlanta Fed's Bostic

How lower rates would affect new vs. existing home sales

Investment ideas, build your wealth.

Research / Media release

August 22, 2024

Latest MFAA research highlights picture of a strong industry

Today, the Mortgage & Finance Association of Australia released the latest edition of its sought-after Industry Intelligence Service (IIS) report .

Featuring data for the 1 April – 30 September 2023 period, the report provides insights on the mortgage and finance broking industry including the size of the mortgage broker population, the value of loans settled and lender segment market share.

MFAA CEO Anja Pannek said that despite the period covered in the report being one marked by continued high refinancing levels and borrower concern about interest rates, mortgage broker activity remained strong.

“Our industry is growing, with more mortgage brokers than ever before, and positive shifts recorded across a number of aspects of the industry during the period covered in the report,” she said.

“The choice and competition mortgage brokers have brought to the home lending market to the benefit of consumers shines through in this data.”

Settlement values for mortgage broker originated home loans surpassed $300 billion for a 12-month period for the second time, at $350.63 billion to September 2023.

The mortgage broker population grew 3.3% year-on-year to 19,872. Seven out of ten home loans were written by brokers during the six-month period with the September 2023 quarter recording a 71.5% market share.

However, the conversion rate of home loan applications to settlements has seen a decline, indicating that serviceability challenges are taking a toll on prospective homebuyers seeking finance.

“While overall home loan applications are up across most of the country, we hear consistently from our members that serviceability has been a challenge for their clients as they adjust to current interest rate levels," Ms Pannek explained.

Conversion rates recorded a second consecutive six-month period of decline, experiencing a 9.2 percentage point dip year-on-year and falling below 80% for the first time since 2021.

"The downward shift in conversion rates highlights this it's harder to get deals through, with much more work required on the part of mortgage brokers to find the right solution for their clients,” Ms Pannek said.

The report also covers the extent of commercial lending facilitated by mortgage brokers.

While the number of mortgage brokers who also settled commercial loans during the period declined, the value of those loans reached a record high at $17.29 billion.

For the first time since the measure has been tracked in the IIS, the market share of the major banks fell below 40% for the period covered in the report.

"This result indicates that borrowers are more confident to go through lenders outside the big four to secure a loan that meets their needs," said Ms Pannek.

"There are over 100 lenders in the market today, and it is because of brokers that Australian homebuyers have access to a wide range of lenders. It is also clear that this choice is a valued and important part of the market."

The IIS report draws on data supplied by the industry’s leading aggregator brands to provide mortgage broker, industry performance and demographic data.

The IIS was first published in 2015, this is the 17th edition.

Download the Industry Intelligence Service 17th edition .

You may also like

10.04.2024 Media release, Research

The home loan discharge process must be improved – MFAA

The mortgage and finance broking industry’s peak association has made six recommendations to improve the home loan discharge process in a new whitepap...

06.02.2024 Research, Media release

New research spotlights mortgage brokers impact in simplifying lenders mortgage insurance for home seekers

Insights from a new research survey confirm that mortgage brokers are critical to building aspiring home buyers’ understanding of how lenders mortgage...

24.07.2024 Research, Media release

MFAA discussion paper sets out guidance for the use of AI in broking

The paper, titled Embracing the future: Towards the safe and ethical use of AI for the mortgage broking industry, was informed by research carried out...

COMMENTS

Finance is a critical catalyst of food systems transformation. At the 2021 United Nations Food Systems Summit, the Financial Lever Group suggested five imperatives to tap into new financial ...

Forgiving Medical Debt Won't Make Everyone Happier. by Rachel Layne. Medical debt not only hurts credit access, it can also harm one's mental health. But a study by Raymond Kluender finds that forgiving people's bills—even $170 million of debt—doesn't necessarily reduce stress, financial or otherwise. 16 Jul 2024.

The Journal of Finance publishes leading research across all the major fields of financial research. It is the most widely cited academic journal on finance. Each issue of the journal reaches over 8,000 academics, finance professionals, libraries, government and financial institutions around the world. Published six times a year, the journal is the official publication of The American Finance ...

Over the past two decades, artificial intelligence (AI) has experienced rapid development and is being used in a wide range of sectors and activities, including finance. In the meantime, a growing and heterogeneous strand of literature has explored the use of AI in finance. The aim of this study is to provide a comprehensive overview of the existing research on this topic and to identify which ...

The Journal of Finance publishes leading research across all the major fields of financial research. It is the most widely cited academic journal on finance and one of the most widely cited journals in economics as well. Each issue of the journal reaches over 8,000 academics, finance professionals, libraries, government and financial ...

The Journal of Finance publishes leading research across all the major fields of finance. It is one of the most widely cited journals in academic finance, and in all of economics. Each of the six issues per year reaches over 8,000 academics, finance professionals, libraries, and government and financial institutions around the world.

by Carolin E. Pflueger, Emil Siriwardane, and Adi Sunderam. This paper sheds new light on connections between financial markets and the macroeconomy. It shows that investors' appetite for risk—revealed by common movements in the pricing of volatile securities—helps determine economic outcomes and real interest rates.

