Strategic Risk Assessment Template, Examples, & Checklist for 2022

July 29, 2020

The first step in building a risk management plan is to conduct an initial risk assessment. What sets a strategic risk assessment apart from other risk assessment methods is that it is driven by the business’s core strategies. Get up to speed on strategic risk assessment with a checklist, template, and examples below.

What Is a Strategic Risk Assessment?

A strategic risk assessment is a systematic, continuous process for organizations to identify its strategic risks and understand how those risks are being managed across the business. “Strategic risks” are the risks that are most consequential to the organization’s ability to execute its strategy and achieve its objectives. They entail the risk exposures that can ultimately impact shareholder value or even threaten the business’s survival.

Planning a Strategic Risk Assessment

The strategic risk assessment process should be led by management, but receive input from and be reviewed in conjunction with the Board. The outcome of this risk assessment is to achieve consensus, among Board members and management, around the top key risks facing the organization. This process aligns with COSO’s 2017 ERM framework and is based on research by Dr. Mark Frigo, Director of the Center for Strategy, Execution, and Valuation at DePaul University, and Richard Anderson, a retired Partner at PwC and a clinical professor at the Strategic Risk Management Lab at DePaul.

Risk Assessment Checklist

Strategic Risk Assessment Template

1. understand the strategies of the organization.

The first step of the risk assessment is to develop an overview of the organization’s key strategies and business objectives. For some businesses, this data may already be well-developed and formally documented. If not, the risk assessment team can leverage examples such as The Return Driven Strategy model to understand and identify the strategies most critical to achieving the organization’s overall objectives. This is a crucial step in helping management and the Board eventually prioritize the potential risks to these strategies.

2. Collect data and views on strategic risks from the organization

The second step is to collect information from the organization regarding its strategic risks. This can be achieved by:

- Reviewing financial reports and investor presentations

- Interviewing key executive leaders regarding what they view as strategic risks

- Surveying business leaders and other personnel with views on risks, e.g. compliance, internal audit , and external audit teams

It can be helpful to use the information gathered on strategic risks in Step 1 to frame these interviews and surveys around the business’s key strategies. It can also be useful to interview key executive leaders regarding what they view as potential emerging risks in addition to gathering their feedback on strategic risks. This is a good time to consider incorporating risk assessment analytics to the data you gather on strategic risks.

3. Prepare a preliminary strategic risk profile

The next step is to utilize the results from steps 1 and 2 of the risk assessment planning to develop a preliminary profile of the organization’s strategic risks. The risk assessment team can use the Strategic Risk Management Model as a template to help assess the risks related to each of the top strategies identified. Ultimately, this profile should contain a list of the top risks to the organization’s strategy and objectives and their potential severity or ranking. How detailed this profile is, and how it will be presented, should be carefully catered to the culture of your organization. Color-coding risks and using visual heat maps may be helpful in presenting this information to management and the Board for review and discussion.

4. Validate and finalize the strategic risk profile with management and the Board

Upon presenting the preliminary strategic risk profile to leadership, the next step is for the risk assessment team to facilitate a discussion among key executives to help refine, validate, and finalize the risk profile. The ensuing cross-dialogue and conversations about risk and opportunity are among the most valuable conversations for shaping business strategy, as they unite executives across the organization to share their unique perspectives and collectively vet and prioritize the organization’s top key risks.

5. Develop a strategic risk management action plan

This step entails leveraging the results of the previous steps to produce a strategic risk management action plan to help manage and monitor the identified strategic risks. The action plan involves developing an appropriate risk response (accept, avoid, pursue, reduce, share) to each critical risk identified in accordance with the organization’s risk appetite. The consolidated action plan should prioritize these risk responses and allocate resources across them. Best practice indicates the action plan should also include a charter that:

- Has a formal statement on the organization’s risk appetite

- Assigns responsibilities and accountability for risk monitoring and actions among management, internal audit and compliance

6. Communicate the strategic risk profile and action plan

Once the strategic risk management action plan has been developed, it should be validated and finalized by management and the Board. Once finalized, this profile and plan must be communicated with the organization in order to help develop and build the organization’s risk culture.

7. Implement the enterprise risk management action plan

The value of performing a strategic risk assessment is realized when the organization implements the resulting action plan to manage and monitor its strategic risks. However, enterprise risk management should not be regarded as a one-time, annual procedure, but as a continual, ongoing process that can be built upon and strengthened. As such, these steps should be repeated as frequently as needed in response to significant external events that can affect the business, such as the 2008 financial crisis or the COVID-19 crisis. Furthermore, leveraging risk management software can help streamline and centralize the risk assessment process, creating the foundation for a mature ERM program. To learn how AuditBoard can help you manage your risk management plan from end to end, contact us by filling out the form below.

Related Articles

Uncovering Hidden Risks: A Comprehensive Guide to Business Plan Risk Analysis

A modern business plan that will lead your business on the road to success must have another critical element. That element is a part where you will need to cover possible risks related to your small business. So, you need to focus on managing risk and use risk management processes if you want to succeed as an entrepreneur.

How can you manage risks?

You can always plan and predict future things in a certain way that will happen, but your impact is not always in your hands. There are many external factors when it comes to the business world. They will always influence the realization of your plans. Not only the realization but also the results you will achieve in implementing the specific plan. Because of that, you need to look at these factors through the prism of the risk if you want to implement an appropriate management process while implementing your business plan.

By conducting a thorough risk analysis, you can manage risks by identifying potential threats and uncertainties that could impact your business. From market fluctuations and regulatory changes to competitive pressures and technological disruptions, no risk will go unnoticed. With these insights, you can develop contingency plans and implement risk mitigation strategies to safeguard your business’s interests.

This guide will provide practical tips and real-life examples to illustrate the importance of proper risk analysis. Whether you’re a startup founder preparing a business plan or a seasoned entrepreneur looking to reassess your risk management approach, this guide will equip you with the knowledge and tools to navigate the complex landscape of business risks.

Why is Risk Analysis Important for Business Planning?

Risk analysis is essential to business planning as it allows you to proactively identify and assess potential risks that could impact your business objectives. When you conduct a comprehensive risk analysis, you can gain a deeper understanding of the threats your business may face and can take proactive measures to mitigate them.

One of the key benefits of risk analysis is that it enables you to prioritize risks based on their potential impact and likelihood of occurrence . This helps you allocate resources effectively and develop contingency plans that address the most critical risks.

Additionally, risk analysis allows you to identify opportunities that may arise from certain risks , enabling you to capitalize on them and gain a competitive advantage.

It is important to adopt a systematic approach to effectively analyze risks in your business plan. This involves identifying risks across various market, operational, financial, and legal areas. By considering risks from multiple perspectives, you can develop a holistic understanding of your business’s potential challenges.

What is a Risk for Your Small Business?

In dictionaries, the risk is usually defined as:

The possibility of dangerous or bad consequences becomes true .

When it comes to businesses, entrepreneurs , or in this case, the business planning process, it is possible that some aspects of the business plan will not be implemented as planned. Such a situation could have dangerous or harmful consequences for your small business.

It is simple. If you don’t implement something you have in your business plan, there will be some negative consequences for your small business.

Here is how you can write the business plan in 30 steps .

