To read this content please select one of the options below:

Please note you do not have access to teaching notes, compensation gap, retrenchment strategy and organizational turnaround: a configurational perspective.

Journal of Organizational Change Management

ISSN : 0953-4814

Article publication date: 29 June 2020

Issue publication date: 21 November 2020

This paper extends the current understanding of the retrenchment-–turnaround relationship in declined companies by introducing a compensation gap view. It argues that the effectiveness of the retrenchment strategy is contingent on reducing the executive-employee compensation gap in the turnaround process.

Design/methodology/approach

Drawing from a two-stage turnaround model and insights from the literature on executive-employee compensation gap, we develop and test a theoretical model that explains how five attributes, which refer to executive-employee compensation gap, asset retrenchment, cost retrenchment, ownership and size, affect the outcome of the organizational turnaround. This paper uses the fuzzy-set qualitative comparative analysis (fsQCA) method and based on the samples of 112 listed companies that experience the decline between 2005 and 2013.

This paper concludes two valid causal paths and finds that small companies with small executive-employee compensation gap have a higher likelihood of successful turnaround when they implement cost or asset retrenchment actions. As for large state-owned companies, they should reduce the costs and maintain a small executive-employee compensation gap. An excessive compensation gap can be problematic, which could impair the organizational ability to cope with adversity and decline.

Research limitations/implications

First, this paper taps the vital role of employees in the turnaround process besides the mainstream “organizational decline-layoffs” logic, which hints a new human resource management strategy when organizations are facing decline. Second, this paper reveals the theoretical linkage between pay dispersion, internal stakeholder and organizational resilience. Third, as a methodological contribution, we introduce fsQCA, overcoming the shortcomings of turnaround strategy research with case and regression analysis and breaking through the paradigm of “specific factor-turnaround.”

Practical implications

Organizational turnaround is a systematic process that constitutes multiple factors together. When organizations take the asset retrenchment to stop bleeding, reducing the executive-employee compensation gap will help enhance employee's cognition of organizational values and strategic goals, eliminate feelings of exploitation in retrenchment implementation and thus effectively promote turnaround. This paper also provides a basis for executive compensation restrictions and re-examines pay dispersion and economic inequality.

Originality/value

This study sheds some light on the importance of the executive-employee compensation gap in retrenchment strategy and contributes to both organizational turnaround and pay dispersion theories. Also, it reveals the theoretical linkage between internal stakeholders, organizational resilience and long-term orientation.

- Compensation gap

- Retrenchment strategy

- Organizational decline

- Organizational turnaround

Acknowledgements

The authors gratefully thank two anonymous reviewers for their constructive comments and suggestions, and we acknowledge the sponsorship provided by the National Natural Science Foundation of China (No. 71832006).

Tao, Y. , Xu, G. and Liu, H. (2020), "Compensation gap, retrenchment strategy and organizational turnaround: a configurational perspective", Journal of Organizational Change Management , Vol. 33 No. 5, pp. 925-939. https://doi.org/10.1108/JOCM-11-2019-0340

Emerald Publishing Limited

Copyright © 2020, Emerald Publishing Limited

Related articles

All feedback is valuable.

Please share your general feedback

Report an issue or find answers to frequently asked questions

Contact Customer Support

Retrenchment strategy: How to cut costs and improve efficiency with a retrenchment strategy

1. understanding retrenchment strategy, 2. assessing the need for retrenchment, 3. cost reduction measures, 4. workforce optimization, 5. streamlining processes, 6. communication and change management, 7. financial restructuring, 8. monitoring and evaluation, 9. case studies and success stories.

1. The Rationale Behind Retrenchment:

- Financial Distress : Companies facing financial distress, declining profits, or mounting debt often turn to retrenchment strategies. These organizations need to regain financial stability by reducing expenses and optimizing resource allocation .

- Strategic Repositioning : Sometimes, retrenchment is a proactive move to reposition the company strategically. It allows organizations to shed non-core or underperforming assets, refocus on core competencies, and reallocate resources to growth areas.

- Market Changes : external factors such as changes in market dynamics, technological disruptions, or shifts in consumer preferences may necessitate retrenchment. For instance, a company in the declining print media industry might divest its newspaper division and invest in digital media.

2. Types of Retrenchment Strategies:

- Cost Reduction : This is the most common form of retrenchment. It involves cutting costs across the board, including layoffs, renegotiating supplier contracts, and eliminating non-essential expenses. Example: A retail chain closing unprofitable stores.

- Asset Sales : Selling off non-core assets or business units to generate cash. Example: A conglomerate divesting its unrelated subsidiaries.

- Restructuring : Internal reorganization to improve efficiency. It may involve merging departments, centralizing functions, or changing reporting structures.

- Downsizing : Reducing the workforce to align with business needs. Downsizing can be painful but is sometimes necessary for survival.

- Outsourcing : Contracting out non-core functions to external service providers . Example: IT support or customer service outsourcing.

- Exit from Markets : Exiting unprofitable markets or discontinuing product lines. Example: A multinational company withdrawing from a low-growth region.

3. Challenges and Considerations:

- Employee Morale : Layoffs and downsizing impact employee morale . effective communication and support are crucial during retrenchment.

- legal and Ethical issues : compliance with labor laws , severance packages, and ethical treatment of employees are essential.

- Reputation Risk : Retrenchment can affect the company's reputation among customers, investors, and the public.

- Strategic Alignment : Retrenchment decisions must align with the overall corporate strategy .

- Timing : Choosing the right time for retrenchment is critical. Delaying or acting prematurely can have adverse effects.

4. real-World examples :

- IBM : In the 1990s, IBM faced financial challenges due to declining mainframe sales. It implemented a massive restructuring plan, including layoffs and divestitures. Eventually, IBM transformed into a services and software company.

- General Electric (GE) : Under CEO Jack Welch, GE aggressively pursued retrenchment strategies. It sold off non-core businesses, streamlined operations, and focused on high-growth sectors.

Remember, retrenchment is a strategic tool, not a sign of failure. When executed thoughtfully, it can lead to renewed competitiveness and long-term success . Organizations must weigh the costs, benefits, and implications before embarking on this path.

Understanding Retrenchment Strategy - Retrenchment strategy: How to cut costs and improve efficiency with a retrenchment strategy

1. Financial Perspective:

- cost-Benefit analysis : Organizations must weigh the potential benefits of retrenchment against the associated costs. This analysis considers both short-term savings (e.g., reduced payroll, facility closures) and long-term implications (e.g., impact on employee morale, customer perception).

- Financial Metrics : Key performance indicators (KPIs) such as return on investment (ROI) , profit margins , and cash flow guide decision-makers. If declining financial performance persists, retrenchment becomes a viable option.

2. Operational Perspective:

- Process Efficiency : Evaluate existing processes for inefficiencies. Are there redundant tasks, bottlenecks, or outdated workflows? Streamlining operations can lead to cost savings .

- Resource Allocation : Assess resource allocation across departments. Are certain functions overstaffed while others are understaffed? Proper allocation ensures optimal utilization.

- Technology Assessment : Consider whether investments in technology (automation, digitization) can enhance efficiency. For example, automating manual data entry can reduce labor costs .

3. Market Perspective:

- Industry Trends : Analyze industry trends and competitive forces. If the market is shrinking or evolving, retrenchment may be necessary to adapt.

- Market Share : A declining market share signals the need for strategic adjustments. Companies must decide whether to focus on core competencies or diversify.

- Customer Demand : changing customer preferences impact product lines. Retrenchment might involve discontinuing low-demand products or services.

4. human Resources perspective :

- Workforce Assessment : Evaluate the skills and capabilities of employees. Redundancies, skill gaps, or underperforming teams may necessitate retrenchment.

- Employee Morale : Downsizing affects morale. Transparent communication and fair treatment during retrenchment are crucial.

- Alternatives to Layoffs : Explore alternatives like retraining , redeployment , or voluntary early retirement before resorting to layoffs.