The Board of Directors of the Southern Finance Association and the Southwestern Finance Association are pleased to announce the selection of the new editors of the Journal of Financial Research. Professors Erik Devos, William B. Elliott, and Murali Jagannathan will begin their three-year term on January 1, 2018. More details can be found here.

Overview. The Journal of Economics and Finance is the official journal of the Academy of Economics and Finance. It publishes theoretical and empirical research papers in economics and finance. Its primary focus is on empirical studies utilizing recent advances in econometrics with an emphasis on the policy relevance of the findings.

The Financial Review is the official EFA journal, publishing research that provides new insights into important issues in all areas of financial economics. Abstract This paper provides a prospective look at the most exciting open research questions for future finance research in three important areas: (1) banking stability; (2) the intersection ...

Finance Research Letters invites submissions in all areas of finance, broadly defined. Finance Research Letters offers and ensures the rapid publication of important new results in these areas. We aim to provide a rapid response to papers, with all papers undergoing a desk review by one of the …. View full aims & scope.

The Journal of Corporate Finance aims to publish high quality, original manuscripts or shorter format papers in both theoretical and empirical corporate finance. Areas of interest include, but are not limited to: financial structure, governance, product markets, payout, labor, innovation, risk …. View full aims & scope.

This paper develops a tradeoff theory of capital structure, testing the idea that firms with low risk assets—and hence underpriced equity—may want to rely disproportionately on debt. The model accommodates both corporate finance and asset pricing evidence, renewing a fruitful connection between asset pricing and corporate finance research.

Quantitative Finance (since December 2008). For a specific paper, enter the identifier into the top right search box.. Browse: new (most recent mailing, with abstracts) ; recent (last 5 mailings) ; current month's listings; specific year/month:

Explore the latest full-text research PDFs, articles, conference papers, preprints and more on FINANCE. Find methods information, sources, references or conduct a literature review on FINANCE

In this paper, I provide an overview of the research on the real effects of financial reporting on investing and financing decisions made by firms. Accounting can improve investment efficiency and affect nearly every aspect of the financing decision by reducing information asymmetry and improving monitoring.

Topics covered by networks include accounting, economics, financial economics, legal scholarship, and management (including negotiation and marketing). The SSRN eLibrary consists of abstracts of scholarly working papers and forthcoming papers and an electronic paper collection of downloadable full text documents in pdf format.

Furthermore, the paper examined the Review of Behavioral Finance (78 articles in Scopus) and Journal of Behavioral and Experimental Finance (141 papers in Scopus.) Finally, other studies approached behavioral finance differently. The authors discussed research and trends in behavioral finance over the past 20 years (1995-2013) [14]. By ...

Conlisk (1996) presented a number of papers dealing with limited rationality; Duxbury (2015) made a research of perceptions provided by experimental studies examining financial decisions and market behavior; whereas Libby et al. (2002) compiled a series of experimental papers in finance to illustrate how experiments can be conducted successfully.

Papers in this series are designed to disseminate findings from research that advances understanding of financial stability. The papers are in a format intended to generate discussion and critical comments. They are works in progress and subject to revision. ... Subscribe to our email list for the latest updates, research, and news. Enter your ...

Corporate Finance. These research topic ideas explore a breadth of issues ranging from the examination of capital structure to the exploration of financial strategies in mergers and acquisitions. Evaluating the impact of capital structure on firm performance across different industries.

Between 2008 and 2014, the Top 4 banks sharply decreased their lending to small business. This paper examines the lasting economic consequences of this contraction, finding that a credit supply shock from a subset of lenders can have surprisingly long-lived effects on real activity. 26 Jun 2017. Working Paper Summaries.

More from NBER. In addition to working papers, the NBER disseminates affiliates' latest findings through a range of free periodicals — the NBER Reporter, the NBER Digest, the Bulletin on Retirement and Disability, the Bulletin on Health, and the Bulletin on Entrepreneurship — as well as online conference reports, video lectures, and ...

1. Introduction. As a scholarly field of enquiry, finance has developed rapidly over the past 30 years - both in terms of the volume of published work and its quality (Ashton et al., 2009, p. 205).As a sub-discipline it now holds a credible position in business schools and social science faculties globally. 1 Considering it a sub-field of economics, Kelly and Bruestle (2011, Table 3) show ...

At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage rates that help you manage your financial life.

Today, the Mortgage & Finance Association of Australia released the latest edition of its sought-after Industry Intelligence Service (IIS) report.. Featuring data for the 1 April - 30 September 2023 period, the report provides insights on the mortgage and finance broking industry including the size of the mortgage broker population, the value of loans settled and lender segment market share.