This free Notion document contains the best 100+ resources you need for building a successful startup, divided in 4 categories: Fundraising, People, Product, and Growth.

This free eBook goes over the 10 slides every startup pitch deck has to include, based on what we learned from analyzing 500+ pitch decks, including those from Airbnb, Uber and Spotify.

This free sheet contains 100 accelerators and incubators you can apply to today, along with information about the industries they generally invest in.

This free sheet contains 100 VC firms, with information about the countries, cities, stages, and industries they invest in, as well as their contact details.

This free sheet contains all the information about the top 100 unicorns, including their valuation, HQ's location, founded year, name of founders, funding amount and number of employees.

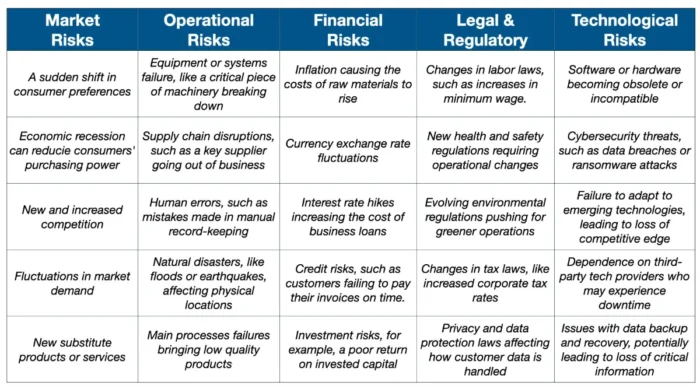

12 Types of Business Risks and How to Manage Them

Description

Everything you need to raise funding for your startup, including 3,500+ investors, 7 tools, 18 templates and 3 learning resources.

Information about the countries, cities, stages, and industries they invest in, as well as their contact details.

List of 250 startup investors in the AI and Machine Learning industries, along with their Twitter, LinkedIn, and email addresses.

List of startup investors in the BioTech, Health, and Medicine industries, along with their Twitter, LinkedIn, and email addresses.

List of startup investors in the FinTech industry, along with their Twitter, LinkedIn, and email addresses.

90% of startups fail .

Thanks to the explosion of the digital economy, business founders have plenty of opportunities that they can tap into to build a winning business.

Unfortunately, there is a myriad of challenges your new business has to navigate through. These risks are inevitable, and they are a part of life in the business world.

However, without the right plan, strategy, and instruments, your business might be drowned by these challenges.

Therefore, we have created this guide to show you how can your business utilize risk management to succeed in 2022.

There are many types of startup and business risks that entrepreneurs can expect to encounter in 2022. Most of these threats are prevalent in the infancy stages of a business.

To know what you’ll be up against, here is a breakdown of the 12 most common threats.

12 Business Risks to Plan For

1) economic risks.

Failure to acquire adequate funding for your business can damage the chances of your business succeeding.

Before a new business starts making profits, it needs to be kept afloat with money. Bills will pile up, suppliers will need payments, and your employees will be expecting their salaries.

To avoid running into financial problems sooner or later, you need to acquire enough funds to shore up your business until it can support itself.

On the side, world and business country's economic situation can change either positively or negatively, leading to a boom in purchases and opportunities or to a reduction in sales and growth.

If your business is up and running, a great way to limit the effect of negative economic changes is to maintain steady cash flow and operate under the lean business method.

Here's an article from a founder explaining how he set up a lean budget on his $400k/year online business.

2) Market Risks

Misjudging market demand is one of the primary reasons businesses fail .

To avoid falling into this trap, conduct detailed research to understand whether you will find a ready market for what you want to sell at the price you have set.

Ensure your business has a unique selling point, and make sure what you offer brings value to the buyers.

To know whether your product will suit the market, do a survey, or get opinions from friends and potential customers.

Building a Minimum Viable Product of that business idea you've had is the recommendations made by most entrepreneurs.

This site, for example, was built in just 3 weeks and launched into the market to see if there was any interest in the type of content we offered.

The site was ugly, had little content and lacked many features. Yet, +7,700 users visited it within the first week, which made us realize we should keep working on this.

90% of startups fail. Learn how to not to with our weekly guides and stories. Join 40,000+ founders.

3) Competitive Risks

Competition is a major business killer that you should be wary of.

Before you even start planning, ask yourself whether you are venturing into an oversaturated market.

Are there gaps in the market that you can exploit and make good money?

If you have an idea that can give you an edge, register it. This will prevent others from copying your product, re-innovating it, and locking you out of what you started.

Competitive risks are also those actions made by competitors that prevent a business from earning more revenue or having higher margins.

4) Execution Risks

Having an idea, a business plan, and an eager market isn’t enough to make your startup successful.

Most new companies put a lot of effort into the initial preparation and forget that the execution phase is equally important.

First, test whether you can develop your products within budget and on time. Also, check whether your product will function as intended and whether it’s possible to distribute it without taking losses.

5) Strategic Risks

Business strategies can lead to the growth or decline of a company.

Every strategy involves some risk, as time & resources are generally involved to put them into practice.

Strategic risk in the chance that an implemented strategy, therefore, results in losses.

If, for example, the Marketing Department of a company implements a content marketing strategy and a lot of months, time & money later the business doesn't see any ROI, this becomes a strategic risk.

6) Compliance Risks

Compliance risks are those losses and penalties that a business suffers for not complying with countries' and states' regulations & laws.

There are some industries that are highly-regulated so the compliance risks of businesses within them are super high.

For example, in May 2018, the EU Commission implemented the General Data Protection Regulation (GDPR), a law in privacy and data protection in the EU, which affected millions of websites.

Those websites that weren't adapted to comply with this new rule, were fined.

7) Operational Risks

Operational risks arise when the day-to-day running of a company fail to perform.

When processes fail or are insufficient, businesses lose customers and revenue and their reputation gets ruined.

One example can be customer service processes. Customers are becoming every day less willing to wait for support (not to mention, receive bad quality one).

If a business customer service team fails or delays to solve customer's issues, these might find their solution in the business competitors.

8) Reputational Risks

Reputational risks arise when a business acts in an immoral and discourteous way.

This led to customer complaints and distrust towards the business, which means for the company a big loss of sales and revenue.

With the rise of social networks, reputational risks have become one of the main concerns for businesses.

Virality is super easy among Twitter so a simple unhappy customer can lead to a huge bad press movement for the company.

A recent example is the Away issue with their toxic work environment, as a former employee reported in The Verge .

The issue brought lots of critics within social networks which eventually led the CEO, Steph Korey, to step aside from the startup ( she seems to be back, anyway 🤷♂️! ).

9) Country Risks

When a business invests in a new country, there is a high probability it won't work.

A product that is successful in one market won't necessarily be in another one, especially when people within them are so different in cultures, climates, tastes backgrounds, etc.

Country risk is the existing failure probability businesses investing in new countries have to deal with.

Changes in exchange rates, unstable economic situations and moving politics are three factors that make these country risks be even more delicate.

10) Quality Risks

When a business develops a product or service that fails to meet customers' needs and quality expectations, the chance these customers will ever buy again is low.

In this way, the business loses future sales and revenue. Not to mention that some customers will ask for refunds, increasing business costs, as well as publicly criticize the company's products, leading to bad reputation (and a viral cycle that means even less $$ for the business).

11) Human Risk

Hiring has its benefits but also its risks.

Employees themselves involve a huge risk for a business, as they become to represent the company through how they work, mistakes committed, the public says and interactions with customers & suppliers,

A way to deal with human risk is to train employees and keep a motivated workforce. Yet, the risk will continue to exist.

12) Technology Risk

Security attacks, power outrage, discontinued hardware, and software, among other technology issues, are the events that form part of the technology risk.

These issues can lead to a loss of money, time and data, which has many connections with the previously mentioned risks.

Back-ups, antivirus, control processes, and data breach plans are some of the ways to deal with this risk.

