Sample Letters

Writing a Credit Card Application Request Letter That Works

As someone who has written countless credit card application request letters, I understand the nuances and the importance of crafting a compelling letter. This guide aims to help you create an effective credit card application request letter, with tips from my personal experience, real-life examples, and three unique templates to get you started.

Key Takeaways

- Purpose: Understand the importance of a well-crafted credit card application request letter.

- Structure: Learn the essential components of a successful letter.

- Templates: Access three unique templates to use as a reference.

- Tips: Gain insights from personal experiences to enhance your letter.

- Examples: See how these principles are applied in real-life scenarios.

Guide to Writing a Credit Card Application Request Letter

Start with a Formal Salutation

- Address the letter to a specific person if possible.

- Use a professional greeting such as “Dear [Title] [Last Name],”.

State the Purpose of the Letter

- Be clear about why you are writing.

- Mention the specific credit card you are applying for.

Introduce Yourself

- Provide a brief introduction of yourself.

- Mention your current financial status and credit history.

Explain Why You Want the Credit Card

- Highlight the benefits you are seeking from the card.

- Mention any specific features that appeal to you.

Provide Supporting Details

- Include relevant financial information.

- Attach any necessary documents such as proof of income or bank statements.

Express Gratitude

- Thank the recipient for considering your application.

- Be polite and professional throughout the letter.

End with a Formal Closing

- Use a professional closing such as “Sincerely” or “Best regards,”.

- Sign the letter.

Template 1: Applying for a New Credit Card

[Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date]

[Recipient’s Name] [Bank Name] [Bank Address] [City, State, ZIP Code]

Dear [Recipient’s Name],

I am writing to express my interest in applying for the [Name of Credit Card] offered by your esteemed bank. I have been a loyal customer of [Bank Name] for the past [number] years, and I believe this credit card will greatly benefit my financial needs.

As a [Your Occupation] with a stable income and a good credit score, I am confident in my ability to responsibly manage this credit card. I am particularly interested in the [specific feature or benefit of the credit card] and believe it will complement my financial planning.

Enclosed with this letter are copies of my recent bank statements and proof of income. I appreciate your consideration of my application and look forward to a positive response.

Thank you for your time and assistance.

Sincerely, [Your Name]

Template 2: Requesting an Upgrade

I am writing to request an upgrade to my existing credit card account with [Bank Name]. Currently, I hold a [Current Credit Card] and would like to upgrade to the [Desired Credit Card].

Over the past [number] years, I have maintained a good standing with your bank, consistently paying my dues on time and managing my credit responsibly. I believe that the [Desired Credit Card] will better suit my current financial needs, especially with its [specific feature or benefit].

Attached are my recent bank statements and credit report for your reference. I would appreciate your consideration of my request and look forward to your favorable response.

Thank you for your attention to this matter.

Best regards, [Your Name]

Template 3: Applying for a Credit Card for Business Use

[Your Name] [Your Business Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date]

I am writing to apply for the [Name of Business Credit Card] for my business, [Your Business Name]. As a [Your Position] at [Your Business Name], I manage the financial operations and believe that this credit card will significantly aid in our financial management.

Our business has been in operation for [number] years, and we have a solid financial track record. The benefits offered by the [Name of Business Credit Card], such as [specific feature or benefit], are particularly appealing and align with our business needs.

I have enclosed our recent financial statements and business plan for your review. I appreciate your consideration and look forward to a positive response.

Thank you for your time and support.

Tips from Personal Experience

- Be Honest and Transparent: Always provide accurate information. Misrepresentation can lead to rejection or future complications.

- Highlight Your Strengths: Emphasize your financial stability and creditworthiness.

- Keep it Professional: Use a formal tone and avoid any informal language.

- Follow Up: After sending your letter, follow up with a call or email to ensure it was received and inquire about the next steps.

Real-Life Examples

Example 1: successful application for a travel credit card.

I once applied for a travel credit card by emphasizing my frequent travel needs and the benefits I would gain from the card’s rewards program. By providing detailed travel expense reports and proof of consistent income, I successfully obtained the card, which has since been an invaluable tool for managing travel expenses.

Example 2: Business Credit Card Upgrade

In another instance, I requested an upgrade to a business credit card by highlighting our business’s financial growth and the additional benefits the upgraded card would provide. The supporting documents, including our business’s financial statements, played a crucial role in securing the upgrade.

Frequently Asked Questions

| Question | Answer |

|---|---|

| What should I include in my credit card application request letter? | Your personal details, the purpose of the letter, your financial status, and supporting documents. |

| How can I increase my chances of approval? | Provide accurate information, highlight your financial strengths, and attach necessary documents. |

| Is it necessary to address the letter to a specific person? | Yes, if possible, as it makes the letter more personal and direct. |

By following this guide and using the provided templates, you can create a persuasive credit card application request letter that stands out. Remember, the key is to be clear, concise, and honest. Good luck!

How to Write a Credit Card Authorization Letter (With Sample)

Adina Lazar is a freelance writer and blogger specializing in finance. She writes original content that helps readers make smart financial decisions.

A credit card authorization letter allows someone else to make a payment using your credit card. That’s a potentially risky thing to do, so you need to be careful about specifying exactly what you are authorizing a third party to do.

We’ll show you how to create this document and also give you a sample of how it should look like.

Example of a Credit Card Authorization Letter

Here’s an example of how a detailed credit card authorization letter should look like (we’re using a Travel Agency authorization reference for a flight ticket):

If you’re unsure about what to include in your letter, don’t hesitate to ask the third party you’re authorizing. Make sure you’re as specific as possible, so your credit card is used exactly as you instructed.

Download Credit Card Authorization Letter Templates:

⏬ Credit card authorization letter template for Microsoft Word ⏬ Credit card authorization letter template for Google Docs ⏬ Credit card authorization letter template in PDF

Here’s a sample credit card authorization letter using our template:

⚠️ Please Read Before Using This Template!

This template must be customized to fit your circumstances. You will see instructions for the information that you will need to insert. These instructions are indicated by ____ text.

Be sure that you fill in all required information and delete the placeholder text before you send the letter.

Your letter will be less effective if our instructions are still visible!

Key Takeaways

- Purpose of Credit Card Authorization Letters: With these letters you grant permission for a specific purpose, allowing a designated individual or company to use your credit card for a limited time or a one-time transaction, typically when you’re not present.

- Common Scenarios Requiring Authorization: examples include booking travel through a travel agency, paying for another person’s hotel stay, or authorizing a trusted institution to use your card on your behalf, especially in situations like booking flights.

- Distinguishing from Authorized Users: A credit card authorization letter differs from adding an authorized user. While the former is a one-time or limited-use consent, an authorized user has continuous access to the account, albeit without ownership.

- Cautionary Notes: Credit card authorization letters should not be used casually, especially for friends or family members. Sharing your credit card with someone, even with written consent, can violate your credit card agreement and expose you to potential fraud.

What Is a Credit Card Authorization Letter?

A Credit Card Authorization letter is a document that authorizes someone else to use your credit card for a specific purpose. This can be paying for utilities, the mortgage, a car loan payment, or other dues you might have. It’s usually addressed to an institution or company, and it is only used on a one-time basis or for a limited time indicated in the letter.

The letter contains your written consent to use the card, as well as specific instructions on how and when it may be used by the recipient. Its purpose is to allow the merchant to use your credit card without you being present to do so yourself.

To better understand this, let’s look at an example.

Travel agencies often ask for a credit card authorization letter when they book a trip on your behalf using your credit card details. By providing the letter, you consent to them using your card to book the trip. The letter also protects them from any liability in case you decide to dispute the transaction later on.

Besides booking a holiday with a travel agent, there are a few other common scenarios when you may need to write a credit card authorization letter.

💡 A credit card authorization letter shouldn’t be confused with being an authorized user. An authorized user is like a secondary account holder (without ownership) that has continuous access to the account and can use it to build credit.

When Do I Need a Credit Card Authorization Letter?

Knowing when you might need a credit card authorization letter can be extremely useful. Let’s look at a couple of common situations that may require a letter of authorization.

