Join 307,012+ Monthly Readers

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

The Equity Research Analyst Career Path: The Best Escape from a Ph.D. Program, or a Pathway into the Abyss?

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

- “Analyst” is a vague job title that could refer to anyone from entry-level hires in the back office to senior professionals leading teams and managing relationships.

- “Equity” seemingly has 5,192 different meanings depending on the context.

- There are different levels within the Analyst role, and the job also differs based on the company type (bank vs. dedicated research firm vs. hedge fund vs. asset management firm).

- And “Research” itself is a vague term… since all knowledge workers do some amount of research in their jobs.

Here, we’re referring to the Equity Research Analyst role at investment banks and dedicated research boutiques that produce and sell their own equity research reports .

This division is often labeled “sell-side research,” and we’ve covered it in the articles on equity research recruiting , equity research careers , equity research internships , and the equity research associate role .

We’ll pick up the coverage here and move straight to the top of the ladder:

The Equity Research Analyst Job Description

Unlike in investment banking and private equity , where the Analyst is at the bottom of the hierarchy, the Analyst sits at the top in research.

The Analyst’s job is to manage relationships with the companies they cover and the institutional investors that might be interested in those companies.

The division is known for its equity research reports , but Analysts add value mostly by setting up meetings, making introductions, and giving investors new perspectives or information they hadn’t considered.

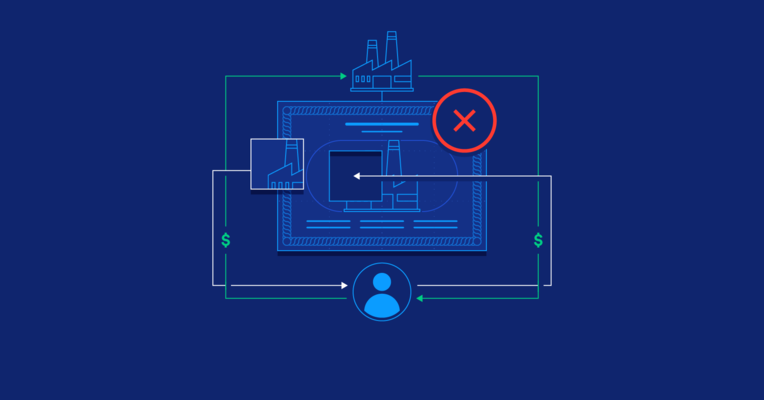

For many decades, Analysts did this and gave away research for free to encourage institutional investors to trade with their bank, indirectly generating commissions.

Now, with MiFID II in place in Europe , institutional clients pay directly for research, so the role generates revenue more directly (or fails to do so if the clients don’t pay).

Banks in other regions can still use the old business model and give away research for free to generate trading commissions, but these new rules are likely to spread worldwide.

If you look at the main tasks in the research division:

- Speaking with market participants (management teams and investors).

- Doing industry research (e.g., collecting data on market share, pricing, etc.).

- Writing the reports (both short, update reports and longer thought pieces).

- Building models and valuations.

- Determining market sentiment.

Analysts spend most of their time on tasks #1 and #5 – building relationships and generating market insights – and little time on writing reports, building models, or collecting data.

A Day in the Life of an Equity Research Analyst

To illustrate the differences between the Associate and Analyst roles, we’ll walk through a day in the life from the perspective of an Analyst.

Note that this is a “normal day,” i.e., not one during earnings season or an important conference:

7 AM – 8 AM: Arrive at the office, read the news, and look at emails from traders and salespeople asking about a few companies in your coverage universe.

You also start reviewing a few research notes written by your two junior Associates. The numbers look fine, but the commentary is too confusing.

8 AM – 10 AM: You communicate your changes to the Associates when they arrive, and then you ask one of them to research a new digital media company in the healthcare vertical that you might want to add to the coverage universe.

The market opens, but there haven’t been any big corporate announcements or other dramatic happenings, so things are calm as you review your calendar for the day.

10 AM – 12 PM: You take several calls from institutional investor clients: one from a hedge fund Analyst at a mid-sized firm, one from a Portfolio Manager at a large asset management firm , and one from a PM at a start-up hedge fund investing in the TMT sector .

They’re all looking for insights into companies’ earnings announcements in a few weeks; a few also want to meet with the management teams of software and internet companies you cover.

12 PM – 2 PM: You head out to lunch on the other side of town to meet with the CEO and CFO of a newly public Software-as-a-Service (SaaS) company in the consumer retail vertical .

They have solid growth and cash flow numbers and want more institutional attention, so you try to explain investor skepticism toward anything retail-related (well, except for Amazon).

But you agree to make their case to a few institutional clients who have invested in the sector before.

2 PM – 3 PM: On your way over to meet with another company, you take a call in the car from an Associate PM at a growth-oriented hedge fund.

He wants to do a deep dive into one SaaS company’s “true” churn rate because he doubts the official numbers released by management.

You don’t have all the numbers in front of you, so you give vague responses and then refer him to one of your Associates to get more detail.

3 PM – 5 PM: You arrive at the other company: a digital marketing agency and online advertising platform with ~200 employees that is looking to go public in the next few years.

You explain that they’ll need much higher revenue (closer to ~$100 million rather than their current $20 million) to get there and that they’ll need to downplay the “agency” part and focus on the tech platform.

They claim that they have a new technology that will use “AI” to automate client onboarding and campaign setup, but they’re evasive about the details.

You’re quite skeptical, but if this company somehow goes public, it might be worth adding to your coverage. You also make a note to ask around about the feasibility of this technology.

5 PM – 7 PM: Head back to the office and review what the Associates have been working on all day, including a few new notes, updated models, and an Initiating Coverage Report.

You make some edits and then strategize with the one Associate about the super-persistent Associate PM who kept asking for the “real churn numbers” for that one company.

The firm is a good client, but this one guy is so demanding that you’re reconsidering the relationship. You head home after this.

11 PM: As you’re about to go to sleep, an activist hedge fund announces that it has taken a 5% stake in one of the companies in your coverage universe: a security software company.

These types of late-night / last-minute announcements are not common, but they do happen.

You’ll need to have an immediate view in the morning, so you ask your Associate to prepare a few thoughts and come in early so you can send out a short note before the markets open at 9:30 AM.

Why Become an Equity Research Analyst?

The equity research industry as a whole is not in great shape, with falling compensation, headcount reductions, and MiFID II forcing an unbundling of research.

And hardly anyone “interviews for” an Analyst role in equity research – you have to work there for a few years and win promotions up to that level.

So, if you break in as an Equity Research Associate , why would you want to stay in the field long enough to reach the Analyst level?

The short answer is, “there probably isn’t a good reason to do so,” but I like to be fair and balanced, so here’s a quick list of the pros and cons:

Advantages:

- Interesting Work and Solid Pay… for Now – Senior ER Analysts can earn in the mid-six-figures up to the $1 million range, and the work is arguably more interesting and less stressful than what Managing Directors in investment banking All signs point to falling pay, though, so who knows if this will last.

- Potential Exit Opportunities – You’re not quite as “trapped” as, say, a mid-level banker who quits and doesn’t have many other options. You could move to buy-side research roles, go into sales, join a normal company, or go into investor relations at companies or fundraising on the buy-side.

- It’s a Good “Escape Route” from Other Fields – Especially if you have something like an M.D. or Ph.D. in a highly technical field, equity research might allow you to use your expertise to move into plenty of other roles (though you don’t need to reach the Analyst level to do this).

Disadvantages:

- The Industry is Declining – It’s still possible to make money and advance in a declining industry, but it’s more difficult than it is an industry where headcounts and revenue are growing. Also, no one knows how MiFID II and passive investing will play out long-term; the impact could be anything from “neutral to slightly negative” to “apocalypse now.”

- It’s a Huge Grind to Reach the Analyst Level – You’ll have to make it through many, many, many earnings seasons and model/research updates to make it to the top. This process can get quite repetitive, especially if you’re covering an industry less prone to surprises (e.g., not tech or healthcare).

