Investment Banking Resume Examples and Templates for 2024

- Resume Examples

- Resume Text Examples

How To Write an Investment Banking Resume

- Entry-Level

- Senior-Level

Investment Banking Text-Only Resume Templates and Examples

Raymond Ortiz (123) 456-7890 [email protected] 123 Bridge Street, Boston, MA 12345

An Investment Banker with five years of experience, specializing in financial analysis, client relations, economics, and commercial banking. A proven track record of developing investment strategies for high-net-worth clients and maximizing portfolio performance.

Professional Experience

Investment Banker, New England Investing Co., Boston, MA October 2019 – Present

- Analyze client portfolios valued at $150K-$700K to evaluate investment opportunities, assess ROI potential, and provide recommendations to maximize portfolio performance

- Performance analysis of business financials, analyze product use cases, and evaluate market landscapes to determine long-term ROI growth for business investments, resulting in 100%-300% increase in portfolio growth for client accounts

- Attend meetings with existing clients and potential prospects to provide education on investment strategies, economics, and portfolio management

Investment Banker, Boston Financial Consultants, Boston, MA May 2017– October 2019

- Analyzed investment opportunities and ROI potential for businesses within the healthcare sector, including medical suppliers and clinical laboratories

- Provided bimonthly updates to clients and marketing teams on portfolio performance, purchasing decisions, and company financials

Bachelor of Science (B.S.) Economics Boston College, Boston, MA September 2013 – May 2017

- Investment Banking

- Financial Analysis

- Client Relations

- Portfolio Management

Certifications

- Series 7, FINRA, 2017

- Series 63, FINRA, 2017

- Series 65, FINRA, 2017

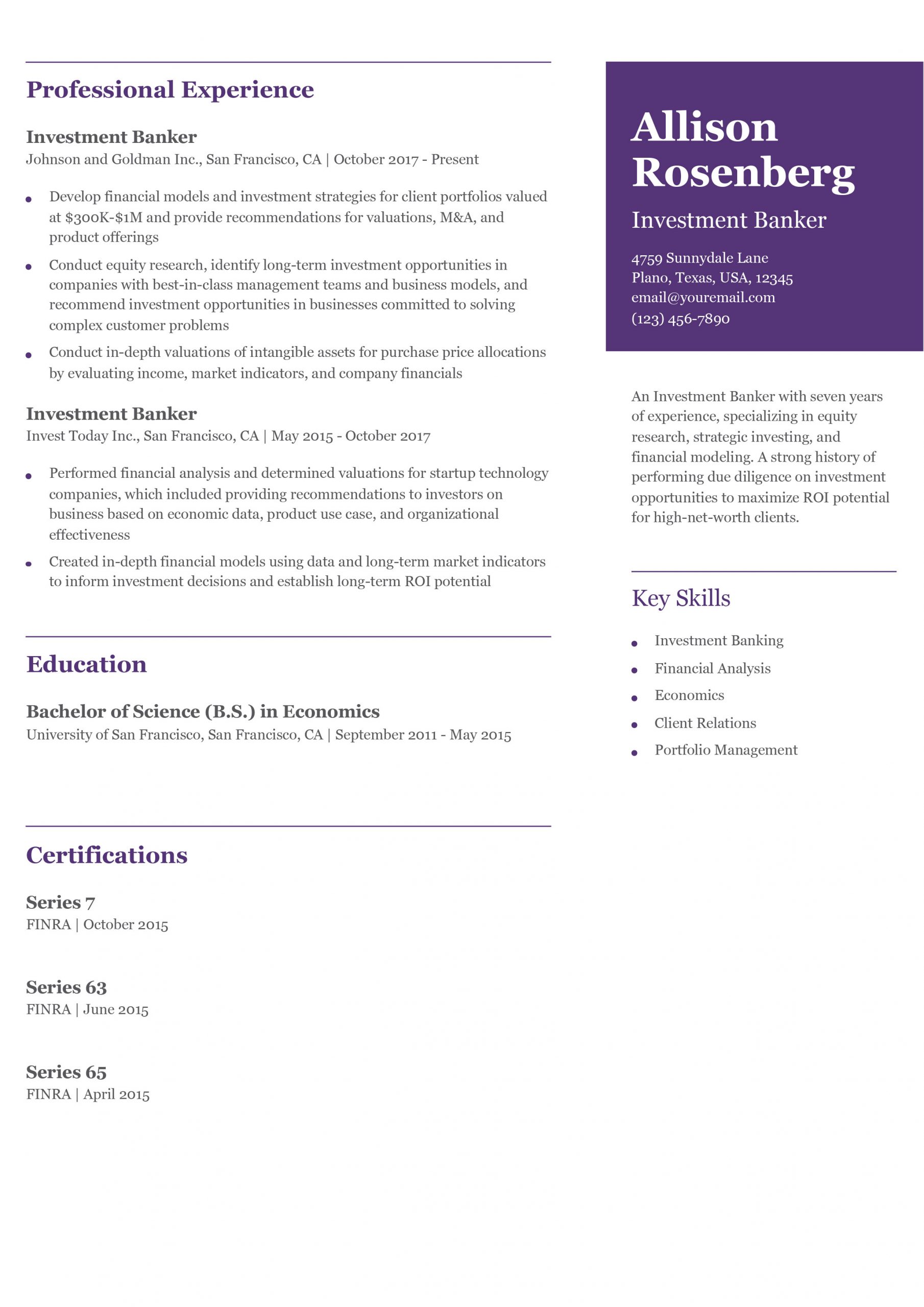

Allison Rosenberg (123) 456-7890 [email protected] 123 Santa Maria, San Francisco, CA 12345

An Investment Banker with seven years of experience, specializing in equity research, strategic investing, and financial modeling. A strong history of performing due diligence on investment opportunities to maximize ROI potential for high-net-worth clients.

Investment Banker, Johnson and Goldman Inc., San Francisco, CA October 2017 – Present

- Develop financial models and investment strategies for client portfolios valued at $300K-$1M and provide recommendations for valuations, M&A, and product offerings

- Conduct equity research, identify long-term investment opportunities in companies with best-in-class management teams and business models, and recommend investment opportunities in businesses committed to solving complex customer problems

- Conduct in-depth valuations of intangible assets for purchase price allocations by evaluating income, market indicators, and company financials

Investment Banker, Invest Today Inc., San Francisco, CA May 2015 – October 2017

- Performed financial analysis and determined valuations for startup technology companies, which included providing recommendations to investors on business based on economic data, product use case, and organizational effectiveness

- Created in-depth financial models using data and long-term market indicators to inform investment decisions and establish long-term ROI potential

Bachelor of Science (B.S.) Economics University of San Francisco, San Francisco, CA September 2011 – May 2015

- Series 7, FINRA, 2015

- Series 63, FINRA, 2015

- Series 65, FINRA, 2015

Mina Sayed (123) 456-7890 [email protected] 123 Bedford Avenue, New York, NY, 12345

An Investment Banker with 10+ years of experience, specializing in providing investment strategies for opportunities within the alternative energy, automotive, and utility industries. A proven track record of maximizing portfolio growth and profitability by evaluating competitive advantages and identifying long-term market potential.

Investment Banker, Klein and Davidson Consulting, New York, NY September 2016 – Present

- Create dynamic investment strategies for client portfolios valued at up to $1.5M, develop complex financial models, and deliver presentations to clients and prospects

- Build relationships with corporate leaders and lead investigative meetings between high-profile investors and C-level executives during the due diligence phase

- Identify opportunities within the clean energy space, including solar companies and electric vehicle manufacturers

Investment Banker, Invest Today Inc., New York, NY May 2011 – September 2016

- Conducted equity research for a financial investment firm to identify and evaluate opportunities to invest in companies trading at below market value

- Performed due diligence on businesses by evaluating industry fundamentals, creating financial models, and attending industry trade shows

Bachelor of Science (B.S.) Economics Columbia University, New York, NY September 2007- May 2011

- Financial Modeling

- Investment Strategy

- Relationship Building

- Competitive Analysis

Investment bankers provide financial analysis to corporations, governments, and large institutions. These positions are highly lucrative due to the high earning potential of bonus structures. You must create an accomplishment-driven resume to separate yourself from the competition during your job search.

The key is to build a resume that highlights your advanced knowledge of financial strategy and brands you as a thought leader within the investment banking industry. Throughout this guide, we’ll provide expert tips to help you translate your career experience into a powerful marketing document.

1. Write a dynamic profile summarizing your investment banking qualifications

To grab the hiring manager’s attention, you must create a strong opening summary that captures the most compelling aspects of your professional experience. Start by detailing your job title, years of experience, and three to four specializations that align with the job description. As an investment banker, you should also emphasize the types of industries you’ve worked in. Use the summary to show hiring managers that you’ve acquired knowledge of various kinds of businesses, which is essential for making the right financial decisions.