How Businesses Can Use Risk Management To Grow Business

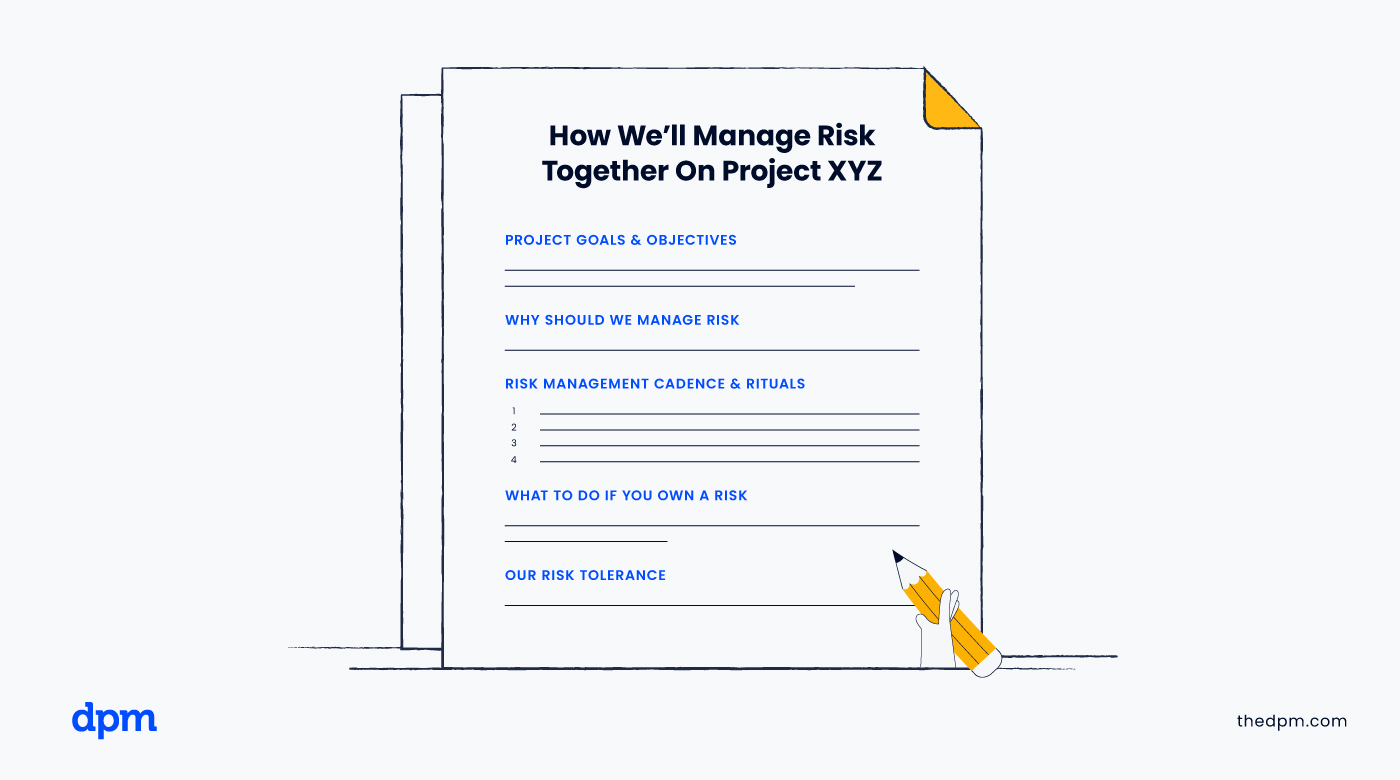

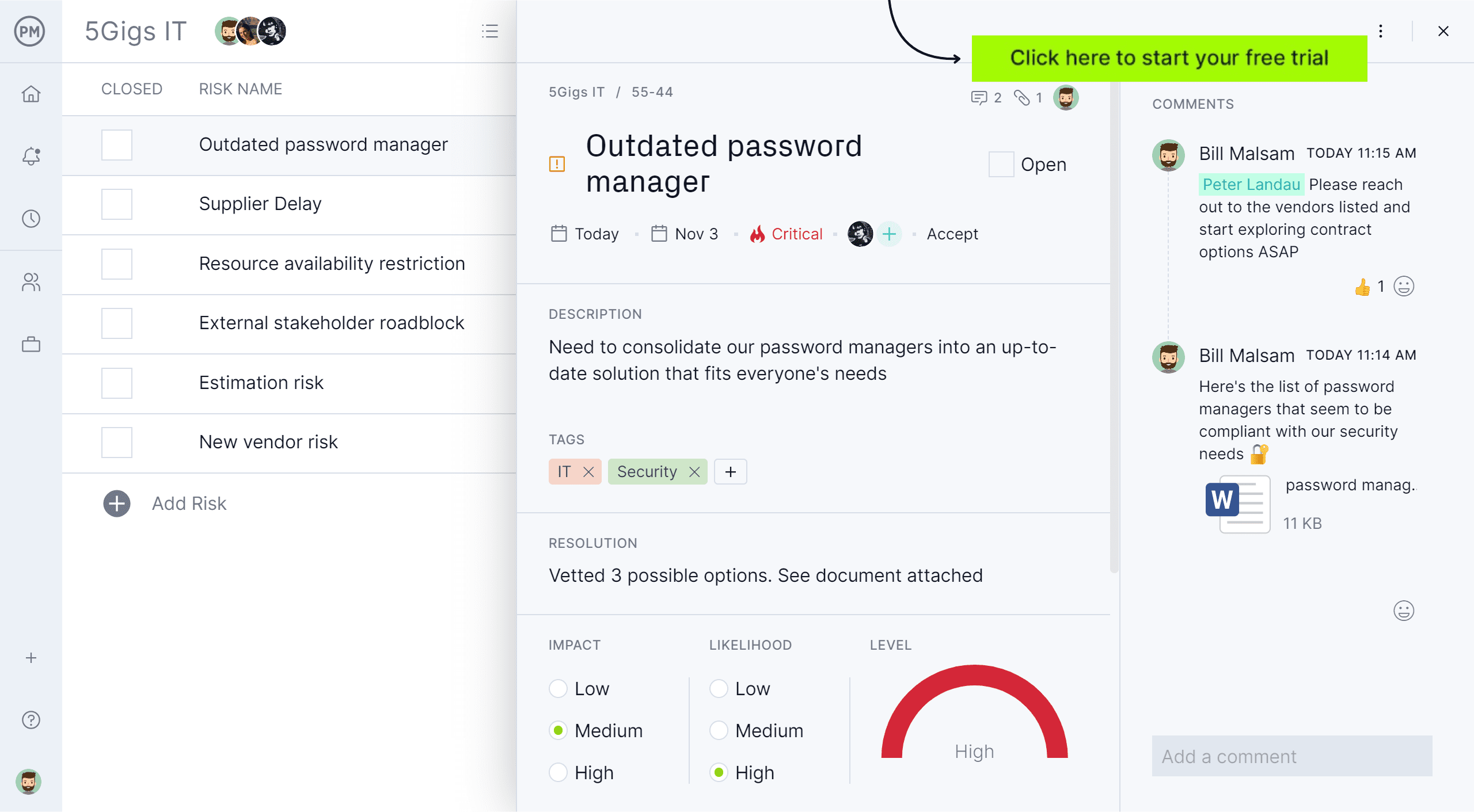

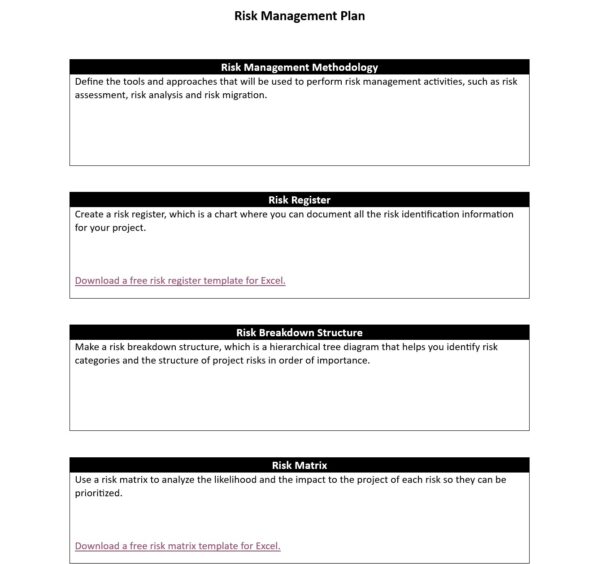

To mitigate any future threats, you need to prepare a comprehensive risk management plan.

This plan should detail the strategy you will use to deal with the specific challenges your business will encounter. Here’s what to do.