Equity Research Analyst Salary & Lifestyle

There are several different levels within the “Analyst” title, ranging from Vice President (VP) to Managing Director (MD).

At the low end, VP-level Analysts might earn around the $200K to $300K USD salary range at large banks in major financial centers.

Directors move up to the $300K to $600K range, and MDs go up to the $500K to $1 million range.

Around 50% of this compensation comes in the form of base salary, and it’s up to 75% at the lower levels.

These figures will almost certainly fall due to MiFID II and declining research budgets at buy-side firms, but you could still earn into the mid-six figures for the foreseeable future.

As you saw in the day-in-the-life account above, Analysts might work the same amount as Associates: 50-70 hours per week , with ~12-hour days on average, and longer hours during earnings season.

The key difference is that Analysts must travel a lot more , including client visits, conferences, and company meetings.

That means it’s arguably a more stressful job since they also have to review work from the Associates and give them direction.

Recruiting: Pathways into the Equity Research Analyst Role

The Analyst role is a senior one, so you don’t interview for it right out of undergrad or an MBA program.

Most often, people start at the Associate level out of undergrad or a Master’s in Finance program , stay for a few years, and then advance up to the Analyst level… if there’s an opening.

Traditionally, it has been quite difficult to move up by staying at the same bank because Senior Analysts rarely left their jobs voluntarily.

So, research professionals often moved around to different banks and advanced with each move.

Advancing to the Analyst level comes down to proving that you can do the same job that they do: speaking with clients and management teams, delivering insights, and setting up meetings – as opposed to burying yourself in models and reports all day.

Besides this path, some people move into equity research from strategy or management consulting, Big 4 firms , or even corporate finance roles.

However, they join at the Associate level unless they’re already quite senior in their previous industry.

Another option is to complete an advanced degree, such as an M.D. or a Ph.D. in a technical field (physics, engineering, biology, etc.), and then work in a group where technical knowledge is required to understand companies ( biotech , pharmaceuticals, semiconductors , etc.).

But once again, you’re unlikely to join directly at the Analyst level, so you’ll have to demonstrate your accounting/finance/business knowledge to get there and then perform well on the job to advance.

For more on these points, see the article on equity research recruiting .

The Equity Research Analyst Job: Worth the Grind or the Career Change?

In these articles, I usually conclude with an “It depends”-type answer and present both sides.

But I’ll be more definitive here: a long-term career in equity research is probably not worth it in the 2020s unless you truly love it and can’t imagine doing anything else.

Research is still a great entry point into finance because of the lack of a standard, on-cycle hiring process, and the ability to break in as a non-traditional candidate.

But there’s serious skepticism about its long-term future, and I can’t credibly recommend it as an option on-par with careers in investment banking , private equity , or venture capital .

People are also pessimistic about the future of sales & trading , but there’s a key difference: there are still opportunities there if you’re a programmer or you work with more mathematically complex products.

By contrast, there’s less room for programming or advanced math in the fundamental analysis of companies, and the negative trends in equity research affect the industry as a whole – not just specific desks or groups.

So, the Equity Research Analyst job may not be “a pathway into the abyss,” but it’s also not a career I would recommend – unless you’re so enthusiastic about research that you couldn’t imagine doing anything else.

You might be interested in:

- Biotech Equity Research: The Best Escape Plan from Medicine or Academia?

- Fixed Income Research: The Overlooked Younger Brother of Equity Research?

About the Author

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street . In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Read below or Add a comment

16 thoughts on “ The Equity Research Analyst Career Path: The Best Escape from a Ph.D. Program, or a Pathway into the Abyss? ”

curious to know your thought on ER now? Im an undergrad studying history but am looking at internships in the ER sector for next summer in London. I have already completed a few virtual internships but am now looking to expand my experience in the financial world. Any advice would be appreciated.

I don’t think much has changed. Compensation might be a little different now, but ER is still not a great long-term career path due to MiFID II, falling numbers of boutiques, and lower fees paid for research. It’s still a decent starting option, but you normally want to move into a deal-based role or a buy-side role after spending a few years there.

Now that this report is 2 years old, curious to hear your thoughts on the outlook for ER. It appears that comp in the U.S. has remained the same since before. Do you think that the effects of MiFid II already been “priced in”? Or will comp begin to fall gradually from here on out?

I would be surprised if compensation increases substantially. It’s true that MiFID II has not been the end of the world, but the impacts on ER groups and firms has been uneven, with some growing and some shrinking. It’s probably less bad than initially feared, but still not a great industry outlook.

I’ve been reading a lot on here for the last couple weeks (love it!) and gotten really interested in Equity Research. Thing is, I’m a 35 year old woman living in Zürich with a humanities PhD leaving the academy. What I read about this career suits me to the core, but I don’t want to invest time in learning modelling and other skills if my apps will be rejected out of hand because of my humanities background. Spent 5 years as a postdoc and realised the academy is not for me, but I got my PhD from an Ivy, if that helps. Do I have any chance of getting into ER? I don’t mind the pay or the shrinking prospects. I love the idea of doing crazy amounts of research and finding things people missed, or just packaging the information so other people can get it.

I think it will be extremely difficult to get into ER if you have a humanities PhD and you’ve worked in academia up until this point. PhDs in technical fields like physics, engineering, chemistry/biology, etc., can get in, but it’s much tougher to do that from a non-technical field. You might have better luck aiming for an investor relations role or something else where communication skills are valued more than technical/accounting/finance knowledge.

Can you chime on the prospect of a career as buyside research analyst? For both equity and credit research. I’m relatively junior but have always worried about things you laid out on this article.

I think buy-side research is somewhat safer because MiFID II does not directly affect firms in a negative way, and buy-side firms will always need people to do fundamental research. Yes, fee compression hurts, but that is just one headwind vs. multiple headwinds for equity research.

I would also say that credit research, especially in areas like high-yield or distressed, is probably safer than equity research because it’s tricky to evaluate those types of bonds, and fixed income has seen less automation / passive investing than equities (yes, there are lots of bond index funds and ETFs, but most are investment-grade).

Saying to avoid it may be a little harsh. Maybe compared to IB/PE, sure, upside comp is more limited. But a job where you can work 50 hours a week and make mid 6 figures still sounds a lot better than most jobs in the corporate world. If you are a good enough associate and stick around long enough you are bound to have an open analyst seat to fill.

That’s fair enough. Though I think 50 hours a week is a bit on the low side, and I expect compensation to drop over time. I guess my thinking is that if you really want better hours, less stress, low-to-mid-six-figure compensation, and more stability, something like corporate development is better… assuming you want to work on deals. If you just want to follow companies, sure, maybe equity research is still a good option.

What about the overall future of Asset Management? Is it wise to pursue a career in Asset Management?

I think it’s also not great, but not necessarily “to be avoided” as equity research is because there’s no MiFID II that completely changes their business model. Yes, fee compression and passive investing have hurt AMs, but passive investing could turn into a giant bubble that bursts at some point, and there will always be some demand for active managers. Also, quant-like skills will become more important there. For more, please see:

https://mergersandinquisitions.com/

I’m curious, is there anywhere in the public equities realm (excluding quant roles) that you would outright recommend to someone starting today?

OK, maybe I’m being a little harsh here. It’s not that I would universally recommend against public markets / public equities roles. It’s more that if you can’t decide between deal-based roles and public markets ones, then you’re safer picking a deal-based role because they’ve held up better over time and are under less fee and headcount pressure.

That said, if you are 100% certain you want to do public markets and have the track record and experience, go ahead.

Within public equities, if you exclude quant roles, Analyst roles at any of the big long-only funds are still fine. It’s just that they don’t hire that many people and turnover isn’t that high, so it’s harder to win these roles.

As always, the more specialized you can be, the better… find a niche like emerging market stocks or a specific industry or sub-industry and become the top expert there.

For the record, I wasn’t trying to be critical of your view. It just feels like every discussion of roles in the public equities realm nowadays is very defeatist. As someone that missed the track for private investing (at least until an MBA at a minimum), it gets a bit heavy to read continuously that your career path is in decline. So I was just curious if there was anywhere that you still viewed positively.