Professional Profile - Example #1

An Investment Banker with five years of experience specializing in financial analysis, client relations, economics, and commercial banking. A proven track record of developing investment strategies for high-net-worth clients and maximizing portfolio performance.

Professional Profile - Example #2

An Investment Banker with 10+ years of experience specializing in providing investment strategies for opportunities within the alternative energy, automotive, and utility industries. A proven track record of maximizing portfolio growth and profitability by evaluating competitive advantages and identifying long-term market potential.

2. Outline your investment banking experience in a compelling list

When crafting your professional experience section, you’ll want to consider whether or not your bullet points are accomplishment-driven, emphasizing the value you generated for clients and organizations. You’ll also want to ensure that your document effectively captures the full scope of your expertise in financial analysis and investment strategy.

Try leveraging monetary figures, percentages, and financial data from your career as an investment banker to maximize the impact of your bullet points. Incorporating numbers into your document will draw the reader’s eye and establish credibility and a sense of scope for your professional achievements. For example, you could highlight the size of the investment portfolios you managed or how your financial strategies positively impacted ROI.

Professional Experience - Example #1

- Develop financial models and investment strategies for client portfolios valued at $300K to $1M and provide recommendations for valuations, M&A, and product offerings

Professional Experience - Example #2

3. outline your education and investment banking-related certifications.

In addition to your education, you’ll need to highlight certifications to advance your investment banking career. Many institutions require these credentials, even for entry-level roles. Some certifications you should target are the Series 7, Series 63, Series 66, and Series 79 licenses, all acquired through FINRA. Obtaining a Certified Financial Analyst designation is also worth considering, as this is one of the industry’s oldest and most prominent credentials.

- [Certification Name], [Awarding Organization], [Completion Year]

- Series 7, FINRA, 2018

- Series 63, FINRA, 2016

- [Degree Name]

- [School Name], [City, State Abbreviation] [Dates Enrolled]

- Bachelor of Science (B.S.) Economics

- Columbia University, New York, NY September 2007- May 2011

4. Include a list of your skills and proficiencies related to investment banking

Most organizations rely on Applicant Tracking Systems (ATS) to identify qualified candidates for potential job opportunities. If your resume lacks certain keywords, your application may not reach the hiring manager. To mitigate this risk, evaluate the job description and integrate key terms that match the needs of the organization you’re applying to. Below, you’ll find a list of keywords that you may encounter throughout your job search:

| Key Skills and Proficiencies | |

|---|---|

| Accounting | Client Relations |

| Due Diligence | Economics |

| Equity Research | Finance |

| Financial Analysis | Financial Modeling |

| Financial Planning and Analysis (FP&A) | Investment Banking |

| Investment Strategy | Leadership |

| Market Analysis | Merger and Acquisition (M&A) |

| Portfolio Management | Relationship Building |

| ROI Analysis | Strategic Investing |

| Strategic Partnerships | Valuations |

5. Highlight Your Leadership and Client Relations Skills

Showcasing your leadership capabilities and client relations experience while pursuing investment banker opportunities is important. In this role, you’ll be interfacing with high-level executives and attending meetings with various cross-functional teams to conduct due diligence and provide recommendations to grow client portfolios. Interpersonal skills are essential for investment bankers, as you’ll need to communicate high-level financial strategies and concepts to the C-suite.

How To Pick the Best Investment Banker Resume Template

If you struggle to find a suitable template, you’re not alone. With such a wide variety of options, finding the ideal fit for your professional needs can be challenging. The most important aspect of any resume template is structure and organization. Hiring managers will be interested in your financial expertise and investment banking accomplishments first and foremost, so avoid flashy colors and graphics that may draw the reader’s eye away from your content.

Frequently Asked Questions: Investment Banking Resume Examples and Advice

What are common action verbs for investment banking resumes -.

It’s easy to find yourself running out of action verbs when crafting your professional experience section. It's essential to differentiate your word choice, as your bullet points may appear stale or redundant. To help you out, we’ve compiled a list of action verbs you can use to keep your content fresh and compelling:

| Action Verbs | |

|---|---|

| Analyzed | Built |

| Collaborated | Conducted |

| Coordinated | Created |

| Determined | Developed |

| Drove | Enhanced |

| Evaluated | Identified |

| Implemented | Led |

| Managed | Negotiated |

| Oversaw | Performed |

| Provided | Supported |

| Finance | |

How do you align your resume with a job description? -

According to the Corporate Finance Institute , the average annual salary for investment bankers ranges from $125K to $500K, depending on your experience level. Align your resume with individual job descriptions to differentiate yourself from the competition. Start by researching the company and incorporating qualifications, skills, and achievements that match their needs.

For example, suppose an organization heavily focuses on investment opportunities in startup technology companies. In that case, craft bullet points that highlight your ability to evaluate long-term ROI potential based on market indicators and product use cases. You'll increase the odds of landing your next job opportunity by showcasing specific examples of you developing investment strategies and facilitating portfolio growth.

What is the best investment banker resume format? -

Reverse chronological is the ideal format for investment banker resumes. Hiring managers will always be most interested in your recent experience, which places those jobs at the top of your document. Avoid functional resume formats here.

Craft your perfect resume in minutes

Get 2x more interviews with Resume Builder. Access Pro Plan features for a limited time!

Crafting a matching cover letter can be a strong asset for your job application. This allows you to showcase aspects of who you are as a professional that you wouldn’t usually be able to highlight on your resume. In your middle paragraphs, you should mention the organization’s reputation, mission statement, or culture and why this draws you to apply for the position. For information, view our business cover letter guide .

Frank Hackett

Certified Professional Resume Writer (CPRW)

Frank Hackett is a professional resume writer and career consultant with over eight years of experience. As the lead editor at a boutique career consulting firm, Frank developed an innovative approach to resume writing that empowers job seekers to tell their professional stories. His approach involves creating accomplishment-driven documents that balance keyword optimization with personal branding. Frank is a Certified Professional Resume Writer (CPRW) with the Professional Association of Resume Writers and Career Coaches (PAWRCC).