5. legal and Ethical considerations :

- Legal Compliance : Retrenchment must adhere to labor laws, contractual obligations, and severance agreements. Consult legal experts to avoid legal pitfalls .

- Ethical Treatment : Balancing financial needs with ethical treatment of employees is essential. Organizations should minimize harm and provide support during transitions.

6. Examples :

- Company A : Faced with declining sales, Company A conducted a thorough cost analysis. They decided to close underperforming branches, resulting in significant savings.

- Company B : To adapt to digital disruption, Company B retrained its workforce in data analytics and AI. This strategic move improved efficiency and competitiveness.

In summary, assessing the need for retrenchment involves a holistic evaluation of financial, operational, market, HR, legal, and ethical aspects. Organizations must navigate this complex terrain with foresight, empathy, and a commitment to long-term sustainability. Remember, retrenchment is not a one-size-fits-all solution; it requires tailored strategies aligned with the organization's unique context and goals.

Assessing the Need for Retrenchment - Retrenchment strategy: How to cut costs and improve efficiency with a retrenchment strategy

In this section, we will explore various insights from different perspectives on cost reduction measures . We will discuss strategies that can help businesses optimize their expenses and improve overall efficiency .

1. Streamlining Operations: One effective cost reduction measure is to streamline operations. This involves identifying and eliminating any unnecessary steps or processes within the organization. By streamlining operations, businesses can reduce waste, improve productivity, and ultimately cut costs.

2. Implementing Technology Solutions: Embracing technology can significantly contribute to cost reduction. By automating repetitive tasks , businesses can save time and resources. For example, implementing an automated inventory management system can help optimize inventory levels , reduce carrying costs, and minimize the risk of stockouts.

3. Negotiating Supplier Contracts: negotiating favorable terms with suppliers is another way to reduce costs . By leveraging the purchasing power of the organization, businesses can secure better pricing, discounts, or extended payment terms . This can lead to significant savings in the long run.

4. outsourcing Non-Core functions : Outsourcing non-core functions can be a cost-effective strategy. By delegating tasks such as payroll processing, IT support, or customer service to external service providers, businesses can reduce overhead costs associated with hiring and training in-house staff.

5. energy Efficiency measures : implementing energy-efficient practices can help reduce utility costs. This can include using energy-saving equipment, optimizing lighting systems, or implementing renewable energy sources . By reducing energy consumption , businesses can lower their operational expenses and contribute to environmental sustainability .

6. Employee Training and Development: Investing in employee training and development can have long-term cost-saving benefits. Well-trained employees are more efficient, productive, and less likely to make costly errors. By providing ongoing training opportunities, businesses can enhance employee skills and knowledge , leading to improved performance and cost reduction.

Remember, these are just a few examples of cost reduction measures. Each business should assess its unique circumstances and tailor strategies accordingly. By implementing effective cost reduction measures, businesses can improve their financial health and achieve long-term success .

Cost Reduction Measures - Retrenchment strategy: How to cut costs and improve efficiency with a retrenchment strategy

Workforce Optimization is a critical aspect of any organization's strategy to enhance efficiency, reduce costs, and maximize productivity. In the context of a retrenchment strategy , where the focus is on streamlining operations and making tough decisions to weather financial challenges, workforce optimization becomes even more crucial.

Let's delve into this multifaceted topic from various perspectives:

1. Human Capital Perspective:

- Skill Alignment : Workforce optimization involves aligning employee skills with organizational needs. This means assessing the existing skill set, identifying gaps, and investing in training or hiring to bridge those gaps. For instance, if a company shifts from traditional manufacturing to digital production, it must ensure that employees acquire digital literacy and programming skills.

- Right-sizing : Organizations often face the dilemma of overstaffing or understaffing. Right-sizing the workforce involves evaluating workload, analyzing historical data , and determining the optimal number of employees needed. For example, during seasonal peaks, a retail business might hire temporary staff to handle increased customer demand.

- Talent Retention : Retrenchment strategies can lead to layoffs, but retaining key talent is essential. Offering incentives, career growth opportunities , and a positive work environment can prevent valuable employees from seeking employment elsewhere.

2. Operational Efficiency Perspective:

- Process Automation : Leveraging technology to automate repetitive tasks can significantly enhance efficiency. For instance, using chatbots for customer service inquiries or implementing robotic process automation (RPA) for data entry can reduce manual effort.

- Flexible Work Arrangements : The pandemic highlighted the benefits of remote work. Organizations can optimize their workforce by allowing flexible arrangements such as telecommuting, compressed workweeks, or job sharing. This not only improves work-life balance but also reduces office space costs .

- cross-training : Cross-training employees to handle multiple roles ensures continuity during absences or emergencies. For instance, a small IT team might have members skilled in both software development and system administration.

3. Financial Perspective:

- Cost-Benefit Analysis : Organizations must weigh the cost of retaining employees against the benefits they bring. For example, retaining a seasoned salesperson with a strong client base might be more cost-effective than hiring and training a new one.

- Outsourcing : Sometimes, outsourcing non-core functions (e.g., payroll processing, IT support) can optimize costs. However, organizations should carefully evaluate the trade-offs , considering quality, security, and long-term impact .

- Voluntary Separation Programs : Offering voluntary early retirement or severance packages can reduce the need for involuntary layoffs. These programs allow employees to exit gracefully while minimizing disruption.

4. Cultural Perspective:

- Communication : Transparent communication about workforce changes is crucial. Employees appreciate honesty and clarity. Leaders should explain the rationale behind optimization decisions and provide support during transitions.

- Employee Morale : A downsized workforce can experience anxiety and low morale. Organizations should invest in employee well-being programs, counseling services, and team-building activities to maintain a positive work environment .

- Inclusion and Diversity : Optimizing the workforce should consider diversity and inclusion . A diverse team brings varied perspectives and fosters innovation. Organizations should avoid biases during retrenchment decisions.

- Amazon : Amazon's use of robots in its warehouses optimizes order fulfillment. Robots handle repetitive tasks, allowing human employees to focus on complex problem-solving .

- IBM : IBM's "workforce rebalancing" strategy involves shifting resources to growth areas (such as cloud computing) while downsizing legacy divisions. This approach ensures agility and competitiveness.

In summary, workforce optimization is a delicate balancing act that requires strategic thinking, empathy, and adaptability. Organizations that navigate it successfully can emerge stronger, even in challenging times.

Workforce Optimization - Retrenchment strategy: How to cut costs and improve efficiency with a retrenchment strategy

1. Understanding Streamlining Processes:

Streamlining refers to the systematic simplification and optimization of workflows, procedures, and tasks. It involves eliminating redundancies, minimizing delays, and enhancing overall productivity. The goal is to achieve more with less—less time, less effort, and fewer resources.

2. Benefits of Streamlining:

- Cost Reduction: By eliminating unnecessary steps, organizations can reduce operational expenses. For instance, automating manual processes can significantly cut down labor costs.

- Improved Efficiency: Streamlined processes lead to faster turnaround times, reduced cycle times, and better resource allocation.

- Enhanced Quality: When processes are streamlined, there's less room for errors or defects. quality control becomes more effective .

- Agility: Streamlined processes allow organizations to adapt swiftly to changes in the market or internal dynamics.

3. Approaches to Streamlining:

- Process Mapping: Start by mapping out existing processes. Identify bottlenecks, redundant steps, and areas for improvement. Tools like flowcharts or swimlane diagrams can help visualize the flow.

- Lean Thinking: Borrowed from manufacturing, lean principles emphasize waste reduction. Techniques like 5S (Sort, Set in order, Shine, Standardize, Sustain) and Kaizen (continuous improvement) play a crucial role .

- Automation: Leverage technology to automate repetitive tasks. For example, invoice processing, data entry, or customer inquiries can be automated using software bots.

- Standardization: Establish standardized procedures and guidelines. When everyone follows the same process, consistency improves.