Types of Risks in Business Planning

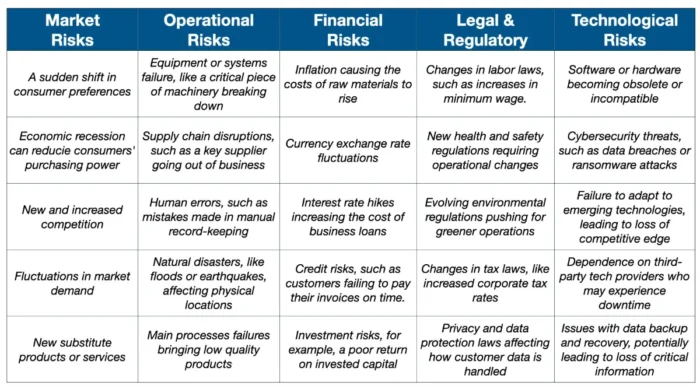

When conducting a business risk assessment for your business plan, it is essential to consider various types of risks that could impact your venture. Here are some common types of risks to be aware of:

1. Market risks

These risks arise from fluctuations in the market, including changes in consumer preferences, economic conditions, and industry trends. Market risks can impact your business’s demand, pricing, and market share.

2. Operational risk

Operational risk is associated with internal processes, systems, and human resources. These risks include equipment failure, supply chain disruptions, employee errors, and regulatory compliance issues.

3. Financial risks

Financial risks pertain to managing financial resources and include factors such as cash flow volatility, debt levels, currency fluctuations, and interest rate changes.

4. Legal and regulatory risks

Legal and regulatory risks arise from changes in laws, regulations, and compliance requirements. Failure to comply with legal and regulatory obligations can result in penalties, lawsuits, and reputational damage.

5. Technological risks

Technological risks arise from rapid technological advancements and the potential disruptions they can cause your business. These risks include cybersecurity threats, data breaches, and outdated technology infrastructure.

Basic Characteristics of Risk

Before you start with the development of your small business risk management process, you will need to know and consider the essential characteristics of the possible risk for your company.

What are the basic characteristics of a possible risk?

The risk for your company is partially unknown.

Your entrepreneurial work will be too easy if it is easy to predict possible risks for your company. The biggest problem is that the risk is partially unknown. Here we are talking about the future, and we want to prepare for that future. So, the risk is partially unknown because it will possibly appear in the future, not now.

The risk to your business will change over time.

Because your businesses operate in a highly dynamic environment, you cannot expect it to be something like the default. You cannot expect the risk to always exist in the same shape, form, or consequence for your company.

You can predict the risk.

It is something that, if we want, we can predict through a systematic process . You can easily predict the risk if you install an appropriate risk management process in your small business.

The risk can and should be managed.

You can always focus your resources on eliminating or reducing risk in the areas expected to appear.

Risk Management Process You Should Implement

The risk management process cannot be seen as static in your company. Instead of that, it must be seen as an interactive process in which information will continuously be updated and analyzed. You and your small business members will act on them, and you will review all risk elements in a specified period.

Adopting a systematic approach to identifying and assessing risks in your business plan is crucial. Here are some steps to consider:

1. Risk Identification

First, you must identify risk areas . Ask and respond to the following questions:

- What are my company’s most significant risks?

- What are the risk types I will need to follow?

In business, identifying risk areas is the process of pinpointing potential threats or hazards that could negatively impact your business’s ability to conduct operations, achieve business objectives, or fulfill strategic goals.

Just as meteorologists use data to predict potential storms and help us prepare, you can use risk identification to foresee possible challenges and create plans to deal with them.

Risk can arise from various sources, such as financial uncertainty, legal liabilities, strategic management errors, accidents, natural disasters, and even pandemic situations. Natural disasters can not be predicted or avoided, but you can prepare if they appear.

For example, a retail business might identify risks like fluctuating market trends, supply chain disruptions, cybersecurity threats, or changes in consumer behavior. As you can see, the main risk areas are related to types of risk: market, financial, operational, legal and regulatory, and technological risks.

You can also use business model elements to start with something concrete:

- Value proposition,

- Customers ,

- Customers relationships ,

- Distribution channels,

- Key resources and

- Key partners.

It is not necessarily that there will be risk in all areas and that the risk will be with the same intensity for all areas. So, based on your business environment, the industry in which your business operates, and the business model, you will need to determine in which of these areas there is a possible risk.

Also, you must stay informed about external factors impacting your business, such as industry trends, economic conditions, and regulatory changes. This will help you identify emerging risks and adapt your risk management strategies accordingly.

The idea for this step is to create a table where you will have identified potential risks in each important area of your business.

2. Risk Profiling

Conduct a detailed analysis of each identified risk, including its potential impact on your business objectives and the likelihood of occurrence. This will help you develop a comprehensive understanding of the risks you face.

Qualitative Risk Analysis

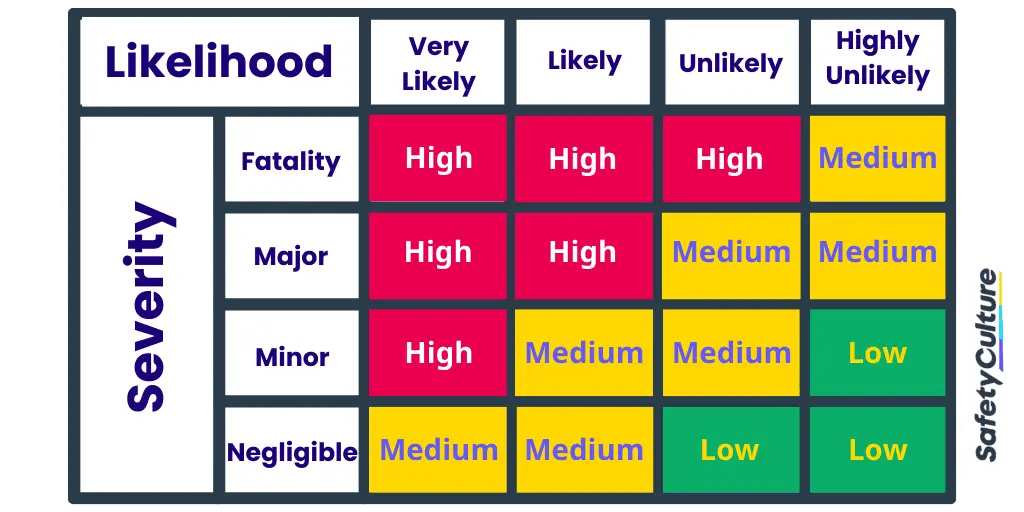

The qualitative risk analysis process involves assessing and prioritizing risks based on ranking or scoring systems to classify risks into low, medium, or high categories. For this analysis, you can use customer surveys or interviews.

Qualitative risk analysis is quick, straightforward, and doesn’t require specialized statistical knowledge to conduct a business risk assessment. The main negative side is its subjectivity, as it relies heavily on thinking about something or expert judgment.

This method is best suited for initial risk assessments or when there is insufficient quantitative analysis data .

For example, if we consider the previously identified risk of a sudden shift in consumer preferences, a qualitative analysis might rate its likelihood as 7 out of 10 and its impact as 8 out of 10, placing it in the high-priority quadrant of our risk matrix. But, qualitative analysis can also use surveys and interviews where you can ask open questions and use the qualitative research process to make this scaling. This is much better because you want to lower the subjectivism level when doing business risk assessment.

Quantitative Risk Analysis

On the other side, the quantitative risk analysis method involves numerical and statistical techniques to estimate the probability and potential impact of risks. It provides more objective and detailed information about risks.

Quantitative risk analysis can provide specific, data-driven insights, making it easier to make informed decisions and allocate resources effectively. The negative side of this method is that it can be time-consuming, complex, and requires sufficient data.

You can use this approachfor more complex projects or when you need precise data to inform decisions, especially after a qualitative analysis has identified high-priority risks.

For example , for the risk of currency exchange rate fluctuations, a quantitative analysis might involve analyzing historical exchange rate data to calculate the probability of a significant fluctuation and then using your financial data to estimate the potential monetary impact.

Both methods play crucial roles in effectively managing risks. Qualitative risk analysis helps to identify and prioritize risks quickly, while quantitative analysis provides detailed insights for informed decision-making.