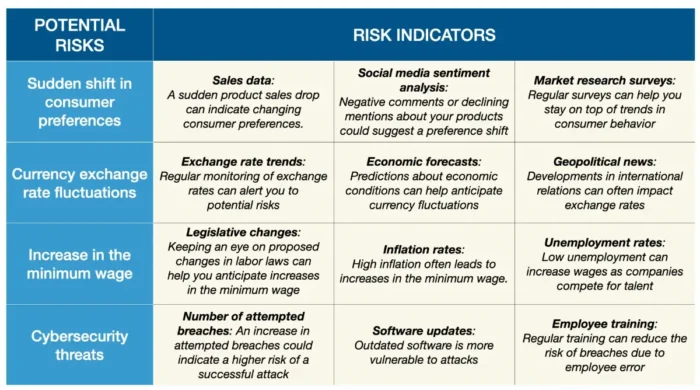

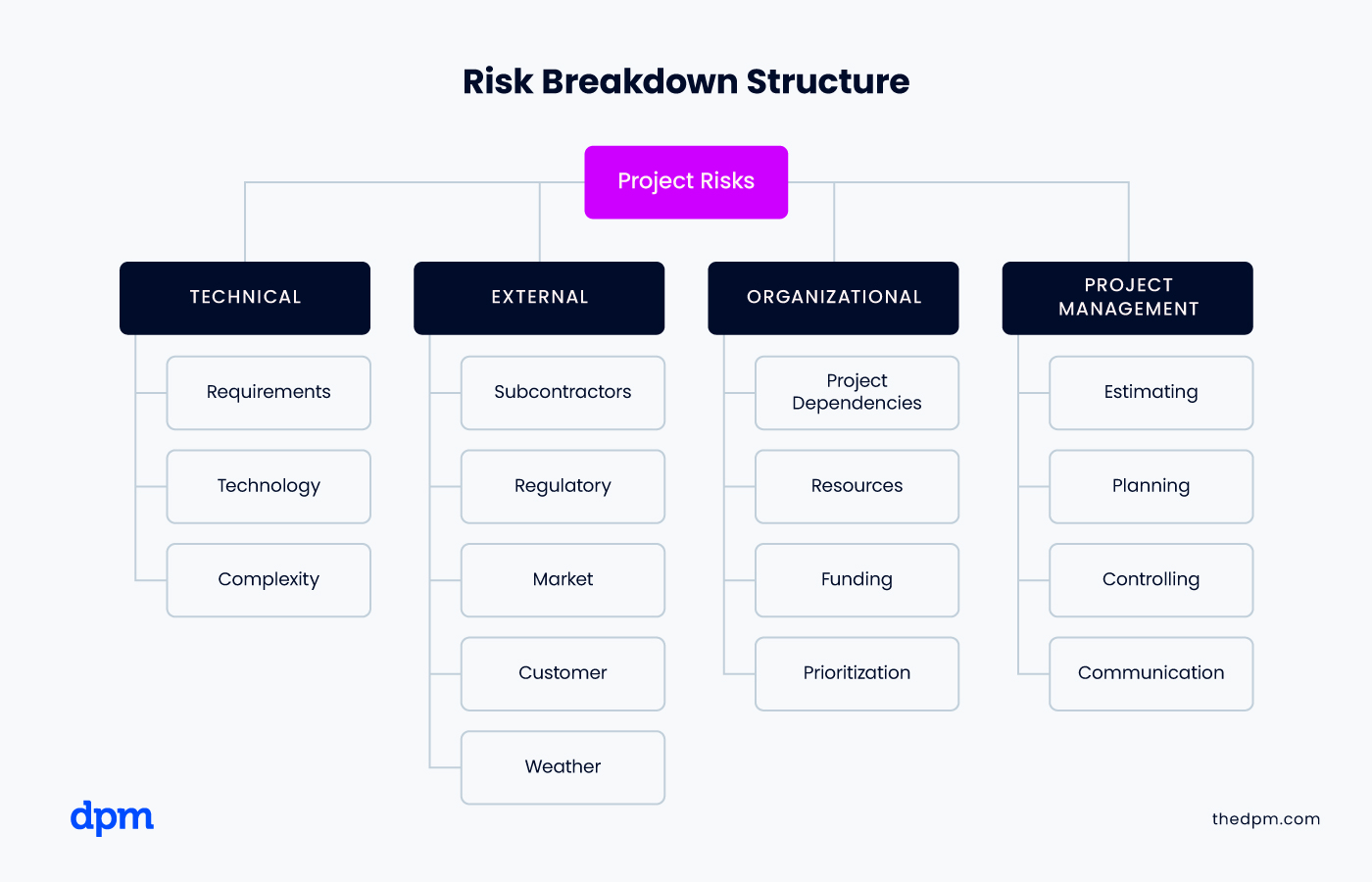

1) Identify Risks

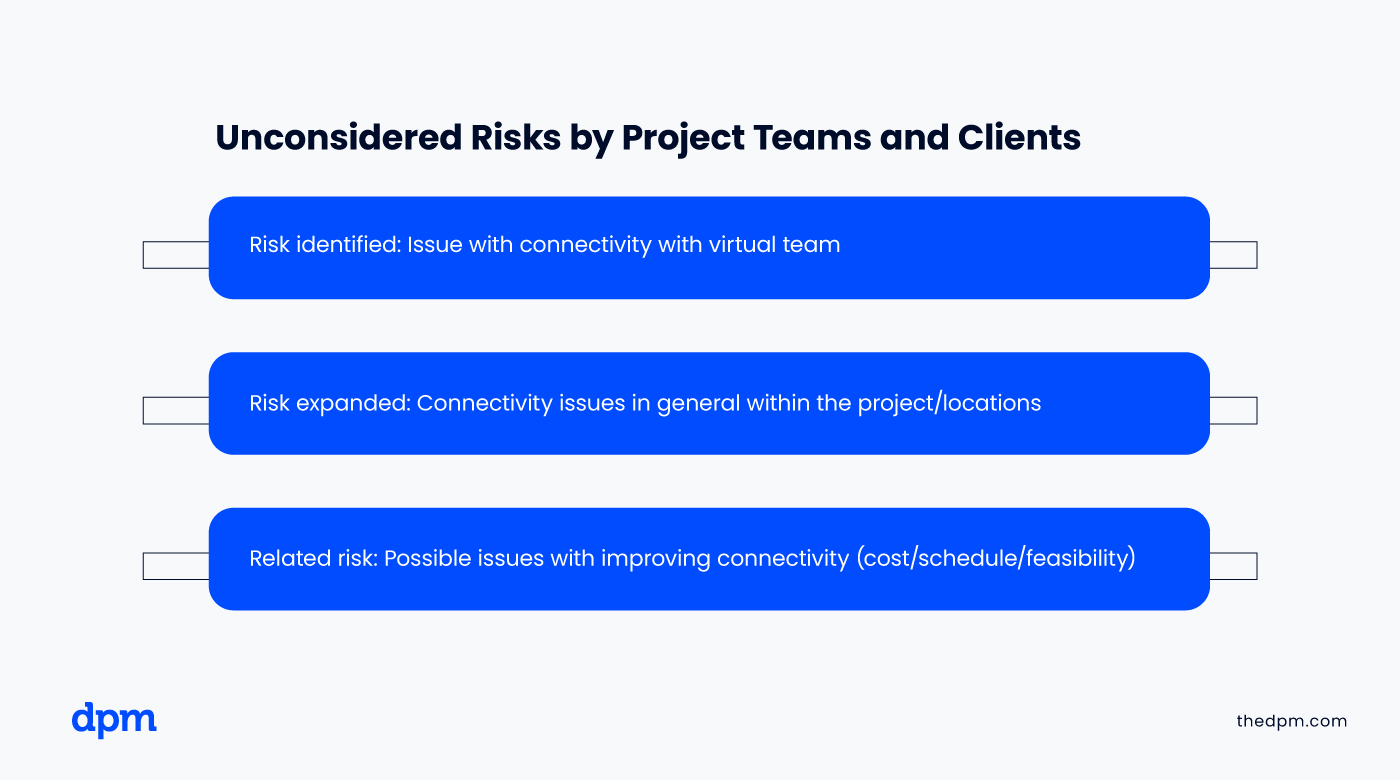

Every business encounters a different set of challenges.

Before mapping the risks, analyze your business and note down its key components such as critical resources, important services or products, and top talent.

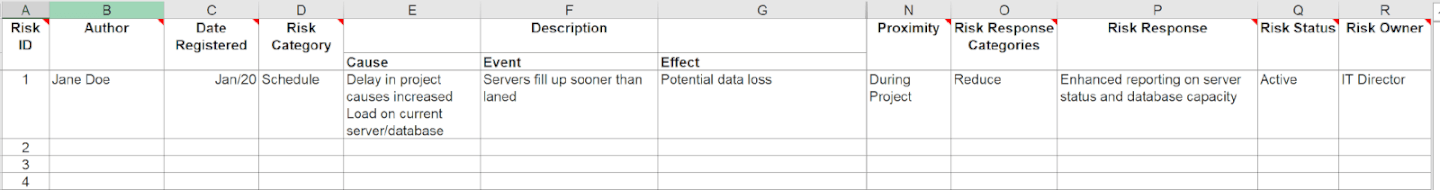

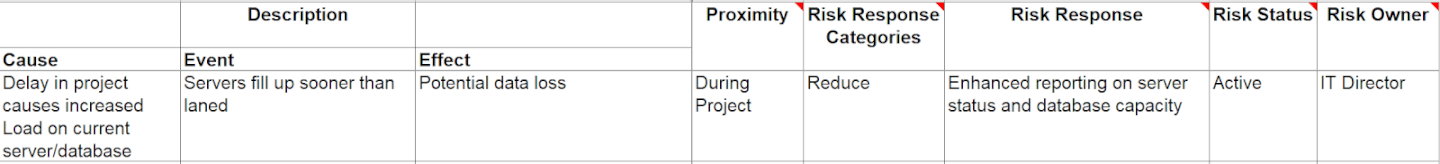

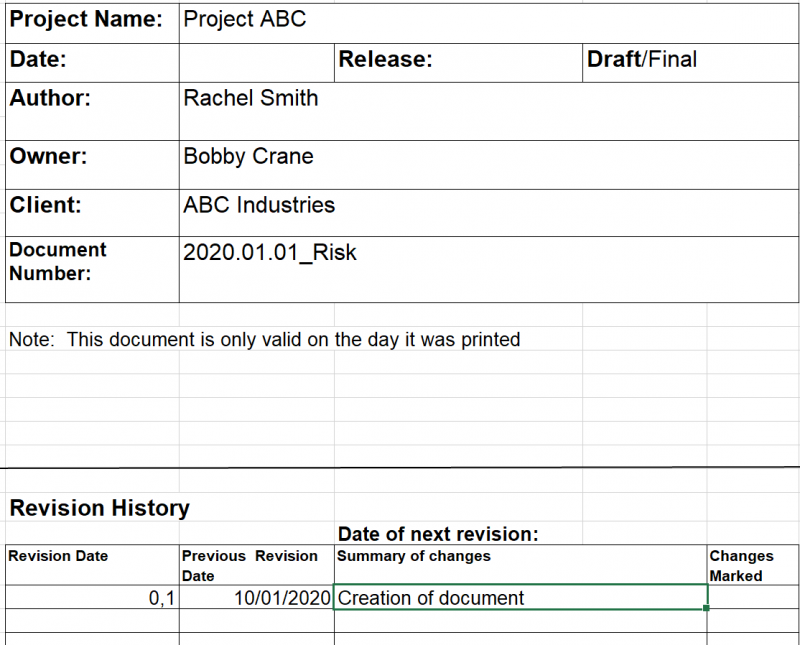

2) Record Risks

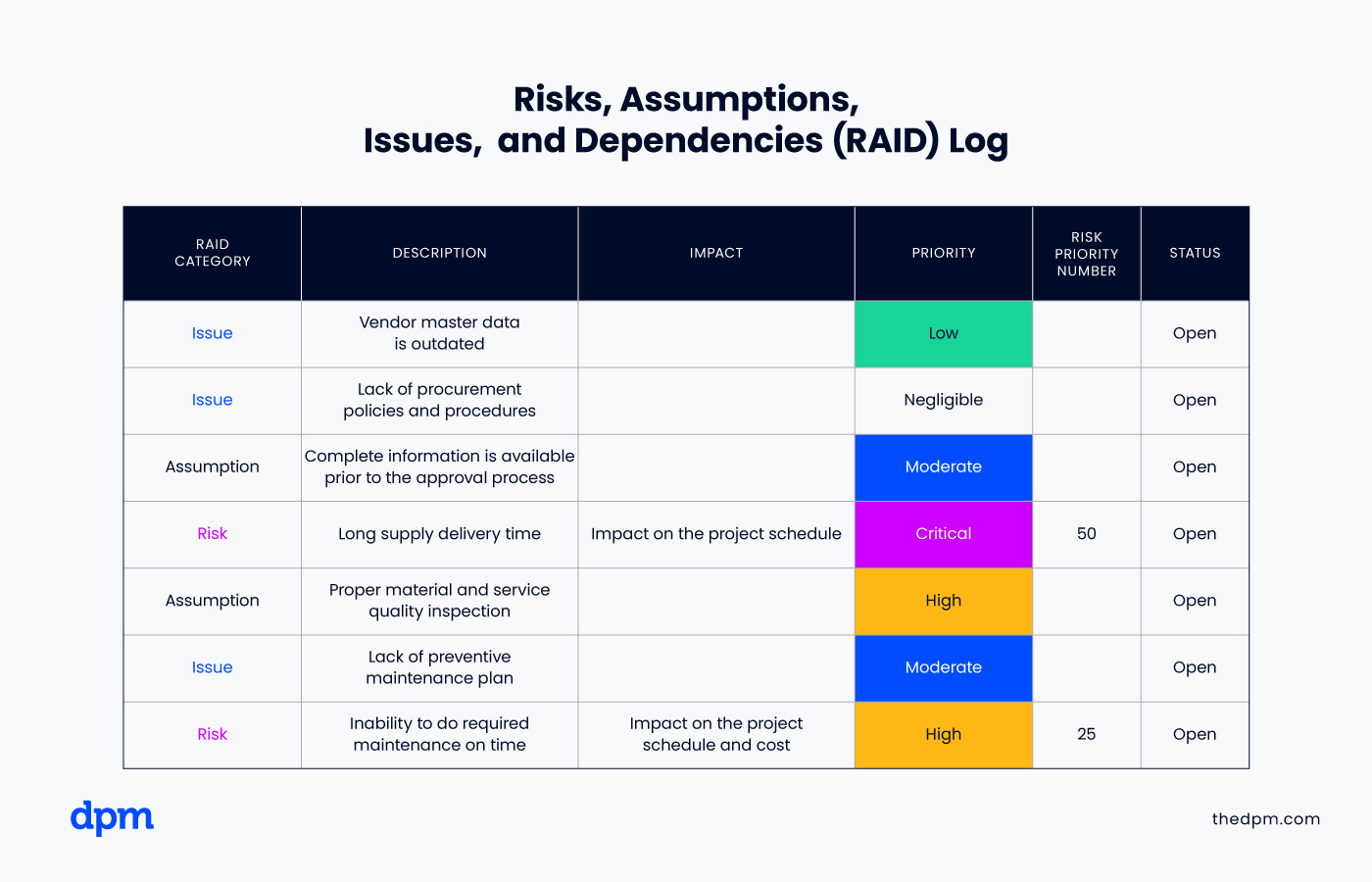

Once risks have been identified, you need to assess and document the threats that can affect each component.

Identify any warning signs or triggers of that recorded risk, also.

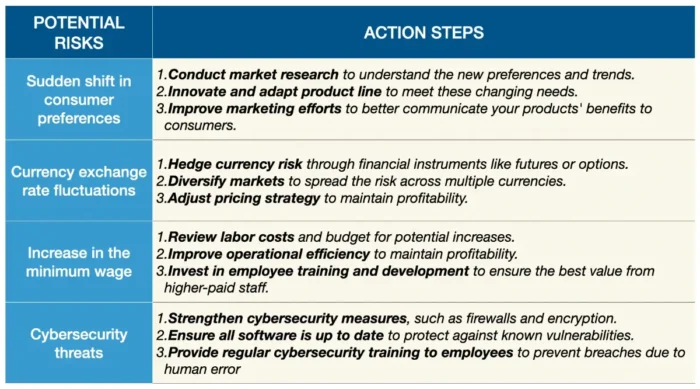

3) Anticipate

The best way to beat a threat is to detect and prepare for it in advance.

Once you know your business can be affected by a certain scenario, develop steps that you will take to stop the risk or to blunt its effects.

