- Options Income Mastery

- Accelerator Program

What Is A Calendar Spread?

3,500 word guide, options trading 101 - the ultimate beginners guide to options.

Download The 12,000 Word Guide

Calendar spreads are a fantastic option trade as you’re about to find out. They can provide a lot of flexibility and variation to your portfolio.

Introduction

Maximum loss, maximum gain, breakeven price, payoff diagram.

- Risk of Early Assignment

How Volatility Impacts The Trade

How theta impacts the trade, calendar spread vs diagonal spread, calendar spread vs iron butterfly, calendar spread vs short straddle, trade management, short-term vs long-term calendar spreads, winning examples, losing examples.

A calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods.

It is sometimes referred to as a horiztonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread.

A standard set up would involve selling the front-month option and buying an option in the next expiry period or further out in time. The trade can also be set up using weekly options.

The further out in time the trader goes to buy the option, the more expensive the trade will be.

Usually traders would set this as an at-the-money spread, but they can also be set up as directional trades with either a bullish or bearish outlook.

Generally if trading a bullish spread I would use calls and for a bearish calendar spread I would use puts. This helps reduce the risk of early assignment.

A calendar spread is a long volatility trade so tends to benefit from rising volatility after the trade is placed.

When the market is in Backwardation can be a good time to enter calendar spreads because the front month volatility is higher than the back month.

In some respects at-the-money calendars are a bit of an oxymoron because it’s a neutral trade that does well if the stock stays flat, but it’s also a long volatility trade which benefits from increased volatility.

The main premise with the trade is that the short-dated options that are sold will experience faster time decay than their longer-dated counterpart. As long as the underlying asset stays inside the profit zone, the trade should do well.

A calendar spread is a debit spread and as such the maximum that the trader can lose is the amount paid to enter the trade.

The sold option is shorter-dated and therefore cheaper than the long-dated option that is being bought which results in a net debit for the trader.

A calendar spread has a similar shaped payoff diagram to a short straddle but the maximum loss is limited whereas the maximum loss on the short straddle is theoretically unlimited.

With a calendar spread, the underlying stock would need to make a pretty big move for the trade to suffer a full loss.

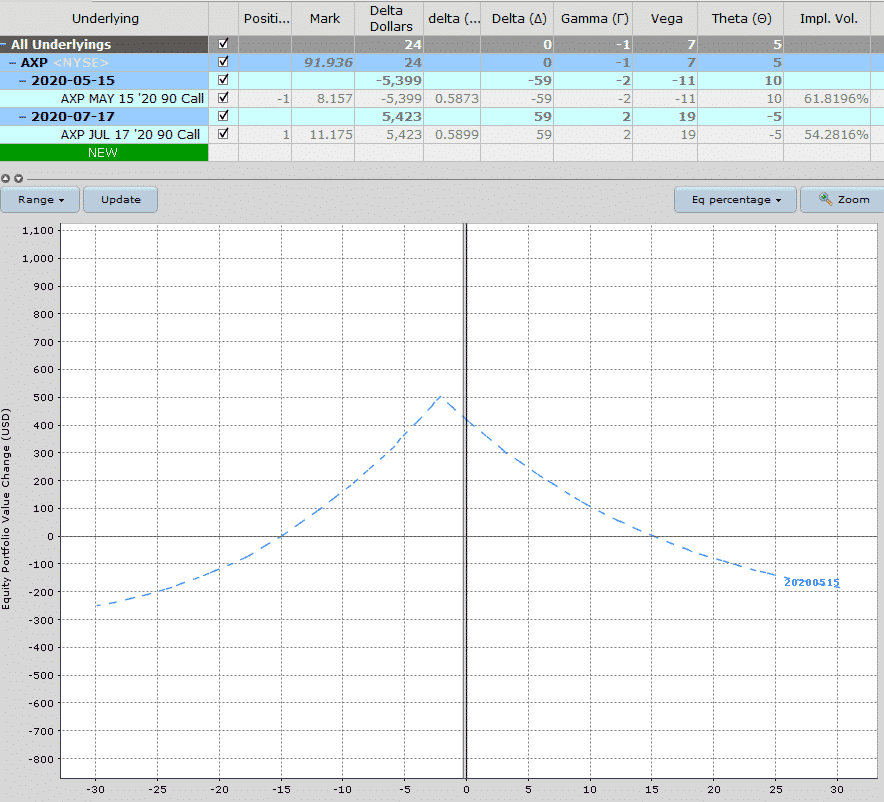

Looking at this example on AXP, the stock would need to have a 30% down move or 25% up move before suffering the maximum loss. Usually traders would adjust or close long before then.

The maximum gain on a calendar spread can’t actually be worked out in advance because it’s impossible to know what the back-month option will be trading for when the front-month option expires.

This is due to changes in implied volatility.

The ideal scenario for the trade is that the stock ends near the short strike at the expiration of the near-term option.

Ideally this would be associated with an increase in implied volatility in the back-month option.

The increase in implied volatility in the back-month helps to offset any negative effects from time decay.

Some traders like to hold the long call as a stand-alone trade after the short call expires. The expired short call helps offset the cost of the long call.

Another idea is to make the trade a “campaign calendar” where the bought option is 3-4 months out and the trader gets the chance to sell 2-3 at-the-money calls over the life of the trade.

Like the maximum gain, the exact breakeven price can’t actually be calculated but we can estimate it.

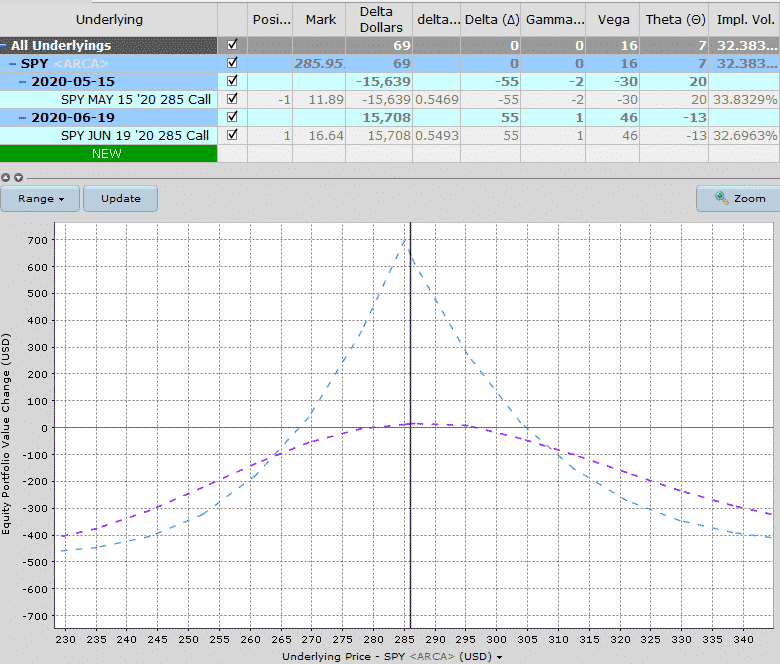

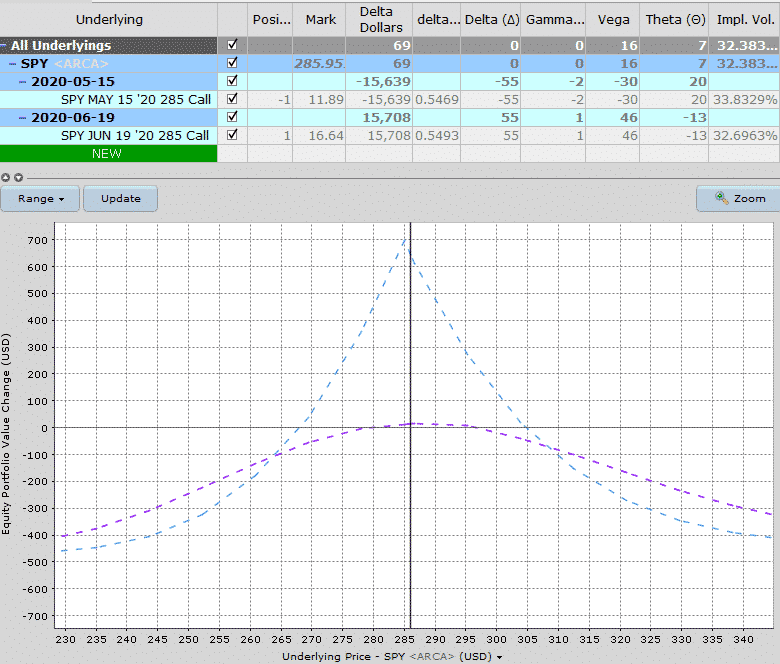

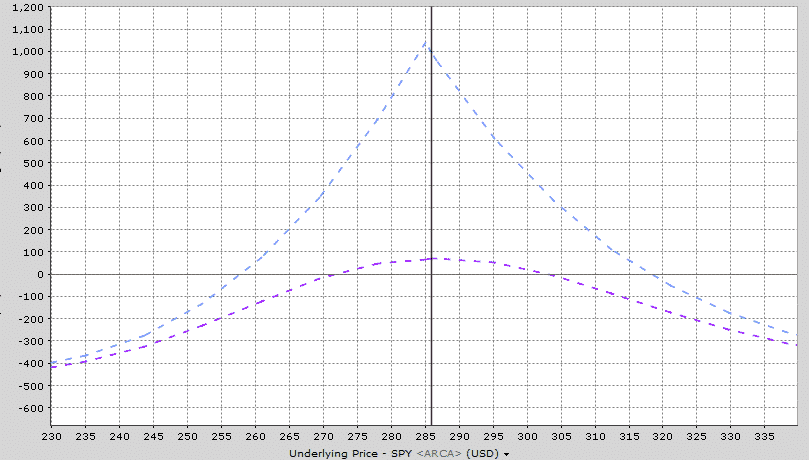

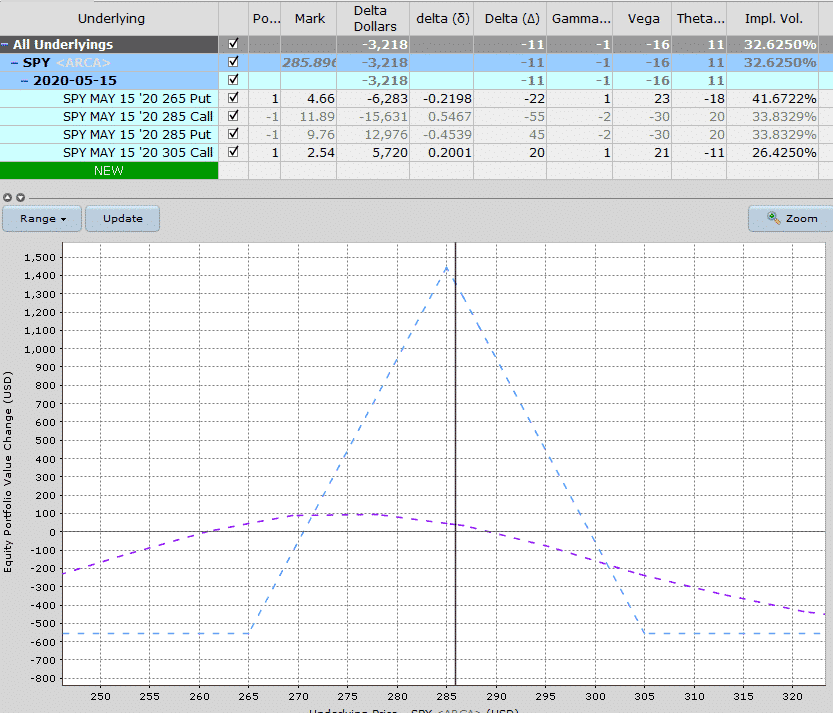

Looking this SPY example, we can see that the breakeven points are estimate around $267 and $305

One theory with calendar spreads is to ensure that the premium paid for the long call is no more than 40% more expensive than the sold option when the strikes are one month apart.