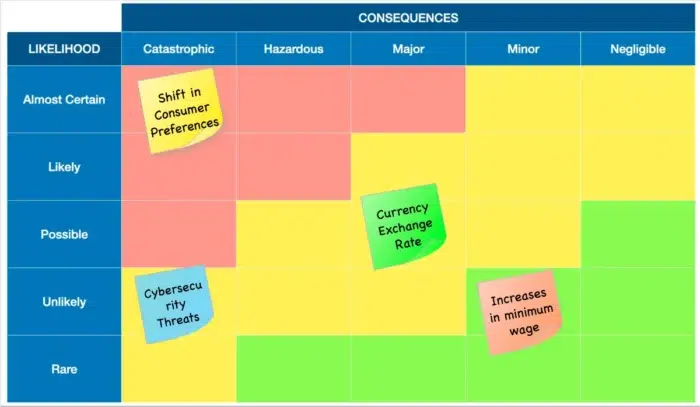

3. Business Risk Assessment Matrix

Once you have identified potential risks and analyzed their likelihood and potential impact, you can create a business risk assessment matrix to evaluate each risk’s likelihood and impact. This matrix will help you prioritize risks and allocate resources accordingly.

A business risk assessment matrix, sometimes called a probability and impact matrix, is a tool you can use to assess and prioritize different types of risks based on their likelihood (probability) and potential damage (impact). Here’s a step-by-step process to create one:

- Step 1: Begin by listing out your risks . For our example, let’s consider four of the risks we identified earlier: a sudden shift in consumer preferences (Market Risk), currency exchange rate fluctuations (Financial Risk), an increase in the minimum wage (Legal), and cybersecurity threats (Technological Risk).

- Step 2: Determine the likelihood of each risk occurring . In the process of risk profiling, we’ve determined that a sudden shift in consumer preferences is highly likely, currency exchange rate fluctuations are moderately likely, an increase in the minimum wage, and cybersecurity threats are less likely but still possible.

- Step 3: Assess the potential impact of each risk on your business if it were to occur . In our example, we might find that a sudden shift in consumer preferences could have a high impact, currency exchange rate fluctuations a moderate impact, an increase in minimum wage minor impact, and cybersecurity threats a high impact.

- Step 4: Plot these risks on your risk matrix . The vertical axis represents the likelihood (high to low), and the horizontal axis represents the consequences (high to low).

By visualizing these risks in a risk assessment matrix format, you can more easily identify which risks require immediate attention and which ones might need long-term strategies.

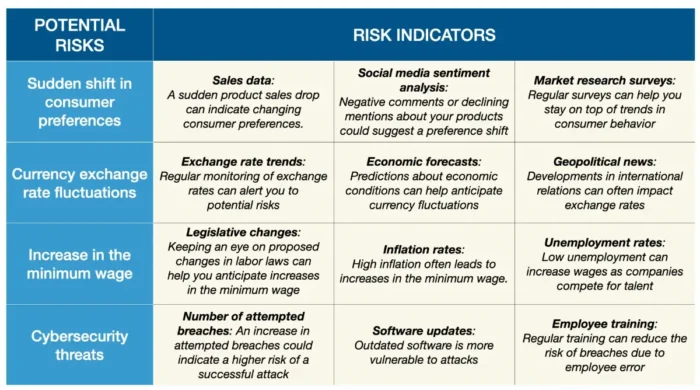

4. Develop Risk Indicators for Each Risk You Have Identified

The question is, how will you measure the business risks for your company?

Risk indicators are metrics used to measure and predict potential threats to your business. Simply, a risk indicator is a measure that should tell you whether the risk appears or not in a particular area you have defined previously. They act like a business’s early warning system. When these indicators change, it’s a signal that the risk level may be increasing.

For example, for distribution channels, an indicator can be a delay in delivery for a minimum of three days. This indicator will tell you something is wrong with that channel, and you must respond appropriately.

Now, let’s consider some risk indicators for the risks we have already identified and analyzed:

If you conduct all the steps until now, you can have a similar table with risk indicators in your business plan. You should monitor these indicators regularly, and if you notice a significant change, such as a drop in sales or an increase in attempted breaches, it’s time to investigate and take some action steps. This might involve updating your product line, hedging against currency risk, budgeting for higher wages, or improving your cybersecurity measures.

Remember, risk indicators can’t predict the future with certainty. But they can give you valuable insights that can help you prepare for potential threats.

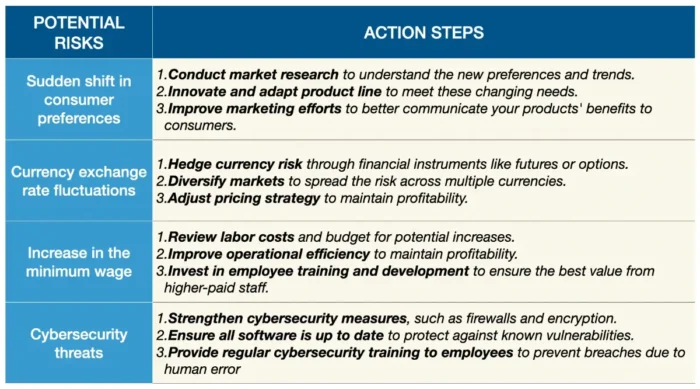

5. Define Possible Action Steps

The question is, what can you do regarding the risk if the risk indicator tells you that there is a potential risk?

Once the risk has appeared and is located, it is time to take concrete action steps. The goals of this step are not only to reduce or eliminate the impact of the risk for your company but also to prevent them in the future and reduce or eliminate their influence on the business operations or the execution of your business plan.

For example, for distribution channels with delivery delayed more than three days, possible activities can be the following:

- Apologizing to the customers for the delay,

- Determining the reasons for the delay,

- Analysis of the reasons,

- Removing the reasons,

- Consideration of alternative distribution channels, etc.

In this part of the business plan for each risk area and indicator, try to standardize all possible actions. You can not expect that they will be final. But, you can cover some basic guidelines that must be implemented if the risk appears. Here is an example of how this part will look in your business plan related to risks we have already identified through the risk assessment process.

6. Monitoring

Because this risk management process is dynamic , you must apply the monitoring process. In such a way, you can ensure the elimination of a specific kind of risk in the future, and you will allocate your resources to new possible risks.

After implementing the actions, you need to ask yourself the following questions:

- Are the actions taken regarding the risk the proper measures?

- Can you improve something regarding the risk management process? Is there a need for new risk indicators?

Techniques and Tools for Business Plan Risk Assessment

Various risk analysis methods, techniques, and tools are available to conduct an effective risk analysis for your business plan. Here are some commonly used ones:

1. SWOT analysis

A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis can help you identify internal strengths and weaknesses and external opportunities and threats. This analysis provides valuable insights into possible business risks and opportunities.

2. PESTEL analysis

A PESTEL (Political, Economic, Sociocultural, Technological, Environmental, Legal) analysis assesses the external factors that could impact your business. This analysis will help you identify risks and opportunities arising from these factors.

3. Scenario analysis

Consider different scenarios that could impact your business, such as best-case, worst-case, and most likely scenarios, as a part of your risk assessment process. You can anticipate potential risks and develop appropriate response strategies by analyzing these scenarios.

4. Monte Carlo simulation

Monte Carlo simulation uses random sampling and probability distributions to model various scenarios and assess their potential impact on your business. This technique provides you with a more accurate understanding of risk exposure.

5. Risk register

A risk register is a risk analysis tool that helps you record and track identified risks and their relevant details, such as impact, likelihood, mitigation strategies, and responsible parties. This tool ensures that risks are appropriately managed and monitored.