1. Booking a hotel room for someone else using your credit card

Many hotels make credit card authorization letters mandatory when you pay for another guest’s accommodation with your card. So if you’re feeling generous and want to pay for your spouse’s hotel room while they’re traveling, ask your hotel about the letter. Not providing it can affect your guest’s hotel stay.

2. Authorizing a business or institution to use your card on your behalf

This is usually a one-time transaction that permits a trusted institution to use your card when you’re not present. It’s most commonly used for booking flights, but there may be other situations where it’s required or useful.

How Do I Write a Credit Card Authorization Letter?

Some businesses (like hotels) usually have their own credit authorization forms. In this case, all you need to do is fill them out!

If you have to write one yourself, don’t stress. Crafting a well-written letter is quick and simple. Use simple language, a formal tone, and include the following features:

- Your full name

- Your contact information

- Your credit card information and billing address (exclude the CVV code)

- The amount you are authorizing

- The reason for the authorization (be specific!)

- The business or institution that is authorized to use it

- The amount of time they can use it for (if it’s recurring)

- Your bank’s contact information (if necessary)

- Your signature

Be Cautious

Credit card authorization letters should not be used to give a friend or a family member permission to use your credit card.

The letter does not protect you against fraud if the other person misuses the card, and giving your credit card to someone else can put you in a vulnerable situation. To make matters worse, you’re also violating your credit card agreement by sharing your card with someone else, even if you provide your written consent.

If you’re unable to use the card yourself, consider adding someone as an authorized user or a joint owner.

More Letter Templates

Our collection of free, fully-customizable letter templates is there to help you write effective letters when you need to set up, cancel or complain about something.

By Adina Lazar

Contributing writer.

Adina Lazar is a freelance writer and blogger specializing in finance. She writes original content that helps readers make smart financial decisions. Follow her on Twitter (@AdinaILazar) or visit her at www.adinalazar.com.

More in Credit Cards

609 Letter Template & How to File a Credit Dispute

Sample Goodwill Letter Template to Remove Late Payments

Sample Pay for Delete Letter for Credit Report Cleanup

How to Write a Credit Inquiry Removal Letter

How to Write a Medical Bill Negotiation Letter

How to Write a Debt Settlement Letter (With Sample)

How to Write a Credit Card Hardship Letter

Sample Letter for Disputing Credit & Debit Card Charges

How to Write a Medical Bill Dispute Letter (Template Included)

Best Secured Credit Cards of 2024

Varo Believe Card Review: Building Credit With Your Debit Card

Best Online Store Credit Cards With Guaranteed Approval in 2024

5 Best Unsecured Credit Cards for Bad Credit in 2024

Self Visa Credit Card: An In-Depth Review for 2024

Applied Bank® Secured Visa® Gold Preferred® Credit Card Review (2024)

Net First Platinum Card Review (2024) | Can It Build Credit?

Best Credit Cards With No Credit Check in 2024

Best Credit Cards for Groceries (2024)

- Cookie Policy

- Privacy Policy

Why Are Gas Prices so High? 18 Questions Answered!

We did a little mythbusting on one of the burning questions of the moment. Here's what you need to know about why gas prices are so ...

How Does Inflation Work: An Illustrated Guide for the Rest of Us

With all this talk about inflation have you ever stopped to consider if you really know what inflation is? If you’re not really sure - join the club and read on. ...

12 Valuation Ratios Every Investor Should Know

Learn all about the 12 valuation ratios that allow investors to quickly estimate a business’s value relative to its ...

Popular Articles

12 best rent reporting services in 2024.

Not all rent reporting services are created equal. To maximize your credit score increase you need to choose the best rent reporter for you. Learn ...

The 15/3 Credit Card Payment Hack: How, Why, and When It Works

Here's what you should know about the 15/3 credit card payment hack, including how it works and whether you should use ...

Yes, You Can Build Credit with a Debit Card. Here’s How!

In this blog post, we take a closer look at why you couldn't build credit with a debit card before, and why you can ...

Word & Excel Templates

Printable word and excel templates.

New Credit Application Letter to Customers

People who regularly buy products from a brand eventually develop trust and a strong relationship. Owing to this, they get the entitlement to apply for buying products on credit. When products are purchased on credit, the customer saves himself from having to pay individually for every purchase.

There may be many issues such as lack of money or unavailability of cash that may hinder the customer to complete the process of buying a product. Therefore, they choose to write the credit application letter in order to request for getting permission to buy things first and pay later.

What is a new credit application letter to customers?

Usually, a customer writes a request letter to a business and asks for the opening of a credit account. In some cases, the business also writes this letter to customers when it wants its buyers to buy products without paying on the spot.

When to write?

Now the question is what makes a business write this letter. There are certain situations and some of these are given below:

When a customer has requested the procedure:

A common situation is when customers request a business to provide them with the information about the entire procedure of getting new credit. In response to the letter or email from the customer, the business replies with this letter and attaches an application form so that the customer can fill it out and initiate the procedure.

When sales of a business are reduced:

Oftentimes, a business realizes that its sales are declining because it does not offer its products on credit, and people who cannot pay immediately switch to those brands that provide them with the opportunity to pay later. So, in order to inform the buyers that buying products with the intent to pay later is possible now, they write this letter.

How to write?

In order to write a letter that is professional and addresses important details in an effective manner, you can follow the tips given below:

Start the letter with admiring the buyers:

As soon as you start the letter, admire the customer for being a loyal buyer and for staying with the company despite the fact that there are many options available. Express your plans to serve the business with better services. This part of the letter pleases the buyer and makes him feel valued. For a business to be successful, it is very important to give due value and respect to purchasers.

Ask the customers to fill out the form:

If you want shoppers to start buying products from you on credit, ask them to fill out the form that you have attached with the letter. Describe that filling this form will be considered as a request from consumers to make some purchases from the business without paying on a spot.

Develop trust:

If you know that the consumer might not be comfortable sharing personal information by filling this form, tell how you are intended to use the shared information and what steps you will take to keep the information protected.

Sample letter:

Subject: New credit application for [X]

Dear value customer,

We are so pleased to know that you are interested in our company and it has always been our topmost priority to serve our customers with the best services.

It is our humble request to our respected customers to submit a credit application. After receiving this application, we will be in a better position to offer our products at the best-discounted prices. We are cognizant of the fact that the information we require from you is a bit sensitive and you may not be comfortable sharing it. However, we collect this information from all our customers. In addition to it, we always take care of this information. It is our top priority to save you from having to pay a higher price just because of the bad credit of other people.

We have enclosed an application form in this letter that you are requested to fill out at your earliest convenience. This way, we will be able to process the information in a better way.

We are looking forward to a humble response from your side.

File: Word (.docx) & iPad Size 22 KB

- Holiday Closing Messages

- Letter Requesting Transfer to another Department

- Letter Requesting Promotion Consideration

- Umrah Leave Request Letter to Boss

- Ramadan Office Schedule Announcement Letters/Emails

- Letter to Friend Expressing Support

- Letter to Employer Requesting Mental Health Accommodation

- Letter Requesting Reference Check Information

- Letter Requesting Salary Certificate

- Letter Requesting Recommendation from Previous Employer

Request or Apply For a Credit Account

I want to establish a line of credit with your company. My employees are making more and more trips to your store and the need to prepare a check for each purchase is becoming inconvenient. It would be much easier to pay at the end of each month. Based on the last few months' purchases, I think a $10,000 credit line is sufficient for now.

If you have any concerns about my company's credit worthiness, please feel free to contact the following companies we have dealt with over the last few years:

Doe Corporation

1600 Main Street

Springfield, Kansas 12345

Telephone: 555-5555

Doe International

Thank you for your assistance. I look forward to hearing from you.

We have been purchasing supplies from Doe Corporation for the last nine months on a cash basis and wish to open a charge account for future transactions with your company. It will ease our bookkeeping tasks to pay bills monthly rather than on delivery. If you would like to consult other companies with whom we have done business, please contact the enclosed credit references. We look forward to your speedy reply.