Calendar spreads have a tent shaped payoff diagram similar to what you would see for a butterfly or short straddle.

This sort of shape results in high gamma near expiry which we’ll look at in more detail shortly.

However, the losses tend to flatten out a bit more along the expiration line for calendar spreads vs a butterfly or short straddle.

The payoff diagram below shows a standard setup for an SPY calendar trade. You can see that the total potential profit is estimated at around $700 and the maximum loss is $475.

One thing I tend to do with calendar spreads and setting either an adjustment point or a stop loss is to look at the T+7 line and see where is cuts through the zero line on the x-axis.

That’s where I set my stop loss or adjustment point.

Risk Of Early Assignment

There is always a risk of early assignment when having a short option position in an individual stock or ETF.

You can mitigate this risk by trading Index options , but they are more expensive.

Usually early assignment only occurs on call options when there is an upcoming dividend payment. Traders will exercise the call in order to take ownership of the share before the ex-date and receive the dividend.

Short puts can also be assigned early. The important thing to be aware of is that early assignment generally happens when a short option is in-the-money.

For this reason, if I’m trading directional calendars I use puts for bearish bets and calls for bullish bets. That way the short options are likely to stay out-of-the-money which significantly decreases the chance of early assignment.

Calendar spreads are long vega trades, so generally speaking they benefit from rising volatility after the trade has been placed.

Vega is the greek that measures a position’s exposure to changes in implied volatility. If a position has negative vega overall, it will benefit from falling volatility.

If the position has positive vega, it will benefit from rising volatility. You can read more about implied volatility and vega in detail here .

Looking at the SPY example above, the position starts with a vega of 16. This means that for every 1% rise in implied volatility, the trade should gain $16.

The opposite is true if implied volatility drops – the position would lose $16.

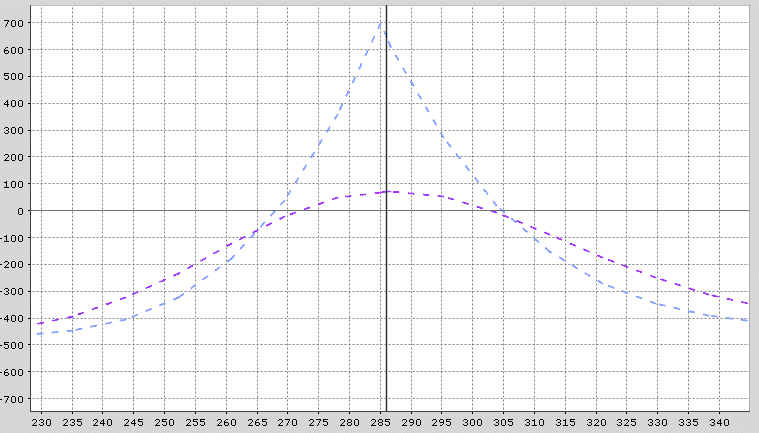

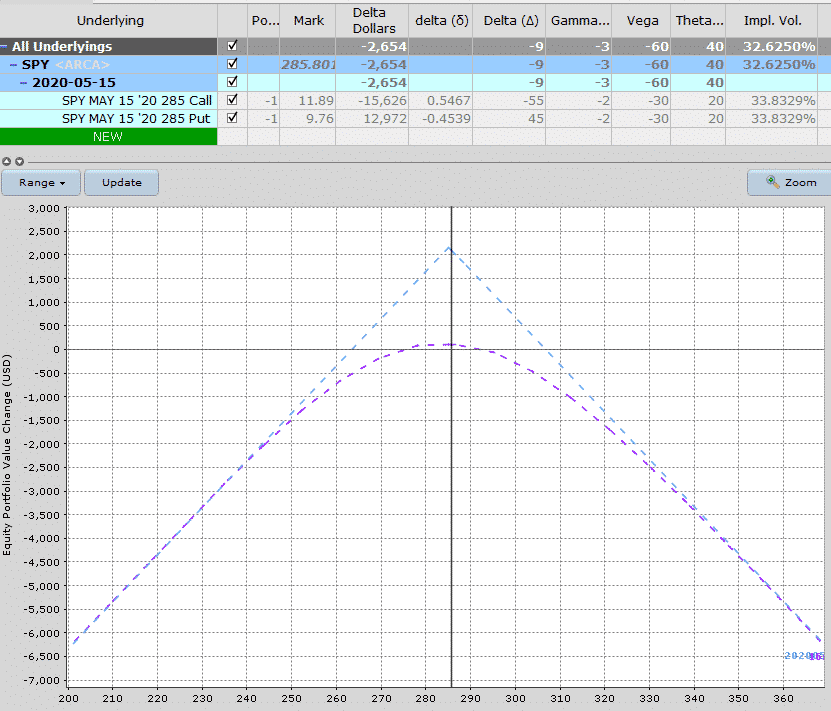

Below is an estimate of what the new payoff diagram looks like assuming a 30% increase in implied volatility. Notice that the maximum gain is now estimated at $1,050 rather than $700.

Of course, the opposite would happen if volatility dropped by 30%.

Calendar Spreads are positive Theta trades in that they make money as time passes, with all else being equal.

This is due to the fact that the short call suffers faster time decay than the bought call.

This is especially true if the bought call is much further out in time (I.e. more than just one month).

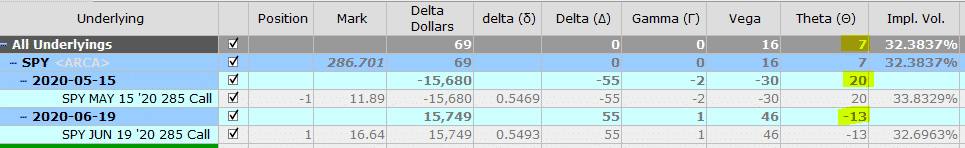

In our SPY example, the trade has positive Theta of 7. This means that, all else being equal, the trade will gain $7 per day due to time decay.

Notice that the positive time decay on the short-term sold call is higher than the time decay being suffered on the longer-dated long call.

We can see this even more if we extend the long call out further in time. This position has overall positive theta of 14 because the December call is only losing $6 per day compared to the June call which was losing $13 per day.

The trade off here is that the December call option costs a lot more requiring the trader to allocate more capital to the trade. But they can turn the trade into a campaign calendar and sell calls against the long call position every month.

Standard calendar spreads are delta neutral, or close to, if placed at-the-money.

The calendar can also be placed with a bullish or bearish bias by placing the spread above or below the current stock price.

Our initial SPY position above had a delta of exactly 0. There is no directional exposure at the initiation of the trade. Of course, that will change as the stock starts to move.

If the stock rallies, the spread will then be below the current price resulting in negative delta.

If the stock falls, the spread will then be above the current price resulting in positive delta.

Calendar spreads are negative gamma. Generally any trade that has a profit tent above the zero line will be negative gamma because they will benefit from stable prices.

Gamma is one of the lesser known greeks and usually, not as important as the others.

I say usually, because you’ll see further down in this post why it can be really important to understand gamma risk .

Calendar spreads maintain a bit of a natural hedge because they are negative gamma, but positive vega.

The ideal scenario is that implied volatility rises (good for positive Vega) but realized volatility remains low (good for negative Gamma).

In other words you want the stock to stay relatively flat, but show a rise in implied volatility (the expectation of future big price moves).

In our SPY example the initial calendar with the long call in June had 0 gamma while the position that used the December long call had gamma of -1.

As you can see, the initial impact of delta and gamma on a calendar spread are pretty low, but that can change as time passes and the stock starts to move.

It goes without saying that as a neutral trade, we have a risk that the price of the underlying will rise or fall sharply causing an unrealized loss, or a realized loss if we close the trade.

Some other risks associated with calendars:

ASSIGNMENT RISK

We talked about this already so won’t go into too much detail here and while this doesn’t happen often it can theoretically happen at any point during the trade.

The risk is most acute when a stock trades ex-dividend.

If the stock is trading well below the sold call, the risk of assignment is very low. E.g. a trader would generally not exercise his right to buy SPY at $280 when SPY is trading at $270 purely to receive a $0.50 dividend.

The risk is highest if the stock is trading ex-dividend and the short call is in the money.

One way to avoid assignment risk is to trade stocks that don’t pay dividends, or trade indexes that are European style and cannot be exercised early.

However, this should not be the primary factor when determining which underlying instrument to trade.

Otherwise, think about closing your calendar before the ex-dividend date if they are close to being in-the-money.

EXPIRATION RISK

Leading into expiration, if the stock is trading just above or just below the short call, the trader has expiration risk.

The risk here is that the trader might get assigned and then the stock makes an adverse movement before he has had a chance to cover the assignment.

In this case, the best way to avoid this risk is to simply close out the spread before expiry.

While it might be tempting to hold the spread and hope that the stock drops and stays below the short call, the risks are high that things end badly.

Sure, the trader might get lucky, but do you really want to expose your account to those risks?

VOLATILITY RISK

As mentioned on the section on the greeks, this is a positive vega strategy meaning the position benefits from a rise in implied volatility.

If volatility falls after trade initiation, the position will likely suffer losses.

The other risk with volatility relates to the volatility curve.

Generally speaking, when volatility rises or falls it has a similar impact across all expiration periods.

However, you could potentially run into a scenario where volatility in the front month rises (bad for the short call) and volatility in the back month drops (bad for the long call).

That would result in a double whammy for the trade.

That scenario may not be that common but it could happen and it’s important that traders understand volatility term structure when placing trades that span different expiration periods.

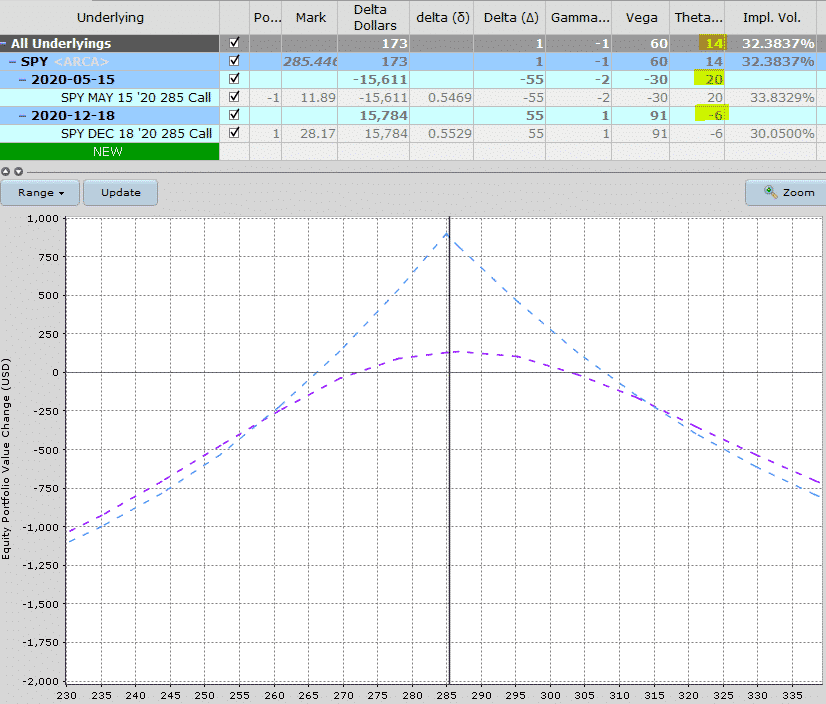

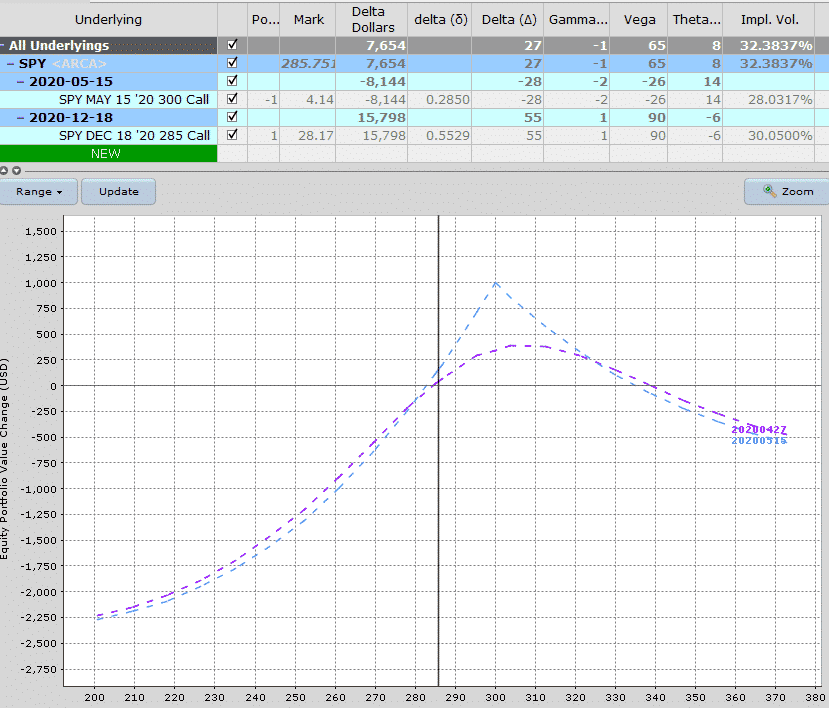

The main difference in a calendar vs a diagonal spread is that you are not trading the same strike price although you are still trading different expiration periods.