Check Out Related Examples

Financial Analyst Resume Examples and Templates

Finance Resume Examples and Templates

Banking Resume Examples and Templates

Build a Resume to Enhance Your Career

- How to Build a Resume Learn More

- Basic Resume Examples and Templates Learn More

- How Many Jobs Should You List on a Resume? Learn More

- How to Include Personal and Academic Projects on Your Resume Learn More

Essential Guides for Your Job Search

- How to Write a Resume Learn More

- How to Write a Cover Letter Learn More

- Thank You Note Examples Learn More

- Resignation Letter Examples Learn More

- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Word Templates

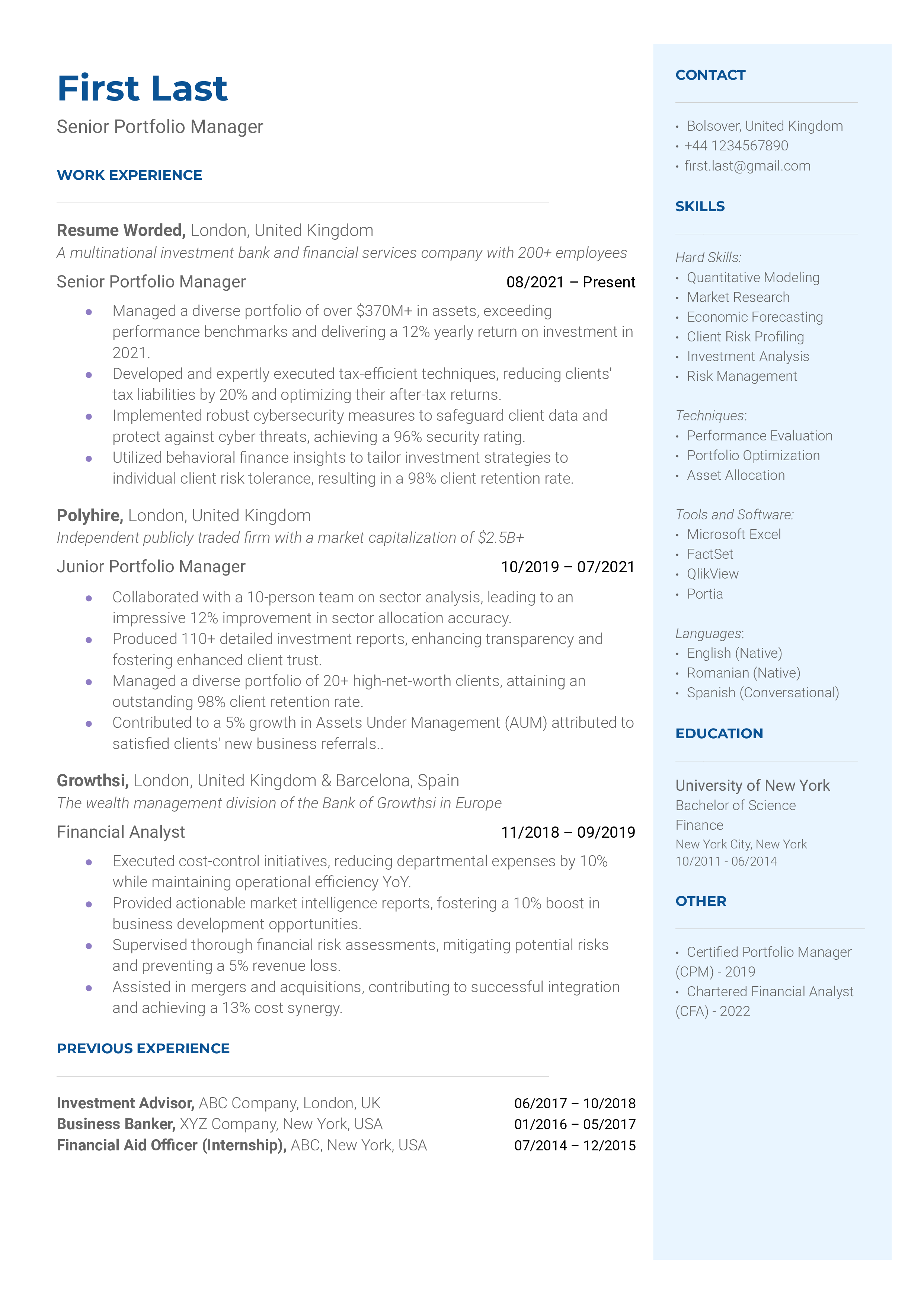

Investment Banking Resume Template

Free resume template to help you break into Investment Banking (IB)

Currently, Adin is an associate at Berkshire Partners, an $16B middle-market private equity fund. Prior to joining Berkshire Partners, Adin worked for just over three years at The Boston Consulting Group as an associate and consultant and previously interned for the Federal Reserve Board and the U.S. Senate.

Adin graduated from Yale University, Magna Cum Claude, with a Bachelor of Arts Degree in Economics.

Josh has extensive experience private equity, business development, and investment banking. Josh started his career working as an investment banking analyst for Barclays before transitioning to a private equity role Neuberger Berman. Currently, Josh is an Associate in the Strategic Finance Group of Accordion Partners, a management consulting firm which advises on, executes, and implements value creation initiatives and 100 day plans for Private Equity-backed companies and their financial sponsors.

Josh graduated Magna Cum Laude from the University of Maryland, College Park with a Bachelor of Science in Finance and is currently an MBA candidate at Duke University Fuqua School of Business with a concentration in Corporate Strategy.

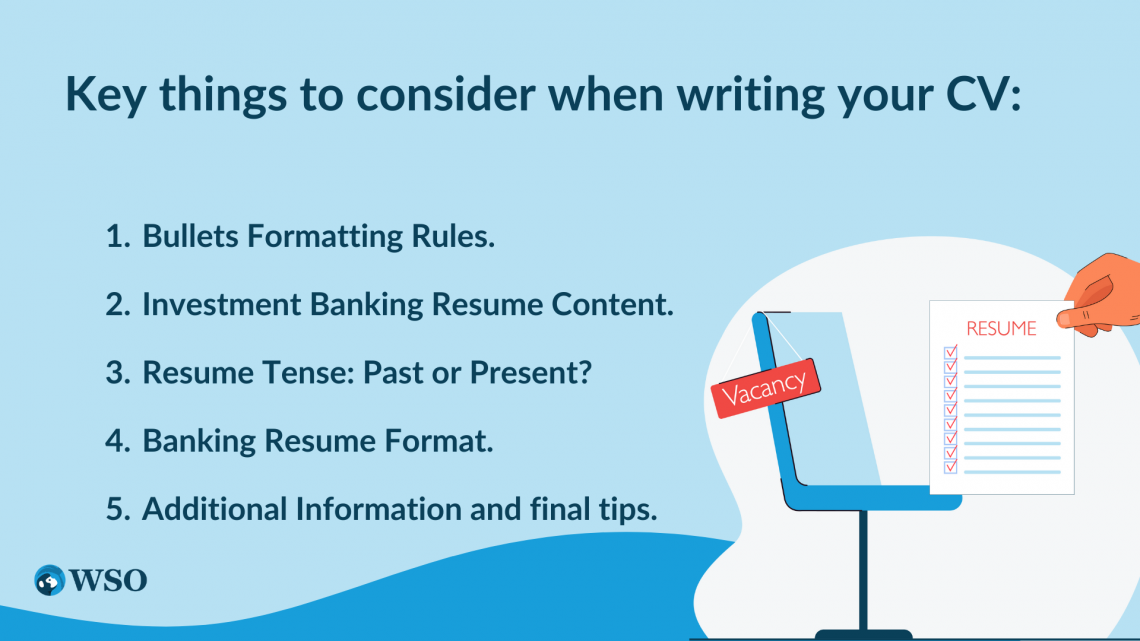

Investment Banking Resume Bullets

Investment banker resume content.

- Resume Tense - Past Or Present?

- Investment Banker Resume Format

- "Additional Information" Resume Section

- Final Resume Tips

Attached to the bottom of this post, you will find the free Wall Street Oasis Investment Banking Resume Template for undergraduate students, used by the WSO paid service and thousands of candidates to successfully land a job in investment banking.

This template helps make sure that your CV format is clean and your investment banking resume is polished, all for free!

After seeing members consistently reference other resume templates in the public resume review forum (which are good but inferior in our opinion), we have decided to release the WSO resume template for free to the public .

This is the same CV template we use in our paid WSO resume reviews with experienced finance professionals.

However, we know how competitive internship applications and summer analyst positions are nowadays, so we're hoping this gives you an even bigger edge in recruiting .

This particular banking resume sample is for undergraduates and is not intended for experienced hires .

Go to the bottom of this post (2 attached files) if you are looking for a resume for experienced hires (with deal experience) .

The Only Program You Need to Land in High Finance Careers

The most comprehensive curriculum and support network to break into high finance.

Across the many resumes, we review, we find that many make the mistake of not using bullets to list their achievements .

In our opinion, this is a big no-no .

Remember that the interviewers have hundreds, if not thousands of resumes on their desk, and you can be very sure they will not read a long block of text .

If not you, someone else would have presented better , and eventually, it is they who will get the call .

To avoid these common and easy-to-fix mistakes , please check out the tips below.

General Formatting Rules

- Keep bullet points at a max of 2 lines ; the ideal would be 1.5 lines

- Make sure that spacing is solid and your bullet points hit the how/why/what/result

Sub-Bullets

Another thing to consider is sub-bullets .

Including sub-bullets in your resume is something you have to be 100% confident in .

If it's just something you're doing for the sake of having a "different" resume , then avoid it .

Here's one good scenario for the use of sub-bullets: if you are describing transaction experience in an internship.

Essentially, if you have to go into more detail to discuss something that is highly relevant to investment banking , then it's worth considering using sub-bullets . Be wary, however, because going into too much detail can cause clutter and get you dinged .

Now it's time to talk about what goes into those bullet points. Fret not! While the content of your bullet points matter, the most important thing is that you don't fudge anything up in terms of formatting and grammar.

- Professional Experience : I want to see professional experience, i.e., roles where you've worked in a paid and professional discipline , and had to pass through an interview process to get there. Having made it successfully through interview processes for earlier internships or jobs is important, as interviewing you is what we plan to do.

- Case study competitions : Some people list these. These are not professional experiences . Including them just looks like you don't have enough professional experience to fill in this area enough. Don't do it.

- Volunteer Positions : Not professional. Send it to extracurricular.

- Strong Names : I like to see names in the PE/banking/HR universe that I recognize because it tells me you could get through their interview process and you've done an internship in something that has reinforced your academic finance skills.

- Keywords that Stand Out : Usually, reviewers skim the bullet points . Below are keywords that catch their eye (which reflect a particular teams' focus, might be different for another team):

- Comparables analysis

- Competition or industry analysis/research

- Due diligence

- DCF valuation

- Leveraged buy out

- Distressed debt

Resume Tense - Past or Present?

The main thing to focus on here is consistency . There are two options:

- Use past tense throughout the entire resume . The reasoning here is that your resume is a summary of everything you've done .

- Use past tense to describe past experiences and present tense to describe what you're currently doing . The reasoning here is self-explanatory; past experiences use past tense while current experiences use present.

