Minnesota Summary Proceedings | Minn. Stat. 524.3-1203

A full Minnesota probate is not always necessary. There are alternate estate administration procedures available to Minnesota residents. Contact a Minnesota probate attorney to discuss your option.

A personal representative or an interested person may file a petition with the court asking the court to determine that, because the decedent’s probate assets do not exceed certain specified limits, the assets should be summarily assigned and distributed to the appropriate persons.

If upon hearing the court determines that there is no need for the appointment of a representative and that the administration should be closed summarily because all of the property in the estate is exempt from all debts and charges in the probate court, a final decree or order of distribution will be signed, with or without notice, distributing property to the appropriate persons.

In certain instances, a personal representative may close an estate administered under the summary procedures of Minnesota Statutes section 524.3-1203 by filing with the court, at any time after disbursement and distribution of the estate, a sworn statement.

Summary Administration

The statutes provide for summary administration in the following cases.

- No Probate Assets Exist for Administration

If the sole asset of the estate is later determined to be a non-probate asset, any interested person may petition the court to close the administration summarily.

Assets Have Been Lost Irretrievably

Sometimes an estate administration is begun in an attempt to preserve an asset or to recover one. If this effort is unsuccessful, the administration may be closed summarily upon the petition of an interested person showing ”that the property has been destroyed, abandoned, lost, or rendered valueless, and that no recovery has been had nor can be had ….”

Only Exempt Assets Exist

Probate assets may exist, but if they are not available for payment to creditors, then no purpose is served by administration. The term “administration” refers to “acts of the representative in collecting property, taking possession thereof, and preserving it, converting it into cash, applying the proceeds to the payment of claims and distributing the residue.” Bengtson v. Setterberg , 227 Minn. 337,358,35 N.W.2d 623, 633 (1949). If there is nothing from which creditors may be paid, there may be nothing to administer, and therefore administration is unjustified. Cf. McHugo v. Norton , 159 Minn. 90, 92 (1924).

Moreover, if assets are exempt from creditors’ claims, no purpose is served by waiting four months to close the estate administration. An earlier closing does not harm the creditors, for they have lost nothing. If the only function of the representative is to deliver the property to the heirs or devisees, then the administration can be closed and the property decreed summarily upon petition by an interested person. A hearing with published notice is required for a petition to decree exempt property summarily; however, the decree may issue after the hearing without a claims period. Examples of exempt assets are discussed below.

Free Initial Consultations

Contact the Flanders Law Firm today. The firm offers free consultations to all potential clients. Call (612) 424-0398.

Related Posts:

“Joe – Thank you again for the expeditious and professional work. It’s nice to have an attorney that I know is going to be candid and approachable throughout.”

——— Gary C. Dahle Attorney at Law ———

Minnesota Summary Administration

Minnesota summary administration – situations.

In a situation where the decedent’s only “ probate asset ” is a homestead, the appointment of a Personal Representative may not be required.

Rather, title to the Homestead can be decreed by the Probate Court to:

- the decedent’s surviving spouse , if any, and

- the decedent’s surviving descendents , if any, who are either Will beneficiaries , or intestate heirs,

pursuant to a Minnesota Summary Administration procedure.

Minnesota Summary Administration – Requirements

The primary requirement for a Minnesota Summary Administration procedure is that the homestead passes to the decedent’s surviving spouse , if any, and/or to one or more of the decedent’s surviving descendants , pursuant to Minnesota law.

If it does, then:

- the homestead is exempt from creditor’s claims, and

- there is no need for the appointment of a Personal Representative .

Minnesota Summary Administration – Probate Court Decree

The end result of a Minnesota Summary Administration is that the court will decree the homestead to the parties entitled thereto.

Thereafter, a certified copy of the court’s decree should be filed in the county real estate records – which when filed – should be effective to evidence the transfer of title to the homestead:

- to the decedent’s surviving spouse, if any, and

- to the decedent’s surviving descendents identified in the decree.

However, any decree with respect Torrens Property must be approved for recording by the County Examiner of Titles .

Minnesota Summary Administration – Probate Court Filing Fees

The filing fees and the notice requirements with respect to a Minnesota Summary Administration are the same as for any other probate proceeding.