A calendar is also a neutral trade, whereas a diagonal spread will have a directional exposure. That could be positive delta or negative delta depending on how the trade is set up.

Looking at the diagonal spread below there is delta of 27 and delta dollars of 7,654. Vega is slightly higher and theta is slightly lower on the diagonal spread vs the calendar.

Calendar spreads and butterfly spreads have quite similar payoff diagrams in that they have the tent shape, but there are slight differences.

The main difference between the two is that butterflies (whether using calls, puts or both) use options in the same expiration period.

For this reason, the maximum gain for a butterfly spread is always known in advance, whereas it’s not possible to know for a calendar because of the potential variation in implied volatility.

A couple of other things to notice when comparing the calendar spread vs the iron butterfly:

1. The profit potential is much higher on the iron butterfly 2. The breakeven points are slightly closer in for the butterfly 3. Even though the iron butterfly is at-the-money, it has slightly negative delta 4. The calendar is positive vega while the iron butterfly is negative vega

Calendar spreads and short straddles also have the tent shaped profit zone but like a butterfly, the main difference is that the short straddle uses options in the same expiration period.

A short straddle is effectively a butterfly spread without the protection of the wings.

Calendar spreads are considered lower risk than a short straddle because the losses are limited to the premium paid for the spread whereas a short straddle has potentially unlimited losses.

A couple of other points to note comparing the calendar spread vs the short straddle:

1. The profit potential on the calendar spread is lower than the short straddle. 2. The breakeven points are further out for the short straddle 3. The short straddle has slightly negative delta 4. Calendar spreads are also positive vega whereas a short straddle is negative vega

Just like I said in my Ultimate Guide To Bear Call Spreads article, I could spend an entire month talking about trade management for calendar spreads, but let’s at least look at some of the basics here.

As with all trading strategies, it’s important to plan out in advance exactly how you are going to manage the trade in any scenario.

What will you do if the stock rallies? What about if it drops? Where will you take profits? Where and how will you adjust? When will you get stopped out?

Lots to consider here but let’s look at some of the basics of how to manage calendar spreads.

PROFIT TARGET

First and foremost, it’s important to have a profit target.

That might be 30% of the potential profit or you may plan on holding to expiration provided the stock stays within the profit tent.

That’s the first decision.

One nice rule of thumb that I use – if I’ve made 50% of the profit potential in less than 50% of the duration of the trade, I take the profit.

So you may want to think about including a time factor in your trading rules.

How long do you plan on holding the trade if neither your profit target or stop loss have been hit?

Another profit taking rule you might consider is – closing when the short call drops to $0.10.

Sometimes the opportunity cost of tying up your margin for the sake of squeezing the last few dollars out of the trade is not worth it.

Having a stop loss is also important, perhaps more so than the profit target.

With calendar spreads, you can set a stop loss based on percentage of the capital at risk.

Some traders like to set a stop loss at 20% of capital at risk. Others might set it as 50%.

If your profit target is 50% and your stop loss is 50%, then any success rate greater than 50% will see you come out ahead.

Then it’s just a numbers game and making sure you have enough trades to make sure the statistics play out.

Whatever you decide, make sure it is written down and mapped out in your trading plan.

ADJUSTMENTS

With calendar spreads, I like to adjust before the stock reaches the breakeven price.

Once the stock gets past the break even price, losses can start to run away from you if the stock keep trending in that direction.

If the stock reaches the break even price and my stop loss has not been hit, I like to add a second calendar to turn it into a double calendar .

That does add more capital to the trade but it also extends the profit zone and can allow you to stay in the trade for longer.

Some people place the second calendar spread at-the-money, but I like to go slightly out-of-the-money which helps to further widen the profit zone.

We talked about this a little bit earlier with the main difference being the cost of the trade.

Long-term trades have lower time decay or theta because the bought option that is further out in time decays at a much slower rate than a shorter-term option.

Longer-term trades have a higher vega exposure, but that doesn’t necessarily mean that they will be more profitable in the event of a rise in implied volatility because each month on the curve is impacted differently.

Generally speaking a volatility spike will impact shorter-term options much more than longer-term options.

Let’s go through a couple of examples of calendar spreads and see how they progressed over the course of the trade.

JPM EXAMPLE

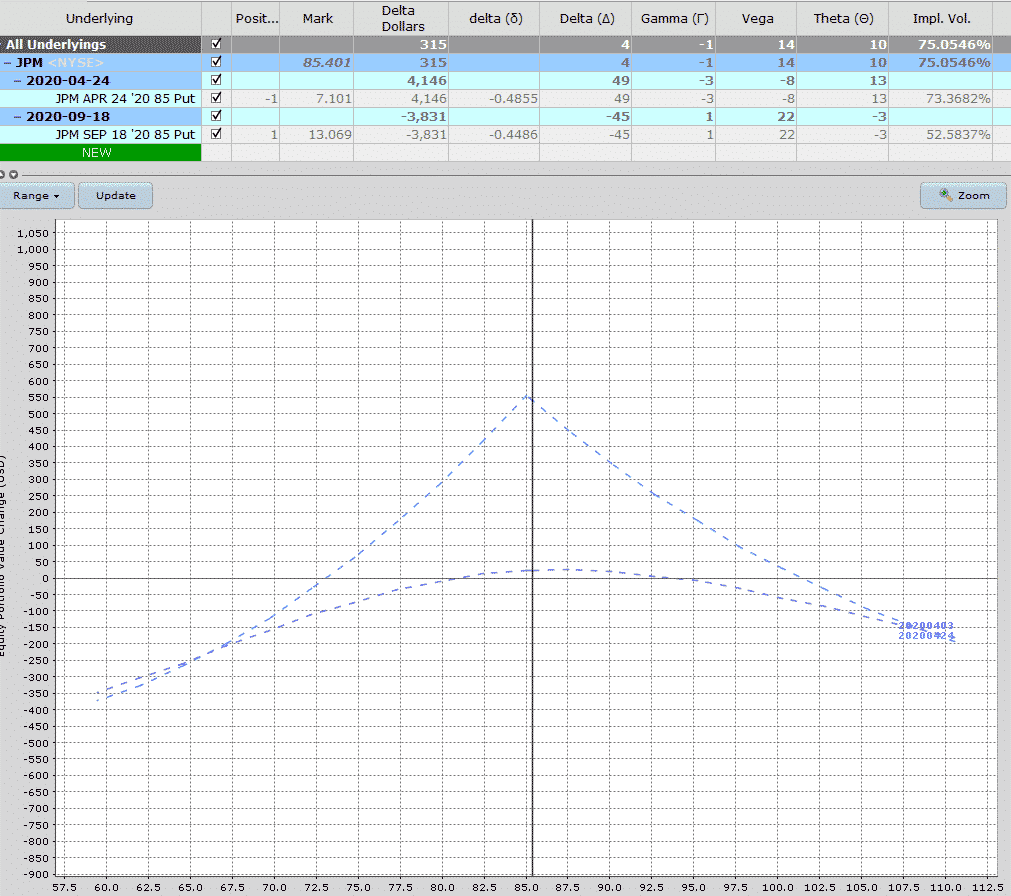

This trade was on JPM entered on April 1st. We sold the April 24th $85 put for $7.10 and bought the September 18th $85 put for $13.07.

The April 24th puts with only 3 weeks until expiry were very high in value (good to be a seller) given that earnings were set for April 14th.

Remember that when an options falls after an earnings release there is a lot of uncertainty and therefore volatility.

Note that the April puts were trading with implied volatility of 73% compared with IV of 52.5% for the September puts.

That’s a great situation for calendar spreads where you are selling high vol and buying lower vol.

The trade had nice breakevens on the upside and downside.

My plan was to close the trade just before earnings no matter what and I ended up getting out when the stock was trading at $102 with a $90 loss.

I didn’t want the risk of holding over earnings as that’s wasn’t part of my trading plan.

But, if I had held on until April 16th when JPM had dropped back to $91, the trade would have been in the black to the tune of $250.

An important thing to notice here is that the front month volatility dropped after earnings from 73% to 61% while the back-month volatility stayed pretty steady and only dropped from 52.5% to 51.99%.

That’s the beauty of calendar spreads!

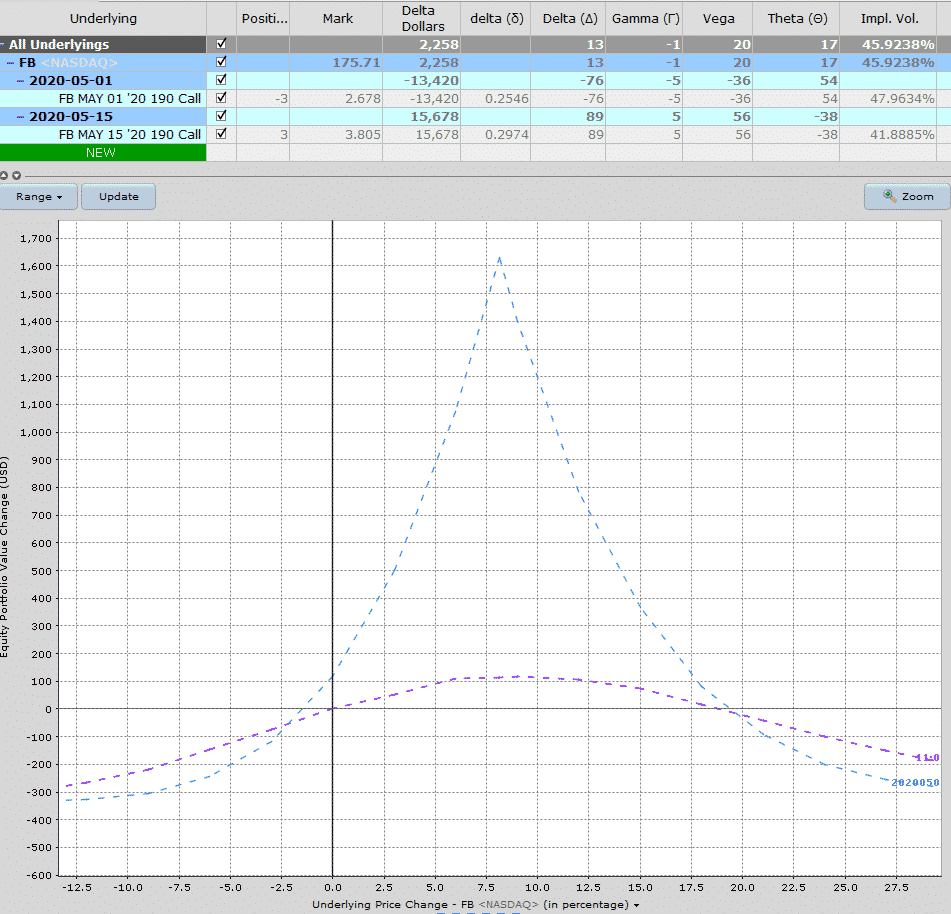

The next example is a FB bullish calendar spread entered on April 15th.