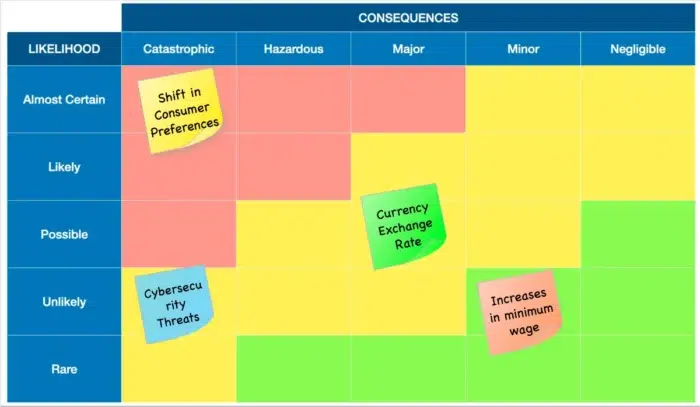

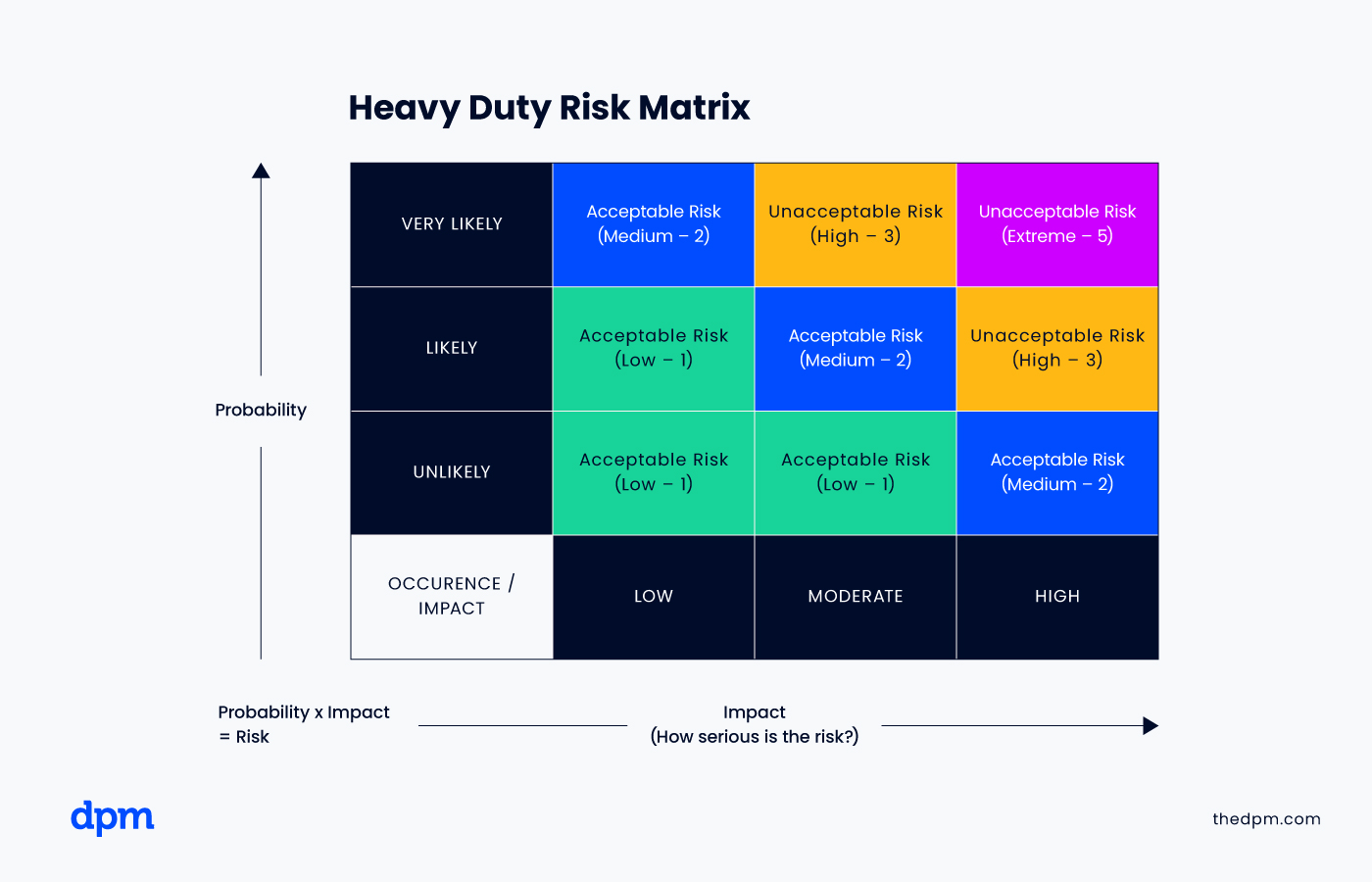

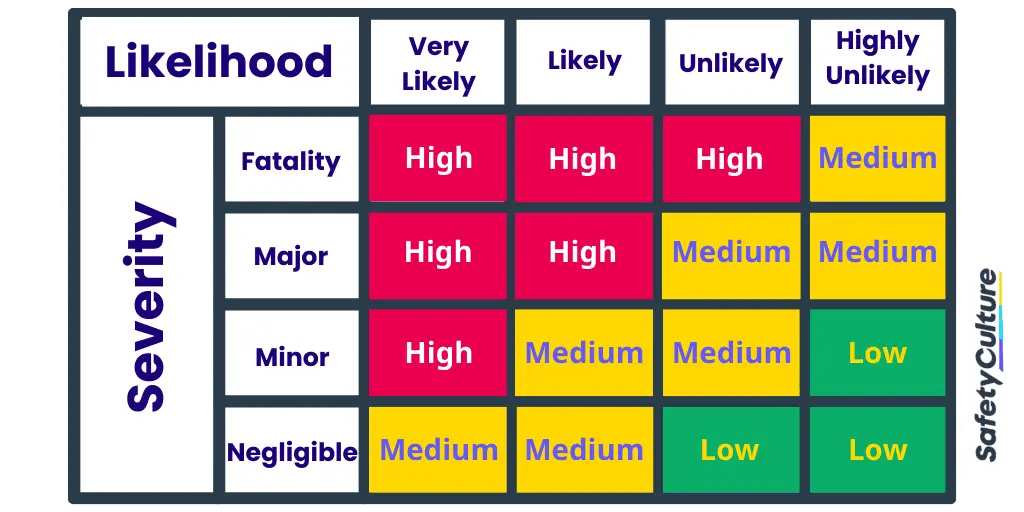

4) Prioritize Risks

Not all types of business risk have the same effect. Some can bring your startup to its knees, while others will only cause minimal effects.

To keep your business alive, start by putting in place measures that protect the vital functions from the most severe and most probable risks.

5) Have a Backup Plan

For every risk scenario, have at least two plans for countering the threat before it arrives.

The strategy you put in place should be in line with the current technology and trends.

Ensure your communicate these measures with all your team members.

6) Assign Responsibilities

When communicating measures with the team, assign responsibilities for each member in case any of the recorded risks affect the business.

These members should also be responsible for controlling the risks every certain time and maintaining records about them.

What is a Business Risk?

The term "business risk" refers to the exposure businesses have to factors that can prevent them from achieving their set financial goals.

This exposure can come from a variety of situations, but they can be classified into two:

- Internal factors: The risk comes from sources within the company, and they tend to be related to human, technological, physical or operational factors, among others.

- External factors: The risk comes from regulations/changes affecting the whole country/economy.

Any of these factors led to the business being unable to return investors and stakeholders the adequate amounts.

What Is Risk Management?

Risk management is a practice where an entrepreneur looks for potential risks that their business may face, analyzes them, and takes action to counter them.

The steps you take can eliminate the threat, control it, or limit the effects.

A risk is any scenario that harms your business. Risks can emanate from a wide variety of sources such as financial problems, management errors, lawsuits, data loss, cyber-attacks, natural calamities, and theft.

The risk landscape changes constantly, therefore you need to know the latest threats.

By setting up a risk management plan, your business can save money and time, which in some cases can be the determinant to keep your startup in business.

Not to mention, on the side, that risk management plans tend to make managers feel more confident to carry out business decisions, especially the risky ones, which can put their startups in a huge competitive advantage.

Wrapping Up

Becoming your own boss is one of the most rewarding things you can do.

However, launching a business is not a walk in the park; risks and challenges lurk around every corner.

If you are planning to establish a new business come 2022, make sure you secure its future by creating a broad risk management plan.

90% of startups fail. Learn how not to with our weekly guides and stories. Join +40,000 other startup founders!

An all-in-one newsletter for startup founders, ruled by one philosophy: there's more to learn from failures than from successes.

100+ resources you need for building a successful startup, divided into 4 categories: Fundraising, People, Product, and Growth.

What is business risk?

You know about death and taxes. What about risk? Yes, risk is just as much a part of life as the other two inevitabilities. This became all the more apparent during COVID-19, as each of us had to assess and reassess our personal risk calculations as each new wave of the pandemic— and pandemic-related disruptions —washed over us. It’s the same in business: executives and organizations have different comfort levels with risk and ways to prepare against it.

Where does business risk come from? To start with, external factors can wreak havoc on an organization’s best-laid plans. These can include things like inflation , supply chain disruptions, geopolitical upheavals , unpredictable force majeure events like a global pandemic or climate disaster, competitors, reputational issues, or even cyberattacks .

But sometimes, the call is coming from inside the house. Companies can be imperiled by their own executives’ decisions or by leaks of privileged information, but most damaging of all, perhaps, is the risk of missed opportunities. We’ve seen it often: when companies choose not to adopt disruptive innovation, they risk losing out to more nimble competitors.

The modern era is rife with increasingly frequent sociopolitical, economic, and climate-related shocks. In 2019 alone, for example, 40 weather disasters caused damages exceeding $1 billion each . To stay competitive, organizations should develop dynamic approaches to risk and resilience. That means predicting new threats, perceiving changes in existing threats, and developing comprehensive response plans. There’s no magic formula that can guarantee safe passage through a crisis. But in situations of threat, sometimes only a robust risk-management plan can protect an organization from interruptions to critical business processes. For more on how to assess and prepare for the inevitability of risk, read on.

Learn more about McKinsey’s Risk and Resilience Practice.

What is risk control?

Risk controls are measures taken to identify, manage, and eliminate threats. Companies can create these controls through a range of risk management strategies and exercises. Once a risk is identified and analyzed, risk controls can be designed to reduce the potential consequences. Eliminating a risk—always the preferable solution—is one method of risk control. Loss prevention and reduction are other risk controls that accept the risk but seek to minimize the potential loss (insurance is one method of loss prevention). A final method of risk control is duplication (also called redundancy). Backup servers or generators are a common example of duplication, ensuring that if a power outage occurs no data or productivity is lost.

But in order to develop appropriate risk controls, an organization should first understand the potential threats.

What are the three components to a robust risk management strategy?

A dynamic risk management plan can be broken down into three components : detecting potential new risks and weaknesses in existing risk controls, determining the organization’s appetite for risk taking, and deciding on the appropriate risk management approach. Here’s more information about each step and how to undertake them.

1. Detecting risks and controlling weaknesses

A static approach to risk is not an option, since an organization can be caught unprepared when an unlikely event, like a pandemic, strikes. So it pays to always be proactive. To keep pace with changing environments, companies should answer the following three questions for each of the risks that are relevant to their business.

- How will a risk play out over time? Risks can be slow moving or fast moving. They can be cyclical or permanent. Companies should analyze how known risks are likely to play out and reevaluate them on a regular basis.