I agree with both views on the LO seats, hard to get and not going anywhere. I would also say that if you don’t mind investing in a very short term, market neutral style, that the multi-manager opportunity set is still quite robust.

Sure, understood. I would not take all of these predictions of doom too seriously – everyone out there, including me, looks at recent history and then tries to project it forward. But things can always change, and industries have gone from positive to negative or the reverse fairly quickly. Just look at all the people who thought investment banking would “die” after the 2008-2009 period, or everyone who thought tech startups would “never come back” after the dot-com crash, etc.

If you like what you’re doing and don’t want to change paths, sure, continue on with it. And yes, multi-manager funds can be a good option as well if you like that style of trading. We did cover MM funds on this site once, but haven’t focused on it too much since I prefer long-term, fundamental analysis/investing.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Tips on How to Get into Equity Research

#1 perform your own research and analysis, #2 get your research published on seeking alpha, #3 share your published article with equity research analysts, #4 follow up and keep networking, additional resources, how to get into equity research.

Four steps to stand out from the crowd

Getting a job in equity research can be extremely competitive . Global investment banks and boutique firms only have so many Analysts and Associates, with a limited number of new people they hire each year. In a competitive marketplace, our guide on how to get into equity research will share some ideas that will help you improve your odds of being hired.

The best way to get into something is to just start doing it. There is virtually no cost (other than your time) to start looking for investment ideas and performing your own valuation modeling of companies. To get the ball rolling, follow these steps:

- Think of an industry or sector that you’re interested in (genuinely)

- Get a list of companies in the sector from Google finance or Yahoo finance

- Filter the companies down by setting criteria such as geographic location, size, the line of business, valuation, etc.

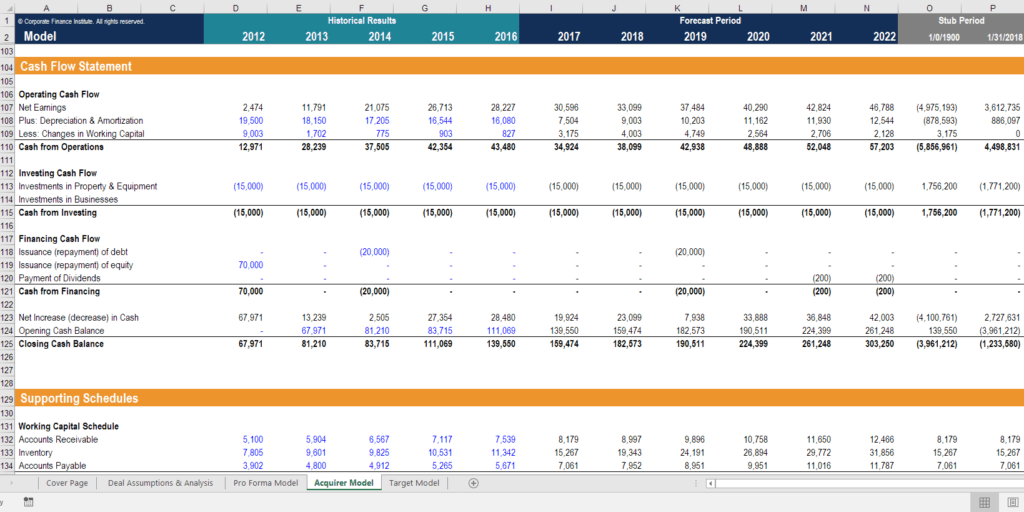

- Download the three financial statements for 3-5 of the companies from EDGAR or the appropriate filing system

- Put all the numbers into Excel, link the 3 statements , and start performing analysis

- Analyze the historical results and build a forecast based on what you think the company is capable of in the future

- Perform a discounted cash flow DCF analysis to value each company

Luckily (or not) we live in a time where it’s easy to get your content published publicly. Seeking Alpha is a crowdsourced equity research platform where anyone, regardless of their background or experience, can publish research as long as it meets their quality requirements.

In order to get your research published on Seeking Alpha follow these steps:

- Develop a thesis about one of the stocks you researched in Step 1 above (i.e., stock is undervalued or overvalued due to x, y, and z)

- Write a thorough report (1,000 to 2,000 words long)

- Include lots of charts, graphs, and outputs from your financial model

- Use lots of headings and create a well-structured article

- Generate a bold title for the article the includes your “call” on the stock (i.e., Short: Online Company Inc Overvalued by 40-50%, Target Price is $X.XX per share)

- If your article is not approved, take the feedback provided and keep working on your research and analysis until the report is approved

Once your equity research report is published, you now have a great reason to start contacting Analysts and Associates at companies that cover the stock (or the sector) that you wrote about. You can also use it in your application form when applying to job postings.

You can do this by following these steps:

- Find job postings at global banks or boutiques that employ analysts in the sector you researched (try looking at efinancialcareers.com for postings)

- In your cover letter (or cover email), include a hyperlink to the Seeking Alpha article you had published, explain your thesis, and why you appear to be correct or incorrect as time has passed since you originally wrote the piece

- Showcase your financial modeling and valuation skills by including the financial model you built to support your research

- Remember to take a very humble approach and explain that you did this exercise for educational purposes and have learned a lot in the process

Networking is by far the best way to get hired (in any industry) and a major component of how to get into equity research. Networking requires a lot of persistence. If you meet resistance as you send out your emails, be sure to ask if they know anyone else who has a strong opinion on the stock you researched.

By always asking each person you talk to for a referral, you can have a continual pipeline of new people to connect with.

At the end of the day, it’s a numbers game, and the more people you connect with and share your research with, the better your odds are of getting hired.

Read CFI’s three-part series on how to network effectively !

Thank you for reading the CFI guide on how to get into equity research. If you follow the above steps, you will learn a lot about what it’s like to be an analyst, and hopefully, improve your chances of getting hired in a super competitive market.

To keep learning and advancing your career, these additional resources will be a big help:

- Overview of Equity Research

- Equity Research Job Description

- Financial Modeling Best Practices

- Analysis of Financial Statements

- See all career resources

- See all capital markets resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

Equity Research Analyst: A Comprehensive Guide to Career Path and Qualifications

Table of Contents

Introduction.

In the world of finance, equity research plays a pivotal role in providing valuable insights to investors, guiding them in making informed decisions regarding stocks and investments. This comprehensive guide will delve into the career path and qualifications required to excel in the field of equity research. Whether you’re a budding finance enthusiast or a seasoned professional looking to further your career, this article will equip you with the knowledge and tools needed to succeed in this dynamic and competitive industry.

Understanding Equity Research

What is equity research.

Equity research is the practice of analyzing various financial instruments, primarily stocks, to provide in-depth insights into their potential for investment. This involves evaluating a company’s financial performance, industry trends, and macroeconomic factors to make informed recommendations to clients or investment firms or wealth management companies.

The Role of an Equity Research Analyst

Key Responsibilities of an Equity Research Analyst:

- Financial Analysis: Equity research analysts are responsible for dissecting a company’s financial statements, including income statements, balance sheets, and cash flow statements. They assess the company’s financial health and performance over time.

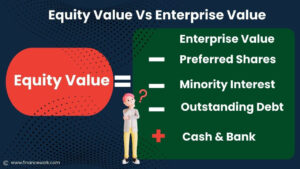

- Industry Analysis: Understanding the dynamics of the industry or sector in which a company operates is essential. Analysts need to identify industry trends, potential risks, and growth opportunities that can impact a company’s stock price.

- Company Valuation: Analysts use various valuation models, such as discounted cash flow (DCF) analysis and price-to-earnings (P/E) ratios, to determine the intrinsic value of a company’s stock. This helps investors assess whether a stock is undervalued or overvalued.

- Recommendations: Based on their analysis, equity research analysts provide buy, sell, or hold recommendations for specific stocks. These recommendations are critical for investors looking to build or adjust their portfolios.

- Report Writing: Analysts produce detailed research reports that summarize their findings and recommendations. These reports are distributed to clients, including portfolio managers and individual investors.