I would like to open a charge account with Doe's Tire. Our fleet of cars and trucks is growing at such a rate that it only makes sense to place our tire needs wholly in Doe's capable hands. A quick credit check will reveal that our company's credit is spotless, so I am confident that a $2000 revolving credit line will serve both of us well. I have enclosed a completed standard credit application form. I look forward to your speedy reply.

We have been very pleased with the quality of your machine and fabrication work on the few custom orders we have brought you. We would be happy if we could open a charge account with you and have you perform all of our automotive machine shop services. Doe's normally does $600 per month in machine service, and we have always done it in-house. However, our machinist has retired, and we need reliable service on a charge basis. Any of the local automotive suppliers will gladly vouch for our good credit, and we will be happy to complete an application to expedite the process. Please respond as quickly as possible, so that we may begin taking in machine work again soon.

How to Write this Credit Letter: Expert Tips and Guidelines

Use a confident and formal tone. Be specific about why you want a credit account and why you are a good credit risk.

- Make your request.

- State the reasons for your request.

- State why you are a good credit risk. If possible, give credit references.

- Ask for an immediate response.

Write Your credit in Minutes: Easy Step-by-Step Guide with Sample Sentences and Phrases

1 make your request., sample sentences for step 1.

- I wish to open a credit account with your company to purchase building materials for a new office building.

- I have enclosed my order form for this month and would like to open a charge account to cover its cost.

- We need to make an unusually large purchase from your company this month and wish to set up a credit account to facilitate payment.

- I would like to set up a line of credit with your company. We have spent $10,000 over the past 12 months and anticipate maintaining this level of spending.

- The Doe Corporation has been your loyal customer for a full year and has always paid for your services in cash. Now we wish to request a $2,000 credit line, effective with our next order.

- For the past nine months we have enjoyed a comfortable business relationship with the Doe Corporation on a cash basis. We feel that now is a good time to open a charge account with your company.

- As I mentioned during our phone conversation this morning, the Doe Corporation is interested in opening a charge account with your company.

Key Phrases for Step 1

- a more convenient payment arrangement

- after doing business with you for

- are interested in opening a

- feel that now is a good time

- for future purchases

- have enclosed an order form

- make monthly payments

- open a corporate credit account

- pay each bill within

- pay in installments

- pay once a month

- plan to spend about

- set this up in the name of

- to establish a line of credit

- to set up a charge account

- to open a credit account

- will allow us to order

- would like to establish

- would prefer to be billed

- would like to open

- would it be possible to

- would like to set up

2 State the reasons for your request.

Sample sentences for step 2.

- Obtaining a credit account would allow me the convenience of making one monthly payment instead of paying for small purchases throughout the month.

- As you know, we have recently expanded our business into five other locations and are doing very well. However, now we must purchase larger quantities of your product and would feel more comfortable if you would bill us for our purchases on the first day of every month, rather than upon delivery.

- The increase in the demand for our tent products means that we will need to purchase more of your canvas than usual. To meet this need, we will need to establish a $5,000.00 credit line with your company.

- We anticipate that our next few purchases will be very large and, in order to cover the costs, we will need to open a charge account.

- We are very pleased with your services and want to continue doing business with you on a regular basis. We think, therefore, that it would be mutually beneficial for us to open a charge account with you.

- Our school's soccer team begins playing on September 3, but we will not have all the money for the players' uniforms until later in the month.

- I enjoyed our conversation earlier this morning and have prepared a copy of our projected needs for the next six months. I think you will agree that the best way to handle our situation is to open a credit account.

Key Phrases for Step 2

- anticipate that our

- are making regular purchases

- easier and more efficient

- expect to be

- have grown very rapidly

- in order to meet

- in addition to other

- instead of several small payments

- make one monthly payment

- must purchase larger quantities

- need to purchase more of

- on a regular basis

- our next few purchases will be

- purchasing increasing amounts of

- recently expanded our

- significant increase in demand

- the best way to handle this is

- want to continue to

- will allow us the convenience of

- within the next few months

- would be mutually beneficial

- would allow me to

- would aid us in budgeting

3 State why you are a good credit risk. If possible, give credit references.

Sample sentences for step 3.

- Our company is expanding rapidly and is financially secure. Please note the following businesses that can verify our financial responsibility:

- Enclosed are the names of three credit references who will be happy to respond to any inquiries regarding my credit history.

- My monthly salary is sufficient to cover my living expenses and to make payments on the beautiful engagement ring that my fiancee has chosen from your store.

- If you would like more information concerning our financial standing and credit history, please contact the following references:

- We have held credit accounts with the following companies for the past three years:

- If we open a charge account at your athletic store, we are confident that we can pay off the entire cost over the next four months.

Key Phrases for Step 3

- are acquainted with our financial standing

- are sure you will

- are confident that we can

- concerning our financial standing

- enclosed are the names of

- established a credit history with

- feel free to

- have grown significantly since

- have held credit accounts with

- have agreed to act as credit references

- have purchased supplies from you since

- hold open lines of credit at

- if you would like more information

- is financially secure

- is sufficient to cover

- please note the following businesses

- regarding our credit history

- regarding our financial credibility

- the following references

- the following companies

- verify our financial responsibility

- welcome to contact

- will be happy to respond

- will provide credit references

- would like to refer you to

4 Ask for an immediate response.

Sample sentences for step 4.

- Thank you for your cooperation. I eagerly await your reply.

- It is important that we receive your response as soon as possible. Thank you for your consideration.

- Thank you for your willingness to help us. We hope to hear from you soon.

- We will appreciate your early reply.

- Thank you for your help and swift response.

- We will appreciate receiving your response as soon as possible.

- I hope to receive your prompt reply so I can plan future transactions accordingly.

- Thank you for your cooperation in this matter.

- Thank you for your assistance. I will contact you in two weeks if I have not received your reply.

Key Phrases for Step 4

- appreciate your early reply

- as soon as possible

- can call me at

- eagerly await your

- for your consideration

- for your assistance

- hope to receive your reply soon

- hope to hear from you soon

- in the near future

- is important that we

- look forward to

- please let us know

- receive your response by

- so I can plan future purchases accordingly

- so that we can plan accordingly

- thank you for

- thanks for your swift response

- when the account is approved

- will contact you in two weeks

- would be greatly appreciated

- would appreciate receiving your response

Recommended Articles

Recommended letter-writing resources.

Action Verbs for Resumes and Cover Letters

Business Letter Format Tips

Letter Closings

Credit Card Closure Application Letter (with Samples & PDFs)

I have listed sample templates to help you craft an effective and professional credit card closure application letter.

Also, I would like to point out that you can also download a PDF containing all the samples at the end of this post.

Application for Termination of Credit Card

First, find the sample template for credit card closure application letter below.

Subject: Request for Closure of Credit Card

Dear Sir/Madam,

I have cleared all the outstanding dues on my card and there are no pending liabilities. Kindly provide a written confirmation that my credit card has been closed and all the automatic payments and charges associated with this card are stopped.

Please also ensure that this closure does not negatively impact my credit score. I have enjoyed being a customer of your bank and I would like to maintain my other accounts without any disruption.

I kindly request you to expedite this process and confirm the closure at the earliest. Please let me know if there are any formalities that I need to complete from my end.

Thank you for your prompt attention to this matter.

Yours faithfully,

Below I have listed 5 different sample applications for “credit card closure application letter” that you will certainly find useful for specific scenarios:

Credit Card Dispute Resolution Application Letter

The transaction details are as follows: – Date of Transaction: [Date of Transaction] – Merchant Name: [Merchant Name] – Transaction Amount: INR [Transaction Amount] – Transaction Reference Number: [Transaction Reference Number]

As soon as I noticed the discrepancy in my credit card statement, I contacted your customer care helpline and was advised to submit a formal dispute resolution application. I kindly request you to look into this matter immediately and take necessary steps to reverse the unauthorized transaction from my credit card account.

Please find enclosed the supporting documents, including my credit card statement, which highlights the disputed transaction. I am also willing to provide any further information or documentation that may be required for the investigation.

I appreciate your prompt attention to this matter, and I hope to have a resolution at the earliest possible. Thank you for your assistance.