- Are we prepared to respond to systemic risks? Increasingly, risks have longer-term reputational or regulatory consequences, with broad implications for an industry, the economy, or society at large. A risk management strategy should incorporate all risks, including systemic ones.

- What new risks lurk in the future? Organizations should develop new methods of identifying future risks. Traditional approaches that rely on reviews and assessments of historical realities are no longer sufficient.

2. Assessing risk appetite

How can companies develop a systematic way of deciding which risks to accept and which to avoid? Companies should set appetites for risk that align with their own values, strategies, capabilities, and competitive environments—as well as those of society as a whole. To that end, here are three questions companies should consider.

- How much risk should we take on? Companies should reevaluate their risk profiles frequently according to shifting customer behaviors, digital capabilities, competitive landscapes, and global trends.

- Are there any risks we should avoid entirely? Some risks are clear: companies should not tolerate criminal activity or sexual harassment. Others are murkier. How companies respond to risks like economic turmoil and climate change depend on their particular business, industry, and levels of risk tolerance.

- Does our risk appetite adequately reflect the effectiveness of our controls? Companies are typically more comfortable taking risks for which they have strong controls in place. But the increased threat of severe risks challenges traditional assumptions about risk control effectiveness. For instance, many businesses have relied on automation to increase speed and reduce manual error. But increased data breaches and privacy concerns can increase the risk of large-scale failures. Organizations, therefore, should evolve their risk profiles accordingly.

3. Deciding on a risk management approach

Finally, organizations should decide how they will respond when a new risk is identified. This decision-making process should be flexible and fast, actively engaging leaders from across the organization and honestly assessing what has and hasn’t worked in past scenarios. Here are three questions organizations should be able to answer.

- How should we mitigate the risks we are taking? Ultimately, people need to make these decisions and assess how their controls are working. But automated control systems should buttress human efforts. Controls guided, for example, by advanced analytics can help guard against quantifiable risks and minimize false positives.

- How would we respond if a risk event or control breakdown happens? If (or more likely, when) a threat occurs, companies should be able to switch to crisis management mode quickly, guided by an established playbook. Companies with well-rehearsed crisis management capabilities weather shocks better, as we saw with the COVID-19 pandemic.

- How can we build true resilience? Resilient companies not only better withstand threats—they emerge stronger. The most resilient firms can turn fallout from crises into a competitive advantage. True resilience stems from a diversity of skills and experience, innovation, creative problem solving, and the basic psychological safety that enables peak performance.

Change is constant. Just because a risk control plan made sense last year doesn’t mean it will next year. In addition to the above points, a good risk management strategy involves not only developing plans based on potential risk scenarios but also evaluating those plans on a regular basis.

Learn more about McKinsey’s Risk and Resilience Practice.

What are five actions organizations can take to build dynamic risk management?

In the past, some organizations have viewed risk management as a dull, dreary topic, uninteresting for the executive looking to create competitive advantage. But when the risk is particularly severe or sudden, a good risk strategy is about more than competitiveness—it can mean survival. Here are five actions leaders can take to establish risk management capabilities .

- Reset the aspiration for risk management. This requires clear objectives and clarity on risk levels and appetite. Risk managers should establish dialogues with business leaders to understand how people across the business think about risk, and share possible strategies to nurture informed risk-versus-return decision making—as well as the capabilities available for implementation.

- Establish agile risk management practices. As the risk environment becomes more unpredictable, the need for agile risk management grows. In practice, that means putting in place cross-functional teams empowered to make quick decisions about innovating and managing risk.

- Harness the power of data and analytics. The tools of the digital revolution can help companies improve risk management. Data streams from traditional and nontraditional sources can broaden and deepen companies’ understandings of risk, and algorithms can boost error detection and drive more accurate predictions.

- Develop risk talent for the future. Risk managers who are equipped to meet the challenges of the future will need new capabilities and expanded domain knowledge in model risk management , data, analytics, and technology. This will help support a true understanding of the changing risk landscape , which risk leaders can use to effectively counsel their organizations.

- Fortify risk culture. Risk culture includes the mindsets and behavioral norms that determine an organization’s relationship with risk. A good risk culture allows an organization to respond quickly when threats emerge.

How do scenarios help business leaders understand uncertainty?

Done properly, scenario planning prompts business leaders to convert abstract hypotheses about uncertainties into narratives about realistic visions of the future. Good scenario planning can help decision makers experience new realities in ways that are intellectual and sensory, as well as rational and emotional. Scenarios have four main features that can help organizations navigate uncertain times.

- Scenarios expand your thinking. By developing a range of possible outcomes, each backed with a sequence of events that could lead to them, it’s possible to broaden our thinking. This helps us become ready for the range of possibilities the future might hold—and accept the possibility that change might come more quickly than we expect.

- Scenarios uncover inevitable or likely futures. A broad scenario-building effort can also point to powerful drivers of change, which can help to predict potential outcomes. In other words, by illuminating critical events from the past, scenario building can point to outcomes that are very likely to happen in the future.

- Scenarios protect against groupthink. In some large corporations, employees can feel unsafe offering contrarian points of view for fear that they’ll be penalized by management. Scenarios can help companies break out of this trap by providing a “safe haven” for opinions that differ from those of senior leadership and that may run counter to established strategy.

- Scenarios allow people to challenge conventional wisdom. In large corporations in particular, there’s frequently a strong bias toward the status quo. Scenarios are a nonthreatening way to lay out alternative futures in which assumptions underpinning today’s strategy can be challenged.

Learn more about McKinsey’s Strategy & Corporate Finance Practice.

What’s the latest thinking on risk for financial institutions?

In late 2021, McKinsey conducted survey-based research with more than 30 chief risk officers (CROs), asking about the current banking environment, risk management practices, and priorities for the future.

According to CROs, banks in the current environment are especially exposed to accelerating market dynamics, climate change, and cybercrime . Sixty-seven percent of CROs surveyed cited the pandemic as having significant impact on employees and in the area of nonfinancial risk. Most believed that these effects would diminish in three years’ time.

Looking for direct answers to other complex questions?

Climate change, on the other hand, is expected to become a larger issue over time. Nearly all respondents cited climate regulation as one of the five most important forces in the financial industry in the coming three years. And 75 percent were concerned about climate-related transition risk: financial and other risks arising from the transformation away from carbon-based energy systems.

And finally, cybercrime was assessed as one of the top risks by most executives, both now and in the future.

Learn more about the risk priorities of banking CROs here .

What is cyber risk?

Cyber risk is a form of business risk. More specifically, it’s the potential for business losses of all kinds in the digital domain—financial, reputational, operational, productivity related, and regulatory related. While cyber risk originates from threats in the digital realm, it can also cause losses in the physical world, such as damage to operational equipment.

Cyber risk is not the same as a cyberthreat. Cyberthreats are the particular dangers that create the potential for cyber risk. These include privilege escalation (the exploitation of a flaw in a system for the purpose of gaining unauthorized access to resources), vulnerability exploitation (an attack that uses detected vulnerabilities to exploit the host system), or phishing. The risk impact of cyberthreats includes loss of confidentiality, integrity, and availability of digital assets, as well as fraud, financial crime, data loss, or loss of system availability.

In the past, organizations have relied on maturity-based cybersecurity approaches to manage cyber risk. These approaches focus on achieving a particular level of cybersecurity maturity by building capabilities, like establishing a security operations center or implementing multifactor authentication across the organization. A maturity-based approach can still be helpful in some situations, such as for brand-new organizations. But for most institutions, a maturity-based approach can turn into an unmanageably large project, demanding that all aspects of an organization be monitored and analyzed. The reality is that, since some applications are more vulnerable than others, organizations would do better to measure and manage only their most critical vulnerabilities.

What is a risk-based cybersecurity approach?

A risk-based approach is a distinct evolution from a maturity-based approach. For one thing, a risk-based approach identifies risk reduction as the primary goal. This means an organization prioritizes investment based on a cybersecurity program’s effectiveness in reducing risk. Also, a risk-based approach breaks down risk-reduction targets into precise implementation programs with clear alignment all the way up and down an organization. Rather than building controls everywhere, a company can focus on building controls for the worst vulnerabilities.

Here are eight actions that comprise a best practice for developing a risk-based cybersecurity approach:

- fully embed cybersecurity in the enterprise-risk-management framework

- define the sources of enterprise value across teams, processes, and technologies

- understand the organization’s enterprise-wide vulnerabilities—among people, processes, and technology—internally and for third parties

- understand the relevant “threat actors,” their capabilities, and their intent

- link the controls in “run” activities and “change” programs to the vulnerabilities that they address and determine what new efforts are needed

- map the enterprise risks from the enterprise-risk-management framework, accounting for the threat actors and their capabilities, the enterprise vulnerabilities they seek to exploit, and the security controls of the organization’s cybersecurity run activities and change program

- plot risks against the enterprise-risk appetite; report on how cyber efforts have reduced enterprise risk

- monitor risks and cyber efforts against risk appetite, key cyber risk indicators, and key performance indicators

How can leaders make the right investments in risk management?

Ignoring high-consequence, low-likelihood risks can be catastrophic to an organization—but preparing for everything is too costly. In the case of the COVID-19 crisis, the danger of a global pandemic on this scale was foreseeable, if unexpected. Nevertheless, the vast majority of companies were unprepared: among billion-dollar companies in the United States, more than 50 filed for bankruptcy in 2020.

McKinsey has described the decisions to act on these high-consequence, low-likelihood risks as “ big bets .” The number of these risks is far too large for decision makers to make big bets on all of them. To narrow the list down, the first thing a company can do is to determine which risks could hurt the business versus the risks that could destroy the company. Decision makers should prioritize the potential threats that would cause an existential crisis for their organization.

To identify these risks, McKinsey recommends using a two-by-two risk grid, situating the potential impact of an event on the whole company against the level of certainty about the impact. This way, risks can be measured against each other, rather than on an absolute scale.

Organizations sometimes survive existential crises. But it can’t be ignored that crises—and missed opportunities—can cause organizations to fail. By measuring the impact of high-impact, low-likelihood risks on core business, leaders can identify and mitigate risks that could imperil the company. What’s more, investing in protecting their value propositions can improve an organization’s overall resilience.

Articles referenced:

- “ Seizing the momentum to build resilience for a future of sustainable inclusive growth ,” February 23, 2023, Børge Brende and Bob Sternfels

- “ Data and analytics innovations to address emerging challenges in credit portfolio management ,” December 23, 2022, Abhishek Anand , Arvind Govindarajan , Luis Nario and Kirtiman Pathak

- “ Risk and resilience priorities, as told by chief risk officers ,” December 8, 2022, Marc Chiapolino , Filippo Mazzetto, Thomas Poppensieker , Cécile Prinsen, and Dan Williams

- “ What matters most? Six priorities for CEOs in turbulent times ,” November 17, 2022, Homayoun Hatami and Liz Hilton Segel

- “ Model risk management 2.0 evolves to address continued uncertainty of risk-related events ,” March 9, 2022, Pankaj Kumar, Marie-Paule Laurent, Christophe Rougeaux, and Maribel Tejada

- “ The disaster you could have stopped: Preparing for extraordinary risks ,” December 15, 2020, Fritz Nauck , Ophelia Usher, and Leigh Weiss

- “ Meeting the future: Dynamic risk management for uncertain times ,” November 17, 2020, Ritesh Jain, Fritz Nauck , Thomas Poppensieker , and Olivia White

- “ Risk, resilience, and rebalancing in global value chains ,” August 6, 2020, Susan Lund, James Manyika , Jonathan Woetzel , Edward Barriball , Mekala Krishnan , Knut Alicke , Michael Birshan , Katy George , Sven Smit , Daniel Swan , and Kyle Hutzler

- “ The risk-based approach to cybersecurity ,” October 8, 2019, Jim Boehm , Nick Curcio, Peter Merrath, Lucy Shenton, and Tobias Stähle

- “ Value and resilience through better risk management ,” October 1, 2018, Daniela Gius, Jean-Christophe Mieszala , Ernestos Panayiotou, and Thomas Poppensieker

Want to know more about business risk?