At the time, FB was trading at $175.71.

The chart looked bullish and was showing high levels of accumulation.

The thesis with the trade was that FB was likely to push higher and I had a profit target of $190.

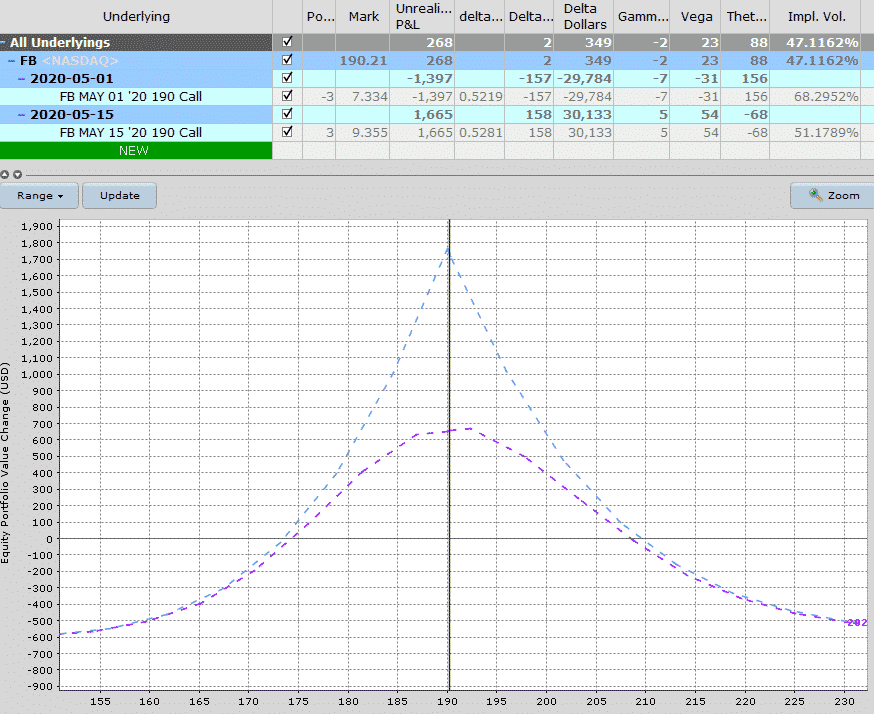

Sure enough, by April 24th, FB hit $190 right on the spot and the calendar spread was showing a profit of $268 which was a 79% return on the initial risk of $338.

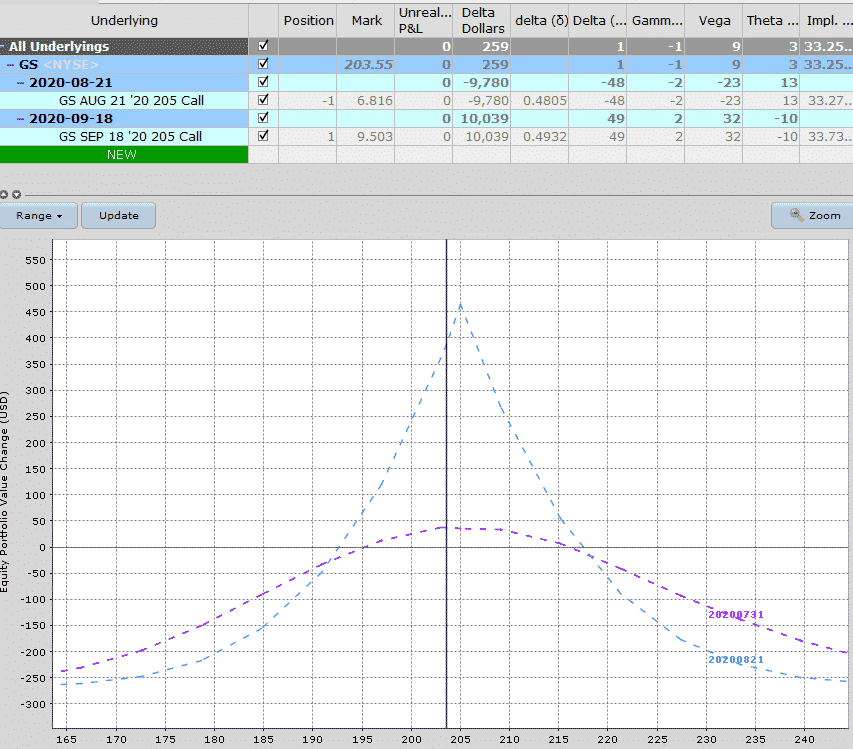

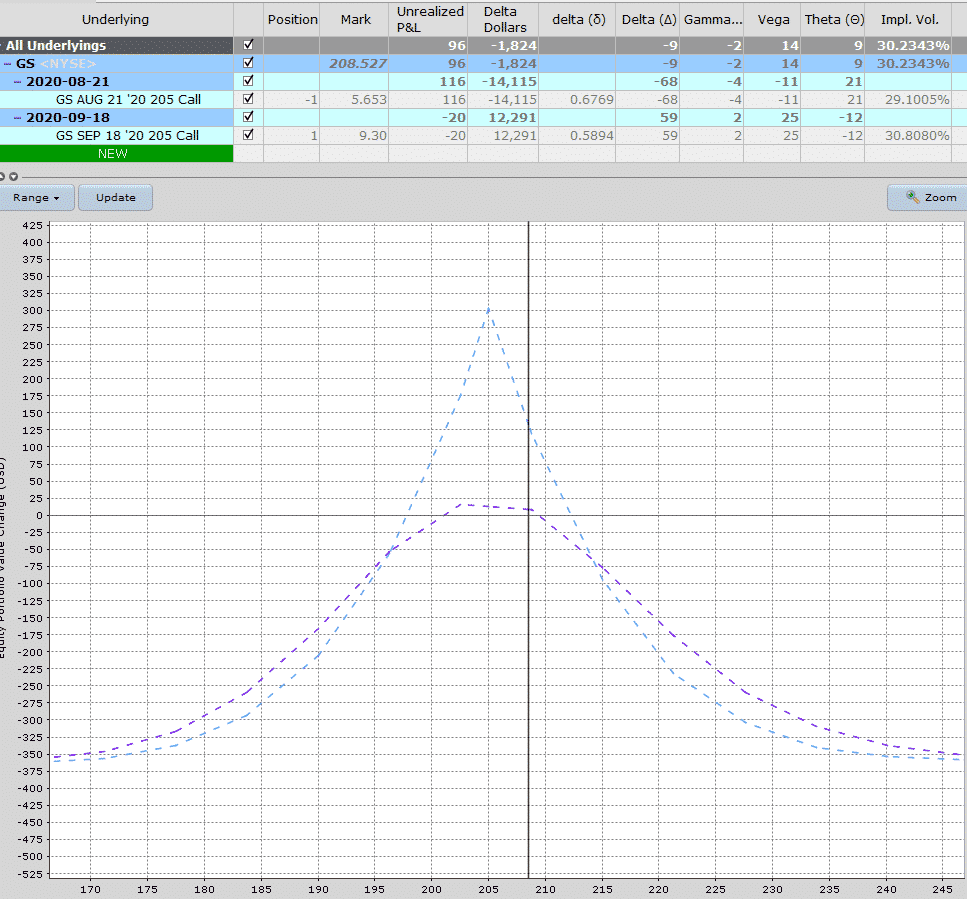

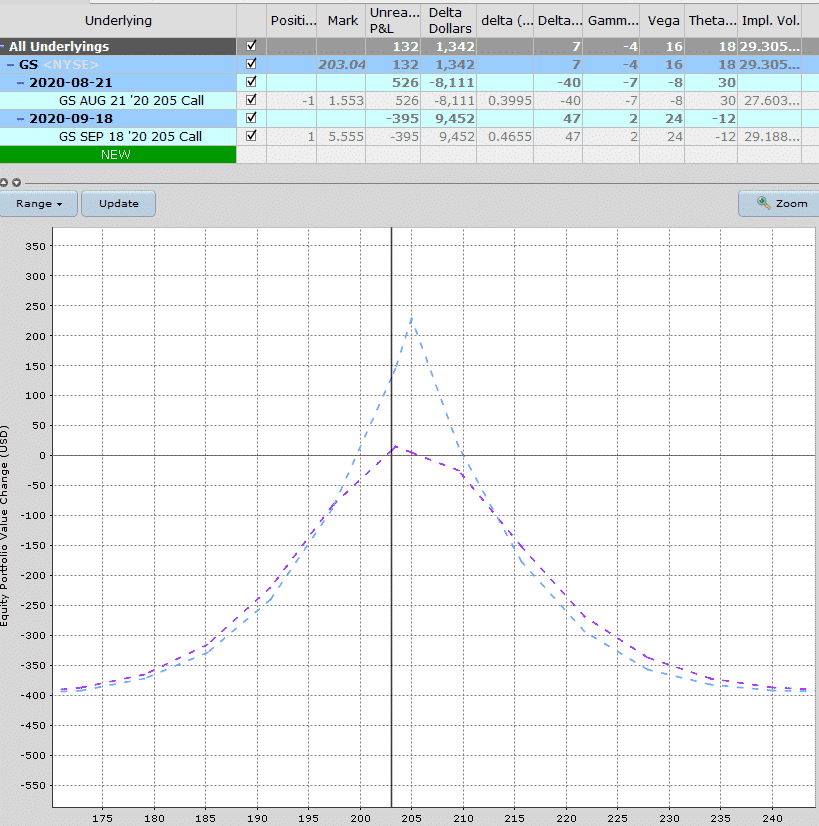

The next example if on Goldman Sachs from August 2020. This was a neutral trade when GS was trading at $203.55.

Entry date was July 23rd and adjustment points were set at 192 and 217.

By August 13th, the trade was looking good at +96 or 35% which was above my profit target. I decided the stay with it because I felt there was a good chance GS would drop down to 205 again.

Four days later, GS pulled back to 203 and the trade was +$132 or 49.25%. Definitely time to close it out.

HD BEARISH CALENDAR EXAMPLE

With this one, HD was showing some negative divergence after an extended run and looked like it might pull back. My target was the 270 level. Trade date was August 31st when HD was trading at 287.28.

The trade worked perfectly with the HD coming right down to the zone by September 3rd. The beauty of this is we gain from the delta and the vega due to the volatility spike. Total profits of +$222 or 31.53%.