[Your Name] [Your Address] [City, Postal Code] [Mobile Number] [Email ID]

Application Letter for Credit Card Limit Reduction before Closure

To, The Branch Manager, [Bank Name], [Branch Address], [City, Postal Code]

I, [Your Name], holding the credit card number [xxxx-xxxx-xxxx-xxxx] with your esteemed bank, kindly request a reduction in the credit limit of my credit card before initiating the closure process.

After the reduction in the credit limit, I would like to initiate the closure process for my credit card. Kindly guide me through the necessary formalities required for the same. I assure you that I will clear any outstanding dues, if any, before the card closure.

I hope that you will consider my request and process it at the earliest. I appreciate your cooperation and assistance in this matter.

Debt Consolidation and Credit Card Closure Application

To, The Branch Manager, [Bank Name], [Branch Address],

Respected Sir/Madam,

Due to unforeseen financial circumstances, I have accumulated debts on multiple credit cards, which has led to difficulties in managing my finances effectively. In order to streamline my debt repayment, I kindly request you to consider consolidating my outstanding debts from different sources into a single loan with your esteemed bank. This will not only help me manage my repayments in a more organized manner but also reduce my financial burden.

As part of the debt consolidation process, I would also like to request the closure of my credit card account with your bank to avoid further debt accumulation. I understand that there may be implications such as pre-closure charges, and I am willing to bear the necessary charges as per the applicable terms and conditions.

Yours faithfully, [Your Name] [Contact Number] [Email Address]

Application Letter for Credit Card Cancellation following Unauthorized Usage

To, The Manager (Name of the Bank and Branch) (Address) (City, Postal Code)

Subject: Application Letter for Credit Card Cancellation following Unauthorized Usage

I, (Your Name), a customer of your esteemed bank holding a credit card with the number (Your Credit Card Number), wish to bring to your attention that there have been unauthorized transactions made using my credit card.

On (Date of Unauthorized Transaction), I noticed an unusual activity on my credit card statement, detailing expenditures that I did not authorize. I immediately informed the customer support helpline to report these unauthorized transactions but have yet to receive a satisfactory resolution.

In light of these events, I kindly request you to cancel my existing credit card and issue a new one with immediate effect. I would also like to seek a waiver on the unauthorized charges incurred on my account, as per the bank’s policy for such incidents.

Name: (Your Full Name) Address: (Your Address) Customer ID: (Your Customer ID) Credit Card Number: (Your Credit Card Number) Contact Number: (Your Contact Number)

I trust your bank to take appropriate action in securing the safety of my account and finances. I appreciate your prompt assistance in this matter and look forward to receiving the new credit card at the earliest.

Credit Card Upgrade and Account Transition Application

To, The Branch Manager, [Bank Name], [Bank Branch], [City], [Postal Code]

I, [Your Full Name], have been a loyal customer of [Bank Name] for the past [Number of Years] years, holding a savings account (Account Number: [Your Account Number]) and a credit card (Card Number: [Your Credit Card Number]). I have always been extremely satisfied with the services provided by your esteemed bank.

In light of the above, I kindly request you to upgrade my existing credit card to the [New Credit Card Name] and initiate the necessary account transition process at the earliest. I am aware of the requirements and eligibility criteria for the new card, and I firmly believe that I meet those prerequisites. I have attached the necessary documents, including my recent salary slip and address proof, for your reference and verification.

Please let me know if any further information or documents are needed from my end to facilitate a smooth transition. I appreciate your assistance in this matter and look forward to enjoying the benefits of the [New Credit Card Name] soon.

[Your Full Name] [Your Mobile Number] [Your Email Address] [Date]

How to Write Credit Card Closure Application Letter

Related Topics:

I am sure you will get some insights from here on how to write “credit card closure application letter”. And to help further, you can also download all the above application samples as PDFs by clicking here .

And if you have any related queries, kindly feel free to let me know in the comments below.

Leave a Reply Cancel reply

An official website of the United States government

Here’s how you know

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

View all Consumer Alerts

Get Consumer Alerts

Credit, Loans, and Debt

Learn about getting and using credit, borrowing money, and managing debt.

View Credit, Loans, and Debt

Jobs and Making Money

What to know when you're looking for a job or more education, or considering a money-making opportunity or investment.

View Jobs and Making Money

Unwanted Calls, Emails, and Texts

What to do about unwanted calls, emails, and text messages that can be annoying, might be illegal, and are probably scams.

View Unwanted Calls, Emails, and Texts

Identity Theft and Online Security

How to protect your personal information and privacy, stay safe online, and help your kids do the same.

View Identity Theft and Online Security

- Search Show/hide Search menu items Items per page 20 50 100 Filters Fulltext search

Sample Letter for Disputing Credit and Debit Card Charges

Contact Your Credit or Debit Card Company

Send a dispute letter to your card company, consider contacting the seller, sample letter for disputing credit or debit card charges, report problems.

You must notify your credit or debit card company of any error you’re disputing within 60 days of the date that the first statement on which the charge appears was sent to you. Consumer protections for credit cards are stronger than protections for debit cards , but some debit card companies voluntarily offer more protections than the law requires. To best protect your rights, review your account statements carefully every month and submit any dispute right away.

Start by calling the card company’s customer service number to report the problem. Find the telephone number on your monthly statement or on the back of your card. Keep a record of who you spoke with and when. Follow up promptly with a letter. The sample below may help.

Many card companies may let you to submit your dispute online. You may have to set up an online account to do that. However, to fully protect yourself, follow up with a letter quickly.

After you call the card company or dispute the charge online, follow up right away with a letter disputing the charge. The letter is a written notice to the card company about the problem. Remember, you must send the letter within 60 calendar days of the date that the first statement on which the disputed charge appears was sent to you.

Make sure your letter includes

- your name and account number

- the dollar amount of the disputed charge

- the date of the disputed charge

- an explanation of why you think the charge is incorrect

Here are some possible reasons why you might believe a charge is incorrect:

- The date or amount of the charge is wrong.

- The charge is for goods or services that you didn’t accept or that weren’t delivered to you as agreed.

- You were charged more than once for something.

- You returned the item, but the credit wasn’t posted to your account.

- You paid for the item, but the payment wasn’t posted to your account.

- You didn’t authorize the transaction.

Send your letter to the address your card company lists for billing disputes, errors, or inquiries. Look on your monthly statement, the card company’s website, or your card agreement to get the right address. The address for billing disputes usually is different from the address where you send your payments.

Send your letter by certified mail, if possible. Ask for a return receipt so you have proof that the card company got your letter. Include with your letter copies of any receipts, checks, or other proof of the transaction. Hold on to your originals.

It also may help to contact the seller for problems you are having with debit or credit card charges. But for most problems, if you don’t first contact the card issuer, you could lose important rights that protect you due to the timing requirements.

When you contact the seller, keep a record of who you spoke with and when. If you resolve the problem, check back with your card company — often your bank — to make sure your account shows the proper credit or refund.

Use this sample letter to help you write your dispute letter.

[Your Name]

[Your Address, City, State, Zip Code]

[Name of Credit or Debit Card Company]

Attn: Billing Inquiries

[Address, City, State, Zip Code]

Re: Notice of disputed charge to Account No. [Your account number]

Dear [Contact Person or Billing Inquiries Division] :

I am writing to dispute a charge of [$______] to my [credit or debit card] account on [date of the charge] . The charge is in error because [explain the problem briefly. For example, the items weren’t delivered, I was overcharged, I returned the items, I did not buy the items, etc . ] .

[Add any additional explanation that may be helpful . For example, “I ordered the items on [date] . The seller promised to deliver the items to me on [date] , but I never received my order.” ]

I am requesting that the error be corrected, that any finance or other charges related to the disputed amount be credited to my account, and that I get an accurate statement.

Enclosed are copies of [describe any enclosed information, like sales slips, payment records, or documentation of shipment or delivery dates] supporting my position and experience. Please correct the error on my account promptly.

[Your name]

Enclosures: [List the documents you are enclosing. Send copies, not the originals.]

If you have an issue with your credit card or bank account, report it to the Consumer Financial Protection Bureau. Go to consumerfinance.gov/complaint or call (855) 411-CFPB (2372).