Both options are totally acceptable, which is why it's up to you to choose which you prefer.

Investment Banker Resume Format

A poorly formatted resume will get thrown out .

Think about it.

A good amount of your time as an investment banker will be spent formatting , so what does it say about you if you can't properly format your own resume?

Lucky for you, you don't have to worry about formatting half as much as other candidates because our template does that for you.

Here's a download link to the resume template included below:

FREE WSO Resume Template

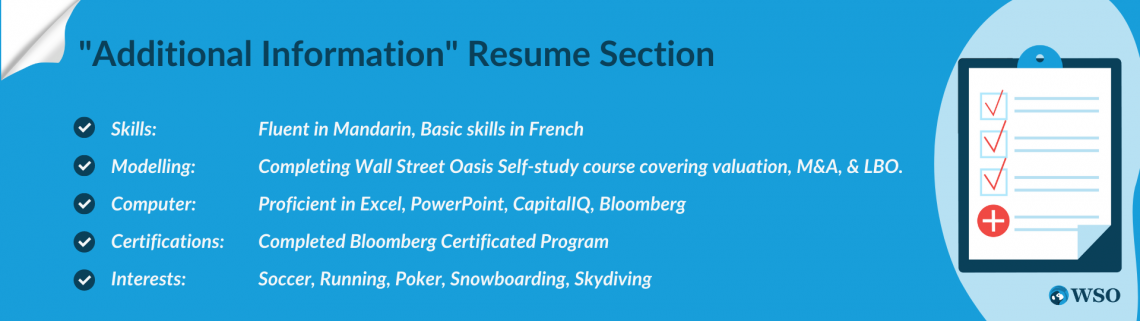

"Additional Information" Resume Section

This is a section that you need to edit to best fit what you have to include .

Don't have any modeling experience? Delete that line.

No computer skills to show off? The same thing applies.

Tailor this area of the resume to highlight your strengths beyond finance .

Here is one example of how you can structure your "Additional Information" section to be more meaningful and provide a few skills that may be impressive to the resume reviewer:

Final Resume Tips

Miscellaneous tidbits of wisdom from @blackice :

- Do: Be Ready to Defend Everything on Your Resume. This should be a given, but people seem to screw this up every day . If you write hang-gliding in your interests' section and then I ask you about it , you better damn well be able to speak about hang-gliding . Otherwise, it undermines everything else on the page.

- Do: Start Your Resume Early! These things take hours and hours to perfect . Many people think you can just sit down in an hour and bang out a perfect resume, but that is simply not the case. It takes time to get right. Do not wait to start until the day before the job posting .

- Don't: Put "Founded Investment Banking Club" on Your Resume. Just Don't Do It.

A couple of quick notes:

- Please feel free to share this post and pass it along to friends.

- If you're looking for our resume for experienced Investment Banking professionals click here.

- Remember, if you are looking for real finance professionals to help you structure and word your resume bullets and experiences, please consider our industry-leading resume editing service , specifically targeted towards investment banking, private equity, hedge funds, trading, management consulting and other finance resumes .

- Our testimonials speak for themselves: https://www.wallstreetoasis.com/career-services/resume-review-edits :-)

Read More About Getting An Investment Banking Job On WSO

- How To Get A Job On Wall Street (When You Don't Know Anybody)

- Investment Banking Interview Questions - 15 Answers To Land The Job

- Can I Get Into Investment Banking From Non-Target School?

Want Your Resume Reviewed by a Pro?

The WSO Resume Review Service has hand-picked the best professionals from thousands of currently practicing finance professionals… people who live and breathe their industry - day in and day out… who can tell you what’s changing firsthand…who LOVE giving back and will keep you up-to-date on everything you need to polish your resume and land more interviews.

WSO's Resume Review Service

Everything You Need To Break into Investment Banking

Sign Up to The Insider's Guide on How to Land the Most Prestigious Jobs on Wall Street.

More Resources:

We hope these templates help you land that dream IB job ! Please check out the following additional resources to help you advance your career:

- Investment Banking Interview Questions

- Private Equity Resume Template

- Hedge Fund Resume Template

- Consulting Resume Template

- Investment Banking Cover Letter Template

| Attachment | Size |

|---|---|

| 28.99 KB | 28.99 KB |

| 29.06 KB | 29.06 KB |

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

or Want to Sign up with your social account?

Build my resume

- Build a better resume in minutes

- Resume examples

- 2,000+ examples that work in 2024

- Resume templates

- Free templates for all levels

- Cover letters

- Cover letter generator

- It's like magic, we promise

- Cover letter examples

- Free downloads in Word & Docs

5 Investment Banking Associate Resume Examples for 2024

- Investment Banking (IB) Associate Resume

- IB Associate 2

- IB Associate 3

- IB Associate 4

- IB Associate 5

- Investment Banking Associate Resume Writing 101

When clients need assistance finding the right investment options, they know they can count on you to prepare cash flow models, draft memorandums, and effectively communicate information.

Have you made an online resume that shows hiring you is the best investment for any organization’s needs? And what about making a cover letter for the job?

Getting hired in a competitive financial space where every decision is crucial can feel daunting. We’re here to help with our investment banking associate resume examples that can act as an easy template for success .

Investment Banking Associate Resume

or download as PDF

Investment Banking Associate 2 Resume

Investment banking associate 3 resume, investment banking associate 4 resume, investment banking associate 5 resume, related resume examples.

- Real Estate Investment Banking

- Investment Banking Analyst

- Financial Analyst

- Business Analyst

- Investment Banking

What Matters Most: Your Investment Banking Associate Skills & Work Experience

Picking the right skills for your investment banking resume is similar to how you’d want to fine-tune all the critical details of an investment portfolio to make it successful.

Just like every client has unique needs, every investment banking organization will also have specific qualifications they’re looking for in the position. That’s why tailoring your AI resume to the job description is essential. Be sure to emphasize key skills each company mentions, like mergers and acquisitions or Oracle Hyperion.

Here are some of the best investment banking associate skills in 2024.

9 best investment banking associate skills

- Capital Markets

- Cash Flow Analysis

- Capital Raising

- Valuation Analysis

- Client Relations

- Investment Portfolios

- S&P Capital IQ

- Microsoft Excel

- Restructuring

Sample investment banking associate work experience bullet points

You know better than anyone that the financial market is heavily based on data.

Use your knowledge of common investment banking metrics to your advantage in this section to find some great examples to include. For example, metrics like liquidity ratios, annual revenue, or costs saved would work well here.

Additionally, it’s essential to keep each example to a short one-sentence description that helps your primary skills like raising capital or client relations shine.

Here are a few samples:

- Used S&P Capital IQ to streamline market analysis, leading to 50% more efficient analysis while generating 67% more accurate data.

- Performed cash flow analysis to help clients optimize their spending and generate 56% higher ROI.

- Created presentations with market data in Microsoft PowerPoint to effectively present the benefits of working with the firm to close 45% more prospective clients.

- Helped clients improve credit ratings by an average of 52 points by reducing accounts receivables and providing guidance to improve debt-to-income ratios.

Top 5 Tips for Your Investment Banking Associate Resume

- Your financial know-how has likely improved a lot since you were an investment banking assistant or intern. Therefore, you should list your most recent experiences first to show your current abilities in aspects like valuation analysis.

- One of the fastest ways to lose a hiring manager’s attention is with a resume full of grammatical errors. Proofread before submitting to show you have the detail-oriented mindset necessary to help clients accurately improve their investment portfolios.

- Just like you would want to keep the presentations and information you provide to clients concise and highly relevant to their financial needs, you should do the same with your resume. Limit it to one page of information that is the most recent and relevant to analyzing aspects like capital markets.

- Action words like “analyzed” or “overhauled” will make your examples sound more impactful. For instance, rather than saying you “know how to do market analysis,” you could say you “analyzed competitive markets to help clients generate 46% better ROI.”

- Your examples should include key metrics like accuracy, processing speeds, and monthly savings whenever possible. It helps you stand out to hiring managers, just like compelling data helps when presenting information to clients.

Your cover letter should help you connect with the organization and explain why you’ll succeed in the workplace. For instance, you could connect with their mission to provide excellent financial resources to clients or how you’ll use your cash flow analysis skills to achieve optimal results.

A resume objective can work well if you have limited experience in the field. For instance, you could include a few sentences about how you’re a motivated professional with two years as an investment banking assistant that have equipped you to provide 51% more efficient analysis of capital markets.

Ideally, you should lean into your data-based mindset to show why you’re the right choice for the job. Include relevant metrics like fee revenue generated while keeping all the information you include highly relevant and custom to each investment bank you apply to.