6. Business Impact Analysis (BIA)

Business impact analysis helps you understand the potential effects of various disruptions on your business operations and objectives. It’s about identifying what could go wrong and understanding how it could impact your bottom line. So, you can conduct business impact analysis as a part of your risk assessment inside your business plan.

7. Failure Mode and Effects Analysis (FMEA)

Using FMEA in your risk assessment process, you can proactively address potential problems, ensuring your business operations run as smoothly as you planned. It’s all about preparing for the worst while striving for the best.

8. Risk-Benefit Analysis (RBA)

The risk-benefit analysis allows you to make informed decisions, balancing the potential for gain against the potential for loss. It helps you choose the best path, even when the way forward isn’t entirely clear. This tool is a systematic approach to understanding the specific business risk and benefits associated with a decision, process, or project.

9. Cost-Benefit Analysis

By conducting a cost-benefit analysis as a part of your risk assessments, you can make data-driven decisions that consider both the possible risks (costs) and rewards (benefits). This approach provides a clear picture of the potential return on investment, enabling more effective and confident decision-making.

These techniques and tools allow you to conduct a comprehensive risk analysis for your business plan.

Mitigating and Managing Risks in a Business Plan

Identifying risks in your business plan is only the first step. To ensure the success of your venture, it is crucial to develop effective risk mitigation and management strategies. Here are some critical steps to consider:

- Risk avoidance : Some risks may be too high to justify taking. In such cases, consider avoiding these risks altogether by adjusting your business plan or exploring alternative strategies.

- Risk transfer : Transferring risks to third parties, such as insurance companies or outsourcing partners, can help mitigate their impact on your business. Evaluate opportunities for risk transfer and consider appropriate insurance coverage.

- Risk reduction : Implement measures to reduce the likelihood and impact of identified risks. This may involve improving internal processes, implementing safety protocols, or diversifying your supplier base .

- Risk acceptance : Some risks may be unavoidable or negatively impact your business. In such cases, accepting the risks and developing contingency plans can help minimize their impact.

In conclusion, a comprehensive risk analysis is essential for identifying, assessing, and managing different types of risk that could impact your success.

Conducting a thorough risk analysis can safeguard your business’s interests, capitalize on opportunities, and increase your chances of long-term success.

Related Posts

How to Write a Business Plan in 36 Steps

Risk Tolerance in Entrepreneurship: A Guide to Successful Business

Business Goals Questions to Develop SMART Goals

Risk Management Guide: Everything You Need to Know About Business Risk

Start typing and press enter to search.

A complete guide to the risk assessment process

Lucid Content

Reading time: about 7 min

Mark Zuckerberg, the founder of Facebook, once said, “The biggest risk is not taking any risk. In a world that's changing really quickly, the only strategy that is guaranteed to fail is not taking risks.”

While this advice isn't new, we think you’ll agree that there are some risks your company doesn’t want to take: Risks that put the health and well-being of your employees in danger.

These are risks that aren’t worth taking. But it’s not always clear what actions, policies, or procedures are high-risk.

That’s where a risk assessment comes in.

With a risk assessment, companies can identify and prepare for potential risks in order to avoid catastrophic consequences down the road and keep their personnel safe.

What is risk assessment?

During the risk assessment process, employers review and evaluate their organizations to:

- Identify processes and situations that may cause harm, particularly to people (hazard identification).

- Determine how likely it is that each hazard will occur and how severe the consequences would be (risk analysis and evaluation).

- Decide what steps the organization can take to stop these hazards from occurring or to control the risk when the hazard can't be eliminated (risk control).

It’s important to note the difference between hazards and risks. A hazard is anything that can cause harm , including work accidents, emergency situations, toxic chemicals, employee conflicts, stress, and more. A risk, on the other hand, is the chance that a hazard will cause harm . As part of your risk assessment plan, you will first identify potential hazards and then calculate the risk or likelihood of those hazards occurring.

The goal of a risk assessment will vary across industries, but overall, the goal is to help organizations prepare for and combat risk. Other goals include:

- Providing an analysis of possible threats

- Preventing injuries or illnesses

- Meeting legal requirements

- Creating awareness about hazards and risk

- Creating an accurate inventory of available assets

- Justifying the costs of managing risks

- Determining the budget to remediate risks

- Understanding the return on investment

Businesses should perform a risk assessment before introducing new processes or activities, before introducing changes to existing processes or activities (such as changing machinery), or when the company identifies a new hazard.

The steps used in risk assessment form an integral part of your organization’s health and safety management plan and ensure that your organization is prepared to handle any risk.

Preparing for your risk assessment

Before you start the risk management process, you should determine the scope of the assessment, necessary resources, stakeholders involved, and laws and regulations that you’ll need to follow.

Scope: Define the processes, activities, functions, and physical locations included within your risk assessment. The scope of your assessment impacts the time and resources you will need to complete it, so it’s important to clearly outline what is included (and what isn’t) to accurately plan and budget.

Resources : What resources will you need to conduct the risk assessment? This includes the time, personnel, and financial resources required to develop, implement, and manage the risk assessment.

Stakeholders: Who is involved in the risk assessment? In addition to senior leaders that need to be kept in the loop, you’ll also need to organize an assessment team. Designate who will fill key roles such as risk manager, assessment team leader, risk assessors, and any subject matter experts.

Laws and regulations: Different industries will have specific regulations and legal requirements governing risk and work hazards. For instance, the Occupational Safety and Health Administration (OSHA) sets and enforces working condition standards for most private and public sectors. Plan your assessment with these regulations in mind so you can ensure your organization is compliant.