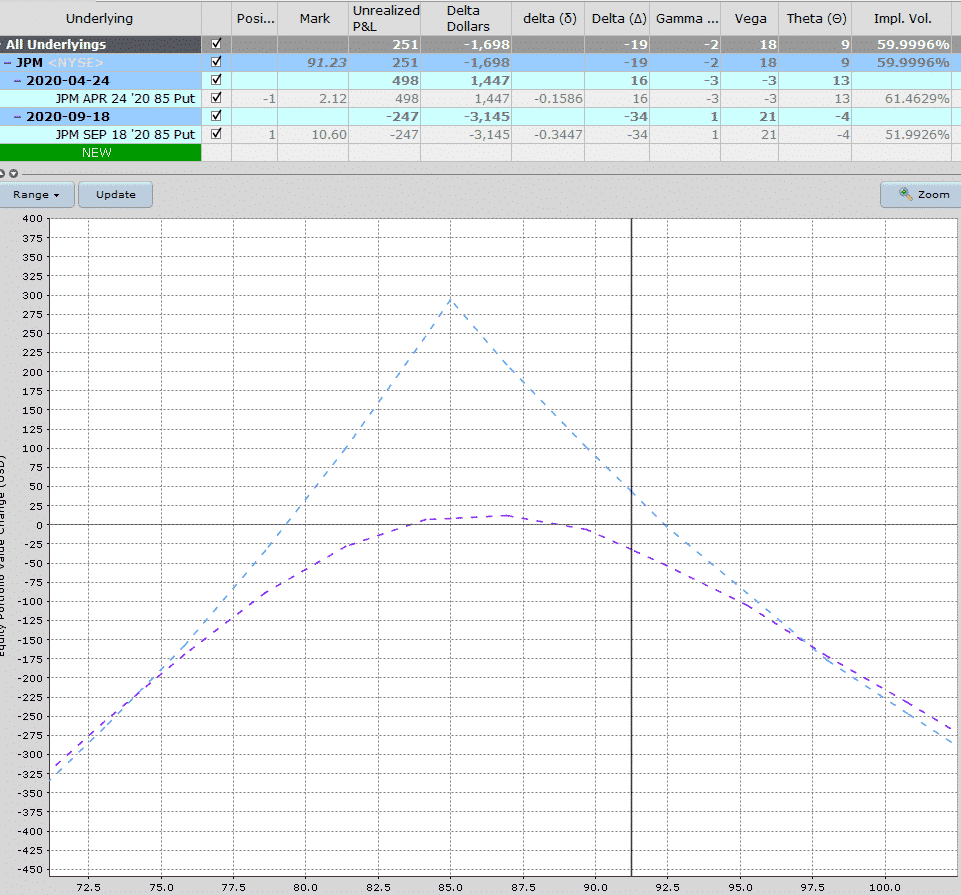

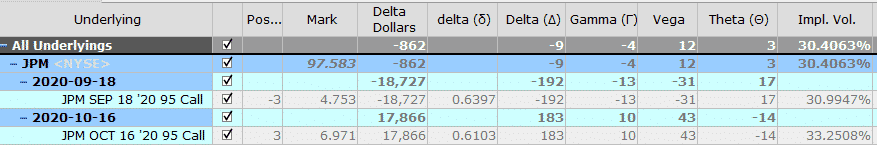

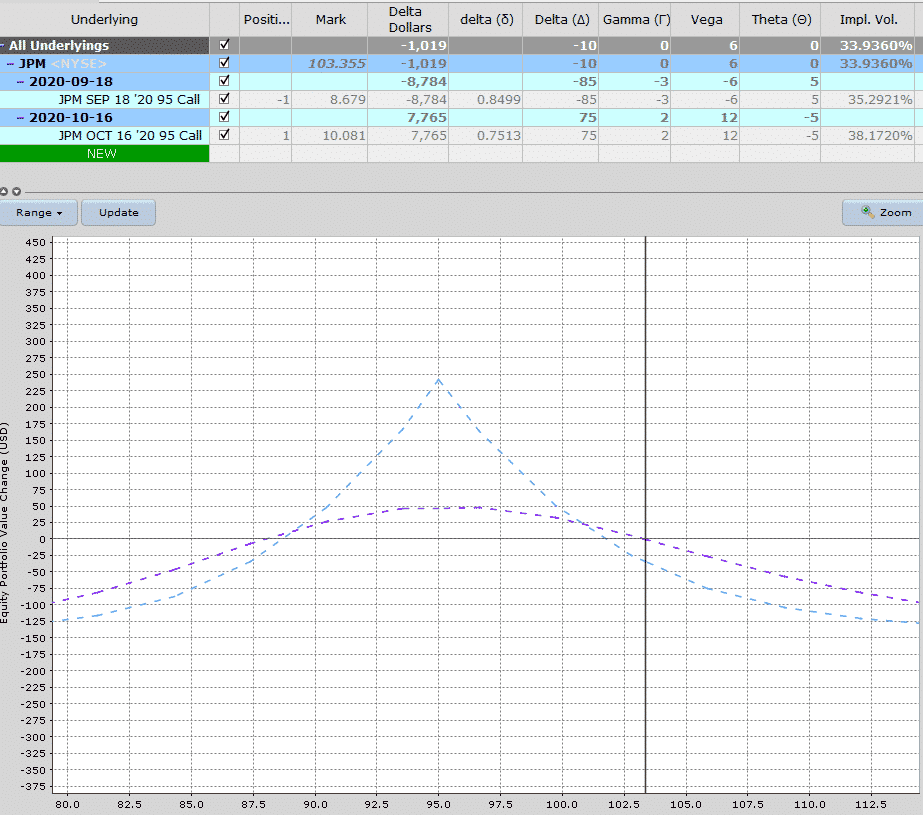

This calendar trade was from August 20th, 2020 on JPM which was trading at 97.58 at the time. Here’s the trade:

I set an adjustment point at 102 and a stop loss of 30%. By August 28th the stock was at 103.35 and had broken through the adjustment point and the stop loss level.

Total loss was $82 per contract or 36.94%.

A calendar spread is an options trading strategy that involves buying and selling two options with the same strike price but different expiration dates.

The goal is to profit from the difference in time decay between the two options.

How Does A Calendar Spread Work?

A calendar spread profits from the time decay of options.

The trader buys a longer-term option and sells a shorter-term option with the same strike price.

The idea is that the shorter-term option will expire worthless, while the longer-term option will retain more value due to its longer time until expiration.

What Are The Risks Of Trading A Calendar Spread?

The main risk of a calendar spread is that the underlying asset moves against the position, causing losses.

Additionally, volatility can also impact the profitability of the trade.

Traders should also be aware of the potential for early assignment of the short option, which can complicate the trade and require additional management.

What Are Some Tips For Trading Calendar Spreads?

Some tips for trading calendar spreads include choosing the right strike price, selecting options with appropriate expiration dates, managing risk with stop-loss orders, and being aware of earnings announcements and other potential volatility events that could impact the trade.

Can Calendar Spreads Be Used In Any Market?

Yes, calendar spreads can be used in any market, including stocks, ETFs, and futures.

They are particularly useful in markets with low volatility and a well-defined trend.

Calendar spreads are a neutral trade that make a nice addition to any option income trader’s portfolio.

The nice thing about them is that that are fairly low risk (unlike short straddles) and they have another benefit of being long vega.

Given that the position contains options across multiple expiration dates, it’s important to have a solid grasp of implied volatility including how volatility changes impact options with different expiration periods.

Calendar spreads have less risk but also less profit potential when compared with short straddles and are also positive vega rather than negative vega.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice . The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Like it? Share it!

The presentation is very easy to follow

Theresbis a thing do not understand

If tradung an ATM calendar and you think the price is going to stay in a range or maybe litle up movement, in order to do not get the short option ITM should not be better to sell puts? Or selling calls if you think is goin is more likeli to stay in range or going down?

Use puts if you think the market is going up and calls if it’s going down.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Closed my Oct BB (a few moments ago) for 34% profit…that is the best of the 3 BBs I traded since Gav taught us the strategy…so, the next coffee or beer on me, Gav 🙂

FEATURED ARTICLES

Small Account Option Strategies

The Ultimate Guide To Implied Volatility

Everything You Need To Know About Butterfly Spreads

Iron Condors: The Complete Guide With Examples and Strategies

Calendar Spreads Options: An In-Depth Guide

Intermediate articles, what are calendar spreads.

A calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility.

A calendar spread can be constructed with either calls or puts by simultaneously entering a long and short position on the same underlying asset but with different expiry dates. Since the goal is to profit from time decay and volatility, the strike price should be as near to the underlying asset’s price as possible. This strategy takes advantage of how near and far dated options act when there is a change in time and volatility.

When running this strategy, you are taking advantage of accelerating time decay on the front-month (short term) option as expiry approaches. Just before the front-month expiration, you are looking to buy back the shorter-term option for near-zero cost but at the same time, you will sell the back-month call to close your position. Ideally, the back-month call will still have significant time value in its price.

Components of an Options Calendar Spread

The short option.

The short option component of a calendar spread is a short-term option sold to other traders. This option brings immediate premium income into your account, but it obligates you to sell or buy the underlying security if it is exercised.

The Long Option

Conversely, the long option in the calendar spread acts as an insurance policy. It is purchased to cover the potential obligation from the short option. If the short option is exercised, you can fulfil your obligation using the long option, which has the same strike price but a longer expiration period.

Long vs. Short Calendar Spreads

There are two types of calendar spreads based on the trader’s position—Long and Short.

Long Calendar Spread

In a long calendar spread, a trader buys a longer-term option and sells a shorter-term option. The idea is to profit from the rapid time decay of the near-term option sold, which ideally results in a net credit when exiting the trade.

Short Calendar Spread

On the contrary, a short calendar spread involves selling a longer-term option and buying a shorter-term option. The goal is to benefit from an increase in the options’ implied volatility or a sharp move in the underlying asset’s price.

Execution and Management of Calendar Spreads

Once you’ve selected the underlying asset and the appropriate strike and expiration dates, it’s time to execute your options calendar spread. You’ll sell the short-term option and buy the long-term option simultaneously, setting up the spread.

However, once the spread is established, it’s crucial to actively manage your position. Keep a close eye on the underlying asset’s price, the short option’s time decay, and changes in implied volatility.

If the short option becomes too risky – if the stock’s price moves too close to the strike price – you might need to close your position early or adjust it. You could roll the short option to a further expiration date or a different strike price, or you might choose to close the spread entirely.

Exiting the Trade: What Are Your Options?

When it comes to exiting your calendar spread, you have several options:

Let the short option expire worthless: If the underlying asset’s price is below the strike price at expiration, the short option will expire worthless. You can then sell another short option against the long option, creating a new calendar spread.

Close the spread: If the stock’s price moves too far from the strike price or implied volatility changes, you can close the spread to prevent further losses.

Roll the short option: If the stock’s price moves close to the strike price, you can roll the short option to a later expiration date, extending the trade’s life.

Exiting the Trade: What Are Your Options?

Like any trading strategy, calendar spreads have their strengths and weaknesses.

Reduced Risk: Calendar spreads limit downside risk to the initial investment, providing a safety net for traders.

Flexibility: These spreads are flexible, allowing adjustments based on market conditions.

Profit Potential: Traders can profit from time decay and volatility changes, widening the range of profitability.

Disadvantages

Limited Profit: The potential profit is limited to the premium received from the short-term option.

Market Sensitivity: Calendar spreads are susceptible to changes in implied volatility and the underlying asset’s price.

Execution Risk: Mispricing or changes in spread can affect the trade execution.

Early Assignments: The biggest risk on your short option call/put is an early assignment, if the stock moves quickly against you this could be exercised, leaving you with high costs, stamp duty and commission fees.

Selecting the Right Strike Price

Choosing the right strike price is paramount in a calendar spread. If the trader believes the underlying asset’s price will rise, they may choose a strike price slightly above the current price. Conversely, if they predict a price drop, a strike price slightly below the current price may be chosen.

Timing the Trade

Timing is also crucial in the execution of calendar spreads. Traders usually establish long calendar spreads when they anticipate an increase in implied volatility and establish short calendar spreads when they expect a decrease.

Calendar Spread Example

A trader believes that the market will be quiet and move sideways until after the December expiration, after which they believe that the market may rally again.

The easiest options to trade here would be to simply buy a March call benefiting from the expected move. However, the March call premium will undoubtedly be expensive due to the amount of time left in the option.

The other way to handle this is to offset some of the call premium by selling a shorter-term call. This is referred to as buying the calendar spread.