Protect your data

This site uses cookies and related technologies for site operation, and analytics as described in our Privacy Policy . You may choose to consent to our use of these technologies, reject non-essential technologies, or further manage your preferences.

Investment Banking Resume Sample

If you are a job seeker in the finance industry, we have good news: the U.S. Bureau of Labor Statistics reports that financial occupations are expected to grow about 8 percent between now and 2024. That means about 632,000 finance careers are expected to be added to the job market.

Yes, this is fantastic news if you are applying to jobs in the financial industry. But are you prepared for the hiring process? Is your resume up to par with today's finance resume best practices? The easiest way to find out is to view sample resumes that align with your desired career field.

As you view this sample resume, keep in mind the best practices for investment banking resumes such as proper formatting and language. You need to make sure you have a strong, up-to-date resume that glides through applicant tracking systems (ATS) and lands you an interview. For that, TopResume is here to help.

What makes a Successful Finance Resume Sample?

The above investment banking resume works because:

- It's concise. Think about how many resumes hiring managers skim through on a daily basis. If important information is difficult to find, why would they choose your resume? Make sure they see your information right away by utilizing phrasing on your resume and putting each phrase into bullet points.

- It uses quantitative information. Not only are numbers concise and easy to digest, the human mind naturally responds better to numbers compared to words. Rather than using words to describe your achievements, use numbers and symbols when creating a resume.

- It uses clear section headings. When deciding how to format a finance resume, remember that the headings must be definitive and stand out from the other text in the document. Don't be afraid to use a shaded box, bold text, and white-space around each heading.

- It has enough white space. Speaking of white space, each page of the resume should have a sufficient amount around all four sides of the document. Also be sure not to push the margins to the edge. If and when a person prints the document, you want to make sure there are no technical challenges.

If your investment banking resume doesn't follow the basic best practices above, it's time to make some changes. TopResume offers three levels of resume writing services with all of the components you need to make your finance resume the best it can be. We guarantee you'll get 2x more job interviews within 60 days or we'll rewrite your resume for free.

Your resume is the tool that can make or break your job search. Use our resume writing service today!

Samples by Category

- Administrative Office Assistant

- Advertising & Marketing

- Construction Contractor

- Customer Service

- Executive Assistant

- Executive/CEO

- Graphic Designer

- Industrial Engineer

- Insurance Agent

- Information Technology

- Mid-Career Professional

- Military-to-Civilian

- Nurse Practitioner

- Nursing (Healthcare)

- Public Relations

- Real Estate Management

- Retail Merchandising

- Safety Management

- Sales Management

- Student (or Recent Graduate)

- Teacher / Professor / Librarian

- Telecommunications

Ready to rewrite your resume?

Want a free resume analysis?

Get the information you need to land your dream job faster – delivered to your inbox, every week.

Thanks! Career advice is on its way.

Resume Builder

- Resume Experts

- Search Jobs

- Search for Talent

- Employer Branding

- Outplacement

- Resume Samples

- Business Strategy

Investment Banking Resume Samples

The guide to resume tailoring.

Guide the recruiter to the conclusion that you are the best candidate for the investment banking job. It’s actually very simple. Tailor your resume by picking relevant responsibilities from the examples below and then add your accomplishments. This way, you can position yourself in the best way to get hired.

Craft your perfect resume by picking job responsibilities written by professional recruiters

Pick from the thousands of curated job responsibilities used by the leading companies, tailor your resume & cover letter with wording that best fits for each job you apply.

Create a Resume in Minutes with Professional Resume Templates

- Continue to develop and improve the process and practice of knowledge and content management within TMT/Industrials

- Assist in the development and continued cultivation of client relationships

- Strong working knowledge of Excel to develop financial models

- Assist Management in instilling a sense of urgency and client focus across the organization

- Manages the administrative assistant and market and project coordination functions for the department

- Assess the effectiveness of established operational risk management controls

- Contribute to the development of KM and Corporate Finance analysis tools to improve the efficiency of junior bankers

- Assist in testing, development and maintenance of IT tools

- Coordinate settlements of revenue sharing between MS and MUMSS working with Mitsubishi and MS overseas finance teams

- Revenue booking and accounting management for Advisory (e.g. M&A), Equity/Debt capital market products

- Management of deal pipeline and updates

- Preparation of various daily/weekly/monthly/quarterly financial reports to the business unit and FCG management

- Balance sheet management

- Create invoice to bill expenses

- Create and maintain files of manager’s correspondence, records, etc

- Responsible for diary management, travel arrangements and scheduling meetings

- Provide administrative support to officers and associates

- Providing support for office related admin

- Preparing travel and entertainment expense reports and provide deal expense breakdown reports

- Telephone cover, lunch cover and assisting in for other support staff

- Assist with special projects such as conference planning/coordination

- Superior knowledge of the Microsoft Office suite (Word, PowerPoint, Excel) and the ability to quickly and independently learn a variety of industry software platforms

- Proven ability to pay close attention to detail and multi-task under tight deadlines

- Excellent interpersonal, presentation, oral and written communication skills in order to convey complex factual and conceptual information to others and promote the interests of CIBC

- Excellent understanding of financial statements, credit analysis and accounting principles

- Drive, enthusiasm, creativity and excellent interpersonal skills, particularly in dealing with teams in different offices

- Strong quantitative and technical abilities

- Excellent analytical ability including demonstrated knowledge of valuation techniques and practices

- Strong verbal and written communications skills

- Ability to work as part of a team in an environment that demands excellence, time and energy

- Strong technical, computational and quantitative skills

15 Investment Banking resume templates

Read our complete resume writing guides

How to tailor your resume, how to make a resume, how to mention achievements, work experience in resume, 50+ skills to put on a resume, how and why put hobbies, top 22 fonts for your resume, 50 best resume tips, 200+ action words to use, internship resume, killer resume summary, write a resume objective, what to put on a resume, how long should a resume be, the best resume format, how to list education, cv vs. resume: the difference, include contact information, resume format pdf vs word, how to write a student resume, investment banking senior assoc resume examples & samples.

- Produces factual and accurate information that's presented to the client

- Seeks opportunities for development through the job itself, through special assignments, training, or external activities

- Attracts and retains quality professionals that will have a positive impact on the SBU and Raymond James (RJ)

- Trains, mentors, and evaluates the performance potential ofinterns, analysts, and associates

- Supervises the analyst's performance expectations and evaluation criteria

- Prepares and delivers standard and tailored presentations and pitches to clients

- Assists with the execution of M&A and financing transactions, financial modeling, industry and comparable company analysis

- Documents and supports the execution of new financing issues for corporate clients

- Identifies new entrants into the space and targets these companies for attention

- Originates new corporate finance ideas for clients and potential clients

- Advanced concepts, practices and procedures of Investment Banking

- Analyzing and interpreting financial statements

- Writing skills

- Gather information, identify linkages and trends and apply findings to reports

- Remain cognizant of our commitment to daily workflow and regulatory compliance during high volume activity

- Assume full responsibility and accountability for own actions

- Demonstrate uncompromising adherence to ethical principles

- Prepare and deliver clear, effective and professional presentations

- Be proactive and demonstrate readiness and ability to initiate action

- Lead the work of others and provide training, coaching and mentoring

- Use appropriate interpersonal styles and communicate effectively, both orally and writing, with all organizational levels

- Bachelor's Degree in related field and a minimum ofthree (3) years of experience in the financial services industry and a MBA

VP, Investment Banking Resume Examples & Samples

- Applies financial analysis, business experience and market knowledge to initiate, and/or assess the likelihood of completing a corporate finance transaction

- Applies commercial judgment in assessing economic risk and return when considering acceptance of corporate finance assignments

- Brings together the most appropriate team to provide exceptional multifunctional and services to the client

- Oversees a team of analysts and senior associates and is responsible for executing transactions

- Coordinates all the work of Analysts and interns

- Attracts and retains quality bankers who will have a positive impact on the SBU and Raymond James (RJ)

- Reviews progress of assignments with senior management

- Advanced investment concepts, practices and procedures used in the securities industry

- Identifying trends and implementing appropriate action

- Analytical skills sufficient to assess and explain events in the market

- Operating standard office equipment and using required software application to produce correspondence, reports, electronic communication, and spreadsheets

- Balance conflicting resource and priority demands

- Partner with other functional areas to accomplish objectives

- Work independently, make non-routine decisions and resolve moderately complex accounting problems

- Attend to detail while maintaining a big picture orientation

- Establish and maintain effective working relationships at all levels of the organization, including negotiating resources

- Project a positive, professional image both internal and with external business contacts

- Convey information clearly and effectively through both formal and informal documents

- Master Degree in Business Administration (MBA) or related field and a minimum of four (4) years of experience in the financial services industry. Energy capital markets and advisory experience at an active investment bank + MBA + completion of first year as a VP or recently promoted to VP highly preferred