- cross-Functional collaboration : Involve stakeholders from different departments. Their insights can lead to holistic process improvements.

4. Examples:

- Order Fulfillment: A retail company streamlines its order fulfillment process by integrating inventory management , order processing, and shipping. This reduces lead times and ensures timely deliveries.

- HR Onboarding: An organization automates employee onboarding—document submission, training modules, and IT setup. This not only saves time but also enhances the new hire experience.

- Supply Chain: A manufacturer collaborates with suppliers to streamline procurement, production, and distribution. Just-in-time inventory management reduces excess stock and storage costs.

5. Challenges and Considerations:

- Resistance to Change: Employees may resist process changes. Effective communication and training are essential.

- Balancing Efficiency and Flexibility: Over-optimization can make processes rigid. Strive for a balance between efficiency and adaptability.

- monitoring and Continuous improvement : Streamlining is an ongoing effort. Regularly monitor processes and seek feedback for further enhancements.

In summary, streamlining processes is not just about trimming the fat; it's about creating a lean, agile, and effective organization. By embracing this mindset, businesses can navigate challenges, improve their bottom line , and stay competitive in a dynamic marketplace.

Streamlining Processes - Retrenchment strategy: How to cut costs and improve efficiency with a retrenchment strategy

1. The importance of Clear communication :

- Leadership Perspective: For executives and managers, communication is more than just conveying information; it's about inspiring confidence, aligning teams, and fostering commitment. Clear, transparent messages are essential to gain buy-in from employees during retrenchment.

- Employee Perspective: Employees crave honesty and clarity. Uncertainty breeds anxiety, so leaders must communicate openly about the reasons for retrenchment, the impact on jobs, and the overall vision for the organization.

2. Channels of Communication:

- town Hall meetings : These large-scale gatherings allow leaders to address the entire workforce simultaneously. They provide an opportunity to share the rationale behind retrenchment, answer questions, and demonstrate empathy.

- One-on-One Conversations: Personalized discussions between managers and employees are crucial. Managers can address individual concerns, provide emotional support, and offer guidance on next steps.

- Written Communication: Memos, emails, and official announcements play a vital role . Clarity, consistency, and empathy should characterize these written messages.

- Intranet and Internal Platforms: Utilize digital platforms to disseminate information, FAQs, and updates. Encourage dialogue through discussion forums .

3. Timing Matters:

- Pre-Announcement Preparation: Leaders should prepare thoroughly before announcing retrenchment. Anticipate questions, rehearse responses, and ensure alignment across the management team.

- Timely Updates: Regular updates keep employees informed about progress, milestones, and any adjustments to the retrenchment plan. Silence breeds rumors; consistent communication dispels them.

4. Listening and Feedback:

- Active Listening: Leaders must actively listen to employees' concerns, fears, and suggestions. Create safe spaces for dialogue, allowing employees to express their emotions.

- Feedback Mechanisms: Anonymous surveys, focus groups, and suggestion boxes provide valuable insights . Use this feedback to refine communication strategies.

5. Empathy and Compassion:

- Walk in Their Shoes: Understand the emotional impact of retrenchment. Acknowledge the loss, validate feelings, and express empathy.

- Support Services: Offer counseling, career transition workshops, and resources to help affected employees cope.

6. examples of Effective communication :

- Case Study: XYZ Corporation

- Before Retrenchment: The CEO held a town hall, explaining the financial challenges and the need for cost-cutting. She emphasized the organization's long-term viability .

- During Retrenchment: Managers conducted personalized conversations, addressing concerns and providing career guidance. Regular email updates kept everyone informed.

- After Retrenchment: The CEO shared success stories of employees who found new opportunities, reinforcing hope.

Remember, communication during retrenchment isn't just about transmitting facts; it's about building trust, maintaining morale, and ensuring a smoother transition. By embracing transparency, empathy, and active listening, organizations can navigate change more effectively.

Communication and Change Management - Retrenchment strategy: How to cut costs and improve efficiency with a retrenchment strategy

1. Debt Restructuring:

- Insight: debt restructuring is often the first step in financial turnaround. It addresses the burden of excessive debt by renegotiating terms with creditors or lenders.

- Examples:

- debt-for-Equity swaps : A distressed company may convert a portion of its debt into equity, diluting existing shareholders but reducing debt obligations.

- Debt Extension: Extending debt maturities provides breathing room for repayment.

- interest Rate reduction : Lowering interest rates minimizes interest expense.

- Case Study: In the early 2000s, General Motors underwent debt restructuring to avoid bankruptcy . It exchanged debt for equity and secured government assistance.

2. Cost Rationalization:

- Insight: Companies must scrutinize costs rigorously. This involves identifying non-essential expenses and eliminating redundancies.

- Operational Streamlining: Consolidating operations, closing unprofitable units, and optimizing supply chains .

- Workforce Reduction: Layoffs, early retirements, and voluntary separation programs.

- Technology Adoption: Investing in automation and digital tools to reduce labor costs.

- Case Study: IBM transformed its business by streamlining operations , focusing on high-margin segments, and embracing cloud computing .

3. Asset Sales and Spin-Offs:

- Insight: selling non-core assets or spinning off divisions can inject cash and sharpen strategic focus.

- Divestitures: Selling subsidiaries, real estate , or intellectual property.

- Spin-Offs: Creating independent entities from existing business units.

- Case Study: Hewlett-Packard (HP) split into HP Inc. (personal systems and printers) and Hewlett Packard Enterprise (HPE) (enterprise solutions).

4. capital Structure optimization :

- Insight: balancing debt and equity to achieve an optimal capital mix.

- Equity Issuance: Raising funds through stock offerings.

- Buybacks: Repurchasing shares to enhance shareholder value.

- Hybrid Instruments: Convertible bonds or preferred stock.

- Case Study: Tesla raised capital through equity offerings to fund its growth and innovation .

5. financial Reporting transparency :

- Insight: Clear, accurate financial reporting builds investor confidence.

- Restating Financials: Correcting errors or misstatements.

- Enhanced Disclosures: Providing detailed information on risks, contingencies, and off-balance-sheet items.

- Case Study: Enron's lack of transparency led to its infamous collapse.

6. Tax Optimization:

- Insight: efficient tax planning reduces the tax burden .

- transfer Pricing strategies : managing intercompany transactions to minimize taxes.

- tax Credits and incentives : leveraging government incentives .

- Case Study: Apple faced scrutiny for its tax practices, leading to changes in its approach.

In summary, financial restructuring is a dynamic process that demands strategic thinking, stakeholder alignment, and adaptability. Companies must navigate these waters carefully, considering both short-term survival and long-term sustainability. By implementing thoughtful measures, organizations can emerge stronger and more resilient.

Financial Restructuring - Retrenchment strategy: How to cut costs and improve efficiency with a retrenchment strategy

Monitoring and evaluation play a crucial role in implementing a retrenchment strategy to cut costs and improve efficiency. By closely monitoring the progress and evaluating the outcomes, organizations can make informed decisions and identify areas for improvement .

From a financial perspective, monitoring involves tracking key performance indicators (KPIs) such as cost reduction targets , budget allocation, and return on investment. evaluating the financial impact of the retrenchment strategy helps determine its effectiveness in achieving cost savings and improving the organization's financial health .

From an operational standpoint, monitoring involves assessing the impact of the retrenchment strategy on various departments and processes. This includes analyzing changes in workflow, resource allocation, and productivity levels. By monitoring these factors, organizations can identify bottlenecks, streamline operations, and optimize resource utilization .

When it comes to evaluating the outcomes of the retrenchment strategy, organizations can use a numbered list to provide in-depth information :

1. Impact on Employee Morale: Monitoring employee morale during and after the retrenchment process is essential. Evaluating the impact of the strategy on employee satisfaction , motivation, and engagement helps identify potential issues and implement measures to mitigate negative effects.