Minnesota Summary Administration – Conclusion

If you have need of a Minnesota Summary Administration procedure, contact attorney Gary C. Dahle , at 763-780-8390, or [email protected].

- Minnesota Probate Administration

- Ancillary Probate in Minnesota

- Commencing Minnesota Probate

- Do-It-Yourself Minnesota Probate

- Minnesota Decree of Descent

- Minnesota Safe Deposit Box

- Minnesota Special Administration

- Minnesota Surviving Spouses

- Hennepin County Minnesota Informal Probate

Copyright 2018 – All Rights Reserved

Gary C. Dahle – Attorney at Law

2704 Mounds View Blvd., Mounds View, MN 55112

Phone: 763-780-8390 Fax: 763-780-1735

Topics of Interest:

- Minnesota Affidavit Collection of Personal Property

- Minnesota Ancillary Probate – Ancillary Probate in Minnesota

- Minnesota Determination of Descent – Minnesota Decree of Descent

- Minnesota Personal Representative – Minnesota Co-Personal Representatives

- Minnesota Probate Law – Minnesota Probate Law Attorney

- Minnesota Probate Lawyer – Minnesota Probate Attorney

- Minnesota Probate New Brighton – Minnesota Probate 55112

- Minnesota Safe Deposit Box – Minnesota Safe Deposit Boxes

- Minnesota Special Administration – Minnesota Special Administrator

Legal Disclaimer

Information provided herein is only for general informational and educational purposes. Minnesota probate law involves many complex legal issues. If you have a specific legal problem about which you are seeking advice, either consult with your own attorney or retain an attorney of your choice . Gary C. Dahle, Attorney at Law, is licensed to practice law in the State of Minnesota, in the United States of America. Therefore, only those persons interested in matters governed by the laws of the State of Minnesota should consult with, or provide information to, Gary C. Dahle, Attorney at Law, or take note of information provided herein.

Accessing the web site of Gary C. Dahle, Attorney at Law – https://www.dahlelaw.com – may be held to be a request for information. However, the mere act of either providing information to Gary C. Dahle, Attorney at Law, or taking note of information provided on https://www.dahlelaw.com, does not constitute legal advice, or establish an attorney/client relationship. Nothing herein will be deemed to be the practice of law or the provision of legal advice. Clients are accepted by Gary C. Dahle, Attorney at Law, only after preliminary personal communications with him, and subject to mutual agreement on terms of representation.

If you are not a current client of Gary C. Dahle, Attorney at Law, please do not use the e-mail links or forms to communicate confidential information which you wish to be protected by the attorney-client privilege . Please use caution in communicating over the Internet. The Internet is not a secure environment and confidential information sent by e-mail may be at risk. Gary C. Dahle, Attorney at Law, provides the https://www.dahlelaw.com web site and its contents on an “as is” basis, and makes no representations or warranties concerning site content or function, including but not limited to any warranty of accuracy, or completeness.

Links to Minnesota Probate Records

Minnesota Department of Health – Death Records Index – 1997 to Present : http://www.health.state.mn.us/divs/chs/osr/DecdIndex/dthSearch.cfm

Minnesota Historical Society – Death Records; 1904 – 2001 : http://www.mnhs.org/people/deathrecords

Minnesota Department of Health – Birth Certificates – http://www.health.state.mn.us/divs/chs/osr/birth.html

Minnesota Historical Society – Birth Records : http://www.mnhs.org/people/birthrecords

Minnesota Marriage Records – https://moms.mn.gov/

Minnesota Probate Law

763-780-8390 [email protected]

When the decedent’s only probate assets are a Homestead , and certain other limited assets, title to the Homestead and such other assets can be decreed by a Minnesota Probate Court to the rightful owners(s) of such assets in Minnesota Summary Probate Proceedings, or a Minnesota Summary Administration – a little known, but valuable, probate title procedure.

Minnesota Summary Probate Proceedings –

Minnesota summary administration, minnesota summary probate proceedings – petitioner.

Any interested person may petition a Minnesota probate court in Minnesota Summary Probate Proceedings – Minnesota Summary Administration for a court decree with respect to certain estate assets.