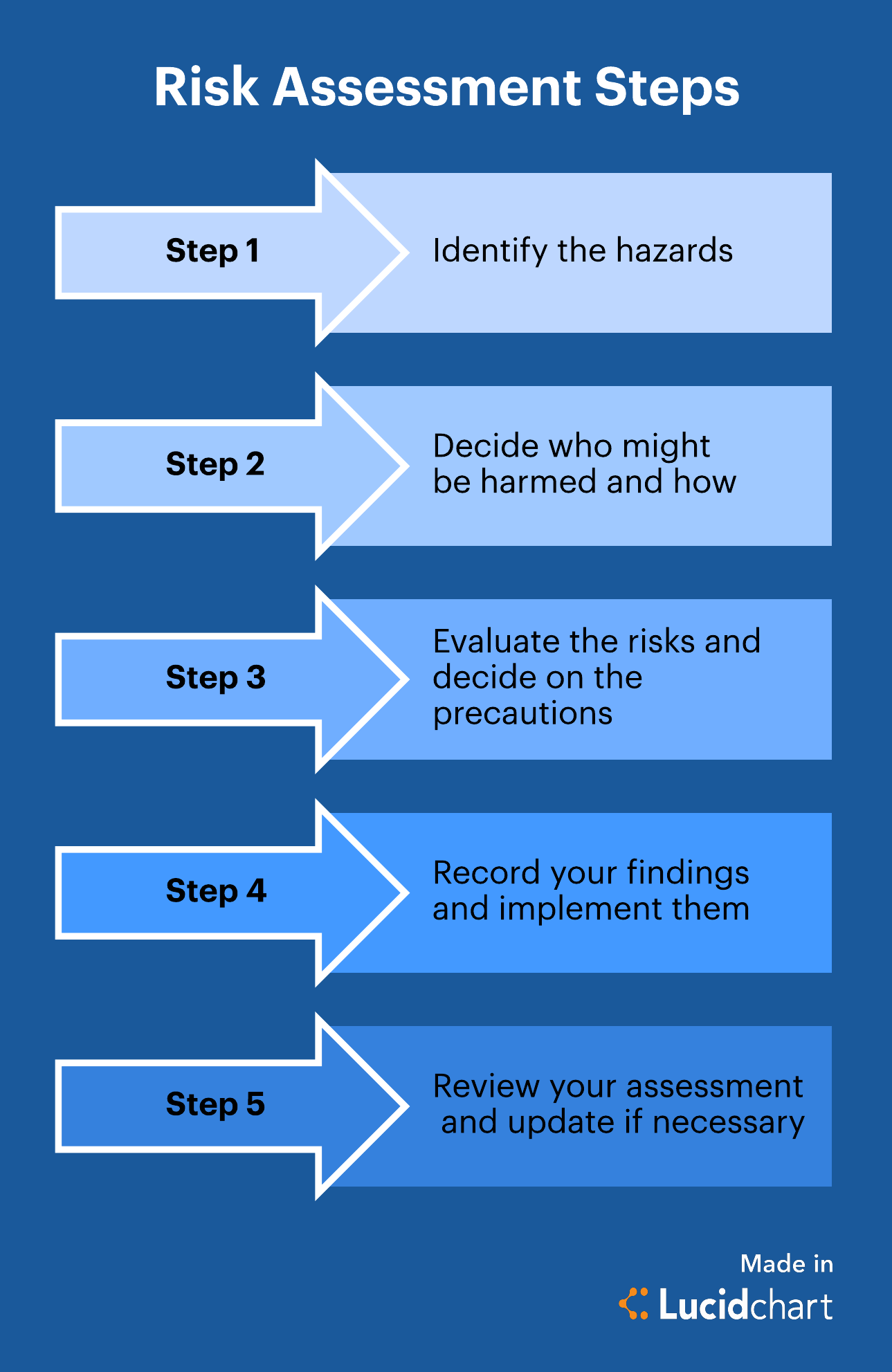

5 steps in the risk assessment process

Once you've planned and allocated the necessary resources, you can begin the risk assessment process.

Proceed with these five steps.

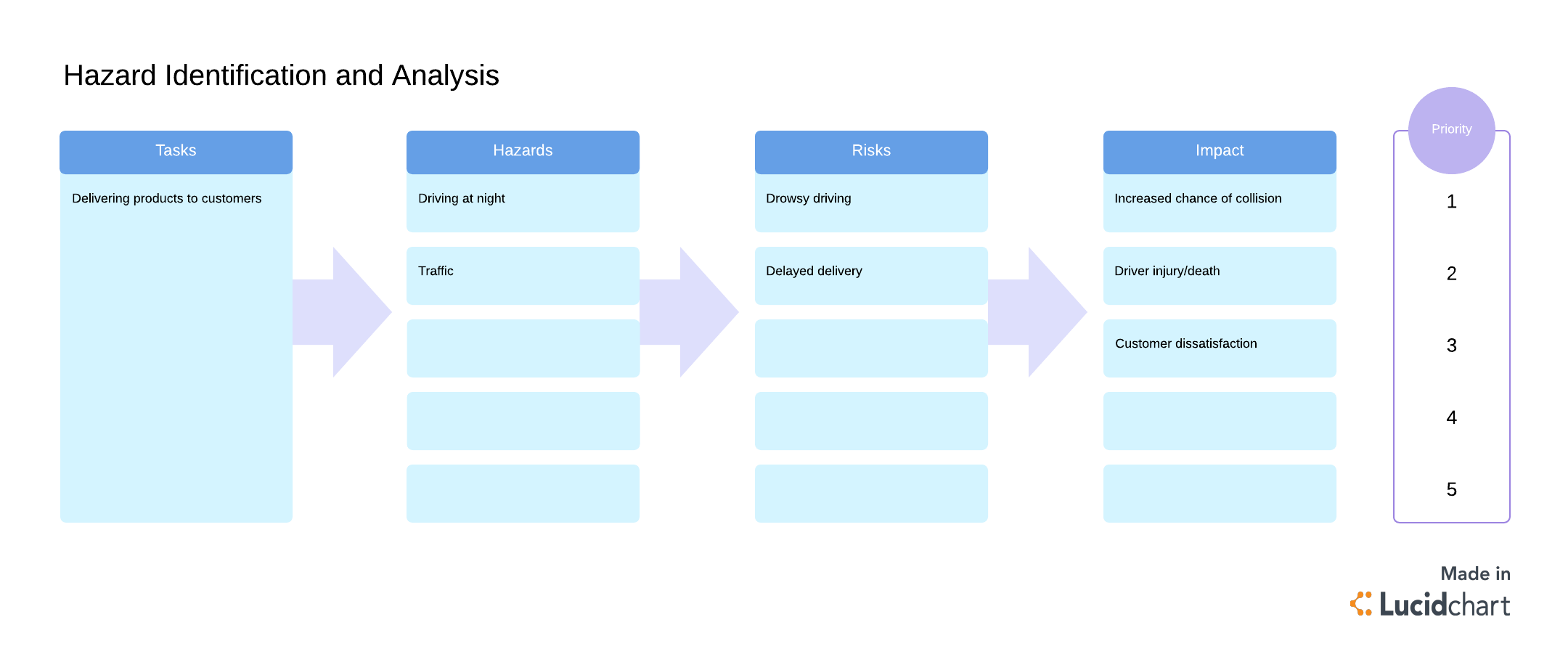

1. Identify the hazards

The first step to creating your risk assessment is determining what hazards your employees and your business face, including:

- Natural disasters (flooding, tornadoes, hurricanes, earthquakes, fire, etc.)

- Biological hazards (pandemic diseases, foodborne illnesses, etc.)

- Workplace accidents (slips and trips, transportation accidents, structural failure, mechanical breakdowns, etc.)

- Intentional acts (labor strikes, demonstrations, bomb threats, robbery, arson, etc.)

- Technological hazards (lost Internet connection, power outage, etc.)

- Chemical hazards (asbestos, cleaning fluids, etc.)

- Mental hazards (excess workload, bullying, etc.)

- Interruptions in the supply chain

Take a look around your workplace and see what processes or activities could potentially harm your organization. Include all aspects of work, including remote workers and non-routine activities such as repair and maintenance. You should also look at accident/incident reports to determine what hazards have impacted your company in the past.

Use Lucidchart to break down tasks into potential hazards and assets at risk—try our free template below.

2. Determine who might be harmed and how

As you look around your organization, think about how your employees could be harmed by business activities or external factors. For every hazard that you identify in step one, think about who will be harmed should the hazard take place.