2. Cost Reduction Effectiveness: Evaluating the actual cost savings achieved through the retrenchment strategy is crucial. This involves comparing the projected cost reductions with the actual results and identifying any discrepancies. Organizations can use examples to highlight specific cost-saving initiatives and their impact on the overall budget.

3. Customer Satisfaction: monitoring customer satisfaction levels during the retrenchment process is vital to ensure that service quality remains unaffected. evaluating customer feedback , conducting surveys, and analyzing customer retention rates can provide insights into the strategy's impact on customer satisfaction.

4. Organizational Resilience: Monitoring the organization's resilience in the face of retrenchment is important. Evaluating the ability to adapt to change, maintain productivity, and sustain business operations helps assess the long-term viability of the strategy.

5. Learning and Improvement: Monitoring and evaluation also provide opportunities for organizational learning and improvement . By analyzing the outcomes and identifying areas for enhancement, organizations can refine their retrenchment strategies for future implementation.

Monitoring and evaluation are integral components of a retrenchment strategy. By closely tracking progress, evaluating outcomes, and making data-driven decisions , organizations can effectively cut costs and improve efficiency while minimizing negative impacts on employees and customers.

Monitoring and Evaluation - Retrenchment strategy: How to cut costs and improve efficiency with a retrenchment strategy

In this section, we delve into case Studies and Success stories related to implementing a retrenchment strategy. By examining real-world examples, we can gain valuable insights into how organizations have effectively cut costs and improved efficiency through strategic retrenchment. Let's explore these case studies from different perspectives:

1. Company A: Streamlining Operations

- Background : Company A, a mid-sized manufacturing firm, faced declining profits due to increased competition and rising operational costs. To address this, they implemented a retrenchment strategy.

- Actions Taken :

- Workforce Reduction : Company A conducted a thorough analysis of its workforce and identified redundant positions. They offered voluntary early retirement packages and streamlined their workforce.

- Plant Consolidation : The company closed down an underperforming plant and consolidated production in a more efficient facility.

- supply Chain optimization : Company A renegotiated contracts with suppliers, reducing costs and improving supply chain efficiency .

- Results :

- Cost Savings : By reducing labor costs and optimizing operations, company A achieved significant cost savings.

- improved Profit margins : The streamlined operations led to improved profit margins, allowing the company to remain competitive.

2. Company B: Product Portfolio Rationalization

- Background : Company B, a consumer goods manufacturer, had a bloated product portfolio with several low-performing SKUs. They decided to focus on core products.

- Product Pruning : Company B analyzed sales data and discontinued low-margin products. They redirected resources to enhance their best-selling items.

- Marketing Realignment : The marketing team shifted its efforts towards promoting high-margin products.

- Increased Efficiency : By eliminating underperforming products, Company B reduced complexity and improved production efficiency .

- Higher Profits : Focusing on core products led to higher sales and better profit margins .

3. Company C: Outsourcing Non-Core Functions

- Background : Company C, a software development firm , struggled with maintaining non-core functions like IT support and payroll processing.

- Outsourcing : Company C outsourced non-core functions to specialized service providers. They retained only essential in-house expertise.

- Cost-Benefit Analysis : The company weighed the costs of outsourcing against the benefits of freeing up internal resources.

- Cost Reduction : Outsourcing reduced overhead costs significantly.

- Focus on Core Competencies : Company C could now focus on software development, leading to better products and customer satisfaction .

4. Company D: Strategic Alliances

- Background : Company D, a pharmaceutical company, faced challenges in research and development (R&D) due to limited resources.

- Collaboration : Company D formed strategic alliances with other pharmaceutical firms. They shared R&D costs and expertise.

- Joint Ventures : The company entered joint ventures for specific drug development projects.

- Accelerated R&D : By pooling resources, Company D accelerated drug development timelines.

- Cost-Efficiency : Joint ventures allowed them to share risks and costs while accessing new markets.

These case studies highlight the diverse ways organizations have successfully implemented retrenchment strategies. Whether through workforce optimization, product rationalization, outsourcing, or strategic partnerships, the key lies in aligning actions with organizational goals. Remember that each situation is unique, and a tailored approach is essential for success.

Case Studies and Success Stories - Retrenchment strategy: How to cut costs and improve efficiency with a retrenchment strategy

Read Other Blogs

Understanding the importance of e-commerce culture is crucial for building a strong e-commerce...

Laser alopecia treatment is a form of low-level laser therapy (LLLT) that uses light energy to...

The interplay between knowledge and self-assurance is a cornerstone of academic achievement. It is...

In the realm of digital marketing, the strategic dissemination of knowledge through email campaigns...

In the realm of customer service, technology has become an indispensable ally. As businesses strive...

The concept of spot price is central to the understanding of commodity markets and, by extension,...

Lead nurturing stands as a pivotal component in the architecture of customer workflow, acting as...

Credit risk governance is the process of defining and implementing the policies, procedures, and...

In this section, we will delve into the realm of online business loans and explore the intricacies...

The Leading Source of Insights On Business Model Strategy & Tech Business Models

Retrenchment strategy

- Retrenchment strategy is a proactive approach employed by organizations facing financial distress, declining performance, or strategic misalignment to streamline operations, reduce costs, and refocus resources on core competencies and value drivers.

- It involves restructuring initiatives such as downsizing, divestitures, asset sales, or business closures aimed at improving efficiency, enhancing competitiveness, and restoring profitability in challenging or uncertain market conditions.

- Retrenchment strategy is often used as a short-term measure to stabilize the organization and create a foundation for future growth , restructuring, or turnaround efforts.

Table of Contents

Principles of Retrenchment Strategy:

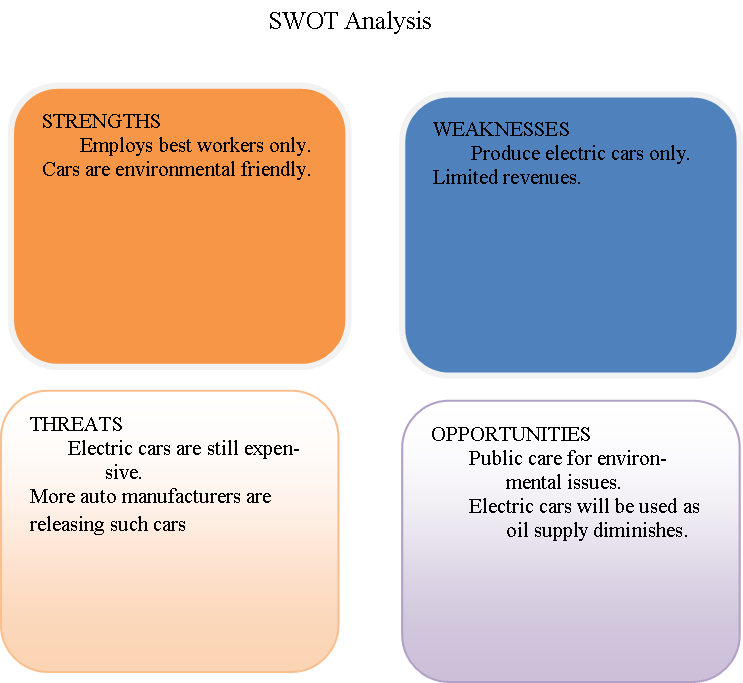

- Retrenchment strategy begins with a strategic assessment of the organization’s strengths, weaknesses, opportunities, and threats to identify areas for improvement and prioritize restructuring initiatives.

- Companies evaluate their business portfolio, market positioning, and financial performance to determine the need for retrenchment and develop a clear roadmap for realignment, cost reduction, or divestiture to enhance long-term viability and competitiveness.

- Retrenchment strategy emphasizes operational efficiency and cost reduction to optimize resource utilization, streamline processes, and eliminate non-core or underperforming assets or activities.

- Companies rationalize operations, consolidate functions, and implement cost-cutting measures to reduce overhead expenses, improve productivity, and enhance profitability while maintaining or enhancing value delivery to customers and stakeholders.