Minnesota Summary Probate Proceedings – Interested Person

The term interested person is defined by M.S. Section 524.1-201(33) as follows:

“ Interested person ” includes heirs, devisees, children, spouses, creditors, beneficiaries and any others having a property right in or claim against the estate of a decedent, ward or protected person which may be affected by the proceeding. It also includes persons having priority for appointment as personal representative, and other fiduciaries representing interested persons. The meaning as it relates to particular persons may vary from time to time and must be determined according to the particular purposes of, and matter involved in, any proceeding.

Minnesota Summary Probate Proceedings – Minnesota Summary Administration – No Personal Representative

When the decedent’s only probate assets were a Homestead , and certain other limited assets, the appointment of a Minnesota Personal Representative is not required, and title to such assets can be decreed by a Minnesota Probate Court in Minnesota Summary Probate Proceedings pursuant to a Decree of Distribution :

- to the decedent’s surviving spouse , if any, and

- to the decedent’s surviving descendents , if any, who are either Will beneficiaries, or intestate heirs.

Minnesota Summary Probate Proceedings – Minnesota Summary Administration – Primary Requirement

The primary requirement in Minnesota Summary Probate Proceedings with respect to the Homestead and certain other limited assets is that such assets pass to:

- the decedent’s surviving spouse , if any,

- and/or to one or more of the decedent’s surviving descendants pursuant to Minnesota law.

If the Homestead and certain other limited assets will pass to such designated persons:

- such assets will be exempt from creditor’s claims, and

- there is no need for the appointment of a Minnesota Personal Representative .

Minnesota Summary Probate Proceedings – Minnesota Summary Administration – Descent of the Homestead

M.S. Section 524.2-402(a) identifies that a Minnesota Probate Court will decree title to the decedent’s Homestead pursuant to a Decree of Distribution in the following manner:

1. No Surviving Descendents – Complete Ownership to the Surviving Spouse

If the decedent has no surviving descendant(s) , the decedent’s entire interest in the Homestead will be decreed by the Probate Court to the surviving spouse – unless the surviving spouse :

- has consented in writing, or

- is deemed to have consented,

to any contrary disposition of the Homestead – in which case the Homestead may not be entirely free from creditor claims, and thus not eligible for Minnesota Summary Proceedings .

2. Surviving Descendents; a Life Estate to the Surviving Spouse – Remainder to the Decedent’s Descendents

If the decedent had a surviving spouse and one or more surviving descendents , the Probate Court will decree:

- a life estate in the Homestead to the surviving spouse – unless the surviving spouse has consented in writing, or is deemed to have consented – to a contrary disposition of the Homestead , and

- the remainder of the decedent’s interest in the Homestead to the decedent’s descendents “ by representation ”.

However, if the surviving spouse has consented in writing, or is deemed to have consented, to any disposition of the Homestead to someone other than the decedent’s descendents – the Homestead may not be entirely free from creditor claims – and thus not eligible for Minnesota Summary Proceedings .

3. No Surviving Spouse – Ownership to the Will Devisees

If there is no surviving spouse , and the decedent’s Will directs the disposition of the decedent’s interest in the Homestead , the decedent’s entire interest in the Homestead may be decreed by the Probate Court to the Will devisees identified in the decedent’s Will .

However, if such Will devisees are other than the decedent’s descendents – the Homestead may not be entirely free from creditor claims, and thus not eligible for Minnesota Summary Proceedings .

4. No Surviving spouse – Ownership to the Surviving Descendents

If there is no surviving spouse , and there is either:

- no Will , or

- the decedent’s Will fails to direct the disposition of the decedent’s interest in the Homestead ,

the decedent’s entire interest in the Homestead will be decreed by the Probate Court to the decedent’s surviving descendant(s) .

Minnesota Summary Probate Proceedings – Minnesota Summary Administration – Probate of the Decedent’s Will

If distribution of the decedent’s Homestead and/or certain other assets is to be made pursuant to the terms of the decedent’s Will , any such Will must be formally admitted to probate before a probate court Decree of Distribution will be issued with respect to such assets.