Top Categories

Request or apply for a credit account letter template.

Edit this template

How to Write a Professional Request for a Credit Account Letter: Benefits of Using Templates

As a business owner, entrepreneur or even a freelancer, it’s important to have access to credit to keep your operations running smoothly. Whether you’re in need of a line of credit, a credit card or a business loan, you’ll need to provide a formal request for a credit account to your preferred financial institution. In this article, we’ll explore the importance of writing a professional request for a credit account letter and explain the benefits of using templates from our website.

Why a Professional Request for a Credit Account Letter Matters

A request for a credit account letter is essentially a formal business letter that outlines your request for a credit account with a specific financial institution. It is important to approach this process with a professional and formal tone to ensure that your request is taken seriously and processed promptly. The letter should be well-written, concise, and clearly articulate the reasons why you need the credit account, how you intend to use the credit, and how you plan to pay it back.

A poorly written letter can undermine your credibility and decrease your chances of being approved for a credit account. Therefore, it’s crucial to take the time to craft a well-written letter that presents you and your business in the best light.

The Benefits of Using Templates

One way to ensure that your request for a credit account letter is well-written is to use a template from our website. Our templates are designed to help you write professional and effective letters with ease. Here are some benefits of using templates from our website:

- Time-Saving: Our templates are pre-written, which means you don’t have to spend time writing a letter from scratch. All you need to do is fill in the blanks with your specific information and details.

- Professional Appearance: Our templates are designed by professionals who understand the importance of a professional appearance. By using our templates, you can ensure that your letter has a professional and polished look that will make a positive impression on the financial institution.

- Structured and Well-Organized: Our templates are structured and well-organized, making it easy to present your information in a clear and concise manner. This will help you to avoid any confusion or misunderstandings when communicating with the financial institution.

- Customizable: Our templates are customizable, which means you can tailor the letter to your specific needs and situation. This allows you to personalize the letter to make it more effective and persuasive.

Supercharge Your Productivity with Visual Paradigm – Online Productivity Suite

Looking to supercharge your productivity? Look no further than Visual Paradigm – Online Productivity Suite. This all-in-one platform is designed to help you create, edit, and share your documents, presentations, PDFs, charts, and digital publications with ease. With a range of intuitive tools, collaborative features, and a user-friendly interface, Visual Paradigm Online is the ultimate solution for maximizing your efficiency. Don’t miss out on this opportunity to streamline your workflow and elevate your work to new heights. Sign up now at https://online.visual-paradigm.com/ and unlock your full potential!

©2024 by Visual Paradigm. All rights reserved.

- Terms of Service

- Privacy Policy

- Security Overview

- Sample letter requesting for a credit card

- Topics >>

- Letter samples >>

- Credit Sample Letters - format and templates -03/25/14

- « Previous

- Next »

- RE: Sample letter requesting for a credit card -SUMAN DEVI (12/23/16)

- Dhani-lanban (dahki)v/p-Pritampuri. Neemkathana Dist -Sikar Rajasthan 332708

- Sample letter requesting for a credit card -Smita Julka (03/31/14)

Related Content

- Sample letter requesting an increase in credit

- Sample letter asking a reason for a denial of credit

- Sample letter to notify an error in credit report and seek c...

- CareerRide on YOUTUBE

- CareerRide on INSTAGRAM

Related Topics

- Order Sample Letters - format and templates

- Credit Sample Letters - format and templates

- Medical Care Sample Letters - format and templates

- Goodbye Letter Samples - format and templates

- Complaint Letter Sample - format and templates

- Invitation Letter Samples - format and templates

- PRO Courses Guides New Tech Help Pro Expert Videos About wikiHow Pro Upgrade Sign In

- EDIT Edit this Article

- EXPLORE Tech Help Pro About Us Random Article Quizzes Request a New Article Community Dashboard This Or That Game Happiness Hub Popular Categories Arts and Entertainment Artwork Books Movies Computers and Electronics Computers Phone Skills Technology Hacks Health Men's Health Mental Health Women's Health Relationships Dating Love Relationship Issues Hobbies and Crafts Crafts Drawing Games Education & Communication Communication Skills Personal Development Studying Personal Care and Style Fashion Hair Care Personal Hygiene Youth Personal Care School Stuff Dating All Categories Arts and Entertainment Finance and Business Home and Garden Relationship Quizzes Cars & Other Vehicles Food and Entertaining Personal Care and Style Sports and Fitness Computers and Electronics Health Pets and Animals Travel Education & Communication Hobbies and Crafts Philosophy and Religion Work World Family Life Holidays and Traditions Relationships Youth

- Browse Articles

- Learn Something New

- Quizzes Hot

- Happiness Hub

- This Or That Game

- Train Your Brain

- Explore More

- Support wikiHow

- About wikiHow

- Log in / Sign up

- Education and Communications

- Official Writing

How to Write a Credit Card Settlement Letter

Last Updated: December 28, 2023

Writing to Offer a Settlement

To continue an ongoing negotiation, to confirm a completed negotiation.

This article was co-authored by Clinton M. Sandvick, JD, PhD . Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013. This article has been viewed 73,241 times.

If you owe more on a credit card than you can afford to pay, you may wish to negotiate a settlement with the card company. In a settlement you agree to pay some lesser amount, and the company agrees to accept that amount. You both avoid the trouble and expense of going to court, and you can protect your credit rating at the same time. [1] X Research source You may wish to conduct the negotiations in writing to avoid misunderstandings. Both sides are protected by putting the final settlement in writing.

- Ask if you should address your letter to a particular individual. In most cases you will just write to the collections office (or something similar), but some companies may refer you to a particular individual.

- As an example, your letter might begin by saying, “Due to a recent automobile accident and the medical costs I have incurred, I find that I am unable to make all my outstanding credit card payments. I am writing in the hope of reaching a settlement with you for an amount that I can realistically pay.”

- An explanatory letter for a settlement like this may help you with future lenders as well. Keep a copy of the letter, and be prepared to share it. Potential lenders will be concerned when they see a settlement on your credit history, but your explanation will lend context.

- An offer of this type could say something like, “I am able to make an immediate payment of $4,000 in full settlement of my outstanding credit card debt.” Be sure to use the phrase “in full settlement,” so it is clear that you mean this as a full and final payment and not as part of a payment plan.

- If you intend to begin a payment plan, you could offer something like this: “I would like to start a payment plan, whereby I would pay you $1,000 by the first of each month for the next six months. This $6,000 would constitute full settlement of my outstanding credit card debt.”

- For example, your opening paragraph may say, “I am writing to follow up on our telephone conversation of July 16, 2016. I made an offer to resolve my credit card account with a single payment of $2,000, but you countered by saying that your company would accept $8,000.”

- This latest letter could state, “I appreciate your request for a payment of $8,000. However, I cannot meet your request. I am able to offer a final payment of $3,500 in full settlement of my outstanding debt.”

- Realize that you really have very little leverage for controlling the way the company reports your account to a credit-reporting agency. Even so, it is worth discussing. Ask for the most favorable treatment you can get.

- the amount of your agreement

- the payment deadline. Even if the agreement is for “immediate” payment and you are including a check with the letter, you must say so.

- periodic payment dates if you are setting up a payment plan

- the phrase “full and final settlement.” This binds the company legally to this amount and prevents future collection efforts for any additional amounts.

- a description of how the company will report this debt to the credit-reporting agencies. It makes a difference whether a debt is reported as “paid,” “settled,” or “paid late.” Try to negotiate for a reporting of "paid."

- Send the company two copies of the letter with your original signature. In the body of your letter, request that the account representative sign one of the letters and return it to you.

- Above the signature space, include the words, “Agreement accepted.” Then provide a line for the company representative to sign and insert the date.