Investment Banking & Research Compliance Officer Resume Examples & Samples

- Assist with implementation and communication on new and changing regulations and provide training on current and new rules and regulations

- Manage the firm’s watch and restricted lists, including deal team and wall crossing information

- Provide real-time expertise and guidance on rules and regulations to Investment Banking and Equity Research

- Develop, update and implement compliance policies and procedures, including written supervisory procedures

- Develop necessary surveillance and monitoring of communications between public and private functions as well as Investment Banking and Research

- Manage the SEC and FINRA examinations of the area of responsibility and coordinate response, when necessary

- Manage relations with the regulatory authorities and respond to regulatory inquiries and investigations

- Prepare and file certain regulatory filings and reporting

- Conduct compliance testing per FINRA regulations

- Provide Compliance Chaperone coverage for communications between Investment Banking and Equity Research

- Conduct IB and Equity Research annual compliance meetings

AML Compliance Markets & Investment Banking Advisory Resume Examples & Samples

- Providing general guidance on AML policies and regulations and liaise with Business and Supporting Functions for day-to-day Compliance-related issues and questions

- Working with the GFCC Policy team to review and implement business-specific local KYC and AML procedures, to ensure accuracy and compliance with appropriate Global AML Policies and Standards

- Working with the wider GFCC team to aid in GFCC wide projects and initiatives as related to the Investment Bank

- 5-12 years work experience in a compliance, audit, risk management or control function

- Exposure to AML Compliance work

- Possess a working knowledge of banking operations, financial services laws and regulatory environment, investment banking knowledge will be an advantage

- Strong communication - written and interpersonal

Cib-latin Ameria Investment Banking Coverage & M&a-analyst Resume Examples & Samples

- Build and maintain complex financial models to perform analyses under different scenarios

- Perform full valuation analyses, including DCF, trading comparables, precedent transactions, LBO analyses, among others

- Prepare and review complex financial analyses, including transaction impact analyses such as earnings accretion/dilution and value creation

- Participate in day-to-day deal execution, interacting with senior deal team members, senior client executives, transaction counterparties and other advisors

- Prepare pitches, descriptive memorandums, management presentations, Board presentations and other materials

- Design and analyze transactions' rationale, structures, financial impacts, etc Monitor and evaluate current events related to clients, industries or transactions

- Bachelors' degree from a leading university and fluency in English - experience in M&A is highly preferred

- Strong knowledge of corporate finance and accounting, as well as basic understanding of legal and tax aspects related to M&A transactions

- Solid financial modeling/valuation, including DCF, LBO, trading comparables, precedent transactions, accretion/dilution, value creation analysis, three-statement models and combined pro forma models

- Ability to work in a fast-paced environment, handling multiple projects with different teams and under time constraints

Ib-investment Banking Resume Examples & Samples

- Work independently, producing high quality deliverables such as Descriptive Memorandums, management presentations, Board materials and other presentation materials for use in M&A transactions or strategic client dialog

- Leverage and coordinate the bank's resources on behalf of the client, including industry knowledge from partners in industry coverage groups and expertise from product partners in debt and equity capital markets and corporate finance advisory

- Provide leadership, mentorship and supervision to Analysts

- Bachelors' degree from a leading university; MBA is required for candidates that were not directly promoted from Analyst to Associate within a leading Investment Bank

- At least 2 full years of experience in Capital Markets, Investment Banking or a Corporate Finance related role, , investment banking or a corporate finance related role (i.e. pre-MBA, or equivalent level for direct Analyst promotes). Experience in M&A is highly preferred, but will consider banking experience in an industry coverage group, private equity or similar field

- Ability to comfortably interact with clients in a professional and mature manner

- Intellectual curiosity, strong work ethics and desire to learn

- Ability to work in a fast-paced environment, handling multiple projects with different deal teams

- Exceptional written and verbal communication skills with specific ability to communicate concepts and ideas concisely and defend their validity

Investment Banking Technology Trainer Associate Based Resume Examples & Samples

- Continuously learn the various technology applications within Banking (Desktop, Web, Mobile)

- Deliver varied forms of training to capture maximum participation

- Ensure adequate tracking/metrics of training delivery and work with L&D and Tech to measure impact on usage/ROI

- First Class interpersonal, communication and training skills (both to groups and individuals)

- Excellent Customer Service skills

- Training technology tools and/or Business Analysis experience

Compliance / Investment Banking & Research Resume Examples & Samples

- Interact with Investment Banking and Research departments and serve as advisory liaison

- Coordinate with Research regarding permissible distribution and content (including research reports, marketing materials, sales force memoranda, teach-in documents, internal use only communications)

- Address issues connected to Personal Trading, Outside Business Activities, Registration, and other conflicts of interest

- Undertake special projects as assigned

- Identify regulatory and reputation risks to the firm and address with the Head of the US Control Room and Senior Management

- Assist the Head of the US Control Room with global initiatives and enhancements relating to the Restricted and Watch Lists and areas which may pose a conflict of interest to the firm

- Assist the Control Room in their daily functions

- 5-10 years experience in a similar function

- Understanding of the functions and operations of a Control Room

- In depth knowledge of rules and regulations pertaining to offerings, M&A transactions, exchange offers, tender offers, Anti-Fraud Provisions and regulatory restrictions between Research and Investment Banking departments

- Experience interpreting regulatory rules and writing, implementing compliance policies and procedures

- Strong working knowledge of compliance risks associated with Investment Banking and Research Departments

- Self-starter with ability to follow through on issues and resolve in a timely and reasonable manner

Investment Banking Resume Examples & Samples

- Graduate from a top MBA program or equivalent work experience

- Superior valuation skills

- Ability to learn quickly, with a particular focus on accounting rules and financial valuation methodologies

- Extraordinarily high level of motivation and commitment to working hard

- Extraordinarily high level of focus on work quality and attention to detail

- Commercial instinct and ability to perform under pressure and tight deadlines

- Demonstrated ability to work well in team environment

Investment Banking Valuation Risk Analyst Resume Examples & Samples

- Monthly mark review production to ensure positions are marked correctly in the firm’s books and records. It covers a broad range of listed and derivative products

- Interaction with the trading desks and other internal/external parties in New York, London and Hong Kong

- Preparing summaries on mark review results for senior finance executives and the Business Units

- Developing and standardizing the existing Mark Review processes

- Good understanding of financialmarkets and products and ability to learn new products

- Degree in finance, economics orother quantitative discipline like mathematics

- Strong Inter-personal andcommunication skills

- Solid knowledge of Excel

Investment Banking Controller Resume Examples & Samples

- Preparation and analysis of various monthly financial reports to the business unit and FCG management

- Month end check and control of the regional and global expense charges and allocation to the business unit

- Preparation of weekly and monthly revenue reports

- Ad hoc revenue reporting

- Ad hoc expense trend analysis

- Minimum Bachelor degree

- Basic knowledge of finance or accounting concepts, processes

- Solid knowledge of Microsoft Office, and/or other relevant applications

- Requires at least 1 year of investment banking experience

- Desire for aMedia andCommunicationsexperience during theAnalyst years

- Graduate from a topundergrad program

- Manage Dual Hatted Controllers team supporting MSMS (Morgan Stanley consolidated entity) Global Capital Market Division and MUMSS (MUFG consolidated entity) Investment Banking Division under Joint Venture structure between MS and MUFG

- Revenue booking and accounting management for Advisory (e.g. M&A), Equity/Debt capital market products

- Management Reporting (revenues, expenses, profitability analysis)

- Pipeline Reporting (deal status tracking)

- Client billing management : Fee caluclation/invoicing, client billable expense tracking/invoicing

- Participate in IT development project

- Process renovation

- Manage team of 3

- Leadership and people management skill and good communication skill

- Accounting and product knowldge about Investment Banking Business is preferable, but not mandatory

- Strong communication skill both in verbal and writtenJapanese

VP / Associate, Investment Banking Resume Examples & Samples

- Master’s or undergraduate degree in Business Administration or related fields plus investment banking experience as an Associate/Vice President, or related occupation, working with multinational corporate clients for a global financial services firm

- 4-6 years of experience including analyzing, advising, developing and executing strategic investment banking transactions internationally in diverse industries. Transaction experience in the following areas: mergers, acquisitions, divestitures, joint ventures, defenses, proxy contests, leveraged capital transactions, restructuring and recapitalization advisory, private capital and public equity transactions as well as structured finance and debt transactions across wide range of products on a global level

- Must have strong leadership skills

- Strong people management skills – able to motivate, direct and empower team members through ongoing feedback and coaching

- Strong team player: able to contribute to a team environment that balances individual initiative and team accomplishments. Ability to work under tight deadlines and in a team environment