- Retrenchment strategy focuses on core competencies and value creation to refocus resources, investments, and efforts on areas of strategic importance and competitive advantage.

- Companies assess their core strengths, market opportunities, and customer needs to identify value drivers and prioritize investments in innovation , product development, or market expansion that align with their strategic objectives and long-term growth aspirations.

Key Features of Retrenchment Strategy:

- Retrenchment strategy involves portfolio rationalization and restructuring to divest non-core assets, businesses, or market segments and reallocate resources to high-potential opportunities or strategic priorities.

- Companies assess the performance, strategic fit, and growth potential of each business unit or product line to determine the optimal portfolio mix and streamline operations, enhancing efficiency, focus, and financial performance.

- Retrenchment strategy aims to achieve financial stabilization and debt reduction by optimizing capital structure, improving cash flow, and deleveraging the organization to enhance financial flexibility and resilience.

- Companies prioritize debt repayment, asset monetization, or capital allocation strategies to reduce financial leverage, lower interest expenses, and strengthen the balance sheet , restoring investor confidence and positioning the organization for sustainable growth and value creation.

- Retrenchment strategy builds organizational resilience and change management capabilities to navigate restructuring initiatives, mitigate employee impacts, and foster a culture of adaptability and continuous improvement.

- Companies communicate transparently, engage stakeholders, and provide support, training, and career development opportunities to employees affected by retrenchment, ensuring alignment with strategic objectives, minimizing resistance to change, and maximizing employee morale and productivity during periods of change.

Benefits of Retrenchment Strategy:

- Retrenchment strategy generates cost savings and operational efficiency improvements by streamlining processes, eliminating redundancies, and reducing overhead expenses throughout the organization.

- Companies that implement retrenchment initiatives can achieve significant cost reductions, improve profitability, and enhance competitiveness by optimizing resource utilization and enhancing efficiency in core business operations.

- Retrenchment strategy enhances focus and strategic alignment by reallocating resources, investments, and efforts to areas of core competencies, value creation, and strategic importance.

- Companies that refocus on their core strengths and strategic priorities can streamline operations, accelerate decision-making, and enhance agility in responding to market changes, driving sustainable growth and long-term value creation for stakeholders.

- Retrenchment strategy enhances financial stability and resilience by reducing debt, improving cash flow, and strengthening the organization’s balance sheet .

- Companies that deleverage and optimize capital structure can enhance financial flexibility, reduce financial risks, and withstand economic downturns or market volatility more effectively, positioning themselves for sustainable growth and value creation in the long run.

Challenges of Retrenchment Strategy:

- Retrenchment strategy may impact employee morale and talent retention as workforce reductions, role changes, or organizational restructuring can create uncertainty, anxiety, and job insecurity among employees.

- Companies must prioritize communication, empathy, and support for employees affected by retrenchment, providing training, career development opportunities, and incentives to retain top talent and maintain employee engagement and productivity during periods of change.

- Retrenchment strategy may affect stakeholder perception and reputation management as investors, customers, and partners may interpret restructuring initiatives negatively or question the organization’s long-term viability and competitiveness.

- Companies must manage stakeholder expectations, communicate transparently, and demonstrate commitment to strategic objectives, value creation, and sustainability to maintain trust, credibility, and confidence in the organization’s leadership and direction.

- Retrenchment strategy entails execution risks and implementation complexity, such as operational disruptions, legal or regulatory challenges, and cultural resistance to change, which can impede successful outcomes and delay the realization of intended benefits.

- Companies must plan meticulously, execute decisively, and monitor progress closely to mitigate execution risks, overcome resistance to change, and ensure seamless transition and integration of retrenchment initiatives, safeguarding business continuity and stakeholder value.

Case Studies of Retrenchment Strategy:

- General Electric implements a retrenchment strategy to streamline its business portfolio, reduce debt, and refocus on core industrial businesses such as aviation, healthcare, and renewable energy.

- GE divests non-core assets, spins off business units, and consolidates operations to improve operational efficiency, enhance financial performance, and restore investor confidence, positioning the company for sustainable growth and value creation in dynamic and competitive markets.

- IBM executes a retrenchment strategy to divest non-strategic businesses, realign its product portfolio, and focus on high-growth segments such as cloud computing, artificial intelligence, and cybersecurity.

- IBM streamlines operations, reduces costs, and enhances agility to capture emerging market opportunities, drive innovation , and accelerate growth , leveraging its core strengths and expertise to create long-term value for customers and shareholders.

- Ford adopts a retrenchment strategy to streamline its global operations, reduce complexity, and enhance profitability in a challenging automotive market.

- Ford restructures its business units, rationalizes product offerings, and invests in electrification and mobility solutions to adapt to changing consumer preferences, regulatory requirements, and competitive dynamics, positioning the company for sustainable growth and success in the future automotive landscape.

Conclusion:

Retrenchment strategy is a strategic imperative for organizations facing financial distress, declining performance, or strategic misalignment to streamline operations, reduce costs, and refocus resources on core competencies and value drivers. By implementing retrenchment initiatives such as downsizing, divestitures, or business closures, companies can achieve cost savings, operational efficiency improvements, and financial stability, restoring investor confidence and positioning themselves for sustainable growth and value creation in dynamic and competitive markets. While challenges such as employee morale, stakeholder perception, and execution risks exist, the benefits of retrenchment strategy include focus, strategic alignment, and resilience. Through strategic planning, stakeholder engagement, and decisive execution, companies can navigate organizational challenges effectively, drive turnaround efforts, and emerge stronger, more agile, and better positioned to capitalize on future opportunities for growth and value creation.

Read Next: Porter’s Five Forces , PESTEL Analysis , SWOT , Porter’s Diamond Model , Ansoff , Technology Adoption Curve , TOWS , SOAR , Balanced Scorecard , OKR , Agile Methodology , Value Proposition , VTDF Framework .

Connected Strategy Frameworks

ADKAR Model

Ansoff Matrix

Business Model Canvas

Lean Startup Canvas

Blitzscaling Canvas

Blue Ocean Strategy

Business Analysis Framework

Balanced Scorecard

Blue Ocean Strategy

GAP Analysis

GE McKinsey Model

McKinsey 7-S Model

McKinsey’s Seven Degrees

McKinsey Horizon Model

Porter’s Five Forces

Porter’s Generic Strategies

Porter’s Value Chain Model

Porter’s Diamond Model

SWOT Analysis

PESTEL Analysis

Scenario Planning

STEEPLE Analysis

Main Guides:

- Business Models

- Business Strategy

- Marketing Strategy

- Business Model Innovation

- Platform Business Models

- Network Effects In A Nutshell

- Digital Business Models

More Resources

About The Author

Gennaro Cuofano

Discover more from fourweekmba.

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

- Org. Structures

How Ford used Retrenchment Strategy in India?

Back in 2009, when I purchased my first car, I only had a few brands to choose from. Within the next decade, what I just witnessed was a boom in the automobile industry and other parallel industries.

But this is not an article on the growth and rapid global expansion of the automotive industry (So I will not bore you for sure :). Rather we will talk about the flip side of the coin.

How do companies deal with situations when they found themselves in the “low margin, low growth” category market for a product. Let us take an example of a company and expand the case.

I am talking about the mighty Ford Motors case study from India

Ford was started at Dearborn, Michigan , a suburb of Detroit in 1903 with 12 investors and 1,000 shares. Over the century Ford became global and was open to everyone. As a matter of fact, at the time, Ford’s initial public offering (IPO) of common stock shares was the largest IPO in history.

With its rapid expansion, Ford also entered India in October 1995 as Mahindra Ford India Limited (MFIL), a 50-50 joint venture with Mahindra & Mahindra Limited. By 1998, Ford increased its stake from 50% to 78% and renamed the company to Ford India Pvt. Ltd.

From there on it was unstoppable. It launched iconic cars like Ford Ikon (personal favorite to date) and Ford Escort. In 2011, Ford Figo even received the prestigious Indian Car of the Year Award . Till now it looks like a perfect journey for an international company in India. But the journey was not that simple as it looks.