Expert Q&A

- Consider offering less for older debts. A reasonable offer might be something around 15-to-25 percent of the debt. [11] X Research source Thanks Helpful 0 Not Helpful 0

- Keep a copy of all correspondence. Retain a file of all letters you send and receive. You may need to refer to these in the future as you consider further offers. [12] X Research source Thanks Helpful 0 Not Helpful 0

- Before trying to settle your credit card debt, decide what you can afford to pay. Review all of your outstanding debts, and compare these to your regular income and any other funds you have available. Do this by checking your credit score . Thanks Helpful 0 Not Helpful 0

- You should have the settlement money on hand before writing the final letter. Be aware that failure to make the agreed-upon payment or payments could cause your default on the settlement agreement, generating even more problems for you. Thanks Helpful 0 Not Helpful 0

- Keep a copy of the credit-card settlement letter and all interactions such as payments sent to the company. You may need a record later. Thanks Helpful 0 Not Helpful 0

- Know that a settlement could impact your credit score negatively. Anything other than full, on-time payment will hurt your score to some extent. Thanks Helpful 0 Not Helpful 0

You Might Also Like

- ↑ https://www.nolo.com/legal-encyclopedia/credit-card-debt-settlement.html

- ↑ https://www.bankrate.com/finance/debt/settle-your-debts-yourself-4.aspx

- ↑ https://www.creditinfocenter.com/debt/settle-debts.shtml

- ↑ https://www.experian.com/blogs/ask-experian/defining-charged-off-written-off-and-transferred/

About This Article

- Send fan mail to authors

Did this article help you?

Featured Articles

Trending Articles

Watch Articles

- Terms of Use

- Privacy Policy

- Do Not Sell or Share My Info

- Not Selling Info

Don’t miss out! Sign up for

wikiHow’s newsletter

- Search Search Please fill out this field.

- Credit Cards

- Credit Cards 101

Sample Letter for Closing Your Credit Card

:max_bytes(150000):strip_icc():format(webp)/bio_LaToyaIrby-d7b87e77d6c441e5a61deecedbb3861a.png)

Where to Send Your Letter

- Payments, Interest, and Fees

Frequently Asked Questions (FAQs)

Once you’ve decided to close your credit card, for example because you have too many credit cards or you simply no longer want to have this credit card, you want to be sure to close it the right way .

You can close your credit card without writing a letter, but sending a letter gives you physical proof that you requested your account to be closed. You may even choose to call your credit card issuer first to close your account, and then follow up with a letter for your records. Sending the letter via certified mail gives you additional proof that your request was received. If there's ever a question about whether you closed your account and when, you'll have the letter to back up the fact that you closed your account.

Don't send your letter to the same address that you send your credit card payments. Most credit card issuers have a separate mailing address for correspondence. Check a recent copy of your credit card statement for the correct address. You also will be able to get the correct address from your online statement or by calling your card issuer’s customer service number found on the back of your credit card. Verify that you have the correct address before mailing your letter.

Payments, Interest, and Fees After the Account is Closed

You’ll continue to receive billing statements if you still have a balance when you close the account. You’re still required to make at least the monthly minimum payment until your balance is paid in full, but you won’t be able to make purchases on your account since it’s closed. Your balance will still accrue interest, and any fees will still apply. You can pay off the balance faster by increasing your monthly payment.

If you have any recurring bills being charged to this credit card, make sure you change them to keep them from being declined (and your services from being cancelled).

Your letter doesn’t have to include a reason for closing your account; you can simply state that you want your account to be closed.

Make sure you replace the bold information with your personal and account information. You can customize your own letter, too, but be sure to include your name, billing address, and account number so the credit card issuer can identify your account. If your letter is a followup to a phone call, include the date and time of the call and the name of the representative you spoke with.

When you send your letter via certified mail, you’ll be given a tracking number. You can enter this tracking number into USPS.com to verify when the credit card issuer receives your letter. Sending your letter via certified mail isn't a requirement to close your account, but the extra step is insurance for yourself.

Check with the credit card issuer after a few days to confirm that your account was closed. After about 30 days, you can check your credit reports to be sure the account is accurately updated to show that the account was closed at your request. Here's a sample letter for closing your card:

Sample Letter

Date Your Name Address City, State, Zip Name of Creditor Address City, State, Zip Code Re: Account Number: Account Number (or last four digits of credit card) Dear Sir or Madam: On 6/15/18, I made a request by telephone to have my account closed. This letter confirms that request. Any updates to my credit report should reflect the account was closed at my request. Please send confirmation the account was closed. Sincerely, Your Name

How much does closing a credit card account hurt your credit score?

The exact credit score impact of closing an account will depend on any other accounts you have open. The most significant, immediate impact of closing a credit card will be on your credit utilization ratio. By closing a credit card, you lose that line of credit as part of your total credit profile. Any existing debt you have from other accounts will suddenly take up a higher ratio of your total available credit and hurt your score.

Closing an account will also affect your average age of credit, but you won't notice that effect until the account drops off your credit report, and that can take up to 10 years.

How do you cancel a debit card?

Unlike credit cards, which are tied to a line of credit, debit cards are typically tied to a checking account. You can destroy a debit card by cutting it up, but to "cancel" a debit card account altogether, you'll probably have to close your checking account with the bank.

Consumer Financial Protection Bureau. " I Want to Close My Credit Card Account. What Should I Do? "

TransUnion. " Closing Bank Accounts and Your Credit Score ."

Capital One. " Need an Address for Mailing Things to Capital One? "

Capital One. " Want to Close Your Credit Card Account? "

:max_bytes(150000):strip_icc():format(webp)/cancel-credit-cards-56a6350e3df78cf7728bd67e.jpg)

Search This Blog

Search letters formats here, request letter to bank for credit card cancellation/ closing, submit your comments here.

Please stop using credit card..you will Know the value of money..

The credit card services is pathetic and such same fool thing they their employees said every costumer that if u use this card it will be very helpful for u and this and that but they don't tell u about how much money the cut from ur bank account they are just doing shameless things a ordinary man easy came in their these types of game. So what's a different between them and a shopkeeper they are also doing same while shoppkeer us best from them I . In my neighborhood my uncle lives they are just very tensed about their credit card everytime they cut their money. One day was crying also the bank are shameless

Absolutely 💯 percent right

Post a Comment

Leave your comments and queries here. We will try to get back to you.