The best-case scenario for this trade would be for the market to remain stable until after the December expiry.

Calendar Spread Summary

Calendar spreads provide a potent, flexible, yet intricate trading strategy. Understanding these spreads is essential for any trader seeking to expand their repertoire and venture beyond basic trading methodologies. By balancing the risk and potential reward, selecting the right strike price, and timing the trade, one can navigate the financial markets with precision and expertise.

By understanding the fundamental principles of options calendar spreads, traders can take advantage of time decay and volatility to potentially enhance their portfolio returns. Remember, it’s essential to consider your individual risk tolerance and investment goals when utilising this or any other options strategy.

Configuration:

- Sell a put/call with a strike price near to expiry (Front-month).

- Buy a put/call with the same strike price as above but one month later (back month).

- Both legs need to be either calls or puts.

- Low activity – You are looking for minimal movement in the underlying asset.

- The underlying asset price is to be as close to your strike as possible when the front-month expires.

Max Potential Profit:

- Potential profit is limited to the premium received for the back-month option minus the cost to buy back the front-month option, minus the net debit paid to establish the position.

Max Potential Loss:

- Limited to the premium paid when the trade was opened plus any fees.

What is an options calendar spread?

An options calendar spread, also known as a time spread or a horizontal spread, is a strategy that involves selling a short-term option and buying a longer-term option with the same strike price. Traders use this strategy to capitalise on time decay and changes in implied volatility.

How can an options calendar spread benefit traders?

The main benefits of an options calendar spread include the ability to generate income from time decay of the short-term option and the potential to profit from changes in implied volatility. If the underlying stock’s price remains near the strike price until the near-term option’s expiration, the trader can profit.

What are the key components of an options calendar spread?

The key components of a calendar spread are the short option, which is sold, and the long option, which is purchased. Both options have the same strike price, but different expiration dates.

How is the strike price selected in an options calendar spread?

The strike price in a calendar spread should reflect where you anticipate the underlying asset will trade by the expiration date of the short option. A strike price at-the-money (ATM) typically offers the highest potential return if the stock remains stagnant.

What are the potential risks involved in options calendar spread trading?

The risks in a calendar spread include significant price movements of the underlying stock and changes in implied volatility. A sharp move in the stock price could cause the short option to go in-the-money, potentially resulting in losses

How can a trader exit an options calendar spread?

Traders can exit a calendar spread in several ways: let the short option expire worthless and create a new calendar spread with the long option, close the spread to prevent further losses, or roll the short option to a different strike price or a later expiration date.

OptionsDesk Tips & Considerations

Be aware of early assignment risk on the short options. Best to deploy this strategy during a low implied volatility environment. Never hold through the expiration week of the front-month to avoid the gamma risk. Most of the time, placing the trade with puts will be cheaper than with calls.

Check out our other Articles

Important information : Derivative products are considerably higher risk and more complex than more conventional investments, come with a high risk of losing money rapidly due to leverage and are not, therefore, suitable for everyone. Our website offers information about trading in derivative products, but not personal advice. If you’re not sure whether trading in derivative products is right for you, you should contact an independent financial adviser. For more information, please read our Important Derivative Product Trading Notes .

- Search Search Please fill out this field.

What Is a Calendar Spread?

Understanding calendar spreads, executing the calendar spread.

- Maximum Risk and Profit

- American- vs. European-Style Options

Pros and Cons of Calendar Spreads

The bottom line.

- Options and Derivatives

Calendar Spreads in Futures and Options Trading Explained

James Chen, CMT is an expert trader, investment adviser, and global market strategist.

:max_bytes(150000):strip_icc():format(webp)/photo__james_chen-5bfc26144cedfd0026c00af8.jpeg)

Gordon Scott has been an active investor and technical analyst or 20+ years. He is a Chartered Market Technician (CMT).

:max_bytes(150000):strip_icc():format(webp)/gordonscottphoto-5bfc26c446e0fb00265b0ed4.jpg)

Ellen Lindner / Investopedia

A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates.

In a typical calendar spread, you would buy a longer-term contract and go short with a nearer-term option with the same strike price. If two different strike prices are used for each month, it is known as a diagonal spread. Calendar spreads are also called inter-delivery, intra-market, time, or horizontal spreads.

Essentially, a calendar spread involves a dual wager on a security’s price and volatility across different points in time. Rather than solely predicting whether an underlying asset like a stock will rise or fall, it profits from the passage of time itself.

The mechanics involve simultaneously buying and selling options on the same underlying asset but with different expiration dates. Typically, an investor sells a shorter-term option while purchasing a longer-dated one with the same strike price (the price at which the option can be exercised).

Calendar spreads aim to generate profit when an asset ’s price remains relatively stable. The option sold first will decay in value more quickly because of its closer expiration, hopefully offsetting the cost of the longer-dated option purchase. In addition, the strategy aims to capture changes in “implied volatility,” a factor often tied to the uncertainty that affects option premiums.

Key Takeaways

- A calendar spread is a derivatives strategy that involves buying a longer-dated contract to sell a shorter-dated contract.

- Calendar spreads allow traders to construct a trade that minimizes the effects of time.

- They are most profitable when the underlying asset does not change much until after the near-month option expires.

- These are also called horizontal, inter-delivery, intra-market, or time spreads.

Before getting underway, let’s give you a cheat sheet for some key terms.

- Call option : A contract giving the buyer the right, but not the obligation, to purchase an underlying asset at a set price, called the strike price, by a specific date, called the expiration.

- Put option : A contract allowing the buyer the right to sell an underlying asset at a strike price before the expiration date.

- Long position : Holding an option you bought means you are “long” in that option.

- Short position : Selling an option contract you don’t yet own creates a “short” position.

The typical calendar spread trade involves the sale of an option (either a call or put) with a near-term expiration date and simultaneously buying an option (call or put) with a longer-term expiration. Both options are of the same type and typically use the same strike price. Let’s break this down:

- Sell near-term put/call

- Buy longer-term put/call

- It’s preferable but not necessary that its implied volatility is low.

A reverse calendar spread takes the opposite position and involves buying a short-term option and selling a longer-term option on the same underlying security. Investors executing a reverse calendar spread buy a near-term option and at the same time sell a longer-dated option on the same underlying asset and at the same price.

This reversal hints at the difference in expectations. A reverse calendar spread generally anticipates a significant move (up or down) in the underlying asset’s price. It can also aim to profit from an expected spike in implied volatility, which could boost the value of options even without a large change in the underlying asset itself.

Crucially, the purchased near-term option needs to surge in value sufficiently to surpass the slower decay of the option sold further out in time. Timing and the magnitude of the anticipated move are thus key factors in a reverse calendar spread’s success.

The calendar spread strategy aims to profit from the passage of time or an increase in implied volatility in a directionally neutral strategy.

For a regular calendar spread, since the goal is to profit from time and volatility, the strike price should be as near as possible to the underlying asset’s price. The trade takes advantage of how near- and long-dated options act when time and volatility change. An increase in implied volatility, all other things being equal, would positively impact this strategy because longer-term options are more sensitive to changes in volatility (that is, it has a higher vega ). The caveat is that the two options can and probably will trade at different implied volatilities.

The passage of time, all else being equal, would positively affect this strategy at the beginning of the trade until the short-term option expires. After that, the strategy is only a long call whose value erodes as time elapses. In general, an option’s rate of time decay (its theta ) increases as its expiration draws nearer.

Maximum Risk and Profit on a Calendar Spread

For a debit spread, the maximum loss is the amount paid for the strategy. The option sold is closer to its expiration and, therefore, has a lower price than the option bought, yielding a net debit or cost. The ideal would be a steady to slightly declining underlying asset price during the life of the near-term option, followed by a strong move higher during the life of the far-term option or a sharp increase in implied volatility.

At the expiration of the near-term option, the maximum gain comes when the underlying asset is at or slightly below the strike price of the expiring option. If the asset is above that, the expiring option would have intrinsic value. Once the near-term option expires as worthless, the trader is left with a simple long call position, which has no limit on its potential profit. A trader with a bullish longer-term outlook can reduce the cost of purchasing a longer-term call option.

Here are different ways to employ the strategy, including regular and reverse calendar spreads:

- Long call calendar spread : You buy a longer-term call option and sell a shorter-term call option at the same strike price. This is a wager on a moderate price increase or rising volatility in the underlying asset price.

- Short call calendar spread : You sell a longer-term call option and buy a shorter-dated one at the same strike price. Profits would come if there’s a stable price or decreasing volatility for the underlying asset.

- Long put calendar spread : You buy a longer-term put and sell a near-term put option, both at the same strike price. This strategy anticipates a moderate drop in price or a volatility increase in the underlying asset price.

- Short put calendar spread : You sell a longer-term put option and buy a shorter-term put with the same strike price. Profits come from a stable or increasing underlying asset price or falling volatility.

Note that long spreads usually have a set maximum loss, while short spreads carry greater risk should the underlying asset move sharply against the position. We put this in a chart below. (All spreads require the same option strike prices.)

| Calendar Spread Cheat Sheet | ||||

|---|---|---|---|---|

| Buy a longer-term call option; sell a shorter-term call option | Sell a longer-dated call; buy a shorter call with the same strike price | Buy longer-term put; sell a near-term put | Sell a longer-term put; buy a shorter-term put | |

| Pay | Collect premium | Pay | Collect premium | |

| Moderate ↑ in price or ↑ in volatility | Stable price or ↓ in volatility | Moderate ↓ in price or ↑ in volatility | Stable or ↑ in price or ↓ in volatility | |

| Cost of the spread | Unlimited | Cost of the spread | Unlimited | |

| Unlimited | Net premium | Unlimited | Net premium | |

Difference in Using American- vs. European-Style Options

Regarding index options and the possibility of early exercise, it is essential to differentiate between American- and European-style options . This characteristic of European-style options means the risk of early assignment is eliminated, so the maximum loss is the initial premium paid, barring any unusual circumstances.

However, when dealing with American-style options , the possibility of early exercise requires another consideration in a calendar spread. The primary effect of early exercise on a calendar spread and its maximum loss relates to the short leg of the spread, as the holder of the option that the trader wrote or shorted might decide to exercise the right to buy or sell, depending on whether the option is a call or put. The trader must fulfill the terms of the option contract. Thus, the original calendar spread would no longer exist, which changes the maximum loss. Hence, the early exercise of American-style options adds a layer of risk that requires more active management. Traders would need to adjust their positions to mitigate potential losses.

Calendar spreads have advantages and disadvantages, making them suitable for certain market conditions and strategies while posing risks for others.

Income generation

Flexibility

Limited risk for regular calendar spreads

Managing volatility with time

Limited profit potential

Transaction costs and execution risks

Impact of dividends and interest rates

- Income generation : Calendar spreads can generate income from the premium collected on the short option. This strategy can be particularly good in a sideways or range-bound market, which is when the underlying asset price doesn’t change much.

- Flexibility : There is flexibility to trade based on expectations of volatility and time decay. You can capitalize on the accelerated time decay of the near-term option relative to the longer-term option.

- Limited risk : The maximum loss is limited in the long call and long put calendar spreads to the net premium paid for the spread. This predefined risk for the long call and long put calendar spreads makes managing the potential downside easier.

- Managing volatility with time : This spread is ideal for when you expect an increase in volatility, but not right away. The value of the longer-dated option can increase with a rise in implied volatility, potentially leading to profits.

Disadvantages

- Limited profit potential : While the risk can be limited for long call and long put calendar spreads, so are the profits for short call and short put calendar spreads.

- Complexity : Managing calendar spreads requires a good understanding of options, including how time decay and changes in volatility affect option prices. This complexity can make it challenging for less experienced traders.

- Cost and execution risks : The strategy involves several transactions, which means more transaction costs. Execution risk is also a factor; misalignment in executing the two legs can modify the intended position.