Minnesota Summary Probate Proceedings – Minnesota Summary Administration – Claims for Reimbursement of Minnesota Medical Assistance Benefits

The petitioner in Minnesota Summary Probate Proceedings must provide evidence to the probate court that there are no outstanding claims against the decedent’s estate for medical assistance benefits provided to the decedent, before the probate court will issue a Decree of Distribution with respect to the assets of the estate.

Minnesota Summary Probate Proceedings – Minnesota Summary Administration – Court Decree

The desired end result of a Minnesota Summary Probate Proceedings action is a Decree of Distribution issued with respect to the Homestead, and certain other assets, declaring that ownership of such assets is held by certain designated persons.

Thereafter, a certified copy of the court’s Decree of Distribution should be filed in the county real estate records with respect to the Homestead .

When a certified copy of the court’s Decree of Distribution is filed in the county real estate records , such Decree of Distribution should be effective to evidence the transfer of title to the Homestead :

- to the decedent’s surviving descendents identified in the Decree of Distribution ,

at least with respect to real property which offers the abstract property form of title evidence.

Minnesota Summary Probate Proceedings – Minnesota Summary Administration – Torrens Property

Any Minnesota probate court Decree of Distribution with respect real property which offers the Torrens Property form of title evidence must also be approved for recording by the County Examiner of Titles.

Minnesota Summary Probate Proceedings – Minnesota Summary Administration – Filing Fees and Notice Requirements

The filing fees and the notice requirements with respect to Minnesota Summary Probate Proceedings are the same as for any other probate proceeding.

Conclusion – Minnesota Summary Probate Proceedings;

A.k.a. minnesota summary administration.

If you could benefit from a Minnesota probate court’s Decree of Distribution issued in Minnesota Summary Probate Proceedings – Minnesota Summary Administration , contact attorney Gary C. Dahle , at 763-780-8390, or [email protected] .

For Minnesota Cemetery law issues see http://dahlelawcemeteries.com/

For information on Minnesota Church Corporation law , see also Minnesota Church Law .

For information on Minnesota Transfer on Death Deeds , see also http://www.dahlelawminnesota.com/minnesota-transfer-death-deed/

For information on Minnesota Real Estate Law , see also http://www.dahlelawminnesota.com/minnesota-title-evidence-ownership/

For information on Minnesota Guardianships , see also http://dahlelawguardianships.com/

Gary C. Dahle is also licensed in North Dakota.

For information on North Dakota Probate law, see https://www.dahlelawnorthdakota.com/

For information on North Dakota Transfer on Death Deeds , see also http://northdakotatransferondeathdeeds.com/

Copyright 2022 – All Rights Reserved

Gary C. Dahle – Attorney at Law

2704 Mounds View Blvd., Mounds View, MN 55112

Phone: 763-780-8390 Fax: 763-780-1735

[email protected]

Topics of Interest:

- Minnesota Affidavit Collection of Personal Property

- Minnesota Ancillary Probate – Ancillary Probate in Minnesota

- Minnesota Determination of Descent – Minnesota Decree of Descent

- Minnesota Personal Representative – Minnesota Co-Personal Representatives

- Minnesota Probate Law – Minnesota Probate Law Attorney

- Minnesota Probate Lawyer – Minnesota Probate Attorney

- Minnesota Probate New Brighton – Minnesota Probate 55112

- Minnesota Safe Deposit Box – Minnesota Safe Deposit Boxes

- Minnesota Special Administration – Minnesota Special Administrator

- Minnesota Joint Tenancy

Legal Disclaimer

Information provided herein is only for general informational and educational purposes. Minnesota probate law involves many complex legal issues. If you have a specific legal problem about which you are seeking advice, consult with a Minnesota attorney of your choice .

Gary C. Dahle, Attorney at Law, is licensed to practice law only in the State of Minnesota, in the United States of America. Therefore, only those persons interested in matters governed by the laws of the State of Minnesota should consult with, or provide information to, Gary C. Dahle, Attorney at Law, or take note of information provided herein.

Accessing the web site of Gary C. Dahle, Attorney at Law – https://dahlelawprobate.com – may be held to be a request for information.

However, the mere act of either providing information to Gary C. Dahle, Attorney at Law, or taking note of information provided on https://dahlelawprobate.com, does not constitute legal advice, or establish an attorney/client relationship.