- Client-centricity – Ability to establish rapport with clients so they feel that they have a “personal” relationship with the Firm/Division

- Strong professional skills - recognized for product/financial knowledge, analytical skills and execution experience

- Excellence – able to identify opportunities to optimize a team’s talents and an ability to contribute to profitability and efficiency

- Innovation – able to identify creative solutions in the face of complex problems

- Proactive; self motivated and goal oriented

- Telephone coverage, answer phones, take accurate messages, know executives’ whereabouts at all times, handle urgent/confidential calls with appropriate judgment; back-up other lines, as needed, for bankers and colleagues

- Able to work well remotely with banker when they are traveling

- Heavy client interaction with high-level executives; act as liaison with clients and their assistants

- Coordinate all related conference rooms including any catering, audio/videoconference set up

- Arrange all aspects of travel, keeping executives’ travel profile up-to-date, manage approvals, arrange flights, hotels, rental car and sedan service, currency exchange

- Prepare all itineraries

- Prepare and submit all expense reports on a timely basis, following up on discrepancies and missing receipts to maintain current balances

- Type correspondence, memos and presentations, prepare presentation and meeting materials; copy, collate, bind if necessary

- Maintain filing system, correspondence, documents and personal files for bankers

- Retrieve research or other necessary materials from intra/internet

- Send and retrieve digital and inbound faxes

- Open and distribute executives’ mail, sort and prioritize; arrange messenger and overnight package services

- Train temporary workers on phones and all office routines

- Provide backup support for colleagues during vacation/sick days, and assist their bankers as needed with phone coverage and other office needs

- Miscellaneous support: setup and maintain mail groups, keep orderly, fully-functioning work area

- Excellent communication, writing, judgment, and problem-solving skills

- Strong attention to detail as well as solid organization/time management skills

- Able to work in a fast-paced environment and handle multiple tasks concurrently

- Must be flexible to covering different bankers as group grows or changes

- College Degree Preferred or Relative Corporate Experience preferred (5 Years of Experience)

- Proficient in Microsoft Office applications, especially Outlook for email, calendar and contacts

- Other applications helpful include Excel, PowerPoint, internet and research tools

- Solid typing skills (60 wpm)

- Keep up to date with office procedures and technical training as well as all policy guidelines and compliance requirements

Investment Banking Senior Associate Resume Examples & Samples

- Advanced concepts, practices and procedures of Tax and Accounting

- Problem solving skills and the ability to think independently sufficient to market ideas

- Lead the work of other and provide training, coaching and mentoring

- Interpret and apply policies and identify and recommend changes as appropriate

- Build and maintain complex financial models to perform analyses under different operating scenarios using input from management and public sources

- Perform full valuation analyses, including DCF, trading comparables, precedent transactions and LBO analyses

- Participate in day-to-day deal execution, interacting with senior deal team members, client management teams, transaction counterparties and other advisors

- Manage due diligence processes, including preparing virtual data rooms, tracking and coordinating the information flow, and reviewing and analyzing company information

- Prepare descriptive memorandums, management presentations, Board presentations and other materials for use in M&A transactions or strategic client dialog

- Monitor and evaluate current events related to the client, its industry or the transaction

- At least 1-2 full years of experience in Investment Banking at the Analyst level. Experience in M&A is highly preferred, but will consider banking experience in an industry coverage group, private equity or similar field

- Very strong financial modeling/valuation and analytical skills, including DCF, LBO, trading comparables, precedent transactions, accretion/dilution, value creation analysis, three-statement models and combined pro forma models

- Knowledge of corporate finance and accounting, as well as basic understanding of legal and tax aspects related to M&A transactions

- Experience analyzing company financials

- Ability to conduct thorough, independent research

Investment Banking Product Control Senior Analyst Resume Examples & Samples

- Manage the daily production of desk level P&L and balance sheet. Will include explanation of P&L movements to management, profit attribution analysis, responsibility of position reconciliation’s, balance sheet analysis and control

- Drive improvements to the control infrastructure. The infrastructure is currently undergoing significant change as part of a global automation initiative. This role will be instrumental in making sure that the EMEA requirements and painpoints are represented and addressed as part of this programme

- Have an understanding of desk level strategies to spot or highlight risks and erroneous behaviour

- Be a valued business partner to other departments from a finance perspective. Be aware of booking entries and related accounting treatments

- Understand the Valuation Control process and its impact on the P&L

- Understand the key controls, own the control infrastructure and document those controls on a regular basis for internal and external reviews

- Understand the front to back system and process flows and reconciliations. Interaction with Traders, Middle Office, Risk Management and Accounting Policy on review complex transactions for pricing, reserving and control issues

- Reviewing new trades, understanding the structure, associated risks and the P&L generated on them

- 5 years of experience in the field of accounting or finance

- Corporate treasury, Big 4 audit and/or investment banking related experience is an advantage

Investment Banking Product Control Analyst Resume Examples & Samples

- Ensure that the firm's risk portfolios are fairly valued

- Reconciliation between front and back office systems

- Ensure that market-leading standards are achieved through continuous development and maintenance of strong controls

- Qualified ACA/ACCA/CIMA/CFA is an advantage

- Good understanding of Capital Markets

- Understanding of valuation concepts as they pertain to financial products / derivatives

- Good negotiation skills

Associate, Healthcare Investment Banking Resume Examples & Samples

- Tracking business development (collect research, analyze industry trends)

- Are committed to their own personal success and the success of the institution as a whole

- View our clients as their first priority

VP, Investment Banking M&A Resume Examples & Samples

- Perform complex economic and financial analysis including assessing capital structure alternatives, cost of capital implications, restructuring strategies, and valuation enhancing alternatives

- Initiate, strategize, oversee due diligence and execute global and cross-border financial transactions including mergers, acquisitions, divestitures, joint ventures, unsolicited defense, hostile offers, proxy contests, restructurings, strategic partnerships, spin-offs, exchange offers, leveraged buyouts, and leveraged capitalizations

- Manage and supervise Analysts and Associates in the preparation of complex financial models and financial valuation analysis

- Manage and oversee advisory services including process management, as well as the preparation of detailed industry and company analysis materials

- Establish and maintain strategic communication with existing and potential clients, provide financial advice and solutions for strategic problems and assist clients in achieving short-term and long-term strategic objectives

- Perform business development and initiate banking relationships

- Work directly with senior-level financial and strategic decision-makers of corporations and emerging growth clients

- Bachelor’s degree in Finance or closely related areas of Business Administration

- 7+ years in the financial services industry, specifically within Investment Banking (or 4+ years of Associate Investment Banking experience with a Master's degree in Business Administration)

- Experience with large corporate clients, M&A transactions and capital raising

- Series 79 and 63 licenses required

Investment Banking Product Control Team Leader Resume Examples & Samples

- Participation in desk level activities, including preparing the daily product specific business level revenues and commentary

- Team management responsibility

- University or College degree, preferably specialized in accounting or finance

- Good understanding of capital markets

- Good financial accounting skills

- Control focus / Risk awareness / Auditor approach

- Excellent spoken and written English

- Strong communication skills - written and oral

- Strong MS Office computer skills (especially Excel)

- Ability to meet tight reporting and project deadlines

- Pro-active attitude

- Experience in a supervisory/management role - advantage

Investment Banking Financial Analyst Intern Resume Examples & Samples

- Last year University/College student at a Hungarian institution, specializing in Accounting/Finance (or related)

- New deal administration – job code setup, confirmation of compliance docs

- Deal cost analysis & invoices preparation

- P/L & B/S management (i.e. GL entries, P/L recon & B/S review)

- Liaise with other product controllers for revenue & expense queries

- Ad hoc revenue and expense reporting

- Bachelor Degree (Business/Accounting related degree preferred)

- 3 or more years of industry experience preferred

- Qualified Accountant (CPA/CA) advantageous

- Practical knowledge of finance or accounting concepts and processes

- Strong communication skills in both written and spoken English

- Strong numeracy and analytical skills, experience in reporting of large volume of data

- Ability to work well and accurately under pressure and meet deadlines

- Some exposure to change, managing and delivering projects

- Strong organizational skills to effectively management wide ranging requests

VP of Internal Audit Investment Banking Resume Examples & Samples

- Plan, execute and document audits with limited supervision in a risk focused manner and to a high standard in accordance with department and professional standards

- Plan, execute and document audit reports for audits conducted within the IS business, including risk assessments, audit planning, audit testing, control evaluation, report drafting and follow-up and verification of issue closure. Ensure audits are completed timely and within budget

- Enthusiastic, self motivated, effective under pressure and willing to take personal risk and accountability

Transaction Advisory Services Investment Banking Life Sciences Analyst Resume Examples & Samples