- Client Interaction: Analysts often have direct contact with clients, discussing their research findings and providing insights into investment opportunities. Effective communication is crucial in this role.

- Market Monitoring: Equity research analysts continuously monitor financial markets, staying updated on news and events that may impact the stocks they cover. They need to react swiftly to changing market conditions.

Qualifications for a Career in Equity Research

Educational background.

To embark on a successful career in equity research, a strong educational foundation is essential. Typically, aspiring equity research analysts hold degrees in:

- Finance: A bachelor’s degree in finance or a related field provides a solid foundation.

- Master’s Degree: Many professionals pursue a Master of Business Administration (MBA) or a Master’s in Finance for advanced knowledge.

- Certifications: Obtaining professional certifications such as the Chartered Financial Analyst (CFA) designation adds credibility.

Skills Required for Success:

- Analytical Skills: The ability to dissect complex financial data and draw meaningful conclusions is at the core of this profession.

- Industry Knowledge: In-depth knowledge of specific industries or sectors is essential to understand the nuances that can affect a company’s performance.

- Financial Modeling: Proficiency in financial modeling and valuation techniques is crucial for accurate stock analysis.

- Communication Skills: Analysts must convey their findings and recommendations clearly and persuasively in both written reports and verbal communication.

- Quantitative Skills: Strong mathematical and statistical skills are valuable for data analysis and modeling.

- Economic Awareness: Understanding macroeconomic factors and how they influence financial markets is vital.

- Information Technology: Proficiency in using financial software and data analysis tools is beneficial.

- Ethical Conduct: Equity research analysts must adhere to ethical standards and regulations to maintain the integrity of their research.

- Financial Acumen: Proficiency in financial analysis, accounting, and valuation techniques is crucial.

- Analytical Skills: The ability to dissect complex data and draw meaningful conclusions.

- Research Skills: Conduct thorough research on companies and industries.

- Communication: Effective communication is key to conveying research findings clearly and concisely.

Gaining Experience

Experience is invaluable in equity research. Consider the following steps to gain a competitive edge:

- Internships: Seek internships at financial institutions or investment firms to gain hands-on experience.

- Entry-Level Positions: Begin your career as a research associate or junior analyst.

- Networking: Build a network of professionals in the finance industry to discover job opportunities.

Career Progression

Junior analyst.

As a junior analyst, you will assist senior analysts in research tasks, data collection, and financial modeling.

Senior Analyst

With experience, you can advance to a senior analyst role, where your responsibilities will expand to include making investment recommendations and leading research teams.

Portfolio Manager

For those aiming higher, becoming a portfolio manager allows you to oversee investment portfolios and make high-level investment decisions.

Requirements To Successful Equity Research Analyst

Challenges and Rewards:

While the role of an equity research analyst can be intellectually stimulating and financially rewarding, it comes with challenges. Analysts often work long hours, especially during earnings seasons or when major events affect the market. They also need to adapt to rapidly changing market conditions and regulatory requirements.

However, the rewards include the opportunity to have a significant impact on investment decisions, the potential for a lucrative career, and the satisfaction of continuously learning about finance, economics, and various industries.

Equity research is a challenging yet rewarding career path in the world of finance. Armed with the right qualifications, skills, and determination, you can carve out a successful journey in this industry. Remember, staying updated with market trends and continuously enhancing your knowledge is key to thriving in the competitive landscape of equity research.

Start your journey today, armed with the knowledge and determination to excel in the world of equity research. Your path to success begins with a solid educational foundation, a diverse skillset, and a commitment to continuous growth. Happy investing!

Knowledgiate Team

Doctor michael burry: the investment guru who predicted the housing market crash, chartered financial analyst: mastering the world of finance, the ultimate role of chief investment officers (cios) in corporate finance, principal financial group 401k: a path to secure retirement, certified financial planner: your guide to financial success, wow mortgage: an ultimate guide to home financing, best online brokers: choose the ultimate investment platform for your needs, chart patterns: a comprehensive guide to mastering technical analysis, trading analysis: unleashing the power of data in making informed investment decisions, cost of capital: understanding the key elements and implications completely, subscribe to our mailing list to get the new articles, related articles.

Financial Secrets Revealed: How Deferred Tax Liabilities Impact Your Bottom Line

Using ROI Formula to Calculate ROI: A Comprehensive Guide

Return on Investment Calculation: Understanding the Key Metric for Investment Performance