Nothing herein will be deemed to be the practice of law or the provision of legal advice. Clients are accepted by Gary C. Dahle, Attorney at Law, only after preliminary personal communications with him, and subject to mutual agreement on terms of representation.

If you are not a current client of Gary C. Dahle, Attorney at Law, please do not use the e-mail links or forms to communicate confidential information which you wish to be protected by the attorney-client privilege .

Please use caution in communicating over the Internet. The Internet is not a secure environment and confidential information sent by e-mail may be at risk.

Gary C. Dahle, Attorney at Law, provides the https://dahlelawprobate.com web site and its contents on an “as is” basis, and makes no representations or warranties concerning site content or function, including but not limited to any warranty of accuracy, or completeness.

Links to Minnesota Probate Records

Minnesota Department of Health – Death Records Index – 1997 to Present : http://www.health.state.mn.us/divs/chs/osr/DecdIndex/dthSearch.cfm

Minnesota Historical Society – Death Records; 1904 – 2001 : http://www.mnhs.org/people/deathrecords

Minnesota Department of Health – Birth Certificates – http://www.health.state.mn.us/divs/chs/osr/birth.html

Minnesota Historical Society – Birth Records : http://www.mnhs.org/people/birthrecords

Minnesota Marriage Records – https://moms.mn.gov/

Give the gift

For families

For advisors

Petition For Summary Assignment

Everything you need to know about Minnesota Form Petition For Summary Assignment, including helpful tips, fast facts & deadlines, how to fill it out, where to submit it and other related MN probate forms.

About Petition For Summary Assignment

There are all sorts of forms executors, beneficiaries, and probate court clerks have to fill out and correspond with during probate and estate settlement, including affidavits, letters, petitions, summons, orders, and notices.

Petition For Summary Assignment is a commonly used form within Minnesota. Here’s an overview of what the form is and means, including a breakdown of the situations when (or why) you may need to use it:

Atticus Fast Facts About Petition For Summary Assignment

Sometimes it’s tough to find a quick summary— here’s the important details you should know about Petition For Summary Assignment:

This form pertains to the State of Minnesota

Government forms are not typically updated often, though when they are, it often happens rather quietly. While Atticus works hard to keep this information about Minnesota’s Form Petition For Summary Assignment up to date, certain details can change from time-to-time with little or no communication.

How to file Form Petition For Summary Assignment

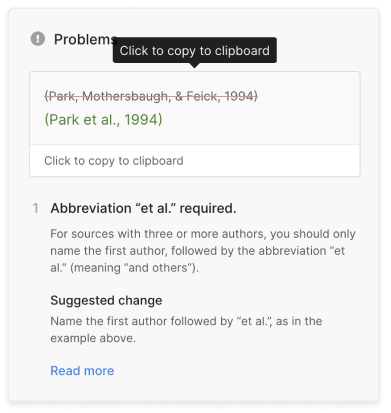

Step 1 - download the correct minnesota form based on the name and id if applicable.

Double check that you have both the correct form name and the correct form ID. Some Minnesota probate forms can look remarkably similar, so it’s best to double, even triple-check that you’re using the right one! Keep in mind that not all States have a standardized Form ID system for their probate forms.

Step 2 - Complete the Document

Fill out all relevant fields in Form Petition For Summary Assignment, take a break, and then review. Probate and estate settlement processes in MN are long enough to begin with, and making a silly error can push your timeline even farther back. No thank you!

Note: If you don’t currently know all of the answers and are accessing Form Petition For Summary Assignment online, be sure to avoid closing the browser tab and potentially losing all your progress (or use a platform like Atticus to help avoid making mistakes).

Step 3 - Have Form witnessed or notarized (if required)

Some States and situations require particular forms to be notarized. If you have been instructed to get the document notarized or see it in writing on the document, then make sure to hire a local notary. There are max notary fees in the United States that are defined and set by local law. Take a look at our full guide to notary fees to make sure you aren’t overpaying or getting ripped off.