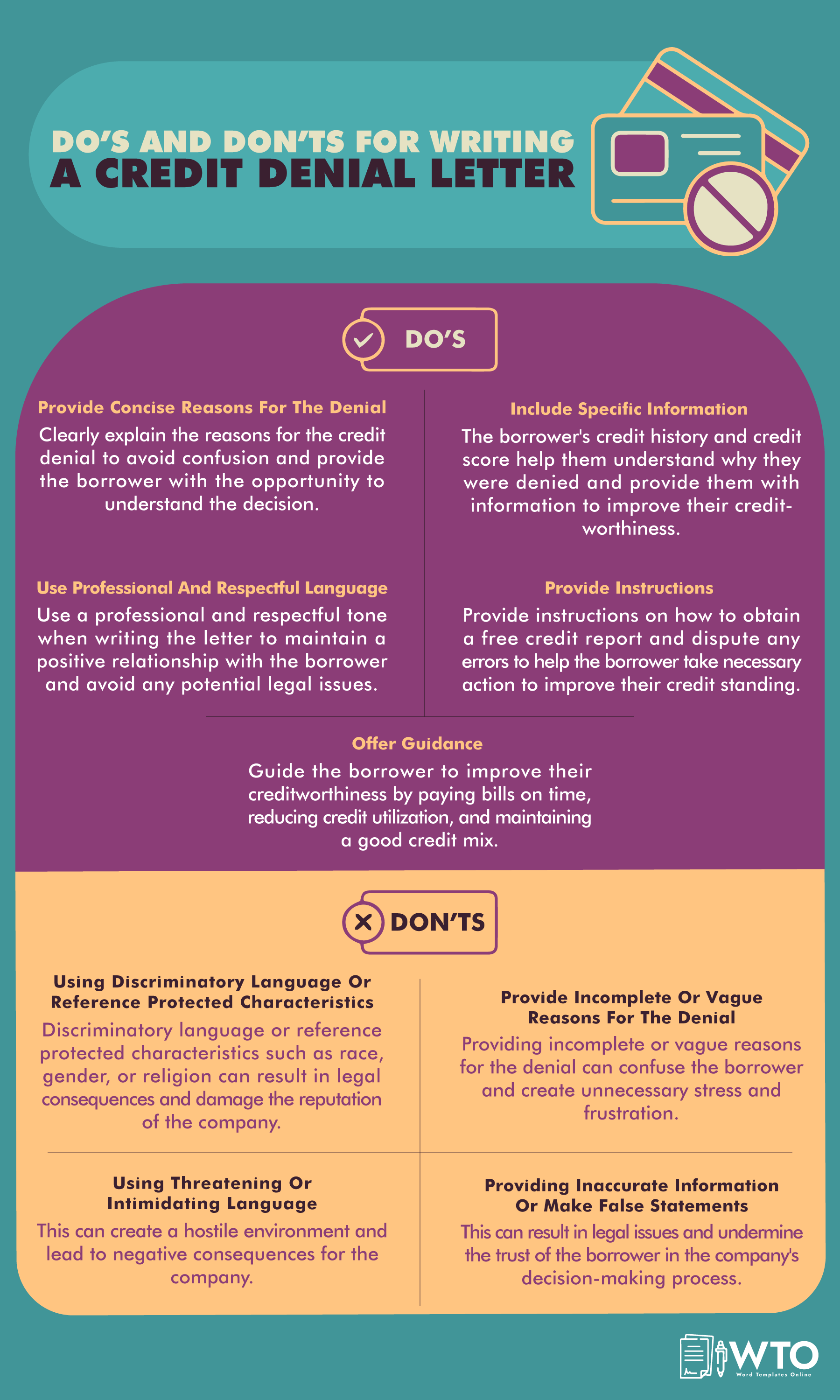

WTO / Letters and Emails / Rejection / How to Write Credit Denial Letter (Samples & Templates)

How to Write Credit Denial Letter (Samples & Templates)

A credit denial letter is an official notification written by lenders to inform an individual or business of the rejection of their loan request.

It is usually sent for applications for loans , mortgages , credit cards, and business credit lines. It also informs the applicant why their application was rejected.

Typically, lenders will deny loan requests if the applicants are not creditworthy, which can result from multiple factors such as incomplete documents, insufficient income, bankruptcy, poor credit score, etc. The letter also communicates the applicant’s credit score, the credit reporting agency used, and the process to obtain their credit report.

Lenders can use templates that include all the information required to produce the formal letters. It is important to note that lenders are expected to reassess their decision to decline an application should the applicant object to it. They should also cite legitimate reasons, such as errors and inaccuracies in the report. Review multiple samples of such letters to understand the different reasons a lender can use to legally deny credit to their clients.

The letter is a legal requirement under the ECOA and the Fair Credit Reporting Act . It provides information to the borrower, protects the lender’s reputation, and complies with legal requirements. Also, it is professional to be transparent about the decision-making process. Online templates are practical tools that can help lenders write such letters.

This article will discuss reasons to reject credit applications and how to write a letter notifying the applicant of such a decision by providing a sample. It also educates lenders on certain legal factors they should know before sending a letter of denial to a credit application.

Reasons for Denying a Credit Request

Letters to notify applicants of refusals of their credit requests serve a valuable purpose by providing individuals with insights into the factors considered by lenders when assessing creditworthiness. By exploring the common reasons for credit denial, we can understand the criteria that financial institutions use to evaluate applicants, empowering individuals to make informed decisions and take proactive steps toward improving their credit standing.

This section discusses the key factors that can influence a credit denial decision:

Credit score

A credit score is a measure or numerical ranking of creditworthiness. Using a standardized formula, you can calculate it from credit information such as length of credit history, payment patterns, credit utilization, and outstanding debt. The higher scores indicate a lower level of risk, making it more likely for such applicants to secure loans at favorable terms. On the other hand, the lower scores may result in credit denial or less favorable loan terms, as they suggest a higher risk of defaulting on payments.

Employment history

Employment status and history are criteria used to determine an applicant’s suitability for loans because they determine their capacity to pay back the loan. So, you need to consider whether an applicant is employed, how long they have been employed, and their current and previous jobs. Having a stable job and career may indicate that they have a reliable source of income and are less likely to default. However, if their employment situation is unstable, it raises concerns about their ability to fulfill financial obligations and is a legitimate basis for refusing their loan request.

Insufficient income

One crucial factor that lending institutions carefully scrutinize when assessing loan applications is the applicant’s income. For lenders, the ability of borrowers to repay their debts is of paramount importance to mitigate the risk of defaults. Therefore, income serves as a critical indicator of an individual’s capacity to meet their financial obligations. When an applicant’s income is deemed insufficient, it can be a compelling reason for denial.

Debt-to-income ratio

The debt-to-income ratio compares an individual’s monthly debt payments to their income. If the ratio is too high, it indicates that a significant portion of income is already allocated towards existing debts, and lenders may perceive the applicant as having a higher credit risk and reject the loan request.

Payment history

Payment history is a reliable criterion for determining an applicant’s eligibility for a loan. If an applicant has a history of late payments or defaults with a specific financial institution, it can significantly impact their chances of getting approved for new credit from that institution.

Unstable housing situation

Lenders might have a negative opinion of housing instability, such as frequent moves or a lack of a permanent address. It can be an indicator of financial uncertainty and affect an applicant’s creditworthiness.

Inaccurate information on a credit report

You can reject an application if the credit report results are inaccurate. The report will indicate the borrowing history, current and previous addresses, bank accounts , employment history, etc. Incorrect information, such as accounts that do not belong to the applicant or inaccurate payment records, can be particularly detrimental.

The accuracy and reliability of this information are of utmost importance in determining an applicant’s creditworthiness. Unfortunately, mistakes or inaccuracies in the reports can occur, and they have the potential to significantly impact an individual’s credit standing. From a lender’s perspective, such errors pose risks and can be a valid reason for credit denial.

Multiple loan applications

You can deny credit to individuals or businesses that have applied too many times in a short period. This will often indicate that the applicant is struggling financially and in desperate need of money, which poses a risk of inability to repay once approved.

How to Write a Letter to Notify Rejection of Credit Application

Most applicants will be distressed by the news, so it is critical to approach the rejection professionally. Your communication must be objective and clearly explain the situation. Using a template can be helpful in properly organizing information and ensuring the decision is effectively conveyed to the client.

The information required in a letter to formally notify applicants that they are ineligible for credit is presented below:

Specify the date

The first element on the letter is the date it was written or issued. The date is needed for reference and filing purposes. A proper format should be used,

March 24, 2023.

Include borrower’s information

Secondly, it must be clear to whom the letter is addressed , i.e., the applicant. Your letter must have the borrower’s name, mailing address, account number, and application ID.

For example, this information can be presented as follows:

Jack Geller 103 City Park Road, New York City, NY 8007 Account No.: 1234 4567 7890 Application ID: JG009282NY

A subject line indicating the purpose of the letter can be included if you are sending an email. For example, RE: Credit Denial Letter for Application ID-2363. This should be followed by a formal greeting such as Dear Mr. Schumacher.

Mention the reason for the denial

Next, indicate the letter’s purpose for rejecting the application and provide a valid reason. You can begin by acknowledging the borrower’s interest in the opening statement before stating that their application is being rejected.

“Thank you for your inquiry about a credit card with B&G Platinum. We are honored by your interest in our company and our services. Unfortunately, we regret to notify you that your application was declined as your debt-to-income ratio is too high and a principal concern for our team.”

Provide credit reporting agency information

Lenders are usually obligated to inform applicants about the credit reporting agency (or agencies) they use to assess their creditworthiness. This section provides details of the agency’s name, contact information, and instructions on how to obtain a free copy of the report for further review. Note that while this information is necessary for a consumer credit application , it is not needed for a commercial application. This is because, in such situations, it is not a requirement of the FCRA.

For example, this section can be written as follows:

“After a thorough search, we determined that your total debt is above $150,000. When compared to your assets, this amount indicates that you have a credit score of 450, which is lower than the 650 required for eligible candidates.”

Specify the adverse action reasons

The letter should include a section detailing the specific adverse action reasons, which are the key factors that contributed to the denial decision.

To comply with regulatory requirements, for example:

“The decision was based specifically on the key adverse action reasons that influenced our decision: a poor credit history and insufficient income.”