Investment Return: Understanding and Maximizing Your Investment Performance

akun pro kamboja

slot thailand

mahjong ways

https://hoerakinderschoenen.nl/

https://bergeijk-centraal.nl/wp-includes/slot-deposit-gopay/

slot mahjong ways

https://www.job-source.fr/wp-content/slot-singapore/

https://tentangkitacokelat.com/wp-includes/slot-deposit-gopay/

slot server thailand

akun pro myanmar

slot garansi kekalahan

slot deposit dana

https://slot-myanmar.deparmotor.com/

https://slotserverluarnegeri.deparmotor.com/

https://slot777.devtmp.focim.edu.mx/

https://bet-200.devtmp.focim.edu.mx/

https://slot-thailand.devtmp.focim.edu.mx/

Slot Server Thailand

https://buggybrolly.com/wp-includes/idn-poker/

https://www.donchuystacoshoputah.com/

https://orderzenseafoodsushigrill.com/

https://www.saltedsalad.com/

https://tastebakerycafe.com/

https://www.order369ramenpokechinesefood.com/

https://www.suiviesante.fr/wp-content/slot-malaysia/

https://www.smokepitgrill.com/

https://www.ilovesushiindy.com/

https://yakikojapanesegrill.com/

https://www.themixxgrill.com/

https://chilangosbargrill.com/

https://tentangkitacokelat.com/wp-content/slot-pulsa/

https://winkelstueck-reparatur.de/wp-includes/slot-pulsa/

https://slot-pulsa.devtmp.focim.edu.mx/

https://kayanscarf.com/

https://www.garage-aymard.fr/wp-includes/slot-qris/

https://nexttech-tt.com/

https://dotnetinstitute.co.in/wp-includes/slot-deposit-gopay/

https://www.yg-moto.com/wp-includes/sbobet/

https://bergeijk-centraal.nl/wp-content/slot777/

https://www.anticaukuleleria.com/slot-myanmar/

https://bergeijk-centraal.nl/wp-includes/slot-bonus-new-member/

https://houseofgabriel.com/wp-includes/slot-bonus/

jurassic kingdom

https://houseofgabriel.com/wp-includes/pomo/slot-petir-merah/

https://houseofgabriel.com/wp-includes/pomo/slot-garansi-kekalahan-100/

https://lajme.org/wp-content/sbobet/

https://houseofgabriel.com/wp-includes/pomo/slot777/

https://houseofgabriel.com/wp-includes/pomo/mahjong-ways/

https://houseofgabriel.com/wp-includes/pomo/bca-slot/

https://houseofgabriel.com/

https://www.job-source.fr/wp-content/sugar-rush/

https://repairkaro.com/pragmatic-play/

pragmatic play

https://idn-poker.zapatapremium.com.br/

https://sbobet.albedonekretnine.hr/

https://mahjong-ways.zapatapremium.com.br/

https://slot777.zapatapremium.com.br/

https://baksobakarmantap.com/slot777/

https://www.entrealgodones.es/wp-includes/slot-pulsa/

https://slot88.zapatapremium.com.br/

https://slot-pulsa.zapatapremium.com.br/

https://hollyorchards.com/wp-content/pyramid-bonanza/

https://slot777.jikuangola.org/

https://slot777.nwbc.com.au/

http://wp.aicallcenter.ai/wp-includes/widgets/slot-deposit-pulsa/

https://choviettrantran.com/wp-includes/slot-deposit-pulsa/

https://kreativszepsegszalon.hu/wp-includes/slot-deposit-pulsa/

https://www.muaythaionline.org/wp-includes/slot-deposit-pulsa/

https://pgdownloads.enterprisedb.com/slot-deposit-pulsa/

https://ebook.franchise.7-eleven.com/slot-pulsa/

https://llohan.hollywood.com/slot-pulsa/

https://transition.site5.com/slot-pulsa/

https://fan.iitb.ac.in/slot-pulsa/

slot server myanmar

https://podcast.peugeot.fr/slot-pulsa/

https://mahjong-ways.softcia.com.br/

https://le-fief-fleuri.fr/core/wp-includes/sbobet/

https://le-fief-fleuri.fr/core/wp-includes/idn-poker/

slot myanmar

slot kamboja

slot bonus new member

bonus new member

https://ratlscontracting.com/wp-includes/sweet-bonanza/

https://quickdaan.com/wp-includes/slot-thailand/

https://summervoyages.com/wp-includes/slot-thailand/

https://aws-klinkier.pl/wp-content/idn-poker/

https://thewolfiscoming.com/wp-includes/slot-bonus/

https://www.handwerksform.de/wp-includes/slot777/

https://www.nikeartfoundation.com/wp-includes/slot-deposit-pulsa/

https://lepremier.miami/wp-content/slot-bonus/

https://www.anticaukuleleria.com/wp-content/cmd368/

https://candyhush.com/wp-content/slot-bonus/

https://showersealed.com.au/wp-content/sabasport/

https://tdapelsin.ru/wp-includes/slot-bonus/

https://kreativszepsegszalon.hu/wp-content/slot-bonus/

https://jakartaaids.org/wp-content/sbobet88/

https://ratlscontracting.com/wp-includes/ubobet/

situs slot nexus

slot bet kecil

slot gacor deposit 10 ribu

slot joker123

slot bet 100

slot deposit 10 ribu

big bass crash slot

spaceman slot

wishdom of athena

slot bonanza

slot spaceman

Rujak Bonanza

Candy Village

Gates of Gatotkaca

Adblock Detected

An Ultimate Guide to Equity Research

This post was originally published on August 15, 2019 and was updated for relevance on July 29, 2024.

Equity research is a specialized field within the finance industry that analyzes public companies, industries, and the overall economy. It helps investors make informed decisions about buying, holding, or selling investments.

In this guide, we’ll explore equity research, its definition, how to conduct research analysis, what goes into a research report, the various roles involved, key considerations when selecting an equity research firm, career pathways into the equity research industry, and more.

With that, let’s get started.

What is equity research?

Before we discuss equity research, it’s important to understand the concept of equity. Equity is the full ownership of an asset once its associated debts have been settled. Equity research, or “securities research,” refers to the process investment banks use to understand a company's overall equity or value.

Equity analysts, often working within an investment bank, lead this process. They create documents that delineate the equity in question within the context of the business, its management, the broader industry, and the economic landscape.

The larger the investment bank, the more reports an equity research team will tend to produce, and the analysis included will be more detailed. Examples of analysis include:

- Review of how the macroeconomic picture is likely to affect the company

- Operational changes or investments that are likely to affect the company’s performance

- Review the company’s financial statements and explanation of changes

- Projections on the status of the company’s revenue (and share price) and where it’s headed

- Recommendations on whether to buy, hold, or sell the company’s equity

How to conduct equity research analysis

Research is the name of the game. An Equity Research Analyst is responsible for providing vetted and trusted insights to make sound and informed investment decisions. This process is typically broken into four stages:

1. Thorough Research

Equity Research Analysts focus on specific regions and sectors. They leave no stone unturned in conducting extensive research, thoroughly reviewing financial reports, balance sheets in Excel, earnings releases, industry trends, regulatory changes, macroeconomic factors, and more that could impact the companies they are analyzing.

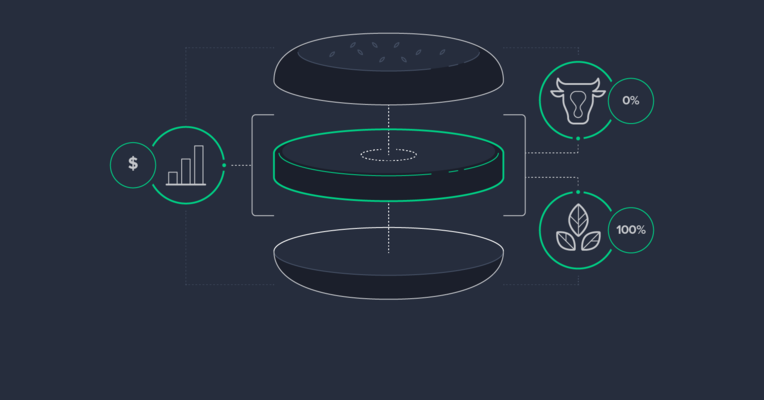

2. Financial Modelling & Valuation

Financial modeling involves creating mathematical representations of a company's financial performance by forecasting future results based on historical data and assumptions. Valuation is used to determine the fair value of a company's stock using methods such as discounted cash flow analysis and comparable company analysis. These tools help evaluate a company's financial health and growth potential to advise on investments.

3. Creating Equity Research Reports

Equity Research Analysts are responsible for condensing their findings into easily understandable reports for investors. We'll expand on this more in the next section.

4. Communication Skills & Publication

Equity Research Analysts in senior or lead positions often present their findings to their organization or client base. These individuals must be able to simplify complex financial data, so strong communication and presentation skills are essential.

What is an equity research report?

Buy-side or sell-side, an equity research report typically includes the following:

- An industry research overview that covers trends and news related to competing companies.

- A company overview that includes any recent business developments and quarterly performance results.

- The equity analyst provides an investment thesis explaining the reasons behind their prediction of the stock's performance. This section also includes the target share price, which many consider the most critical aspect of the report.

- A financial model-based forecast of the company's income, cash flow, and valuation.

- Risks associated with the stock.

Difference between a career in equity research and investment banking

Investment banking and equity research are similar but have clear distinctions in their intended outcome. Investment banking is all about helping companies raise money through stocks and bonds, offering mergers and acquisitions services, and managing significant financial deals.

Equity research involves evaluating individual stocks and providing investment advice based on their potential value and performance.

In essence, investment banking focuses on managing financial transactions, while equity research focuses on analyzing and valuing individual stocks.

When considering a career between the two, it's imperative to evaluate the following factors:

1. Educational Background

Both career paths require a bachelor's degree in economics, accounting, finance, or engineering. For career growth, a Chartered Financial Analyst (CFA) designation is often required for Equity Research Analysts, while investment banking can require a Master of Business Administration (MBA). Additionally, investment bankers must pass the Series 79 exam , which measures the knowledge needed to perform the critical functions of an investment banking representative.

2. Career Path

In investment banking, the career path is straightforward. It starts with being an analyst, then an associate, and climbing to higher positions. In equity research, the career path could be more transparent. Typically, it involves transitioning from associate to analyst, senior analyst, and then to the role of vice president or director of research. Investment bankers have better opportunities to reach top positions because of their involvement in making deals and managing clients. They often go on to work for private equity firms for venture capitalists. Research analysts are frequently seen solely as number crunchers and not thought of as being able to drive substantial business growth.

3. Skill Set

It should come as no surprise that Equity Research Analysts require strong analytical and mathematical skills to handle complex calculations, build predictive models, and prepare financial statements. They must also be proficient communicators capable of simplifying complex financial data. As for investment bankers, financial modeling and industry analysis are crucial early in their careers. However, as they advance, they transition to a sales-oriented mindset, excelling at closing deals and managing client relationships.

4. Work-Life Balance

Equity research is known for long hours, particularly during earnings season, but there are periods of relative calm. Investment banking is another beast, typically requiring brutal hours, often up to 100 hours per week. A recent article in Forbes highlighted that work-life balance has become a significant concern in investment banking. This is particularly after the reported deaths of two Bank of America employees who were said to be working up to 110 hours per week.

5. Recognition

Equity research reports offer visibility to associates and junior analysts. Senior analysts are sought after by the media for comments on the companies they cover. Junior investment bankers work in obscurity but gain visibility as they progress in their careers. Visibility for investment bankers significantly increases when they work on large, prestigious deals.