Related articles.

What matters most? Six priorities for CEOs in turbulent times

Creating a technology risk and cyber risk appetite framework

Risk and resilience priorities, as told by chief risk officers

Risk Management, Risk Analysis, Templates and Advice

- #1 Mind Mapping Tool

- Collaborate Anywhere

- Stunning Presentations

- Simple Project Management

- Innovative Project Planning

- Creative Problem Solving

The Top 50 Business Risks And How To Manage them!

Risk is simply uncertainty of outcome whether positive or negative ( PRINCE2, 2002, p239 ). Business risk is uncertainty around strategy, profits, compliance, environment, health and safety and so on. stakeholdermap.com

The Top 50 Business Risks

| Business Risk description | Actions that could be taken to manage the risk |

|---|---|

| 1. Assets - to buildings, assets e.g. fire, flooding | |

| 2. Bad debt | |

| 3. Bankruptcy of suppliers or clients | |

| 4. Brand fatigue | |

| 5. - poor or becoming less effective | |

| 6. Cashflow | |

| 7. Client attrition |

| Risk description | Actions that could be taken to manage the risk |

|---|---|

| 8. Competition: aggressive | |

| 9. Competition: better intelligence | |

| 10. Competition: legal action | of legal action |

| 11. Compliance with regulations, laws etc | team |

| 12. Copyright theft - theft of your copyright or action against your business | |

| 13. Cost of components - increase or decrease | |

| 14. Customer satisfaction low |

| Risk description | Actions that could be taken to manage the risk |

|---|---|

| 15. Data security | |

| 16. Difficult-to-sell product | materials, sales plays, provide additional sales training |

| 17. Environment - natural or business environment | to employees of extreme weather - ensure safe temperatures at work, access to water, home working in bad weather, support with travel, accomodation etc to facilities, buildings, , materials - insurance e.g. buildings and contents, invest in storm protection, fire prevention etc |

| 18. Espionage (commercial) | |

| 19. Exchange rates e.g. forex | and buy or sell currency in the spot market |

| 20. Failure of utilities e.g. water, electricity | |

| 21. Health and safety | and complete a |

| Risk description | Actions that could be taken to manage the risk |

| 22. Lack of office space | |

| 23. Lack of skills/expertise | |

| 24. Loss of key skills | |

| 25. Loss of political support | |

| 26. Machinery failure | |

| 27. Market acceptance | |

| 28. Market changes e.g. movements in stock prices, interest rates, commodity prices. | |

| 29. Natural disaster | |

| 30. New markets - distract or provide opportunity | |

| 31. Operational risk e.g. risk to day-to-day | |

| 32. Patent theft/infringement - of your patents or competitor against your business | |

| 33. Poor management | |

| 34. Political instability e.g. coup, or political unrest | |

| 35. Profit - loss of profit or missing profit projections |

| Risk description | Actions that could be taken to manage the risk |

| 36. Recession | |

| 37. Regulatory compliance - difficulty in compliance or failure to comply | |

| 38. Reputation - negatively impacted | |

| 39. Revenue forecast missed | |

| 40. Seasonal risk | |

| 41. Staff sickness/absence | |

| 42. Supply chain failure/delays | procedures |

| 43. Technology - advances provide opportunity or threaten existing products | |

| 44. Technology breakdown e.g. server outage | |

| 45. Theft - of product, information from shop floor | |

| 46. Time-to-market | |

| 47. Transportation delay or damage | |

| 48. Under-resourcing | needed over peak periods e.g. Amazon warehouse model from repetitive time-consuming work |

| 49. Unexpected demand - supply issues | |

| 50. War - military conflicts |

Download the full list of Business Risks

Word download - the top 50 business risks (word), pdf download - the top 50 business risks (pdf), 20 common project risks - example risk register, checklist of 30 construction risks, overall project risk assessment template, simple risk register - excel template, business risk - references and further reading, read more on risk management.

- Risk Assessment

- Construction Risk Management

- Risk Management Glossary

- Risk Management Guidelines

- Risk Identification

- NHS Risk Register

- Risk Register template

- Risk Management Report

- Risk Responses

- Prince2 Risk Register

- Prince2 Risk Management Strategy

Share this Image

Risk Mitigation Strategies: Types & Examples (+ Free Template)

Effective enterprise risk management is more important than ever. A recent 2023 State of Risk Oversight Report by NC State University shows that while two-thirds of business leaders (out of 454 respondents) acknowledge escalating risks, only a third are geared up to tackle them.

This points to a serious disconnect between the organization’s needs and its risk management strategy. No plan is bulletproof, but effective preparation and monitoring will help you minimize risks and their impact on business.

In this article, we explore the different risk mitigation strategies and how you can implement them to protect your organization’s performance and stability.

What Is Risk Mitigation?

Risk mitigation is a proactive business strategy to identify, assess, and mitigate potential threats or uncertainties that could harm an organization’s objectives, assets, or operations. It entails specific action plans to reduce the likelihood or impact of these identified risks.

Conversely, risk management is a broader, more comprehensive process that involves various stages like risk identification, assessment, response, and monitoring.

While risk mitigation focuses on direct actions to eliminate or diminish threats, risk management encompasses the entire life cycle of dealing with risks.

They may sound similar, but risk mitigation is a subset and vital component of the risk management process.

%20(1).png)

Why Is Risk Mitigation Important?

The stakes are high, according to the 2023 State of Risk Oversight Report. We're seeing near-record levels of risk events and complexities across organizations.

So what does a robust risk mitigation plan offer you? For starters, it's not about ignoring risks, but rather tackling them head-on with actionable steps. This ensures you have a business continuity plan in the face of disruptions.

An effective risk mitigation process also provides a clearer picture of potential obstacles, which helps with strategic decision-making. This helps manage operational risks and create a resilient supply chain . It also assures employees that they are working with a company that prioritizes job security.

But risk mitigation isn't all defense—it also sets you up to seize growth opportunities. By identifying and minimizing risks, you can make calculated moves that optimize your business portfolio .

What Are The Types Of Risks?

Your risk mitigation strategies should be tailored to your business, which means it can't be a carbon copy of another organization's risk mitigation strategy. The risks you face will vary based on your industry, sector, and other unique factors.

Some of the most common types of risks include:

- Competitor risk: Threats from rival organizations.

- Economic risk: Vulnerabilities due to economic fluctuations.

- Political risk: Impact of political factors.

- Financial risk: Exposure to financial uncertainties.

- Operational risk: Daily hazards in operations , including cybersecurity risks.

📚You can learn more about risk types and strategies to mitigate them in this article .

What Are The Risk Mitigation Strategies?

Described below are the most common risk mitigation strategies.

Tip: You should always start with a complete risk analysis to pick the right strategy for your business.

Risk avoidance strategy

The most straightforward way to deal with risks is to remove them entirely. This involves steering clear of any actions or situations that could harm your business. But be cautious: sidestepping one risk might require sacrificing other resources.

A large technology company plans to launch a new product in an international market, but a risk assessment uncovers considerable regulatory and political obstacles.

Opting for a risk avoidance strategy, the company chooses not to enter the new market, eliminating these high-stakes risks. Instead, it reallocates resources to bolster existing markets or pursue other low-risk opportunities.

While this approach removes immediate risks, it also sacrifices the potential revenue and growth the new product could have generated in that market.

Risk transfer strategy

Sometimes you can pass risks on to someone else. This usually involves using contracts, insurance, or outsourcing . This is a good strategy if it's cheaper to pay another company to take on the risk than to deal with it yourself.

💡 Examples:

- Work with a third-party logistics provider (3PL) for your shipping and delivery needs. The contract often includes clauses that transfer the risk of damaged or lost goods during transit to the 3PL. Upon damaged products, the 3PL is liable to compensate your business for the losses.

- Pay an insurance company a small fee to avoid the full financial implications of unforeseen events like accidents.

📚 Recommended read: Unlocking The Power Of Logistics Strategy To Achieve Supply Chain Excellence

Risk acceptance strategy

Sometimes taking a risk is a good choice, especially if the potential reward is high or the likelihood of problems is low. Each business has its own comfort level for risk and uses that to decide which risks are worth taking. It’s also better to accept risks if the costs of avoiding them are too high.

Many startups know they have a high chance of failing early on. But they're willing to take that risk because the possible rewards, like growth and profit, make it worthwhile.

If you’re following this strategy, you must constantly monitor the threat level. If it rises above acceptable risk levels, or if your risk appetite changes, you might need to switch to a different strategy to protect your business.

Risk reduction strategy

In cases where you can’t avoid or accept the risks, it’s best to pursue measures to reduce their impact altogether. Risk reduction involves implementing proactive and concrete actions to make a potential problem less severe.

💡 Examples:

- An oil drilling company in a hurricane-prone region may invest in advanced high-tech weather systems to better predict stores. This move will help them to prepare in advance and reduce the likelihood of costly disruptions due to natural disasters.

- If you identified that you’ll run out of funds to complete a project, you could switch to more affordable materials or scale back the project size. You could also look for extra funding. Each option helps lower the risk of running out of money before completing the project.

Risk monitoring strategy

Risks are an ongoing fact of doing business and carefully monitoring them will ensure that mitigation measures remain effective. Risk monitoring involves regular evaluations and adjustments to strategies to address changing circumstances.

💡 Example:

A manufacturing company can continually monitor supply chain risks like supplier reliability, geopolitical issues, and market trends. If there are potential disruptions, they can take timely actions to adjust sourcing strategies or secure alternative suppliers.

What Are The Steps To Mitigate Risks?

The following steps will help you identify risks and implement a responsive risk mitigation strategy:

1. Understand what you’re up against

Systematically examine all the possible risks to your business by conducting an internal and external analysis. You can use the SWOT analysis to identify the current and future state of your business. Pay attention to the “Threats” quadrant that highlights potential risks.

.jpg)

You can also use other strategic analysis tools like PESTLE Analysis or Porter’s 5 Forces to analyze the business’s external environment for any potential threats.

💡Involve key stakeholders to gain a diverse perspective and access to insights that may not be immediately apparent. They can help you see what’s happening on the front lines so you can assess risks accurately.

2. Assess and prioritize the risks

After listing all the possible risks, it’s time to analyze the probability of their occurrence and the potential negative impact. You can use a risk matrix to help you assess and prioritize risks based on their likelihood and impact. This will help you focus your resources on the most critical risks.