Right to obtain a free report

Lenders typically highlight the recipient’s right to access a free copy of their report within a specified timeframe. This provision allows individuals to review the report for inaccuracies or discrepancies that may have impacted the credit decision.

“We understand that credit denial can be disappointing, and we encourage you to review your credit report, which you can obtain free of charge from [credit reporting agency’s name], to ensure its accuracy and address any areas that may require improvement.”

Your contact information

The letter for denial should be concluded by providing your contact information , including your name and contact details such as phone number, email address, and mailing address. This information is meant to facilitate future correspondence if the borrower has questions about the denial or future applications.

Charles MajorsJenkins Micro-Finance CompanyDownhill AvenueAugusta, Maine [email protected] (0288) 3630-8999

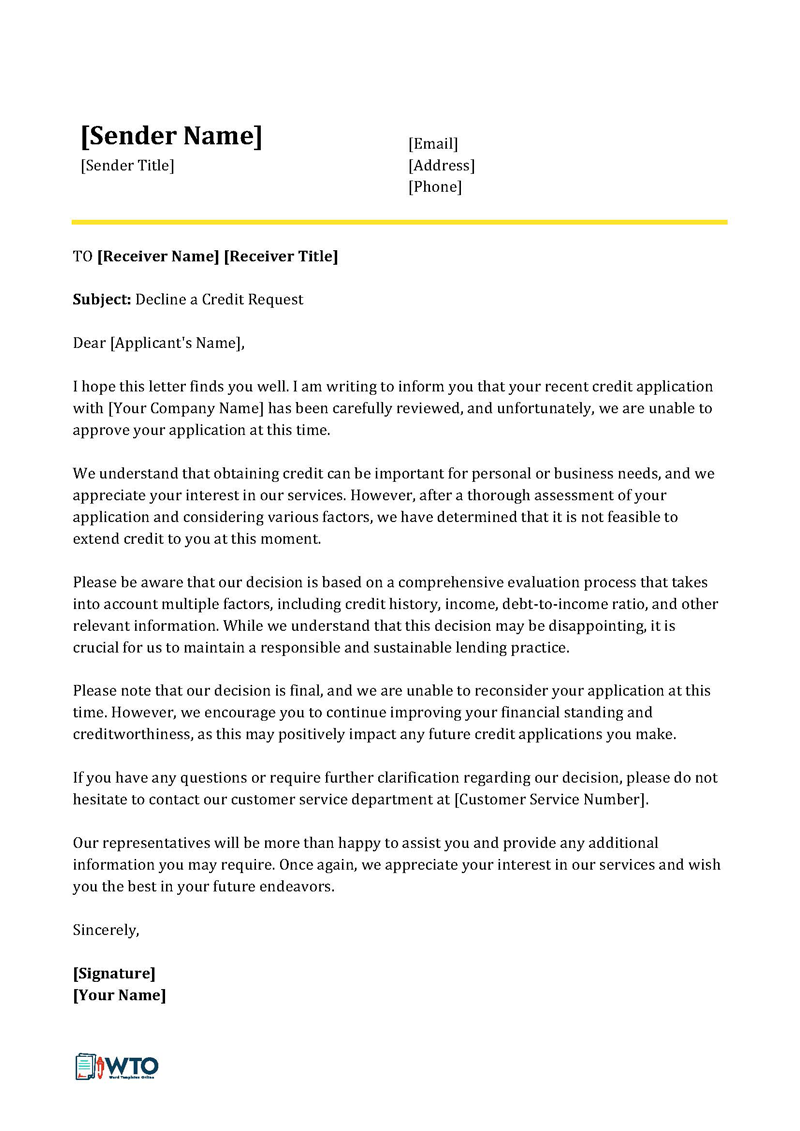

Free Templates

To simplify the writing process, you can use the free downloadable templates for these letters provided in this article. They can be customized to suit your needs and preferences. Also, they are professionally designed to create legible and presentable letters that protect a financial institution’s reputation.

Credit Denial Letter Template

[Your Company Name]

[Your Company Address Line 1]

[Address Line 2]

[City, State, Zip Code]

[Phone Number]

[Email Address]

[Today’s Date]

[Applicant’s Name]

[Applicant’s Address Line 1]

Dear [Applicant’s Name],

Thank you for your interest in [Credit Product/Service, e.g., credit card, loan, etc.] with [Your Company Name]. We appreciate the opportunity to review your application. After careful consideration, we regret to inform you that we are unable to approve your request at this time.

The decision to decline your application was based on the following reason(s):

- [Reason for denial, e.g., credit score below our minimum requirement, insufficient income, employment history, etc.]

- [Any additional reason(s)]

In accordance with the Fair Credit Reporting Act, you have the right to a free copy of the credit report used in our decision-making process. To obtain your report, please contact the credit reporting agency listed below within 60 days of receiving this notice:

Credit Reporting Agency Information:

[Agency Name]

[Agency Address]

[Agency Phone Number]

[Agency Website]

Furthermore, you have the right to dispute the accuracy or completeness of any information in your credit report. If you have any questions or believe this decision is based on incorrect information, please do not hesitate to contact us at [Your Phone Number] or [Your Email Address].

We understand that this may be disappointing news, and we encourage you to review your credit report and financial situation. Improving certain factors may increase your eligibility for [Credit Product/Service] in the future. For any questions about improving your creditworthiness or to discuss potential options moving forward, please feel free to reach out to our customer service team.

Thank you again for considering [Your Company Name] for your financial needs. We hope to have the opportunity to serve you under different circumstances in the future.

[Your Name]

[Your Title]

Sample Credit Denial Letter

Dear Mr. Doe,

Thank you for applying for the Sunset Credit Card with Sunset Bank. We value your interest in our products and services and appreciate the opportunity to review your application.

After a thorough review of your application and credit information, we regret to inform you that we are unable to approve your request for credit at this time. The decision is based on the following primary reason(s):

- Credit Score Below Minimum Requirement: Your current credit score of 620 falls below our minimum requirement for the Sunset Credit Card, which is set at 650. Our decision was influenced by the credit report obtained from Equifax, one of the leading credit reporting agencies.

- High Utilization of Existing Credit Lines: Our review also noted a high utilization rate on your existing credit lines, which is another factor in our decision-making process.

In accordance with the Fair Credit Reporting Act, you are entitled to a free copy of your credit report from Equifax, used in our decision-making process, if you request it within 60 days of receiving this letter. To obtain your report, please contact:

P.O. Box 740241

Atlanta, GA 30374-0241

Phone: 1-800-685-1111

Website: www.equifax.com

You also have the right to dispute any inaccuracies in the information provided by the credit reporting agency.

We encourage you to review your credit report and address the factors that have affected our decision. Improving your credit score and lowering your credit utilization may enhance your eligibility for credit in the future.

Please understand that this decision does not diminish the value we place on your interest in our services. We would be happy to review another application from you in the future, should your financial situation change.

If you have any questions or require further clarification, please do not hesitate to contact our customer service team at (555) 890-1234 or via email at [email protected].

Thank you again for considering Sunset Bank for your credit needs. We hope to have the opportunity to serve you in the future.

Credit Manager

Sunset Bank

Key Takeaways

This rejection letter from Sunset Bank regarding the credit card application is a well-structured and considerate communication. Here’s why it’s effective:

Gratitude and Politeness: The letter starts with a courteous tone, expressing gratitude for the applicant’s interest in the bank’s services, which sets a positive tone despite the disappointing news.

Clear Explanation: It provides a clear explanation for the decision, citing specific reasons such as the credit score falling below the minimum requirement and high utilization of existing credit lines. This transparency helps the applicant understand the basis of the decision.

Reference to Rights: By mentioning the Fair Credit Reporting Act, it informs the applicant of their rights to access their credit report and dispute any inaccuracies, demonstrating the bank’s commitment to regulatory compliance and consumer rights.

Encouragement for Improvement: Despite the rejection, the letter encourages the applicant to take steps to improve their creditworthiness, indicating a willingness to consider future applications if their financial situation improves. This supportive approach maintains a positive relationship with the applicant.