In August 2019, the company reported a 31% YoY decline in sales to 5517. To give an idea, industry leader Maruti Suzuki sells more than this in a day. With just a 3% Market Share and $2 billion in investments over its two decades of existence, Ford India eventually decided to exit the Indian Market in September 2019.

Hi Nikhil – Speculations aside, Ford has no intention to exit India and will continue bringing products that Indian customers want and value. ^AZ — Ford India (@FordIndia) September 25, 2019

It did not exit completely though. Ford India just ended its independent operations. It went on a Joint Venture with Mahindra. Ford India transferred its assets to Mahindra, giving the latter a 51% stake. Ford India still had a 49% stake and voting rights.

Read: How Facebook used “Beachhead Strategy” to become a giant?

That was Ford India’s Story. But in general, a company exiting a market has to deal with many external forces and drivers. It is very complex to decide which market and which product/service to forgo and how.

But one solution to this is the Retrenchment strategy . The strategy aims to make the organization financially stable and future-oriented. Especially in tough times due to Covid-19, Retrenchment strategy is used by many companies.

Lets first understand what it is!!

What is the meaning of Retrenchment Strategy?

In the early 20th century, many military battles, such as those in World War I, were fought in a series of parallel trenches. The strategy says to focus on strength and concentrate on holding a small trench. This small retreat was preferable to losing the battle entirely. Trench warfare inspired the business term retrenchment.

This strategy slowly become popular and is now used in corporate and startups.

Retrenchment strategy in laymen’s terms is an abandonment of a non-performing market or a non-performing product that is no longer profitable to the organization. Retrenchment is often accomplished by laying off employees or closing certain branches. In general, the retrenchment strategy is about the strategic contraction of a business or a part of the business to enhance the overall business performance.

A retrenchment strategy is used when an organization seeks to reverse a decline in performance. The main focus of such a strategy is to increase operating efficiencies and improve cash flow Arthur G. Bedeian

What are the types of Retrenchment Strategies?

There are primarily three types of retrenchment strategies.

- Turnaround Strategies – This happens when a company is facing negative cash flows or low profitability or declining market share or worsening debt-equity ratio . In such cases, the focus is either on reducing costs and investments through downsizing or stricter control on expenditures or selling or assets. Or increasing profitability through better monetization opportunities like launching new products or revamping the brand or reducing prices to increase sales.

- Divestment strategies – Divestment is simply the process of selling subsidiary assets, investments, or divisions of a company. The strategy is adopted when a part of a business or division was acquired but did not turn out to be profitable or the division needs heavy investments in some form but a company is better off without it. In such cases, the organization either sells the division or separates the division ( spin-off ) by making it an independent entity that is responsible for its own profitability.

- Liquidation strategies – Liquidation a last resort that any company would like to adopt. The company implements this strategy when it is no longer in a position to pay to its creditors or shareholders due to cash shortage or lack of market requirement for its products. In summary, it’s about selling the business and its assets when it is no longer attractive to run the business.

Ford India, Other Organizations and the Retrenchment strategy

Ford is one of the top 5 automobile manufacturers in the world in terms of Volumes. No one would have ever thought that one-day Ford would use Retrenchment Strategy in one of the key markets- India. I must emphasize here that India is currently the 4th largest market in the world and is expected to be the world’s third-largest automotive market in terms of volume by 2026.

Read: Will Digital Growth help India Unlock Trillion Dollar Opportunity?

As market dynamics change, each company needs to adapt to economic cycles.

In the year 2019, Ford made an announcement. The Ford motor decided to retrench from India and transfer operations to Mahindra & Mahindra along with its assets. It’s not exactly a liquidation strategy as it still holds 49% of the business along with voting rights.

So Ford motor remains in a country that has a very high growth potential without having to shoulder the full cost burden of developing new models. The strategy helped Ford in generating some cash flow to find its growth avenues elsewhere.

The Retrenchment strategy is used by organizations all around the world especially by startups. A great example is how P&G the world’s largest consumer products maker focused to improve revenue and profit. Using the Retrenchment strategy P&G dropped almost 100 of its product categories and focused on the key product to maximize long-term value and create exciting opportunities within the businesses.

Now let talk about the fast-food sector which has used the Retrenchment as a key strategy. The McDonald’s and KFC’s combined foreign sales rose 400% in the last decade mostly due to sales in China. But in the years 2012 to 2017, the companies have since retrenched or sold their Chinese operations to simply its sprawling business through the franchise model

What are the Challenges of Retrenchment Strategy?

The retrenchment strategy has its challenges especially when the market a company is retrenching from is a lucrative and growing market. The organization is losing out on an opportunity to be part of such a market.

Retrenchment from a market might give the global brand name bad press and can affect the global business. Companies might also receive bad publicity due to the firing of people or mass layoffs as part of its retrenchment strategy.

As they say, every coin has two sides. Retrenchment strategy can act as a boon but if wrongly implemented can act as a bane. But then that’s a story for another time!!

Interested in reading our Advanced Strategy Stories . Check out our collection.

Also check out our most loved stories below

IKEA- The new master of Glocalization in India?

IKEA is a global giant. But for India the brand modified its business strategies. The adaptation strategy by a global brand is called Glocalization

Why do some companies succeed consistently while others fail?

What is Adjacency Expansion strategy? How Nike has used it over the decades to outperform its competition and venture into segments other than shoes?

Nike doesn’t sell shoes. It sells an idea!!

Nike has built one of the most powerful brands in the world through its benefit based marketing strategy. What is this strategy and how Nike has used it?

Domino’s is not a pizza delivery company. What is it then?

How one step towards digital transformation completely changed the brand perception of Domino’s from a pizza delivery company to a technology company?

Why does Tesla’s Zero Dollar Budget Marketing work?

Touted as the most valuable car company in the world, Tesla firmly sticks to its zero dollar marketing. Then what is Tesla’s marketing strategy?

Microsoft – How to Be Cool by Making Others Cool

Microsoft CEO Satya Nadella said, “You join here, not to be cool, but to make others cool.” We decode the strategy powered by this statement.

Abhiyash is a technology enthusiast with 6 years of experience working in different business domains and functions. A firm believer of kaizen principle.I love travelling, hiking and meeting new people.

Related Posts

AI is Shattering the Chains of Traditional Procurement

Revolutionizing Supply Chain Planning with AI: The Future Unleashed

Is AI the death knell for traditional supply chain management?

Merchant-focused Business & Growth Strategy of Shopify

Business, Growth & Acquisition Strategy of Salesforce

Hybrid Business Strategy of IBM

Strategy Ingredients that make Natural Ice Cream a King

Investing in Consumer Staples: Profiting from Caution

Storytelling: The best strategy for brands

How Acquisitions Drive the Business Strategy of New York Times

Rely on Annual Planning at Your Peril

How does Vinted make money by selling Pre-Owned clothes?

N26 Business Model: Changing banking for the better

Sprinklr Business Model: Managing Unified Customer Experience

How does OpenTable make money | Business model

How does Paytm make money | Business Model

Write a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

- Advanced Strategies

- Brand Marketing

- Digital Marketing

- Luxury Business

- Startup Strategies

- 1 Minute Strategy Stories

- Business Or Revenue Model

- Forward Thinking Strategies

- Infographics

- Publish & Promote Your Article

- Write Article

- Testimonials

- TSS Programs

- Fight Against Covid

- Privacy Policy

- Terms and condition

- Refund/Cancellation Policy

- Master Sessions

- Live Courses

- Playbook & Guides

Type above and press Enter to search. Press Esc to cancel.

Retrenchment Strategy – Meaning, Types, Examples, and Tips

We’re living in a time where businesses and companies are developing policies and organizational structures to decide what suit their interest. When a tough time hits the trades, businesses cut down the business’s redundant departments to ensure financial stability and profitability to the company.