- Impact of dividends and interest rates : Unexpected dividends can affect the optimal strike price and profit for equity options. Interest rate changes can also impact the cost of the options, especially for the longer-term options in the spread.

Calendar spreads are good for traders looking to profit from time decay and volatility differences between short- and long-term options. However, the strategy requires careful management and an understanding of options, and its effectiveness can be influenced by transaction costs, execution risks, and changes in the market, such as from dividends and interest rates.

Example of a Calendar Spread

Suppose that Exxon Mobil ( XOM ) stock is trading at $89.05 in mid-January. You can do the following calendar spread:

- Sell the February 89 call for $0.97 ($97 for one contract)

- Buy the March 89 call for $2.22 ($222 for one contract)

The net cost of the spread is thus: 2.22 - 0.97 = $1.25, or $125 for one spread.

This calendar spread will pay the most if XOM shares remain relatively flat until the February options expire, allowing you to collect the premium for the option that was sold. Then, if the stock increases between then and the March expiry, the second leg will profit. The ideal would be for the price to become more volatile in the near term but to generally rise, closing just below 95 at the February expiration. This allows the February option to expire as worthless while still allowing you to profit from increases in the price until the March expiration.

Since this is a debit spread , the maximum loss is the amount paid for the strategy. The option sold is closer to expiration and thus has a lower price than the option bought, yielding a net debit. In this case, you hope to capture gains from a rising price (up to but not beyond $95) between the purchase and the February expiration.

If you were to simply buy the March expiration, the cost would have been $222, but by employing this spread, the cost is only $125, resulting in less risk. Depending on the strike price and contract type, the strategy can be used to profit from neutral, bullish, or bearish market trends.

Are There Any Other Options Spreads or Strategies in Futures Trading?

Traders have a variety of spread strategies on options and futures to hedge, speculate, or generate income. These strategies can be complex and require a solid understanding of the underlying market. Some common options spreads and strategies include butterfly spreads , straddles and strangles, inter-commodity spreads, covered calls, and protective puts.

What Is the Difference Between a Long Calendar Spread and a Short Calendar Spread?

The main difference lies in the initial position taken with the options involved. A long calendar spread is generally done to capitalize on the relative time decay of options with different expirations in a low-volatility environment with limited risk. By contrast, a short calendar spread aims to take advantage of high volatility in the near term but carries a higher risk because of the potential for significant losses if the market moves sharply.

What Are the Best Time Frames for Calendar Spreads?

The optimal time frame for a calendar spread depends on market conditions, the underlying asset, and your objectives. You should consider volatility expectations, earnings and similar events, and the overall market.

It is critical for you to monitor and adjust your positions as market conditions change. Successful traders often use historical data, implied volatility metrics, and their expectation of market sentiment about upcoming macro and micro events to fine-tune their choice of expiration dates for both legs of the calendar spread.

Calendar spreads in futures and options trading are highly sophisticated strategies that cater to traders who leverage differences in time decay and volatility between contracts with different expiration dates. A calendar spread involves the simultaneous purchase and sale of options of the same type and strike price but with varying expirations, capitalizing on the accelerated decay of the near-term option relative to the longer-term option.

These strategies can effectively help to mitigate risk, reduce the cost of the spread, and offer some income through premiums. However, their success demands in-depth knowledge of volatility, interest rates, and risk management, making calendar spreads a potent yet complex tool for experienced traders aiming to navigate short-term price moves or prepare for long-term shifts in the market.

Correction—July 27, 2024: This article was corrected to properly state the definitions for a short call calendar spread and a short put calendar spread.

Scott Nations, via Wiley. “ The Complete Book of Option Spreads and Combinations: Strategies for Income Generation, Directional Moves, and Risk Reduction, Plus Website .” John Wiley & Sons, 2024. Pages 93–108.

Russell A. Stultz, via Google Books. “ The Option Strategy Desk Reference: An Essential Reference for Option Traders ,” Pages 27–33. Business Expert Press, 2019.

Adapted from Scott Nations, via Wiley. “ The Complete Book of Option Spreads and Combinations: Strategies for Income Generation, Directional Moves, and Risk Reduction, Plus Website .” John Wiley & Sons, 2024. Page 108.

:max_bytes(150000):strip_icc():format(webp)/bullcall-spread-4200210-1-blue-759c3882be664370823655c8d7ac9bb5.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

Stack Exchange Network

Stack Exchange network consists of 183 Q&A communities including Stack Overflow , the largest, most trusted online community for developers to learn, share their knowledge, and build their careers.

Q&A for work

Connect and share knowledge within a single location that is structured and easy to search.

What happens when a calendar spread is assigned in a non-margin account?

A well-known option investment strategy is the so-called "calendar spread", which involves buying and selling options on the same stock with different expiration dates. If the strike prices are also different, then it's called a "diagonal spread", if I'm not mistaken. I've seen this described here: http://optionradio.com/pages/l-content/training/leaps.htm .

The optionradio.com author suggests that it is a good idea to buy a long-term option and then sell shorter term calls on the same stock. He then says that you absolutely do not want to get assigned on the short option that you sell. He says,

It can get too complicated so do not let that happen. Even if you must buy the call back at a loss because you timed it wrong.

I'll take the author at his word that I don't want to get assigned in this situation, but I would like to know in the case that it does happen, how does the broker handle it? I'm especially concerned about if it happens in a non-margin account, such as an IRA (where the law actually prohibits investing on margin).

- call-options

- option-strategies

- covered-call-writing

- It's not strictly true that you cannot have margin on an IRA, but that's kind of beside your main question. ( fool.com/knowledge-center/… ) – user32479 Commented Jul 12, 2016 at 13:24

2 Answers 2

I would think that a lot of brokers would put the restriction suggested in @homer150mw in place or something more restrictive, so that's the first line of answer.

If you did get assigned on your short option, then (I think) the T+3 settlement rules would matter for you. Basically you have 3 days to deliver. You'll get a note from your broker demanding that you provide the stock and probably threatening to liquidate assets in your account to cover their costs if you don't comply. If you still have the long-leg of the calendar spread then you can obtain the stock by exercising your long call, or, if you have sufficient funds available, you can just buy the stock and keep your long call.

(If you're planning to exercise the long call to cover the position, then you need to check with your broker to see how quickly the stock so-obtained will get credited to your account since it also has some settlement timeline. It's possible that you may not be able to get the stock quickly enough, especially if you act on day 3.)

Note that this is why you must buy the call with the far date. It is your "insurance" against a big move against you and getting assigned on your short call at a price that you cannot cover.

With the IRA, you have some additional concerns over regular cash account - Namely you cannot freely contribute new cash any time that you want. That means that you have to have some coherent strategy in place here that ensures you can cover your obligations no matter what scenario unfolds. Usually brokers put additional restrictions on trades within IRAs just for this reason.

Finally, in the cash account and assuming that you are assigned on your short call, you could potentially could get hit with a good faith, cash liquidation, or free riding violation when your short call is assigned, depending on how you deliver the stock and other things that you're doing in the same account. There are other questions on that on this site and lots of information online. The rules aren't super-simple, so I won't try to reproduce them here. Some related questions to those rules:

- Trading with Settled / Unsettled Funds (T+3)

- How can I buy and sell the same stock on the same day?

An external reference also on potential violations in a cash account: https://www.fidelity.com/learning-center/trading-investing/trading/avoiding-cash-trading-violations

I can't speak for all brokerages but the one I use requires cash accounts to have cash available to purchase the stock in this situation. With the cash available you would be able to purchase the stock if the option was exercised.

Hope this helps

You must log in to answer this question.

Not the answer you're looking for browse other questions tagged options call-options option-strategies spreads covered-call-writing ..

- Featured on Meta

- Bringing clarity to status tag usage on meta sites

- We've made changes to our Terms of Service & Privacy Policy - July 2024

- Announcing a change to the data-dump process

Hot Network Questions

- Parse Minecraft's VarInt

- Why doesn't the world fill with time travelers?

- Why do National Geographic and Discovery Channel broadcast fake or pseudoscientific programs?

- How bad would near constant dreary/gloomy/stormy weather on our or an Earthlike world be for us and the environment?

- How to attach a 4x8 plywood to a air hockey table

- Is it advisable to contact faculty members at U.S. universities prior to submitting a PhD application?

- What happens when a helicopter loses the engine and autorotation is not initiated?

- Exact time point of assignment

- Passport Carry in Taiwan

- How do you determine what order to process chained events/interactions?

- Running different laser diodes using a single DC Source

- What would be non-slang equivalent of "copium"?

- How much missing data is too much (part 2)? statistical power, effective sample size

- How does \vdotswithin work?

- Story where character has "boomerdisc"

- How to volunteer as a temporary research assistant?

- How to total time duration for an arbitrary number of tracked tasks in Excel?

- Change output language of internal commands like "lpstat"?

- What to do when 2 light switches are too far apart for the light switch cover plate?

- Could someone tell me what this part of an A320 is called in English?

- Philosophies about how childhood beliefs influence / shape adult thoughts

- How can you trust a forensic scientist to have maintained the chain of custody?

- What are the risks of a compromised top tube and of attempts to repair it?

- How Can this Limit be really Evaluated?

How To Trade Calendar Spreads: Risks, Setups, Profitability

When market conditions deteriorate, options are a secret weapon investors can use. Some investors get a chill down their spine when they hear the term ‘options,’ but the truth is, there is an array of options strategies that can help mitigate some of the risks associated with market volatility. One of those strategies is a calendar spread. Here we outline how to trade calendar spreads.

What Are Options Calendar Spreads?

An options calendar spread is a derivatives strategy that is established by entering a long and short position on the same underlying asset at the same time. The only difference is the options’ expiration dates.

Typically, someone deploying a calendar spread strategy would buy a longer-dated contract and sell a nearer-term option that has an identical strike price — a strike price is a set price that a derivative contract can be bought or sold at.

The trade’s goal is to profit from time passing and/or increased implied volatility in a directionally neutral strategy. With those goals in mind, the strike price should be as close as possible to the price of the underlying stock.

The trade benefits from how near and long-dated options act as time and volatility advance. If volatility increases it has a positive effect on this strategy because longer-term options are much more sensitive to volatility changes. There’s one caveat: the two options will likely trade at different implied volatilities.

Time passing also has a positive effect on this strategy, but it’s more limited and only at the beginning of the trade until the short-term option expires . Once that happens, the strategy is simplified to a long call only, with a value that will continue to erode as time passes.

In a nutshell, the calendar spread strategy allows traders to buy a longer-dated contract and sell a shorted-dated one, allowing them to create a trade that minimizes the effects of time versus holding a long option ( call/put ) only .

Calendar spreads are most profitable when the underlying stock remains fairly constant and doesn’t make any drastic moves in either direction until after the expiration of the near-month option .

Calendar spreads can also be called time spreads, horizontal spreads, inter-delivery or intra-market.

Why Trade Calendar Spreads

The major benefit of calendar spreads is they are an excellent way to fuse the benefits of spreads and directional options trades within the same position. Depending on how you implement the strategy, you can assume that either:

- A market-neutral position that’s used a few times to pay for the spread while also taking advantage of the decay of time.

- A short-term market-neutral position with a longer-term directional bias armed with the potential for unlimited gain.

No matter which of the above occurs, the trade can provide benefits that traditional calls or puts simply can’t.

If a trader does the opposite of a calendar spread and buys a short-term option and sells a long-term option on the same underlying security, it’s known as a reverse calendar spread .

There are some calendar spread training tips to keep in mind, including:

- Pick expiration months as for a covered call — You should consider your calendar spread strategy like a covered call , with one difference — the investor doesn’t own the underlying stock, but does own the right to buy it. When you treat this trade as a covered call , you can quickly and easily choose the expiration months. As you select the long-term option’s expiration date , it’s advised to go at least two to three months out. But, when choosing the short strike, it’s best to sell the shortest dated option because these values decay the quickest and can be rolled out weekly/monthly (or even faster) over the trade’s lifetime.