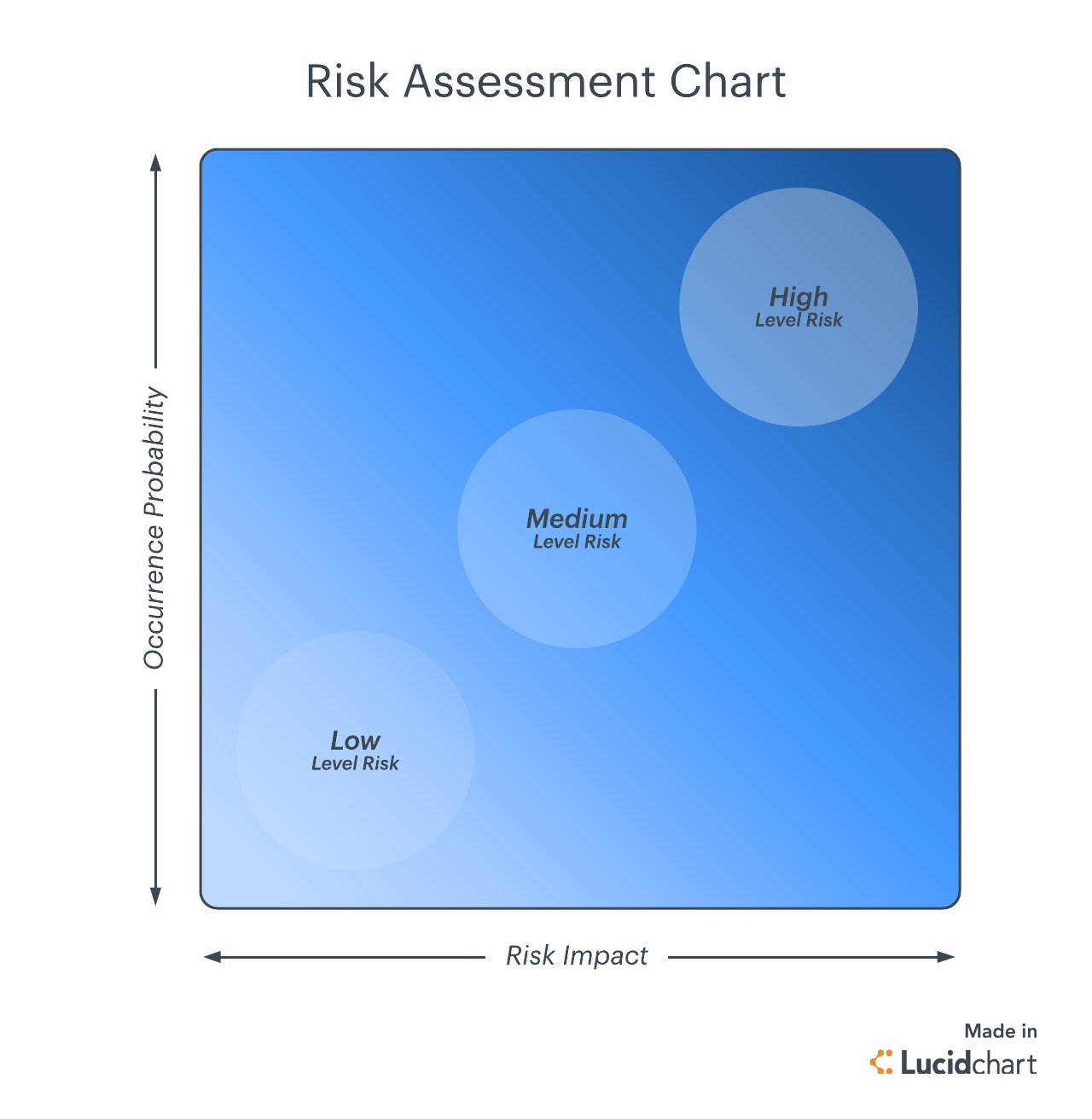

3. Evaluate the risks and take precautions

Now that you have gathered a list of potential hazards, you need to consider how likely it is that the hazard will occur and how severe the consequences will be if that hazard occurs. This evaluation will help you determine where you should reduce the level of risk and which hazards you should prioritize first.

Later in this article, you'll learn how you can create a risk assessment chart to help you through this process.

4. Record your findings

If you have more than five employees in your office, you are required by law to write down your risk assessment process. Your plan should include the hazards you’ve found, the people they affect, and how you plan to mitigate them. The record—or the risk assessment plan—should show that you:

- Conducted a proper check of your workspace

- Determined who would be affected

- Controlled and dealt with obvious hazards

- Initiated precautions to keep risks low

- Kept your staff involved in the process

5. Review your assessment and update if necessary

Your workplace is always changing, so the risks to your organization change as well. As new equipment, processes, and people are introduced, each brings the risk of a new hazard. Continually review and update your risk assessment process to stay on top of these new hazards.

How to create a risk assessment chart

Even though you need to be aware of the risks facing your organization, you shouldn’t try to fix all of them at once—risk mitigation can get expensive and can stretch your resources. Instead, prioritize risks to focus your time and effort on preventing the most important hazards. To help you prioritize your risks, create a risk assessment chart.

The risk assessment chart is based on the principle that a risk has two primary dimensions: probability and impact, each represented on one axis of the chart. You can use these two measures to plot risks on the chart, which allows you to determine priority and resource allocation.

Be prepared for anything

By applying the risk assessment steps mentioned above, you can manage any potential risk to your business. Get prepared with your risk assessment plan—take the time to look for the hazards facing your business and figure out how to manage them.

Now it's time to create your own risk management process, here are five steps to get you started.

About Lucidchart

Lucidchart, a cloud-based intelligent diagramming application, is a core component of Lucid Software's Visual Collaboration Suite. This intuitive, cloud-based solution empowers teams to collaborate in real-time to build flowcharts, mockups, UML diagrams, customer journey maps, and more. Lucidchart propels teams forward to build the future faster. Lucid is proud to serve top businesses around the world, including customers such as Google, GE, and NBC Universal, and 99% of the Fortune 500. Lucid partners with industry leaders, including Google, Atlassian, and Microsoft. Since its founding, Lucid has received numerous awards for its products, business, and workplace culture. For more information, visit lucidchart.com.

Related articles

5 steps to any effective risk management process.

While you can’t entirely avoid risk, you can anticipate and mitigate risks through an established risk management process. Follow these steps!

5 steps of the strategic planning process

Implement the strategic planning process to make measurable progress toward achieving your company’s vision and make decisions that will keep you on the path to success for years to come.

Bring your bright ideas to life.

or continue with

By registering, you agree to our Terms of Service and you acknowledge that you have read and understand our Privacy Policy .

- Sign up for free

- SafetyCulture

- Risk Analysis

Risk Analysis: A Comprehensive Guide

Everything you need to know about risk analysis: its components, types, and methods, as well as examples and steps on how to perform risk analysis

What is Risk Analysis?

Risk analysis is a multi-step process aimed at mitigating the impact of risks on business operations. Leaders from different industries use risk analysis to ensure that all aspects of the business are protected from potential threats. Performing regular risk analysis also minimizes the vulnerability of the business to unexpected events.

Difference Between Risk Assessment and Risk Analysis

Risk assessment is just one component of risk analysis. The other components of risk analysis are risk management and risk communication. Risk management is the proactive control and evaluation of risks while risk communication is the exchange of information involving risks. Unlike risk analysis, risk assessment is primarily focused on safety and hazard identification .

Risk Analysis Framework

Types of Risk Analysis

As risk analysis covers a wide range of topics, there are many approaches to analyzing risks or types of risk analysis. These include, but are not limited to, the following:

- Risk Benefit & Cost Benefit Analysis A risk benefit analysis involves weighing the pros and cons (benefits and risks) of an action. Elements are ranked and evaluated against the impact of their potential success or failure. Meanwhile, a cost benefit analysis sums the projected or estimated costs of an action and weighs the total cost against the potential benefits and opportunities.Both types of analysis help leaders carefully weigh their decision in pursuing a plan or action. Choosing to pursue a risk-heavy or cost-heavy action can result in losses.

- Needs Assessment A needs assessment is a systematic process of identifying and evaluating organizational needs and gaps. It gives leaders an idea of where the business may be lacking and helps them refocus resources towards achieving goals more efficiently.

- Business Impact Analysis A business impact analysis entails planning for operational disruptions caused by natural disasters and other external factors. It is the basis for investment in recovery, prevention, and mitigation strategies.

- Failure Mode and Effect Analysis A failure mode and effects analysis is a systematic method of anticipating potential failures in business processes and mitigating their impact on customers. It improves product and service reliability and reduces the cost of failures.

- Root Cause Analysis A root cause analysis focuses on identifying and eliminating root causes to solve problems. It helps in the prevention of recurring problems by targeting the ineffective systems behind them. Aside from failure mode and effects analysis, other root cause analysis tools are 5 Whys , 8D , and DMAIC (part of Six Sigma ).

Risk Analysis Methods

There are two main risk analysis methods. The easier and more convenient method is qualitative risk analysis. Qualitative risk analysis rates or scores risk based on the perception of the severity and likelihood of its consequences. Quantitative risk analysis , on the other hand, calculates risk based on available data.