- A bachelor's degree and 1-2 years of related work experience

- An efficient use of research databases

- A willingness and ability to travel as necessary

Global Investment Banking Summer Analyst Program Resume Examples & Samples

- Performing various financial analyses, including valuations and merger consequences

- Conducting comprehensive and in-depth company and industry research

- Preparation of presentation and other materials for clients

- Participation in due diligence sessions

- Communication and interaction with deal team members

- Management of several projects at once and work effectively as an individual and as part of a team

- Assertiveness, initiative, leadership, strong work ethic, team focus

Associate, Investment Banking Resume Examples & Samples

- Play a key role supporting origination, opportunity evaluation and deal execution, working on a broad scope of assignments and products in the Technology industry

- Work closely with senior and junior bankers and expected to make an immediate contribution

- Prepare presentation and other materials for clients

- Perform various financial analyses, including valuations and merger consequences

- Conduct comprehensive and in-depth company and industry research

- Participate in due diligence sessions

- Communicate and interact with deal team members and clients across different regions

- Manage several projects at once and working effectively as an individual and as part of a team

- MBA degree with outstanding academic qualifications

- A track record of superior performance in extracurricular and professional activities

- Dedication to building a career in the investment banking industry

- Knowledge of or experience in Technology industry preferred

Investment Banking Department Resume Examples & Samples

- Fulfilling RA and banker information requests, especially in evenings and on weekends, for among other things: (1) agency-published company, industry and technical reports; (2) agency reports showing the derivation of historical adjusted credit ratios for rated companies; (3) standard pages describing the ratings process, rating fees, the pros/cons for getting rated, etc.; (4) custom searches of agency databases to identify precedents and examples needed by bankers for pitches or deals; and (5) schedules of comparable-company ratings (showing (a) methodology-derived Indicated corporate ratings; (b) Definitive ratings vs. Indicated ratings; and (c) Moody’s ratings vs. S&P ratings)

- Applying agency-published methodologies/models to derive: (1) estimated pro forma credit ratios adjusted for operating leases, pensions, etc.; (2) indicated corporate ratings based on sector-specific methodologies and other decision frameworks; (3) debt-instrument ratings (based on Moody’s loss-given-default [LGD] model and S&P's recovery analysis framework); and (4) liquidity ratings

- Developing/updating standard RA pages for pitches and other client meetings, including (1) the pros/cons for getting rated, descriptions of the ratings process, rating fees, etc.; (2) qualifications and credential pages, including deal tombstones and lists of previously worked-on sector- and situation-specific deals; and (3) selected case studies

- Developing/applying RA templates for ratings assessment presentations to bankers and clients

- Preparing standard pages for pitches and other presentations on technical issues, including (1) the derivations of estimated pro forma credit ratios, indicated and definitive corporate ratings, instrument ratings, and liquidity ratings; (2) selected pages for banker training presentations; and (3) selected pages for occasional presentations to IBD and coverage/products groups on new rating methodologies and other agency-related developments

- Preparing selected pages for clients’ presentations to rating agencies

- Deriving deal-specific estimated rating-agency fees

- Candidate Value Proposition

- Internal mobility is encouraged

- Demonstrated academic achievement

- A basic knowledge of accounting for financial reporting and financial statements

- Ability to multi-task with strong attention to detail

- Demonstrated ability to work in a time-sensitive environment

- A can-do attitude and willingness to ask questions when clarity is needed

- Demonstrated interest in business (industries, companies and industries), especially from a credit perspective

- A basic familiarity with capital markets

- Excellent PC skills; advanced knowledge of Excel, Word and PowerPoint a must

- Willingness to travel and spend time in New York for possible training

PMO Analyst Investment Banking Resume Examples & Samples

- Maintain financial controls and systems for recording, monitoring, forecasting and budgeting of all project expenditure

- Work closely with the financials lead on all aspects of the budgeting and forecasting lifecyle

- Monitor Risk & Issue management & appropriate escalation

- Task tracking i.e. capture & manage to close all approvals/deliverables in a timely manner

- Fully support infrastructure and build projects including administration, organisation of project meetings and minutes

- Maintain existing departmental and Project Office policies and procedures

- Continue to update and improve business and project methodologies

- Support all Project and Program Managers with day to day running of project admin tasks

- Excellent oral and written communication skills necessary to effectively communicate issues, risks and progress on complex processes to multiple stakeholders including Front Office and IT Management

- Prioritize tasks, work within deadlines, taking a pragmatic and considered approach, paying close attention to details

- Has the confidence and ability to convincingly structure, summarise, defend and present recommendations

- 1-3 years experience as a PMO analyst

- Strong computer skills, especially Excel, Visio, Power Point and SharePoint

- Banking and/or consultancy background and an understanding of structured program management in the banking arena

- A proven track record of successfully supporting highly complex projects within a banking environment

Corporate Intern Investment Banking Resume Examples & Samples

- Performs other duties and responsibilities as assigned

- Fundamental concepts, practices and procedures of a professional office environment

- Organize and prioritize multiple tasks and meet deadlines

- Daily P&L reporting of European IBD products

- Revenue recognition and booking into the in-house pipeline system

- Preparation of weekly performance review pack with the Business Unit

- Management of IBD pipeline, project updates

- Monthly P&L reconciliation

- Management of aged ‘receivables’ balances for IBD core products

- Participation in client fee and expense billing

CIB F&bm-asia Investment Banking Profit & Loss Associate Resume Examples & Samples

- Process, record and report P&L generated by the business in a controlled, accurate and timely manner

- Perform P&L and position reporting and report the make up and drivers of the P&L with commentary

- Report front office sign off results and resolve issues accordingly

- Work closely with the Middle Office, LEC, Controllers, Business Managers and Front office

- Closely work with Financial Control in Mumbai and Delaware to ensure proper financial controls are in place for the business

- Participate and lead system enhancements and work-flow re-engineering projects, and other ad-hoc information requests and projects

- Ensure sound P&L control environment by continuous improvement and adhere to new standards and regulations

- Ensure continuous adherence to the firm-wide P&L standards

- Main P&L contact for FO, regional Controllers & Business managers (Hong Kong, Australia and Japan)

- Complete & consolidate daily, weekly and monthly reporting – working closely Middle Office, Controllers, Front Office and Business managers, and reports daily to DRR

- Maintain commentary on deals booked and other analysis

- Follow up and resolution of unexplained items, breaks, FO/BM queries on P&L

- Complete metrics to monitor P&L performance

- Perform daily, weekly and monthly controls and review on P&L, risks and positions

- Reconcile of Aqueduct, DRR, P&L and general ledger

- Completion of monthly FX trade out and assist on transfer pricing processes

- Complete ad hoc queries and projects as required

- Drive continuous process improvements

- Be trained and back up the Product Controller function as needed

- Minimum 2 years’ experience with banking / financial services background

- University degree in Finance and Accounting preferred

- Dynamic team player able to adapt to changing environment and multiple demands

- Strong work flow management and control mindset

- Good interpersonal, communication and problem solving skills

- Strong organizational and time management skills and able to work on multiple projects with competing deadlines

Operations Securities Investment Banking Syndicate Operations Associate Resume Examples & Samples

- Solid understanding of primary and secondary debt security markets

- Proven process re-engineering skills

- Effective analytical ability

Investment Banking Financial Controller Resume Examples & Samples

- Revenue reporting and analysis to Business Units

- Working collaboratively with global Trading Fee Controlling group, global stakeholders, traders, clients and other departments

- Understanding of financial products

- Demonstrated ability to: prioritize competing responsibilities, work under pressure, meet challenging deadlines and capability to build and maintain effective business relationships

- Working as Dual Hatted Controller supporting MSMS (Morgan Stanley consolidated entity) Global Capital Market Division

- Excelent communication skill

- Accounting and product knowledge about Investment Banking Business is preferable, but not mandatory

- Japanese verbal & read & write communication skill, English communication skill

Finance Business Partner Global Investment Banking Technology Resume Examples & Samples

- Supporting the IB IT CFO with business partnering activities and cost decision support for IB IT and their management team

- Cost control is a key focus across Group Technology and Continuous development of MI to specifically aid cost reduction and other change initiatives in order to support strategic planning and decision-making is critical. Specifically leading the Consumer Forecast (allocations to the IB business division) process including providing transparency and advice on how to reduce IT allocations

- Supporting the monthly financial reporting and forecasting process together with commentary and storyboard. Support for IT business cases, their approval process and a mechanism where costs and benefits can be tracked and reported

- Preparation of the annual Operating Plan and other administrative tasks and ad hoc requests received by the team. As well as engaging with regional Finance and Business teams to extract relevant data for the provision of ad hoc reporting requests