6. Compensation

Investment banking generally offers higher earning potential compared to equity research. For example, according to Wall Street Oasis (WSO), investment banking associates earn between $150,000 and $200,000 with substantial bonuses, while senior vice presidents or managing directors earn over $400,000 annually. WSO also says entry-level analysts start between $50,000 and $80,000 and have the potential to make up to $500,000 as they grow to leadership positions.

Roles in equity research

In the world of equity research, it is crucial to understand the distinction between a buy-side and sell-side Equity Research Analyst. Below, we'll outline their respective areas of focus and ultimate objectives.

1. Sell-side analysts

Sell-side Equity Research Analysts work for investment banks and provide their clients with sell-side research and recommendations on stocks and other financial instruments. Their primary goal is to generate trading commissions and investment banking business for their firm.

2. Buy-side analysts

A buy-side Equity Research Analyst works for institutions that buy and sell securities, such as mutual funds, hedge funds, and pension funds. Their role involves researching and making investment recommendations for their firm's portfolios.

Best Equity Research Firms

Below are some of the top-ranking equity search firms.

- JP Morgan —J.P. Morgan’s Research team uses state-of-the-art technologies and innovative tools to provide clients with top-notch analysis and investment advice.

- Barclays —The equity research teams cover hundreds of stocks across the Americas and Europe, delivering event analysis, stock ideas, and sector themes. They collaborate with other teams to offer clients unique, cross-asset perspectives on industries and markets.

- Credit Suisse AG —The team has original research on over 3,000 companies with thought-provoking thematic analysis, differentiated trading ideas, and coordinated global views.

- Bank of America Financial Center —The company offers comprehensive research and analysis for both institutional and retail clients. It encompasses over 4,000 companies across 35 global sectors in developed and emerging markets. Its research involves fundamental and technical analysis as well as hedging strategies.

- Morgan Stanley —Through timely, in-depth analysis of companies, industries, markets, and world economies, Morgan Stanley has earned its reputation as a leader in investment research.

Things to consider when hiring an equity research firm

When evaluating an equity research firm, it’s essential to consider the experience and reputation of its analysts, the firm’s track record of accurate stock picks and recommendations, the depth and quality of their research reports, the firm's access to company management and industry experts, their industry specialization, the firm's coverage universe, the timeliness of their research, and the overall transparency and integrity of their research process.

How to get into equity research

If you are considering entering the equity research space, you will likely need a finance, accounting, or economics background. Many professionals in this field begin with a bachelor's degree in finance or a related field. Those seeking career advancement often pursue a master's degree or a CFA designation to enhance their resume.

Research assistant, junior analyst, or equity research associate are common entry-level roles. Advancing in your career will require gaining experience in financial analysis, modeling, and report writing. Developing a solid network of connections within the industry is also crucial for discovering new opportunities in equity research. Like all areas of business, networking is critical.

Staying up to date on the latest trends and news within the equity research space is important for understanding the workings of the stock market and developing strong analytical and critical thinking skills. This is crucial for ensuring high-quality, long-lasting success in equity research.

The Importance of Equity Research

As we've discussed, equity research is essential for investors as it provides valuable information and investment recommendations. It involves digging into company finances, creating financial models, and meeting with industry experts.

Equity research supports investment decisions, evaluates securities, and guides investors and fund managers. For example, it helps predict the future growth potential of tech companies, find investment opportunities in the pharmaceutical industry, and understand how macroeconomic trends affect different sectors and stocks.

Final Thoughts

Equity research is crucial in empowering investors to make informed investment decisions. Through comprehensive analysis of financial data, market trends, and company performance, equity research provides valuable insights that enable investors to identify attractive opportunities and manage their portfolios effectively. By leveraging the expertise of research analysts and utilizing robust analytical techniques, investors can gain a deeper understanding of the risks and potential returns associated with specific investment opportunities. Ultimately, equity research is a fundamental tool for institutional and retail investors, helping them navigate the complexities of the financial markets with confidence and clarity.

Get your M&A process in order. Use DealRoom as a single source of truth and align your team.

Equity Research: A Complete Beginner’s Guide

A Former JP Morgan Equity Analyst gives a basic overview of what equity research is, different job roles, important skills, how to approach completing a research report, and exit opportunities. It also introduces some of the basic equity research vocabulary.

By Created Kacper Borowiec (2019-01-16 21:16:00)

An exhaustive but very well-thought catalog of tutorials for individuals looking for an introduction to equity research.

Let us know your interests

AnalystSolutions respects your privacy and will never share your information with others. You can remove yourself from any distribution with one click.

You have Successfully Subscribed!

Evalulate our tools for free.

We offer free full versions of our content for evaluation purposes (valued at over $700) to professionals holding the following roles:

- Manager of buy-side or sell-side analysts (DOR or PM)

- CFA Society leader responsible for programming

- Professor teaching students pursuing careers in equity research

You will receive:

- Free GAMMA PI™ assessment

- Free access to our presentation "Are You a Great Analyst?"

- Free full workshop (not "Preview" version), including all materials (Learner Workbook, Slides and Quick Reference Cards)

- Sample chapter of Best Practices for Equity Research Analysts

To ensure a quick verification of your role above (usually within one business day), please provide the email address issued by your organization.

Try 2 of the 15 GAMMA PI™ Modules for Free

You will be directed to the FREE SAMPLE EDITION of our GAMMA PI™ Equity Research Analyst Self-Assessment. Please provide a valid email address to receive your results (your email address remains confidential within AnalystSolutions).

All About Equity Research [The ONLY Guide You’ll Need in 2024]

Equity research is a key pillar in the world of finance that bridges the gap between companies, investors, and the market . In this guide, we will delve deep into the world of equity research, exploring its purpose, the process, the roles involved, and the skills required to succeed in this field.

We’ll also discuss the types of equity research, dissect the intricacies of equity research reports, and shed light on the exciting job opportunities this sector offers. Furthermore, we will touch upon the evolving trends in equity research and how they’re shaping the industry’s future.

Let’s get started-

What Is Equity Research?

In the world of finance, ‘equity’ refers to the ownership of assets after all debts associated with those assets are paid off. In simpler terms, if you were to sell all of your company’s assets and pay off its debts, the leftover money would represent your company’s equity. Hence, equity research is an in-depth analysis of a company’s total equity or value.

But equity research isn’t just a mere calculation of assets and liabilities. It’s a rigorous, methodical examination of all the aspects that contribute to a company’s financial performance, and thus, its equity. It is akin to a detective’s investigation, digging through layers of financial statements, market trends, sector overviews, and macroeconomic factors to arrive at a comprehensive understanding of a company’s financial standing and future prospects.

Understanding Equity Research With a Simple Example

Let’s illustrate this with an example. Suppose an equity research analyst is studying a pharmaceutical company . They won’t only look at the balance sheets or profit and loss statements. They’ll consider factors such as the company’s research and development efforts, the potential market for new drugs, any pending patents, the status of regulatory approvals, and even the broader trends in the healthcare industry.

They might investigate how the company performed during different economic conditions, how well its product pipeline compares to competitors, and how regulatory changes could impact future earnings.

The analyst will also look at macroeconomic indicators. For instance, if a new law threatens to increase the cost of a raw material vital to the company’s main product, that could impact the company’s future profitability, and the analyst would need to factor this into their analysis.

At the end of this investigation, the equity research analyst forms an estimation of the company’s intrinsic value, which they then compare to its current market value . If the intrinsic value is significantly higher than the market value, the analyst might recommend the stock as a good buy, as it’s likely undervalued . On the other hand, if the market value is much higher than the intrinsic value, the stock might be overpriced , and the analyst might recommend investors to sell or avoid it.

Equity research, in essence, is this deep dive into the world of a company’s financials , providing a guide to investors, helping them navigate through their investment journey. It’s the compass that points towards profitable investment decisions.

Roles and Responsibilities of an Equity Research Analyst

An Equity Research Analyst acts as a conduit between investors and the ever-dynamic financial markets, providing them with information and insights necessary to make sound investment decisions. Let’s see how their day looks like –

Deep-Dive Research

Their day-to-day responsibilities start with conducting extensive research i nto specific companies or sectors. They meticulously scrutinize financial reports, balance sheets, cash flow statements, and earnings releases. However, their research isn’t limited to mere numbers. They also keep tabs on industry trends, regulatory changes, and macroeconomic factors that could impact the companies they are following.