Today we’ll discuss retrenchment strategy, its meaning, and types with examples.

Table of Contents

What is Retrenchment Strategy?

Retrenchment strategy is a process through which you cut down all of those products and services that aren’t profiting your business to achieve financial stability. It also means leaving the market where your business can’t sustain itself. It usually results in the form of the sale of assets like product line and firing employees.

Types of Retrenchment Strategies with Examples

Some of the main types of retrenchment strategies are as follows;

Turnaround Strategy

Turnaround strategy is a tool/measure that minimizes the negative trends that impact the company’s performance. It also goes by the name of management measure that could transform the sick business into a healthy position.

The measure also reverses the negative trends like decreasing market share, increasing material cost, lower sales, widening debt-equity ratio, less profitability, working capital issues, negative cash flows, and many other problems. The way businesses follow this strategy; varies from situation to situation.

For instance, Dell Technologies stated in 2006 that the company would follow the cost-cutting strategy by directly selling its products to the customers. The direct sale didn’t work out, and the company faced a tremendous financial loss.

Dell turnaround and pulled out from direct sale strategy in 2007. The brand started selling computers through outlets and retailers. Nowadays, Dell is the 2nad largest world’s retailers in the computer industry.

Divestment Strategy

A large company that has attained many assets, departments, and product divisions analyzes various divisions and departments’ profitability. Whether they’re contributing to the company’s strategy, or they aren’t. If they aren’t achieving the required results, then you cut them loose.

In other words, divestment strategy means the sale of a portion of your business, asset, and division. Companies apply divestment strategy when turnaround strategy has already failed.

Businesses and companies follow the divestment strategy for many reasons like merger plans, creating resources, availability of alternative investment plans, tech up-gradation, persistent issues, negative cash flows, and mismatched assets.

For instance, TATA Group of Companies has got a lot of businesses working under its umbrella. They examine their business now and then; if they find any business out of the company’s core ideology, they divest it.

TATA divested TOMCO and sold it to Hindustan Levers because it thought detergents and soaps weren’t the company’s core business.

Liquidation Strategy

Liquidation strategy is the extreme level in the retrenchment strategy where you permanently shut down the business and sell all of your assets. Liquidation is the final option of the problems of any business because it has serious outcomes. It results in the form of saying no to every potential opportunity and firing all the employees.

Small businesses usually liquidate. Large companies like suppliers, creditors, trade unions, financial institutions, and government departments don’t liquidate.

For instance, online e-commerce is losing traffic on its store daily. The expenses are increasing than the store’s total earning. The management has no other choice but to liquidate the store and pay off the debt.

Reasons for Adopting Retrenchment Strategy

Businesses and companies follow the retrenchment strategy usually because of economic, technological, and structural reasons. They’re as follows;

The economic reason is that the businesses follow the retrenchment strategy to raise funds to start projects and operations.

Adopting the latest technology , electronic systems, computer package, equipment, and chemical formula would lower the demand for more workforces.

The structural reason would require the management to move from a corporate functional strategy to a project-based structure system by reducing the management levels.

How to Implement Retrenchment Strategy

You can implement the retrenchment strategy by following these six steps, and they’re as follows;

- Selection. The management should keep the process of retrenchment process transparent. They should keep the productive employees instead of providing favoritism.

- Appropriate Timing. The management should break the news on Tuesday rather than on Friday. At the beginning of the week, they would be able to support service in difficult times.

- Face to Face. Please give them the news personally rather than employing any other means. It would allow you to have an open discussion with them.

- Accept the Results. People would react differently when they receive tragic news. You should be ready to accept all types of responses.

- Fact & Figures. You have to persuade them with facts and figures that this is happening and the company has no other choice. The career transition is a part of their life.

- Coaching . You should also offer them the service of career coaching to make a successful career transition.

Advantages of Retrenchment Strategy

Cost-efficient.

You may disagree and dislike the process of retrenchment strategy, but it provides you cost-efficient. Businesses have got a lot of various resources scattered in different divisions. It helps them to pull them back together.

When companies are going through the difficult phase of tight finances, the retrenchment helps them meet the expenses. The cost efficiency allows them not to take debt from the financial institutions.

Improved Performance

When the company is going through the retrenchment phase, then all the employees would start behaving better. Their performance would continue to improve because they don’t want to give the employer any reason for firing them. The overall productivity of the company would also improve.

Disadvantages of Retrenchment Strategy

Losing good employees.

It doesn’t matter how transparent the retrenchment process, you can’t see through any person’s inner capabilities. Losing the hardworking employees is a significant loss to the company. The management realizes their importance once they’re gone.

The public’s reaction and their families’ hatred towards the company would also appear on social media. It may last for few days to few months; it depends on how management handles the situation. People want someone to blame for it.

About The Author

Ahsan Ali Shaw

One App for all your Credit Card needs

Understanding Retrenchment Strategy: Types and Examples

Download bharatnxt app for vendor payments.

Table of Contents

- Introduction

What is retrenchment?

What is retrenchment strategy.

- Types of retrenchment strategy 1. Turnaround Strategy 2. Divestment Strategy 3. Liquidation Strategy 4. Captive Company Strategy

- Reasons behind retrenchment strategies 1. Poor Performance 2. Facing Existential Crisis 3. Proper Allocation of Resources 4. Insufficient Resources 5. Improving Management & Enhancing Effectiveness

- Explore Real Life Examples

In today’s ever-changing business world, companies often face uncertainties and financial pressures due to market fluctuations, technological advancements, and changing consumer demands. When financial stability becomes shaky, organizations need effective strategies to steer through these uncertainties and ensure their survival.

That’s where retrenchment strategies step in as essential tactics for tackling such challenges head-on. In this piece, we’ll explore the realm of retrenchment strategies, uncovering their significance, and diverse approaches to overcoming financial setbacks.

Retrenchment involves scaling back or reducing something, typically to conserve resources or address financial challenges.

In the ever-changing world of business, companies sometimes face tough times financially. When the going gets tough, they often turn to a powerful tool called the retrenchment strategy. But what exactly is it? Well, think of a retrenchment strategy as a kind of financial lifeline. It’s like when you’re sailing a ship, and suddenly, you hit a storm. You need to adjust your sails, maybe even throw some cargo overboard to keep the ship from sinking. That’s what a retrenchment strategy does for businesses. It’s all about making smart decisions to cut costs, streamline operations, and get back on course towards smoother waters.

Types of retrenchment strategy

When a business hits a rough patch, it’s like navigating through stormy seas. Let’s explore four types of retrenchment strategies, each with its own unique approach to overcoming challenges:

Turnaround strategy

Think of this as the ultimate comeback story. When a business is struggling, a turnaround strategy steps in to save the day. It’s like a captain steering a ship away from rocky shores. This strategy involves a deep dive into the company’s operations, with a focus on reviving its fortunes. From cutting costs to shaking up the business model, every effort is made to reverse the decline and set the company on a path to prosperity once again.

Divestment strategy

Sometimes, you’ve got to trim the sails to stay afloat. With a divestment strategy, businesses shed excess baggage by selling off underperforming divisions or assets. It’s like decluttering your home to create space for new opportunities. By streamlining operations and focusing on core strengths, companies can reallocate resources where they’re needed most, paving the way for future growth.

Liquidation strategy

When storms rage too fiercely, sometimes the only option is to abandon ship. A liquidation strategy is like hitting the reset button, albeit in the most drastic way possible. It involves winding down the business entirely, selling off assets, and closing the doors for good. While it’s a heartbreaking decision, it allows companies to salvage whatever value they can and move on to new horizons.

Captive company strategy

Imagine a business finding its niche and flourishing within it. That’s the essence of the captive company strategy. Instead of chasing every opportunity, companies focus on a specific market or customer segment where they can excel. It’s like a bird building its nest in a tree that offers the perfect shelter. By honing in on their strengths and serving a dedicated audience, businesses can thrive even in turbulent times.