💡While the risk matrix is easy to read and use, it often relies on qualitative judgments. This can sometimes result in poor resource allocation. To avoid this, whenever possible, convert risks into monetary terms. This provides a more accurate picture of how each risk could financially impact your business.

3. Prepare a plan to execute your risk mitigation initiatives

Once you’ve identified and categorized the potential risks to your business, it’s time to create an action plan. For each identified risk, decide on the most suitable approach: will you avoid, mitigate, transfer, or simply accept it?

Once you've determined your approach for each risk, allocate the needed resources. This includes people, money, and time devoted to implementing the chosen risk mitigation strategies . Have a backup with contingency plans for risks that may not be fully addressed by your initial strategies.

💡You can use Cascade’s Risk Mitigation Strategy Plan Template to cover all the key elements of an effective strategy.

4. Execute your strategy and monitor risks

Risks are always changing. That's why you need to continuously keep an eye on them to make sure your mitigation plans are up-to-date. Establish regular check-ins, such as daily or weekly meetings, to quickly assess the status of your risk mitigation strategies.

To make this process even more efficient, use specific metrics tied to the risks you're managing. Set up triggers that alert you when it's time to take extra steps.

💡Look for strategy execution tools like Cascade that integrate seamlessly with various business platforms. This allows you to bring all your key business data together in a centralized hub, making it easier to stay on top of risks and adjust your strategies as needed.

5. Update risk and adapt your plan

As your business landscape evolves—whether due to market shifts, technological upgrades, or internal developments—your risk mitigation plan must keep pace. Not only can new risks arise, but the importance of existing risks can change as well.

To make these adjustments more data-driven, you can use Cascade's reports .

.png)

These reports help you pinpoint any threats, monitor risks, and keep your team aligned with updated priorities. By constantly refining your plan, you ensure it remains effective in a shifting environment.

Mitigate Risks And Master Chaos With Cascade 🚀

To be resilient and successful, it's crucial to spot and neutralize threats before they escalate. Instead of being reactive, the key is to be proactive—maintaining financial stability, safeguarding your reputation, and staying ahead of the competition.

With features like alignment and collaboration, real-time analytics, and data tracking in one place, Cascade empowers you to detect and manage risks with confidence.

Our strategy execution platform integrates various data sources, giving you centralized visibility over your execution engine. This insight enables you to clear dependencies and mitigate potential risks faster to improve your odds of success.

Curious? Sign up for free or book a 1:1 with Cascade strategy expert .

More related resilience and risk management strategy templates:

- 16 Business Continuity Plan Templates For Every Business

- Operational Risk Assessment Template

- Healthcare Risk Assessment Template

- Compliance Risk Management Plan Template

- Risk Response Plan Template

Popular articles

11 Best Strategic Frameworks For Your Organization + Free eBook

Strategic Analysis Complete Guide: Definition, Tools & Examples

6 Steps To Successful Strategy Execution & Best Practices

.png)

How To Create A Culture Of Strategy Execution

Your toolkit for strategy success.

- My Account My Account

- Cards Cards

- Banking Banking

- Travel Travel

- Rewards & Benefits Rewards & Benefits

- Business Business

Curated For You

Advertisement

Related Content

Types of business risks and ideas for managing them.

Published: July 06, 2023

Updated: July 05, 2024

There are several types of business risks that can threaten a company’s ability to achieve its goals. Learn some of the most common risks for businesses and ideas for how to manage them.

Business risks can include financial, cybersecurity, operational, and reputational risks, all of which can seriously impact a company’s strategic plans if business leaders don’t take action to mitigate them.

What’s most important is that business owners are aware of the risks that could shake up their operations. That way, they can take steps to prevent them or minimize their impact if they occur. Here’s a look at some common business risks.

Financial Risks

Companies must generate sufficient cash flow to make interest payments on loans and to meet other debt-related obligations on time. Financial risk refers to the flow of money in the business and the possibility of a sudden financial loss. A company may be at financial risk if it doesn’t have enough cash to properly manage its debt payments and becomes delinquent on its loans.

Businesses with relatively higher levels of debt financing are considered at higher financial risk, since lenders often see them as having a greater chance of not meeting payment obligations and becoming insolvent. Types of financial risk include:

- Credit risk: When a company extends credit to customers, there is the possibility that those customers may stop making payments, which reduces revenue and earnings. A company also faces credit risk when a lender extends business credit to make purchases. If the company doesn’t have enough money to pay back those loans, it will default.

- Currency risk: Currency risk, also known as exchange-rate risk, can arise from the change in price of one currency in relation to another. For example, if a U.S. company agrees to sell its products to a European company for a certain amount of euros, but the value of the euro rises suddenly at the time of delivery and payment, the U.S. business loses money because it takes more dollars to buy euros.

- Liquidity risk: A company faces liquidity risk when it cannot convert its assets into cash. This type of business risk often occurs when a company suddenly needs a substantial amount of cash to meet its short-term debt obligations. For example, a manufacturing company may not be able to sell outdated machines to generate cash if no buyers come forward.

Cybersecurity Risks

As more businesses use online channels for sales and e-commerce payments, as well as for collecting and storing customer data, they are exposed to greater opportunities for hacking, creating security risks for companies and their stakeholders. Both employees and customers expect companies to protect their personal and financial information, but despite ongoing efforts to keep this information safe, companies have experienced data breaches, identity theft, and payment fraud incidents.

When these incidents happen, consumer confidence and trust in companies can take a dive.

Not only do security breaches threaten a company’s reputation, but the company is sometimes financially liable for damages.

Ideas for managing security risks:

- Investing in fraud detection tools and software security solutions .

- Educating employees about how they can do their part to keep the company’s data safe. Basic guidance includes not clicking suspicious links in emails or sharing sensitive data without encrypting it first.

Operational Risks

A business is considered to have operational risk when its day-to-day activities threaten to decrease profits. Operational risks can result from employee errors, such as undercharging customers. Additionally, a natural disaster like a tornado, hurricane, or flood might damage a company’s buildings or other physical assets, disrupting its daily operations.

Of course, one of the starkest examples of negative impacts to companies' production and supply chain operations is the Coronavirus pandemic. In an April 2022 Small Business Pulse Survey conducted by the U.S. Census Bureau, roughly 65 percent of respondents reported that the pandemic had either a moderate negative effect or a large negative effect on their business.

- Making time for necessary employee training to minimize internal mistakes.

- Developing contingency plans to shield against external events that may impact operations. For example, a restaurant impacted by a natural disaster might be able to partner with another local restaurant, bar, or coffee shop to use their kitchen and sell to-go items.

Reputational Risks

Reputational risk can include a product safety recall, negative publicity, and negative reviews online from customers. Companies that suffer reputational damage can even see an immediate loss of revenue, as customers take their business elsewhere. Companies may experience additional impacts, including losing employees, suppliers, and other partners.

Ideas for managing reputational risks:

- Pay attention to what customers and employees say about the company both online and offline.

- Commit not only to providing a quality product or service, but also to ensuring that workers are trained to deliver excellent customer service and to resolve customer complaints, offer refunds, and issue apologies when necessary.

The Takeaway

Business owners face a variety of business risks, including financial, cybersecurity, operational, and reputational. However, they can take proactive measures to prevent or mitigate risk while continuing to seize opportunities for growth . To learn more about the benefits of risk management planning read, "5 Hidden Benefits of Risk Management."

Frequently Asked Questions

1. what are the main types of business risks.

There are several types of business risks: • Financial Risks • Cybersecurity Risks • Operational Risks • Reputational Risks

2. What are common examples of business risks?

• Financial risks can include cash flow problems, inability to meet financial obligations, or taking on too much debt. • Cybersecurity risks are risks associated with data breaches, hacks, or cyber-attacks. • Operational risks include supply chain disruptions, natural disasters, or IT failures. • Reputational risks can occur when a company's reputation is damaged by negative publicity, scandal, or other events.

3. How can you identify a business risk?

There are a few key ways to identify business risks:

• Reviewing financial statements and performance indicators: This can help you identify risks related to cash flow, profitability, or solvency. • Conducting a SWOT analysis: A SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) can also be a helpful tool for identifying risks and brainstorming ways to mitigate them. • Identifying key dependencies: Key dependencies are things that your business relies on to function, and if they were to fail or be disrupted, it could have a serious impact on your business. • Carrying out root cause analysis: Conducting root cause analysis can help you to identify what underlying factors could lead to a problem or issue.

A version of this article was originally published September 01, 2022.

Photo: Getty Images

Trending Content

- Search Search Please fill out this field.

Identifying Risks

Physical risks, location risks, human risks, technology risks, strategic risks, making a risk assessment, insuring against risks, risk prevention, the bottom line.

- Business Essentials

Identifying and Managing Business Risks

:max_bytes(150000):strip_icc():format(webp)/522293_3816099810338_52357726_n1__marc_davis-5bfc2625c9e77c0058760671.jpg)

Running a business comes with many types of risk. Some of these potential hazards can destroy a business, while others can cause serious damage that is costly and time-consuming to repair. Despite the risks implicit in doing business, CEOs and risk management officers can anticipate and prepare, regardless of the size of their business.

Key Takeaways

- Some risks have the potential to destroy a business or at least cause serious damage that can be costly to repair.

- Organizations should identify which risks pose a threat to their operations.

- Potential threats include location hazards such as fires and storm damage, a l cohol and drug abuse among personnel, technology risks such as power outages, and strategic risks such as investment in research and development.

- A risk management consultant can recommend a strategy including staff training, safety checks, equipment and space maintenance, and necessary insurance policies.

If and when a risk becomes a reality, a well-prepared business can minimize the impact on earnings, lost time and productivity, and negative impact on customers. For startups and established businesses, the ability to identify risks is a key part of strategic business planning . Risks are identified through a number of ways. Strategies to identify these risks rely on comprehensively analyzing a company's specific business activities. Most organizations face preventable, strategic and external threats that can be managed through acceptance, transfer, reduction, or elimination.

A risk management consultant can help a business determine which risks should be covered by insurance.

Below are the main types of risks that companies face:

Building risks are the most common type of physical risk. Think fires or explosions. To manage building risk, and the risk to employees, it is important that organizations do the following:

- Make sure all employees know the exact street address of the building to give to a 911 operator in case of emergency.

- Make sure all employees know the location of all exits.

- Install fire alarms and smoke detectors.

- Install a sprinkler system to provide additional protection to the physical plant, equipment, documents and, of course, personnel.

- Inform all employees that in the event of emergency their personal safety takes priority over everything else. Employees should be instructed to leave the building and abandon all work-associated documents, equipment and/or products.

Hazardous material risk is present where spills or accidents are possible. The risk from hazardous materials can include:

- Toxic fumes

- Toxic dust or filings

- Poisonous liquids or waste

Fire department hazardous material units are prepared to handle these types of disasters. People who work with these materials, however, should be properly equipped and trained to handle them safely.

Organizations should create a plan to handle the immediate effects of these risks. Government agencies and local fire departments provide information to prevent these accidents. Such agencies can also provide advice on how to control them and minimize their damage if they occur.

Among the location hazards facing a business are nearby fires, storm damage, floods, hurricanes or tornados, earthquakes, and other natural disasters. Employees should be familiar with the streets leading in and out of the neighborhood on all sides of the place of business. Individuals should keep sufficient fuel in their vehicles to drive out of and away from the area. Liability or property and casualty insurance are often used to transfer the financial burden of location risks to a third-party or a business insurance company.