Example – An analyst is covering technology companies, they need to be abreast of developments like privacy legislation, advancements in artificial intelligence, or shifts in consumer behavior towards tech products. This requires constant learning and staying updated with news and trends in the sector.

Financial Modelling and Valuation

Equity Research Analysts are also adept at creating complex financial models . They use these models to project future earnings , based on various potential scenarios. Based on these projections, they calculate the intrinsic value of a company’s shares.

Example – Let’s say there’s an auto company that’s planning to launch a new electric car model. An Equity Research Analyst covering this company would build a financial model to estimate additional revenues from this new model, the costs associated with its production, the potential impact on the company’s market share, and so on. They would then use these estimates to calculate what this could mean for the company’s future profitability , and how it could impact the company’s share price.

Also Read: All About Financial Modeling [The ONLY Guide You’ll Need in 2024]

Writing Equity Research Reports

One of the key deliverables of an Equity Research Analyst is the Equity Research Report. These reports encapsulate the findings of their research and analysis in a format that’s digestible for investors. The report typically includes

- An overview of the company

- A summary of recent developments

- Detailed financial analysis

- Future projections, and

- Most importantly, an investment recommendation (buy, hold, or sell)

The equity research reports have a broad audience – institutional investors, retail investors, fund managers, and sometimes, the companies themselves. Given the diverse readership, the reports need to be accurate, unbiased, and clear. A well-written report can significantly influence investment decisions, underscoring the responsibility on the analyst’s shoulders.

Communication and Presentation

Finally, an Equity Research Analyst often has to present their findings to clients, fund managers, or within their own organizations. This could be through conference calls, presentations, or even TV interviews. Hence, strong communication skills and the ability to explain complex financial concepts in a simple way are essential traits for an Equity Research Analyst.

The Process of Equity Research

The process of equity research is like peeling back the layers of an onion to reveal the core truth about a company’s financial health and potential. It involves multiple steps, each equally important in creating a well-rounded view of the company.

Step 1: Selection of Companies

The first step in equity research is the selection of companies. Analysts often specialize in specific sectors or industries , such as technology, healthcare, or energy. The choice of companies to analyze within those sectors depends on several factors, including market capitalization, relevance in the industry, or particular events like mergers or IPOs.

Step 2: Industry Analysis

After choosing the companies, analysts start with a broad industry analysis . They look at the industry size, growth rate, major competitors, regulatory environment, and key trends. This macro view provides context for the company’s operations and potential growth.

Step 3: Company Analysis

Once they’ve understood the industry context, analysts move onto detailed company analysis. This involves a deep dive into the company’s financial statements, including balance sheets, income statements, and cash flow statements. They also examine the company’s business model, products or services, competitive positioning, management quality, and corporate governance practices.

Step 4: Financial Modelling and Projections

After developing an in-depth understanding of the company, analysts use this information to build detailed financial models. These models involve projections of the company’s future revenues, expenses, and earnings, often under different scenarios. For example, they might project how the company’s earnings could be affected under different economic conditions or if a new product line succeeds or fails.

Step 5: Valuation

The next step is the valuation, where analysts use techniques such as Discounted Cash Flow (DCF) analysis, Price/Earnings (P/E) ratio, or Comparables analysis to estimate the intrinsic value of the company’s shares . This value is then compared with the current market price to determine whether the company’s shares are undervalued or overvalued.

Step 6: Report Writing and Recommendation

Finally, analysts compile their research findings, financial model outputs, and valuation results into a comprehensive equity research report . The report also includes a recommendation, typically a ‘buy’, ‘hold’, or ‘sell’ for the company’s stock based on the analyst’s analysis.

It’s important to note that equity research is a continuous process . Companies release financial information quarterly, industry trends evolve, and macroeconomic conditions change. Therefore, analysts regularly update their reports to reflect the most recent data and insights.

Key Aspects of Equity Research Reports

An Equity Research Report is a comprehensive document that encapsulates an analyst’s view of a company, sector, or industry . These reports are essential tools that investors use to understand and navigate the financial markets. Here are the key aspects of an equity research report:

Executive Summary

Every report begins with an executive summary that provides a brief overview of the analyst’s findings and recommendations. This part is designed to provide a quick snapshot of the key takeaways from the report.

Company Overview

This section provides a detailed description of the company , including its history, management, product or service offerings, and business model. It also includes an overview of the company’s key strategies and competitive advantages. This information helps readers understand the company’s operations and its position within its industry.

Industry Overview

The industry overview offers an analysis of the broader sector or industry in which the company operates. It covers aspects such as industry size, growth rates, key trends, major competitors, and regulatory environment . This context is crucial in understanding the company’s potential for growth and the challenges it might face.

Financial Analysis

In this part of the report, the analyst presents their detailed analysis of the company’s financials. This usually includes examination of the i ncome statement, balance sheet, and cash flow statement. The analyst may also discuss financial ratios, growth rates, profitability metrics, and other key financial indicators. This section provides insights into the company’s financial health and performance.

Financial Projections and Valuation

The heart of the equity research report is the financial projections and valuation section. Here, the analyst lays out their forecasts for the company’s future earnings and financial performance. They also present their valuation of the company’s stock, typically arrived at using financial modelling techniques like Discounted Cash Flow (DCF), Price/Earnings (P/E) ratio, or Comparables analysis.

Investment Thesis and Recommendations

In the final section, the analyst presents their investment thesis – their argument for why an investor should or should not invest in the company’s stock. They also provide a clear investment recommendation, typically a ‘buy’, ‘hold’, or ‘sell’ rating. This section is the culmination of all the analyst’s research and analysis.

Types of Equity Research

Equity research is carried out by different types of institutions for various purposes . Understanding the differences among them can help in comprehending the perspectives and potential biases in the research. Here are the key types of equity research:

Sell-Side Equity Research

Sell-side analysts work for brokerage firms and investment banks. Their research is primarily aimed at selling securities, providing investment recommendations, and facilitating transactions , which helps their companies earn brokerage and transaction fees. Sell-side research is generally freely available, and the firms distribute it widely to attract business from institutional and retail investors.

Buy-Side Equity Research

Buy-side analysts work for institutional investors such as mutual funds, hedge funds, pension funds, and insurance companies. They conduct research to assist the fund’s managers in making investment decisions for the fund’s portfolio. Their research is typically proprietary and is used solely for the benefit of the fund that employs them.

Independent Equity Research

Independent equity research firms are third-party entities that aren’t directly involved in trading securities. They sell their research to hedge funds, asset managers, and sometimes individual investors . Since these firms don’t have a trading department and aren’t seeking investment banking business, their research is perceived as unbiased. They have gained popularity over the past decade due to their perceived objectivity.

Internal Equity Research

Large corporations often have their internal equity research teams. These analysts perform research on competitors, suppliers, and customers to assist in strategic decision-making. This research is generally not available to the public as it is used for internal corporate strategy and planning purposes.

Each type of equity research has its strengths and weaknesses , and they all play essential roles in the financial ecosystem. Understanding their differences and potential biases can help investors and decision-makers use this research more effectively.

Skills Required for a Career in Equity Research

Equity research is a challenging and intellectually demanding field that requires a combination of hard and soft skills. If you’re considering a career in equity research, here are the key skills you’ll need to succeed:

Financial Literacy

A fundamental understanding of financial principles is the bedrock of equity research. This includes knowledge of financial accounting, corporate finance, economics, and statistics . Analysts need to be comfortable reading and interpreting financial statements, calculating financial ratios, and understanding economic indicators.

Analytical Skills

Equity research involves extensive data analysis. Analysts need to sift through large volumes of data, spot trends, interpret complex information , and draw meaningful conclusions. Strong analytical skills are crucial to understand the past performance of a company and make accurate forecasts about its future.