- Leg in — Traders who own calls or puts against a stock can sell an option against the position and “leg” into a calendar spread anytime . Say a trader owns calls on a certain stock and it’s made a substantial move up but has recently leveled out, they can sell a call on the same stock as long as they’re neutral over the short-term. This strategy is great to allow traders to ride out the dips in upward trending stocks.

- Managing risk — Our last suggestion is to plan to manage risk. By this, we mean that traders could plan their position sizes around the maximum trade loss and attempt to cut losses short as soon as they deem that the trade no longer falls within their forecast’s scope.

> How To Analyze Covered Calls

What Is The Purpose Of A Calendar Spread?

A calendar spread’s purpose is to take advantage of expected fluctuations in volatility and time decay while simultaneously reducing the effect of movements in the underlying security.

The underlying stock reaching or nearly reaching the nearest strike price at expiration and taking advantage of near time decay is the goal of a long call calendar spread. Depending on where the stock is in relation to the strike price, the forecast can be neutral, bullish or bearish.

> How To Calculate Covered Call Returns

Call Calendar Spreads

A call calendar spread is one of the most popular calendar spreads. It can be applied by buying a longer-term call option while selling a shorter-term call option that’s at-the-money or slightly out-of-the-money simultaneously. The two options have the same strike price.

The purpose of a call calendar spread is to sell time, with the options trader hoping the price of the underlying stays the same when near month options expire so that they expire without any value.

On the other hand, since near-month options decay a lot faster than longer-term options, the long-term options keep their value. This allows the options trader to decide between owning the longer-term calls for less or writing more calls and repeating the process.

A rule of thumb is to own long calls with at least 45-60 days of time to expiration, before time-decay (theta) accelerates.

Maximum Profit

Maximum profit is realized when the stock price is the same as the call price on the short call’s expiration date.

This is the aim of maximum profit because the long call has maximum time value when the stock price is the same as the strike price.

Maximum Risk

A long calendar spread with a call’s maximum risk is equal to the spread’s cost, including all commissions.

If the stock price starts sharply moving away from the strike price, the difference between the calls will approach zero and the full amount that was paid for the spread is lost .

Say the stock price falls dramatically and then the price of both calls approach zero for a net difference of zero. If the price of the stock starts to rally sharply, sending both calls into deep-in-the-money, the prices of both calls will become equal for a net difference of zero.

> How To Trade Covered Calls In Down Markets

Put Calendar Spreads

A put calendar is another options strategy involving the sale of a short-term put contract and the purchase of another put that has a later expiration date . For example, say an investor buys a put option with 60 days or more until it expires and they simultaneously sell a put option at the same strike price with 15-30 days or less until it expires.

Put calendars are used when the near-term outlook turns neutral or bullish and the long-term outlook is bearish . To turn a profit, the investor needs the underlying price to trade sideways or higher over the remaining time on the put that they sold before the remaining time on the put they purchased expires. Put calendars require paying a premium to start the position.

Put calendars also benefit from time decay since the options have the same strike price and there’s no intrinsic value to worry about capturing.

So, when investors are seeking to take advantage of the value of time, the most significant risk is the option getting deep in or out of the money, and therefore the time value disappearing quickly.

Throughout the short-term option’s life, its potential profit is limited to the extent the short-term option drops in value faster than the long-term option. However, when the short-term option expires , the strategy evolves into a long put with substantial potential profit opportunity as the potential loss becomes limited to the premium the investor paid to initiate the position.

Increases in implied volatility (IV) have positive effects on the put calendar spread strategies. Typically, long-term options are more sensitive to changes in market volatility. However, it’s important to remember that both short and long-term options can trade at different implied volatility levels — and they probably will.

How Does A Calendar Spread Make Money?

Calendar trades generally make money when the extrinsic value on the option sold decays at a faster rate than the extrinsic value of the option bought. Here’s an example:

You’re a trader and you believe the market will continue to be quiet and stable after an option’s September expiration because it’s not an election year or there are no other signs of forthcoming market volatility.

Instead, you believe the market will rally tremendously when the option expires. So, you could simply buy a December call. But, the call premium will be expensive because of the amount of time left in the option in question. So, you could sell a shorter-term call at the same strike price to offset some of the premium — that’s called buying the calendar spread.

Do Calendar Spreads Work?

Yes, calendar spreads can be an excellent way to fuse the benefits of spreads and directional options trades that are in the same position.

Long calendar spreads are good strategies to use when traders anticipate the price will be near the strike price at the front-month option’s date of expiration.

Are Calendar Spreads Profitable?

Yes. Calendar spreads are most profitable when the underlying asset doesn’t make any dramatic moves up or down until the expiration of the near-month option.

Are Calendar Spreads Limited Risk?

Yes, especially long calendar spreads with calls compared to short calendar spreads, which are strategies that profit from low volatility in the underlying stock.

On the other hand, long calendar spreads don’t require as much capital, they have limited risk and they also have a smaller potential for limited profit.

Another example of how calendar spreads feature limited risk is when a short call is assigned and the stock is sold and a short stock position is created. In long calendar spreads with calls, this leads to a two-part position composed of short stock and long call. This position in particular has limited risk on the upside in addition to significant profit potential on the downside.

If a trader is bearish, he will maintain his position hoping that the forecast will come to fruition and he will earn a profit. If the short stock position is unwanted, it must be closed by exercising the call or buying to close the borrowed stock and selling the call.

Just because calendar spreads may incur limited risk doesn’t mean they are entirely without risk. It’s important to know the following risks of calendar investing :

- Limited upside early on — Calendar trading has a very limited upside when both legs are at play. But, once the short option reaches expiration, the remaining long position gains unlimited profit potential. It is a natural trading strategy when it’s in its early stages. If the stock begins to move more than expected, this can lead to limited gains.

- Expiration dates — You have to be aware of expiration dates with calendar trading. As the short-term option’s expiration date approaches, you have to take action. If it expires out-of-the-money, the contract will expire without value. If the option is in-the-money, you’ll want to consider buying back the option at market price. Once you take action with the short-term option, you can decide whether or not to roll the position.

- Untimely entry — It’s essential to avoid untimely entry when trading calendar spreads. Ill-timed trades can lead to maximum losses swiftly. A smart trader will survey the market’s overall condition to ensure they trade in the same direction as the underlying trend of the stock.

Do You Need Margin For Calendar Spreads?

Although calendar spreads are bought in a margin account, there is no margin requirement because, in theory, the purchase option has a longer life than the written one . But, the risk is still 100 percent of the capital you commit.

So, it’s important to place careful consideration into which strategy you choose to deploy and how much capital you want to place at risk and potentially lose if your market forecast isn’t realized.

If margins are charged in calendar spreads, they feature as one-sided margin for the position the investor takes (+) Calendar Spread charge — this is charged because the price moves across months don’t show a perfect correlation.

What Is A Diagonal Calendar Spread?

When calendar spreads have different strike prices, they’re known as diagonal spreads . This options strategy takes place by entering into a long and short position in two options of the same kind at the same time:

- Two call options; or

- Two put options

The strategy got its name because of how it combines a horizontal spread (which involves different expiration dates) and a vertical spread (which involves different strike prices).

The difference between regular calendar spreads and diagonal calendar spreads is that in the diagonal spread, the two options have different strike prices and different expiration dates. The strategy behind diagonal calendar spreads can lean bullish or bearish.

The strategy got its name based on how it combines a calendar spread (also known as horizontal spread), with different expiration dates and a vertical spread with different strike prices.

The terms for the different types of spreads — horizontal, vertical and diagonal — refer to each option’s position on an options grid.

- Vertical Spread Strategies — These options have different strike price but the same expiration dates.

- Horizontal Spread Strategy — These options use the same strike prices, but different expiration dates and thus are arranged horizontally on the calendar.

In the diagonal spread, the options are arranged diagonally because of their different strike prices and expiration dates.

Most diagonal spreads are long spreads with one sole requirement for the holder to buy the option with the longer expiration date and sell the shorter-term option. Naturally, the opposite also rings true and is required — for short spreads, the holder must buy the shorter expiration and sell the longer one.

What Is A Bull Calendar Spread?

A bull calendar spread is used when traders try to profit from an expected increase in the price of the underlying asset.

Bull spreads can be created by using puts and calls at different strike prices. In this strategy, call options at a lower price are purchased and call options at a higher price but with the same expiration date are sold.

If puts are used to create a bull calendar, a short put is sold at a higher strike price to a long put. When the expiration dates are the same, this is called a bull put spread. When they differ, a put calendar bull spread is formed.

What Is A Bear Calendar Spread?

The bear spread is the opposite of the bull spread and is made up conventionally of two options: long put and short put. Traders deploy this strategy when they believe the long-term forecast for the underlying asset is bearish or heading for a decline.

A bear put calendar spread is a fairly versatile strategy that’s constructed by selling a short-term put option and buying a long-term put, which leads to a net debit.

It’s technically possible to also create a bear calendar using calls. To do so, a call option is sold at a lower strike price than another call option is bought. If both options are in the same month, this forms a bear call spread. When the calls are placed in different months, a call calendar bear spread is formed. Generally, this is avoided because the short call is placed further out in time, and therefore creates much higher margin requirements – because when the long call expires, the remaining short call is naked, and therefore exposes the trader to unlimited theoretical risk potential.

Here are a few things to keep in mind when trading this strategy:

- Generates more time as time decays

- The risk is limited to the net debit

- Benefits from increased volatility

To learn more about how this strategy can work in your favor or information and tips on any other investing strategies, get started here >

#1 Stock For The Next 7 Days

When Financhill publishes its #1 stock, listen up. After all, the #1 stock is the cream of the crop, even when markets crash.

Financhill just revealed its top stock for investors right now... so there's no better time to claim your slice of the pie.

The author has no position in any of the stocks mentioned. Financhill has a disclosure policy . This post may contain affiliate links or links from our sponsors.

Trading Education Guides Options Trading

Options Calendar Spreads Explained

- By Mike Bolin

- Updated May 1, 2024

- Reviewed by Lucien Bechard

- Fact checked by Angelica Rieder

SHARE THIS ARTICLE

Calendar spreads combine buying and selling two contracts with different expiration dates. With calendar spreads, time decay is your friend. You can go either long or short with this strategy. It’s an excellent way to combine the benefits of directional trades and spreads.

Options have many strategies that allow you to profit in any market, and calendar spreads are just such a strategy. Who doesn’t like being able to make money in a sideways market and up-and-down ones?

Options are great for growing a small account without trading penny stocks . You’re vulnerable to sector manipulation. Options are different, however. You can’t pump and dump options or the large-cap stocks that trade options.

Options Trading Course

Table of Contents

Volatility & Time Advantages

Calendar spreads example, 1. long call calendar spread, 2. short call calendar spread, 3. long put calendar spread, 4. short put calendar spread, 5. futures spread, final thoughts, what are calendar spreads.

Calendar spreads are useful in any market climate. Ultimately, utilizing this strategy is an effective way to minimize risk. If you want to use calendar spreads for income, the good news is that calendar spread earnings tend to be higher than other debit or credit spreads.

With this trading strategy, time decay is your friend. Also, with knowledge of the proper management techniques, you can do well for yourself trading calendar spreads. Check out our trade rooms to see options trading in action.

To utilize a calendar spread strategy, you buy and sell two options. You may trade two calls or two puts, but each is the same type. Additionally, you use the same strike price for both.

The only difference is the expiration dates. For example, you may create one option that expires in a month, then set the second one to expire in two months. Since the dates differ, calendar spreads are called “time spreads” or “horizontal spreads.”

You can go long or short on your spread. To initiate a long calendar spread, you sell the option with the earlier expiration date and buy the option with the later expiration date.