Types of risk analysis associated with qualitative risk analysis are all root cause analysis (RCA) tools except for failure mode and effects analysis, needs assessment, and risk matrix. Furthermore, the most common types of the latter are the 3×3 risk matrix, 4×4 risk matrix, and 5×5 risk matrix .

Risk Assessment Matrix | SafetyCulture

Types of risk analysis included in quantitative risk analysis are business impact analysis (BIA), failure mode and effects analysis (FMEA), and risk benefit analysis.

A key difference between qualitative and quantitative risk analysis is the type of risk each method results in. For qualitative risk analysis, this is projected risk, which is an estimation or guess of how the risk will manifest. Meanwhile, quantitative risk analysis deals with statistical risk. Unlike projected risk, statistical risk is specific and verified. For this reason, it’s often used in the calculation of insurance premiums.

Risk Analysis Example

Though risk analysis is used across industries by businesses of all sizes and types, some leaders may find a risk analysis example that’s specific to their industry more helpful than a generic one. Here are risk analysis examples for three major industries: construction, transport & logistics, and manufacturing.

Construction Risk Analysis Example : The owner of a construction company was presented with a project proposal to build a luxury resort. While pursuing this project may lead to good press for the company, the owner is hesitant to accept the project because her company specializes in mid-range residential buildings. Taking on this project would be both a leap and a challenge. Before making a final decision, she performs a risk-benefit analysis together with her team to see if the benefits of pursuing this project outweigh the risks.

Transport & Logistics Risk Analysis Example : The director of a multinational shipping company is anxious about the impact an upcoming storm will have on business operations. She believes the company should set aside some money for recovery after the storm hits. Her colleague, however, thinks differently. He argues that the storm won’t affect them that much. To convince her colleague and fellow directors, she performs a business impact analysis and presents its results in the next board meeting.

Manufacturing Risk Analysis Example : A newly hired manager is in charge of preparing a factory and its workers for a large influx of customer orders due to the summer season. To get an understanding of what he needs to do for this factory to succeed in producing enough units, he performs a quick needs assessment by asking the workers to fill out a survey on the factory’s processes.

How to Perform Risk Analysis

For leaders who have already decided on the type of risk analysis to perform, here are steps and instructions on how to perform risk analysis for each type:

How to Perform Needs Assessment

- Step 1: Identify requirements – What must the business deliver to succeed?

- Step 2: Assess existing resources – What can be used to achieve success?

- Step 3: Identify needs – What does the business lack that is critical to success?

- Step 4: Develop a plan of action – What must be done to fill the gaps and succeed?

Needs Assessment Template

Use this digital template to identify business/department, performance, and learning needs. It has all the tools leaders need to improve the management of their businesses.

How to Perform Business Impact Analysis

- Step 1: Gather information on business processes, finances, and management.

- Step 2: Identify Recovery Time Objective (RTO) or how long it takes to restore business processes after disruption. RTO helps determine how long the business can function without normal business processes.

- Step 3: Identify Recovery Point Objective (RPO) or the acceptable loss to customers when a disruption occurs. RPO helps determine the estimated financial impact on the business.

- Step 4: Develop workaround procedures of the business in the event of disruption.

- Step 5: Decide business needs based on the information gathered in previous steps.

Business Impact Analysis Template

Use this digital template to assess the impact of possible disruptive events across key business functions. This template includes an assessment of losses in terms of operational activities and revenue. Leaders can use it to prioritize functions for recovery during crises.

How to Perform Failure Mode and Effects Analysis

- Step 1: Identify mechanism of failure

The mechanism of failure (potential failure modes, effects, and causes) can be identified properly when leaders in charge of FMEAs account for past failures, agree upon certain assumptions, and establish ground rules.

- Step 2: Determine RPN

The risk priority number is used to prioritize the potential failures that require additional planning. It’s a product of three factors: severity, occurrence, and detection.

FMEA: RPN Risk Analysis | SafetyCulture

Leaders should focus their improvement efforts on potential failures at the top 20% of the highest RPNs. These high-risk failure modes must be addressed through effective action plans.

- Step 3: Follow-up on actions

After establishing and executing effective action plans, leaders should remember to continuously review these plans and the high-risk failure modes they address.

Failure Mode and Effects Analysis Template

Use this digital template to identify problems in processes or products. Describe the potential failure effect, the potential cause, and current controls. Add the severity, occurrence, and detection ratings. Finally, record the RPN and sign-off.

How to Perform Root Cause Analysis

- Step 1: Define the problem – In the context of risk analysis, a problem is an observable consequence of an unidentified risk or root cause.

- Step 2: Select a tool – 5 Whys , 8D , or DMAIC

5 Whys involves asking the question “why” five times. Though 5 Whys is the easiest to use, it can also oversimplify problems. 8D stands for the eight disciplines of problem-solving. While 8D provides long-term solutions, performing it correctly requires extensive training .

DMAIC, on the other hand, is more comprehensive than 5 Whys, but also relatively easier to perform than 8D, especially if the third step (Analyze) is simplified.

- Step 3: Implement actions – Address root cause/s identified using the tool selected in the previous step by creating and implementing actions. These actions should be specific and directed to the person/s most capable of executing them.

Root Cause Analysis Template

Use this digital template to analyze a recurring problem and its effect on productivity. List reasons why the problem occurs and rate how likely they are to be root causes. Once a root cause has been identified, choose its category and provide a prevention strategy.

For leaders who haven’t decided on a specific type or want a general outline of how to perform risk analysis, refer to the steps below:

- Set the goal for risk analysis

- Collect data to identify risks

- Add values to risks

- Identify highest-priority risks

- Develop a plan to mitigate these risks

- Follow through with the plan

- Review the effectiveness of the plan

Create a Risk Analysis Template

Eliminate manual tasks and streamline your operations.

How to Manage and Communicate Risks

One way to manage risks effectively is to use the ISO 31000 standard. ISO 31000 is an internationally recognized benchmark for risk management. It can be summarized into three guiding rules for leaders to follow:

- Risk management must be structured, innovative, inclusive, dynamic, continuously improving, and customized to fit business objectives.

- Leaders must proactively integrate risk management on all levels of the business.

- Risk management policies and practices should support open risk communication.

Another key aspect of using ISO 31000 is to ensure that all employees are familiar with the standard and/or have received related training on how to apply the standard in their work. While leaders should take responsibility for the overall risk management, they should be careful to not alienate employees from this process. Without the support and input of employees, implementing ISO 31000 will be much harder than it needs to be.

Improve your GRC management

Simplify risk management and compliance with our centralized platform, designed to integrate and automate processes for optimal governance.

ISO 31000:2018 Risk Management Template

Use this digital template to establish a solid risk management framework based on ISO 31000. Show leadership by making a commitment to risk management. Share the responsibility of managing risks with other stakeholders in the business, including employees.

Though adhering to the ISO 31000 standard is recommended, this can seem intimidating or overly complicated for smaller businesses or those with less resources to spend on risk management. A temporary alternative is to use a risk management plan , which should have the following parts:

- Descriptions of all identified risks, their consequences, and possible causes

- A model for estimating the likelihood and severity of consequences (risk analysis)

- Corrective actions to target possible causes or to lessen the severity of consequences

When using a risk management plan , it can be helpful to have a risk management plan template that’s easy to distribute to employees and update when needed. Without a template, it can be difficult to use or create a risk management plan for the entire business.

Risk Management Plan Template

Use this digital template to assess the likelihood and severity of consequences. Specify planned mitigation strategies and the employee/s responsible for executing them. Give the estimated cost and timeline of mitigation actions.