Financial Modelling

Financial modelling is an essential tool in an equity researcher’s arsenal. Analysts use financial models to forecast a company’s future revenues and earnings and estimate the intrinsic value of its shares. Proficiency in Excel and familiarity with valuation techniques such as discounted cash flow (DCF) and comparable company analysis is a must.

Attention to Detail

The devil is often in the details when it comes to equity research. Analysts need to pay close attention to the footnotes in financial statements, the nuances in a CEO’s comments during an earnings call, or the implications of a regulatory change. A small detail can sometimes have a significant impact on a company’s valuation.

Communication Skills

Analysts need to communicate their findings effectively. This includes writing clear, concise research reports that can be understood by people without a financial background. It also involves presenting and defending their views to clients, colleagues, and sometimes, the media. Strong written and verbal communication skills are vital.

Curiosity and Continuous Learning

Equity research analysts need to stay on top of industry trends, economic news, and changes in financial regulations. This requires a natural curiosity and a commitment to continuous learning. An analyst who stops learning risks falling behind in the fast-paced world of finance.

Job Opportunities in Equity Research

Equity research provides a host of job opportunities in a range of firms including investment banks, asset management companies, research firms etc. Let’s understand these roles, their typical responsibilities, average salaries in India, and potential employers:

Equity Research Analyst

As an Equity Research Analyst, you’ll delve deep into company financials, industry trends, and macroeconomic factors to provide investment recommendations. You may focus on a specific sector or cover a broad range of industries. This role involves financial modelling, report writing, and communicating with clients and company representatives.

Average Salary in India : ₹ 7-10 Lakhs per annum Employers : Major employers include JP Morgan, Goldman Sachs, Morgan Stanley, Credit Suisse, Kotak Securities.

Associate Analyst

Those just starting in equity research often begin as Associate Analysts. Working closely with senior analysts, Associates help in collecting data, building financial models, and drafting research reports. It’s a role that provides a solid foundation in the fundamentals of equity research.

Average Salary in India : ₹ 4-6 Lakhs per annum Employers : Firms like Ernst & Young, KPMG, Deloitte, and PwC.

Senior Analyst/Research Director

With experience, an Analyst or Associate can move up to become a Senior Analyst or Research Director. These roles involve more strategic oversight, including deciding which companies or sectors to cover, mentoring junior analysts, and representing the firm to clients, the media, and the public.

Average Salary in India : ₹ 12-20 Lakhs per annum Employers : Multinational banks and brokerage firms like Citigroup, Barclays, ICICI Securities.

Portfolio Manager

Some equity research analysts transition into portfolio management roles over time. As a Portfolio Manager, you would use the insights from equity research to make investment decisions for a fund or portfolio. This role requires a deep understanding of financial markets, risk management, and asset allocation strategies.

Average Salary in India : ₹ 15-25 Lakhs per annum Employers : Asset management companies like HDFC Asset Management, ICICI Prudential, Reliance Nippon Life Asset Management.

Equity Strategist

Equity Strategists work with a macro view, examining factors like economic indicators, industry trends, and market data to provide investment strategies and identify attractive sectors or themes in the market. While less company-specific than an analyst role, strategists still utilize many of the research and analytical skills developed in equity research.

Average Salary in India : ₹ 10-18 Lakhs per annum Employers : Major investment banks and financial services firms like Deutsche Bank, HSBC, UBS.

Investor Relations Role

Equity research analysts can also move into investor relations roles within companies. These professionals communicate with shareholders, analysts, and the broader financial community. Understanding the perspective of equity analysts is valuable in this role since you’ll be communicating key financial and strategic information about the company to the investment community.

Average Salary in India : ₹ 9-15 Lakhs per annum Employers : Large corporations across industries like Tata Group, Reliance Industries, Infosys, Wipro.

Sales & Trading

Some equity research professionals transition into roles in sales & trading. In this capacity, they use their deep knowledge of industries and companies to advise clients on investment strategies, facilitate transactions, and connect buyers and sellers in the financial market.

Average Salary in India : ₹ 8-16 Lakhs per annum Employers : Banks and brokerage firms such as Axis Bank, HDFC Bank, Edelweiss, Sharekhan.

Trends and Future of Equity Research

Equity research, like all facets of finance, is continually evolving in response to changing regulations, technologies, and investor behaviours. Here are some of the current trends and potential future developments in the field:

Digitization and Automation

The digitization of financial information and the development of advanced data analytics tools are transforming the way analysts conduct research. Automated tools are increasingly being used to collect and process data, allowing analysts to focus more on interpreting the data and generating insights.

For example , artificial intelligence (AI) and machine learning (ML) tools are now used to analyze financial statements, track sentiment in news articles and social media, and even to predict future stock price movements.

Increased Regulatory Oversight

In recent years, regulators around the world have been placing increased scrutiny on equity research to promote transparency and prevent conflicts of interest.

For example , the European Union’s MiFID II regulations now require investment firms to separate the costs of research from trading fees. This has led to more demand for independent research and is forcing sell-side firms to demonstrate the value of their research more explicitly.

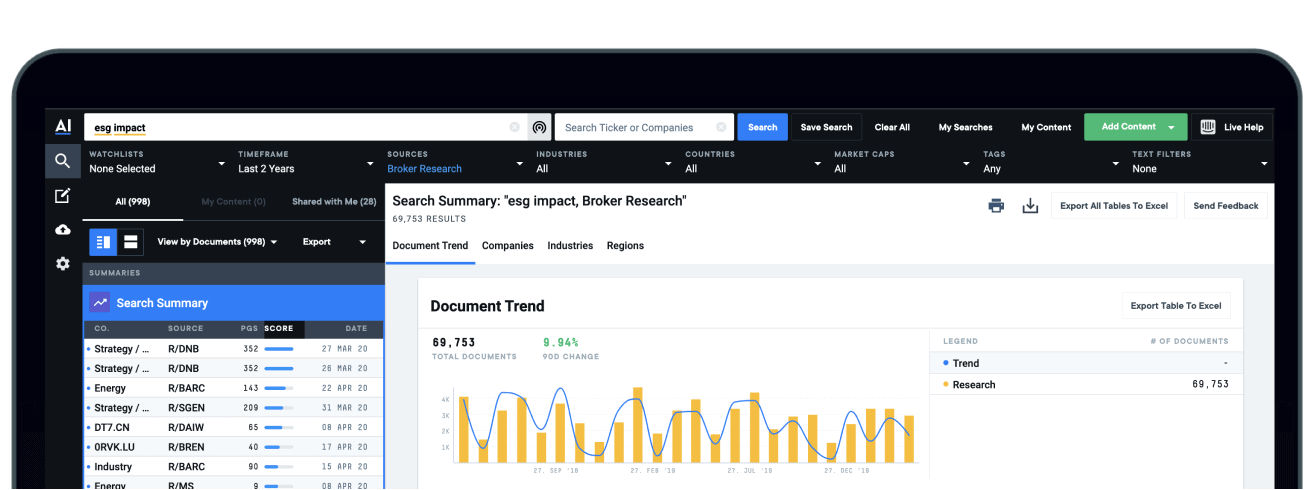

Demand for ESG Analysis

There’s a growing trend among investors to consider Environmental, Social, and Governance (ESG) factors in their investment decisions. This is leading to increased demand for equity research that includes analysis of companies’ ESG performance. Analysts are now required to assess factors such as a company’s carbon footprint, its labor practices, and its board diversity in addition to its financial performance.

Crowdsourced Equity Research

Crowdsourced equity research platforms, where independent analysts and investors share their research and opinions, are gaining popularity. These platforms offer a wider range of views and analyses than traditional equity research sources. However, they also pose new challenges in terms of verifying the credibility of the information.

Emergence of Alternative Data

Equity researchers are increasingly using alternative data – information derived from non-traditional sources like s ocial media sentiment, satellite imagery, or website traffic data – to gain additional insights into a company’s performance. These data sources can provide real-time indicators that can complement traditional financial data and provide an edge to the analysts.

Equity research serves as a vital link between companies, investors, and the financial markets . It involves detailed analysis of financial data, sector trends, and macroeconomic factors to formulate clear, actionable investment recommendations.