These retrenchment strategies may vary in their approach, but they all share a common goal: to guide businesses through rough seas and steer them towards brighter shores. Whether it’s a daring turnaround or a strategic divestment, each strategy offers a lifeline for companies facing challenges on their journey to success.

Explore the motives behind retrenchment strategies

Understanding poor performance in business.

Imagine a business with certain departments or product lines that consistently struggle to generate profits or meet targets. When these areas become a burden on the company’s finances, a retrenchment strategy may be necessary to address the issue. By scaling back or restructuring these underperforming areas, the company can refocus its resources on more profitable ventures.

Businesses facing existential threats

External factors like economic downturns, changes in consumer preferences, or increased competition can pose significant challenges to a company’s survival. In such situations, retrenchment becomes a survival strategy. By cutting costs, streamlining operations, and refocusing efforts, the company aims to weather the storm and emerge stronger.

Optimizing resource allocation

Companies often need to adapt to changing market conditions or seize new opportunities. However, this may require reallocating resources from less productive areas to more promising ones. Retrenchment allows the company to free up resources tied up in underperforming departments or projects and redirect them towards growth initiatives.

Insufficient resources

Imagine a company facing financial constraints due to declining sales or increased expenses. In such cases, retrenchment becomes a means of survival. By cutting costs, reducing overheads, and eliminating non-essential expenses, the company can preserve its financial health and weather the financial storm.

Improving management and enhancing effectiveness

Sometimes, companies become too diversified or spread their resources too thin. This can lead to inefficiencies and decreased effectiveness. Retrenchment helps the company refocus on its core strengths and streamline its operations for better management and efficiency. By eliminating distractions and focusing on what it does best, the company can position itself for long-term success.

Exploring real-life applications: A case study of retrenchment strategy

Let’s delve into real-life example of retrenchment strategy: how businesses have successfully implemented retrenchment strategies to overcome adversity & emerge stronger.

Evolution in action: Dell’s transition from direct selling to retail success

Back in 2006, Dell Technologies made a bold move by adopting a direct-selling strategy, aiming to cut costs by selling products directly to customers. However, this strategy didn’t yield the expected results and led the company to face significant financial setbacks.

Recognizing the need for change, Dell swiftly pivoted from its direct-selling approach in 2007. Instead, they shifted gears and began selling computers through traditional outlets and retailers. This strategic turnaround proved to be a game-changer for Dell. Today, Dell stands tall as the world’s second-largest retailer in the computer industry, showcasing the power of strategic agility and adaptability in the face of adversity.

Adapting to change: Kodak’s journey through the digital revolution

Kodak, once a titan in the photographic film industry, found itself at a crossroads with the advent of digital imaging. Recognizing the urgent need for reinvention, Kodak embarked on a retrenchment strategy. They downsized their traditional film business and redirected their focus towards digital imaging solutions. This strategic shift enabled Kodak to stay relevant in the rapidly evolving digital age, securing their foothold in an industry undergoing profound transformation.

Retrenchment strategies provide a crucial lifeline during tough times, helping businesses cut costs, refocus efforts, and adapt to survive. Real-life examples, such as Dell’s bold shift and Kodak’s digital evolution, showcase how these strategies foster resilience and success. By embracing change and learning from past experiences, businesses can navigate uncertainty and emerge stronger than before.

Consider David, the owner of a small IT consulting firm, who found himself in a dire financial situation after losing several major clients unexpectedly. Desperate for guidance, he turned to online resources and stumbled upon a blog discussing retrenchment strategies for businesses facing downturns. Realizing the importance of making tough decisions to survive the crisis, he sought a solution to streamline his finances amidst dwindling revenue and mounting debts. As he grappled with the harsh realities of retrenchment, he discovered the BharatNXT platform offering comprehensive financial services tailored to small businesses. With this, he could leverage his credit card to make crucial payments to vendors, ensuring the continuity of essential services while buying time to stabilize his cash flow. By doing so, the platform provided him with access to business loans, offering a much-needed infusion of capital to weather the storm. Through the strategic use of credit, timely financial assistance, and prudent vendor management, David navigated through the crisis with resilience, emerging stronger and more resilient in the face of adversity.

Popular Searches

How to become a Businessman | How to reduce Receivable Days | How Refer and Earn Works | How Credit Cards Empower Women | Gst for Restaurants | How Credit Cards Work in Business | Funding Options for Startups | Food Business Ideas | Credit Card Pay off Calculator | Credit Card Interest Rates | Business Licenses | Restaurant Opening Checklist | Refer and Earn | Best Credit Cards for Beginners | Best Credit Cards for Small Business | Best Credit Cards for Fuel | Best Credit Cards for Hotel Booking | Best Airline Credit Cards | Best Credit Card Payment Apps | Compliances for Private Limited Company | What is a Business Credit Card | Collateral Free Loan for MSME | Documents Required for Incorporation of Company | How to Get Certificate of Incorporation | Process of GST Registration | What is Collateral Free Loan | How to File Income Tax Return Online for Small Business | What is Franchising

Business Case Studies, What Employees Want

Mba course case maps.

- Business Models

- Blue Ocean Strategy

- Competition & Strategy ⁄ Competitive Strategies

- Core Competency & Competitive Advantage

- Corporate Strategy

- Corporate Transformation

- Diversification Strategies

- Going Global & Managing Global Businesses

- Growth Strategies

- Industry Analysis

- Managing In Troubled Times⁄Managing a Crisis

- Market Entry Strategies

- Mergers, Acquisitions & Takeovers

- Restructuring / Turnaround Strategies

- Strategic Alliances, Collaboration & Joint Ventures

- Supply Chain Management

- Value Chain Analysis

- Vision, Mission & Goals

- Global Retailers

- Indian Retailing

- Brands & Branding and Private Labels

- Consumer Behaviour

- Customer Relationship Management (CRM)

- Marketing Research

- Marketing Strategies ⁄ Strategic Marketing

- Positioning, Repositioning, Reverse Positioning Strategies

- Sales & Distribution

- Services Marketing

- Economic Crisis

- Fiscal Policy

- Government & Business Environment

- Macroeconomics

- Micro ⁄ Business ⁄ Managerial Economics

- Monetary Policy

- Public-Private Partnership

- Financial Management & Corporate Finance

- Investment & Banking

- Leadership,Organizational Change & CEOs

- Succession Planning

- Corporate Governance & Business Ethics

- Corporate Social Responsibility

- International Trade & Finance

- Entrepreneurship

- Family Businesses

- Social Entrepreneurship

- HRM ⁄ Organizational Behaviour

- Innovation & New Product Development

- Business Research Methods

- Operations & Project Management

- Operations Management

- Quantitative Methods

- Social Networking

- China-related Cases

- India-related Cases

- Women Executives ⁄ CEO's

- Course Case Maps

- Effective Executive Interviews

Video Interviews

Executive brief.

- Case Catalogues

- Case studies in Other Languages

- Multimedia Case Studies

- Textbook Adoptions

- Customized Categories

- Free Case Studies

- Faculty Zone

- Student Zone

- By CaseCode

- By CaseTitle

- By Industry

- By Keywords

Case Categories

- Corporate Governance & Business Ethics

- Investment and Banking

- Human Resource Management (HRM)⁄Organizational Behaviour

- Leadership, Organizational Change and CEOs

- Brand⁄Marketing Communication Strategies and Advertising & Promotional Strategies

- China-related cases

- India-related cases

- Women Executives/CEO's

- Aircraft & Ship Building

- Automobiles

- Home Appliances & Personal Care Products

- Minerals, Metals & Mining

- Engineering, Electrical & Electronics

- Building Materials & Construction Equipment

- Food, Diary & Agriculture Products

- Oil & Natural Gas

- Office Equipment

- Banking, Insurance & Financial Services

- Telecommunications

- e-commerce & Internet

- Freight &l Courier

- Movies,Music, Theatre & Circus

- Video Games