Manage Risks with SafetyCulture (formerly iAuditor)

SafetyCulture is a digital inspection platform businesses can use to identify, analyze, communicate, and manage risks effectively. Together with Mitti, a technology-first insurance company, SafetyCulture rewards businesses that are proactive in managing their risks.

SafetyCulture Platform for Teams

Why use safetyculture.

Minimize your business’ vulnerability to unexpected events and potential threats with a digital tool like SafetyCulture .

✓ Simplify processes with digital checklists ✓ Receive professional reports and share instantly ✓ Use for teams of any size

Streamline your organization’s operations and workflow with our digital checklist. It empowers you to:

- Maintain safety and compliance standards with customizable templates

- Increase your team’s engagement and accountability including contractors and stakeholders

- Create powerful workflows by integrating your existing software

- Gain greater visibility and transparency with real-time reporting

- Access unlimited storage and data security for your reports

Take advantage of our comprehensive features to optimize your operations and enhance workplace safety today.

FAQs about Risk Analysis

What are the 4 components of risk analysis.

The four components of risk analysis are hazard identification, risk assessment, risk management, and risk communication. The risk analysis process follows a general format but can differ based on the needs of an organization or which structure works for them.

What is a risk analysis checklist?

A risk analysis checklist or template is a document that you can use to verify that all aspects of a project or business are analyzed for potential risks. Utilizing this kind of tool helps ensure that nothing was overlooked and also helps maintain a standardized approach when it comes to managing risks.

What is the most commonly used technique for risk analysis?

The most commonly used technique for risk analysis is through the use risk matrix. It is a simple yet effective method that helps assess and prioritize risks based on their likelihood of occurrence and potential impact on a project or business. The risk matrix is typically represented with a visual aid or chart.

SafetyCulture Content Team

Related articles

- Hazard Elimination

Explore the importance of hazard elimination across industries and understand the strategies that solve critical safety issues for employee protection, long-term operational benefits, and sustainable financial success.

- Find out more

- Layer of Protection Analysis

Discover the key aspects of and strategies for LOPA to effectively evaluate and enhance safety systems in high-risk industries.

- Dust Hazard Analysis

Explore the essential components of DHA, its significance, and the strategies for ensuring industrial safety.

Related pages

- Hazard Assessment Software

- Process Hazard Analysis Software

- EHS Risk Assessment Software

- Integrated Risk Management Software

- Operational Risk Management Software

- Reputational Risk

- Reputation Management

- Safety Improvement Plan Template

- Contract Risk Assessment Checklist

- Point of Work Risk Assessment Template

- 7 Best Risk Assessment Templates

- 5×5 Risk Matrix Template

A Sample Template for Conducting Business Risk Assessment

By: Author Tony Martins Ajaero

Home » Starting a Business » Conduct Feasibility Study

How do you conduct a risk assessment on an idea when writing a business plan? Or you need a sample business risk assessment template? I advice you read on. Every business involves some risks. This may be little or much depending on the type of business as well as many other market factors.

Identifying, outlining, and assessing the risks involved in a new business and developing strategies to manage those risks is an important, in fact indispensable step to take when planning a new business.

The Importance of Conducting Business Risk Assessment

By understanding potential risks to your business and outlining strategies to cushion their effects, you will help your business recover quickly if an unexpected incident occurs. For instance, a risk assessment will unveil workplace risks that you or your employees are exposed to. And it will help you meet your legal obligation for providing a safe workplace and reducing the likelihood of workplace mishaps that can impact negatively on your business.

Suggested for You

- How to Do Market Research on an idea Before Starting a Business

- How to Do Feasibility Study for a Business and Write a Report

- Difference Between a Feasibility Study Report and a Business Plan

- 10 Factors to Consider When Choosing a Business Location

- 5 Conditions That Makes a Business Opportunity Feasible

Types of risk vary from business to business, but conducting a risk assessment and preparing a risk management plan involve a process that is common to all business. It goes without saying that the first step to take when conducting a risk assessment is to identify potential risks to your business. Understand the scope of potential risks will help you come up with realistic and cost-effective strategies for handling them.

When considering the types of risks that your business is prone to, it is very important that you think broadly. This is where many people go wrong in their risk assessment; they focus only on the obvious concerns like fire, theft, competition, etc. without paying attention to subtle but equally dangerous concerns.

Assessing your Business for Possible Risks

Only after assessing your business can you successfully identify the risks associated with it. Start by thinking about your critical business activities, which includes your main services, your resources, your employees and factors that could affect them or their work.

These factors include natural disasters, accidents, power failures, and illness. By assessing your business this way, you can work out those aspects that are indispensable to your business.

Conducting Business Risk Assessment – A Sample Template

After assessing your business to get a clear picture of it, you can start identifying the risks involved. Go through your business plan to see those things your business cannot do without, and list some possible risk factors that could cripple those indispensable things. Asking yourself the following questions will be of great help:

- How, why, when, and where are the risks likely to happen in my business?

- Are the risks coming from within or from external sources?

- Who might be affected if an incident occurs?

Don’t just think of what answers you have to these questions, write down your answers. Then start asking yourself as many “what if” questions as you can, using the various risks you have in your list? The following are examples of such questions:

- What if power supply ceases suddenly?

- What if key documents are destroyed?

- What if vital information gets lost due to hard disk crashes or virus attacks?

- What if an intruder gains access to confidential information?

- What if one of your best employees quit suddenly?

- What if your competitors reduced the prices of their products by half?

- What if your suppliers went out of business?

- What if the area you have your business in is affected by a natural disaster?

Also write down your answers to these questions. By now, your risk assessment is gradually taking a good shape. But you are not done yet. After identifying the potential risks to your business, brainstorm with other people, such as your financial adviser, accountant, staff, and other interested parties. This will help you get many more perspectives on risks to your business.

Aside the ones you have listed, think about the events that have affected other businesses already in market, especially your competitors. What factors led to those events? What were the outcomes of those events? Don’t you see them happening to your business, too ? Answer these questions, and you will be able to identify even more risks that may be from external sources.

Don’t forget to identify each step involved in your work processes and outline the associated risks. Think of what factors could hamper each step and how this could affect the rest of the process. Once you have identified the risks associated with your business as explained above, you will need to analyze the likelihood and consequences of each, and come up with options for managing them.

After completing your rough draft, review it, and reproduce it in a better and more presentable format.

- <a title="How to Develop a Marketing Strategy" Go to Chapter 10: W riting a Marketing Plan

- <a title="Business Plan Competitive Market Analysis" Go Back to Chapter Nine Part B: Conducting Competitive Market Analysis

- <a title="Writing your Business Plan Company's Profile" Go Back to Chapter 8: W riting your Company’s Profile

- <a title="The Beginner’s Guide to Writing a Good Business Plan" Go Back to Introduction and Table of Content

IMAGES

VIDEO

COMMENTS

What sets a strategic risk assessment apart from other risk assessment methods is that it is driven by the business’s core strategies. Get up to speed on strategic risk assessment with a checklist, template, and examples below.

Whether you’re a startup founder preparing a business plan or a seasoned entrepreneur looking to reassess your risk management approach, this guide will equip you with the knowledge and tools to navigate the complex landscape of business risks.

Continuity risk assessment. On-going governance, awareness, maintenance & improvement. Plan training & exercising.

Meeting legal requirements. Creating awareness about hazards and risk. Creating an accurate inventory of available assets. Justifying the costs of managing risks. Determining the budget to remediate risks. Understanding the return on investment.

Learn about risk analysis, its types and methods, and how you can use risk analysis to protect your business from potential threats.

Conducting Business Risk Assessment – A Sample Template. After assessing your business to get a clear picture of it, you can start identifying the risks involved. Go through your business plan to see those things your business cannot do without, and list some possible risk factors that could cripple those indispensable things.