There are other business risks associated with location that are not directly related to hazards, such as city planning. For example, a gas station exists on a major road, and as a result of its location, it receives plenty of business. City planning can eventually restructure the area around the gas station. The city may close the road the gas station is on, build other infrastructure that would make the gas station inaccessible, or overall just not take the gas station into consideration with any redevelopment. This would leave the gas station with no traffic to serve.

Alcohol and drug abuse are major risks to personnel in the workforce. Employees suffering from alcohol or drug abuse should be urged to seek treatment, counseling, and rehabilitation if necessary. Some insurance policies may provide partial coverage for the cost of treatment.

Protection against embezzlement , theft and fraud may be difficult, but these are common crimes in the workplace. A system of double-signature requirements for checks, invoices, and payables verification can help prevent embezzlement and fraud. Stringent accounting procedures may discover embezzlement or fraud. A thorough background check before hiring personnel can uncover previous offenses in an applicant's past. While this may not be grounds for refusing to hire an applicant, it would help HR to avoid placing a new hire in a critical position where the employee is open to temptation.

Illness or injury among the workforce is a potential problem. To prevent loss of productivity, assign and train backup personnel to handle the work of critical employees when they are absent due to a health-related concern. Other human-related risks under public attention could be associated with their behaviors and values. Misbehavior of management related to bias, racism, sexism, harassment, corruption, discrimination, pollutive actions, and carelessness about the environment are all actions that represent risk for the companies where these managers work.

A power outage is perhaps the most common technology risk. Auxiliary gas-driven power generators are a reliable back-up system to provide electricity for lighting and other functions. Manufacturing plants use several large auxiliary generators to keep a factory operational until utility power is restored.

Computers may be kept up and running with high-performance back-up batteries. Power surges may occur during a lightning storm (or randomly), so organizations should furnish critical business systems with surge-protection devices to avoid the loss of documents and the destruction of equipment.

Cloud storage is another source of risks nowadays. The process involves backing up data with Amazon Web Services, for example, using Azure, IBM, and Oracle, for instance. This is a huge undertaking that should be considered given the reliance on cloud-based data to run most businesses now. It is important to establish both offline and online data backup systems to protect critical documents.

Although telephone and communications failure are relatively uncommon, risk managers may consider providing emergency-use company cell phones to personnel whose use of the phone or internet is critical to their business.

Strategy risks are not altogether undesirable. Financial institutions such as banks or credit unions take on strategy risk when lending to consumers, while pharmaceutical companies are exposed to strategy risk through research and development for a new drug. Each of these strategy-related risks is inherent in an organization's business objectives. When structured efficiently, the acceptance of strategy risks can create highly profitable operations.

Companies exposed to substantial strategy risk can mitigate the potential for negative consequences by creating and maintaining infrastructures that support high-risk projects. A system established to control the financial hardship that occurs when a risky venture fails often includes diversification of current projects, healthy cash flow, or the ability to finance new projects in an affordable way, and a comprehensive process to review and analyze potential ventures based on future return on investment .

After the risks have been identified , they must be prioritized in accordance with an assessment of their probability. The first step is to establish a probability scale for the purposes of risk assessment .

For example, risks may:

- Be very likely to occur

- Have some chance of occurring

- Have a small chance of occurring

- Have very little chance of occurring

Other risks must be prioritized and managed in accordance with their likelihood of occurring. Actuarial tables —statistical analysis of the probability of any risk occurring and the potential financial damage ensuing from the occurrence of those risks—may be accessed online and can provide guidance in prioritizing risk.

Insurance is a principle safeguard in managing risk, and many risks are insurable. Fire insurance is a necessity for any business that occupies a physical space, whether owned outright or rented, and should be a top priority. Product liability insurance, as an obvious example, is not necessary for a service business.

Some risks are an inarguably high priority, for example, the risk of fraud or embezzlement where employees handle money or perform accounting duties in accounts payable and receivable. Specialized insurance companies will underwrite a cash bond to provide financial coverage in the event of embezzlement, theft or fraud.

When insuring against potential risks, never assume a best-case scenario. Even if employees have worked for years with no problems and their service has been exemplary, insurance against employee error may be a necessity. The extent of insurance coverage against injury will depend on the nature of your business. A heavy manufacturing plant will, of course, require more extensive coverage for employees. Product liability insurance is also a necessity in this context.

If a business relies heavily on computerized data—customer lists and accounting data, for example—exterior backup and insurance coverage is necessary. Finally, hiring a risk management consultant may be a prudent step in the prevention and management of risks.

The best risk insurance is prevention. Preventing the many risks from occurring in your business is best achieved through employee training, background checks, safety checks, equipment maintenance and maintenance of the physical premises. A single, accountable staff member with managerial authority should be appointed to handle risk management responsibilities. A risk management committee may also be formed with members assigned specific tasks with a requirement to report to the risk manager.

The risk manager, in conjunction with a committee, should formulate plans for emergency situations such as:

- Hazardous materials accidents or the occurrence of other emergencies

Employees must know what to do and where to exit the building or office space in an emergency. A plan for the safety inspection of the physical premises and equipment should be developed and implemented regularly including the training and education of personnel when necessary. A periodic, stringent review of all potential risks should be conducted. Any problems should be immediately addressed. Insurance coverage should also be periodically reviewed and upgraded or downgraded as needed.

Prevention is the best insurance against risk. Employee training, background checks, safety checks, equipment maintenance, and maintenance of physical premises are all crucial risk management strategies for any business.

While business risks abound and their consequences can be destructive, there are ways and means to ensure against them, to prevent them, and to minimize their damage, if and when they occur. Finally, hiring a risk management consultant may be a worthwhile step in the prevention and management of risks.

:max_bytes(150000):strip_icc():format(webp)/strategic-management-ADD-Source-7c12087694c9443a99743b612dd1c5d5.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

How to Highlight Risks in Your Business Plan

Tallat Mahmood

5 min. read

Updated October 25, 2023

One of the areas constantly dismissed by business owners in their business plan is an articulation of the risks in the business.

This either suggests you don’t believe there to be any risks in your business (not true), or are intentionally avoiding disclosing them.

Either way, it is not the best start to have with a potential funding partner. In fact, by dismissing the risks in your business, you actually make the job of a lender or investor that much more difficult.

Why a funder needs to understand your business’s risks:

Funding businesses is all about risk and reward.

Whether it’s a lender or an investor, their key concern will be trying to balance the risks inherent in your business, versus the likelihood of a reward, typically increasing business value. An imbalance occurs when entrepreneurs talk extensively about the opportunities inherent in their business, but ignore the risks.

The fact is, all funders understand that risks exist in every business. This is just a fact of running a business. There are risks that exist with your products, customers, suppliers, and your team. From a funder’s perspective, it is important to understand the nature and size of risks that exist.

- There are two main reasons why funders want to understand business risks:

Firstly, they want to understand whether or not the key risks in your business are so fundamental to the investment proposition that it would prevent them from funding you.

Some businesses are not at the right stage to receive external funding and placate funder concerns. These businesses are best off dealing with key risk factors prior to seeking funding.

The second reason why lenders and investors want to understand the risk in your business is so that they can structure a funding package that works best overall, despite the risk.

In my experience, this is an opportunity that many business owners are wasting, as they are not giving funders an opportunity to structure deals suitable for them.

Here’s an example:

Assume your business is seeking equity funding, but has a key management role that needs to be filled. This could be a key business risk for a funder.

Highlighting this risk shows that you are aware of the appointment need, and are putting plans in place to help with this key recruit. An investor may reasonably decide to proceed with funding, but the funding will be released in stages. Some will be released immediately and the remainder will be after the key position has been filled.

The benefit of highlighting your risks is that it demonstrates to investors that you understand the danger the risks pose to your company, and are aware that it needs to be dealt with. This allows for a frank discussion to take place, which is more difficult to do if you don’t acknowledge this as a problem in the first place.

Ultimately, the starting point for most funders is that they want to invest in you, and want to validate their initial interest in you.

Highlighting your business risks will allow the funder to get to the nub of the problem, and give them a better idea of how they may structure their investment in order to make it work for both parties. If they are unsure of the risks or cannot get clear explanations from the team, it is unlikely they will be forthcoming when it comes to finding ways to make a potential deal work.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- The right way to address business risks:

The main reason many business owners don’t talk about business risks with potential funders is because they don’t want to highlight the weaknesses in their business.

This is a fair concern to have. However, there is a right way to address business risk with funders, without turning lenders and investors off.

The solution is to focus on how you mitigate the risks.

In other words, what are the steps you are taking in your business as a direct reaction to the risks that you have identified? This is very powerful in easing funder fears, and in positioning you as someone who has a handle on their business.

For example, if a business risk you had identified was a high level of customer concentration, then a suitable mitigation plan would be to market your products or services targeting new clients, as opposed to focusing all efforts on one client.

Having net profit margins that are lower than average for your market would raise eyebrows and be considered a risk. In this instance, you could demonstrate to funders the steps you are putting in place over a period of time to help increase those margins to at least market norms for your niche.

The process of highlighting risks—and, more importantly, outlining key mitigating actions—not only demonstrates honesty, but also a leadership quality in solving the problems in your business. Lenders and investors want to see both traits.

- The impact on your credibility:

Any lender or investor backs the leadership team of a business first, and the business itself second.

This is because they realize that it is you, the management team, who will ultimately deliver value and grow the business for the benefit for all. As such, it is imperative that they have the right impression about you.

The consequence of highlighting business risks in your business plan with mitigations is that it provides funders a real insight into you as a business leader. It demonstrates that not only do you have an understanding of their need to understand risk in your business, but you also appreciate that minimizing that risk is your job.

This will have a massive impact on your credibility as a business owner and management team. This impact is more acute when compared to the hundreds of businesses they will meet that omit discussing the risks in their business.

The fact is, funders have seen enough businesses and business plans in all sectors to instinctively know what risks to expect. It’s just more telling if they hear it from you first.

- What does this mean for you going forward?

Funders rely on you to deliver on your inherent promise to add value to your business for all stakeholders. The weight of this promise becomes much stronger if they can believe in the character of the team, and that comes from your credibility.

A business plan that discusses business risks and mitigations is a much more complete plan, and will increase your chances of securing funding.

Not only that, but highlighting the risks your business faces also has a long-term impact on your character and credibility as a business leader.

Tallat Mahmood is founder of The Smart Business Plan Academy, his flagship online course on building powerful business plans for small and medium-sized businesses to help them grow and raise capital. Tallat has worked for over 10 years as a small and medium-sized business advisor and investor, and in this period has helped dozens of businesses raise hundreds of millions of dollars for growth. He has also worked as an investor and sat on boards of companies.

Table of Contents

- Why a funder needs to understand your business’s risks:

Related Articles

1 Min. Read

How to Calculate Return on Investment (ROI)

2 Min. Read

How to Use These Common Business Ratios

7 Min. Read

7 Financial Terms Small Business Owners Need to Know

8 Min. Read

How to Forecast Personnel Costs in 3 Steps

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Uncovering Hidden Risks: A Comprehensive Guide to Business Plan Risk Analysis