Step 4 - Submit Petition For Summary Assignment to the relevant office

This is most often the local probate court where the decedent (person who passed away) is domiciled (permanently resides) or the institution involved with this particular form (e.g. a bank). Some offices allow you to submit forms online, other’s don’t, and we while we generally recommend going in-person to expedite the process, sometimes that simply isn’t an option. It’s also a generally good idea to establish a positive working relationship with any probate clerk (unfortunately there’s enough people & process out there making things more difficult and unnecessarily confusing for them), so a best practice is to simply ask the probate clerk proactively exactly how and where they’d prefer you to submit all forms. Need help getting in touch with a local probate court or identifying a domicile probate jurisdiction? 👉 Find and Contact your Local Probate Court 👉 What is a Domicile Jurisdiction?

Sponsored by Atticus App

Need help with Minnesota Probate?

Join all the other families who have trusted Atticus through probate, and experience the peace that comes from knowing you're taking the right steps, spending the least amount of money, and not wasting a single second.

When Petition For Summary Assignment is due

Different probate forms or processes can require different deadlines or response times for completing the appropriate form.

While some steps in the process are bound to specific deadlines (like petitioning for probate, having to submit an inventory of assets , or filing applicable notices to creditors and beneficiaries), many probate forms or processes are not tied to a specific deadline since the scope of work can vary based on situational factors or requirements involved.

Either way, there are a bunch of practical reasons why personal representatives should work to complete each step as thoroughly and quickly as possible when completing probate in Minnesota.

5 reasons you should submit this form as quickly as possible:

The sooner you begin, the faster Minnesota can allow heirs and beneficiaries to get their share of assets subject to probate. Acting promptly can also decrease the costs & overall mental fatigue through an otherwise burdensome process. Helpful Context: What’s the Difference Between Probate and Non-Probate Assets?

In general, creditors of an estate usually have around 3-6 months from the time you file notice to creditors to file any claims for debt against the deceased’s assets. If they don’t, then that debt is forfeited (and more importantly, the executor won’t be held personally responsible). So doing this sooner means you have a better idea of who is owed what and ensures you won’t get a surprise collector months later.

Not filing a will within 30 days (on average) could mean that the probate process proceeds according to intestate laws (laws that govern what happens to someone's stuff without a will) or is subject to unnecessary supervision by the probate court. And if you aren't directly related to the deceased (a.k.a. next of kin ), this could also mean you lose your inheritance.

It’s important to file any necessary state tax returns on behalf of the deceased or estate by the following tax season in Minnesota. If you don’t, you could owe penalties and interest. This also includes any necessary federal tax returns such as Forms 1040, 1041, or even a Form 706 estate tax return.

If a house in the State of Minnesota is left empty (or abandoned) for a while, insurance can get dicey. For example, if the house burns down and no one has been there for a year, an insurance company may get out of paying your claim.

If you’re not using Atticus to get specific forms, deadlines, and timelines for Minnesota probate, then try and stay as organized as possible, pay close attention to the dates mentioned in any correspondence you have with the State’s government officials, call the local Minnesota probate clerk or court for exact answers regarding Form Petition For Summary Assignment, and when in doubt— consult a qualified trust & estates lawyer for that area.

How to Download, Open, and Edit this form Online

Petition For Summary Assignment is one of the many probate court forms available for download through Atticus.

It may also be available through some Minnesota probate court sites, such as . In order to access the latest version, be updated with any revisions, and get full instructions on how to complete each form, check out the Atticus Probate & Estate Settlement software or consider hiring a qualified legal expert locally within Minnesota.

While Atticus automatically provides the latest forms, be sure to choose the correct version of Form Petition For Summary Assignment f using any other site or resource in order to avoid having to re-complete the form process and/or make another trip to the Minnesota probate court office.

Petition For Summary Assignment is a .pdf, so opening it should be as simple as clicking “View Form” from within the Atticus app or by clicking the appropriate link found on any Minnesota-provided government platform. Once you’ve opened the form, you should be able to directly edit the form before saving or printing.

Did you know?

Form Petition For Summary Assignment is a probate form in Minnesota.

Minnesota has multiple types of probate and the necessary forms depend on the unique aspects of each estate, such as type and value of assets, whether there was a valid will, who is serving as the personal representative or executor, and even whether or not they also live in Minnesota.

During probate, all personal representatives and executives in are required to submit a detailed inventory of assets that must separate non-probate assets from probate assets.

Probate in Minnesota, especially without guidance, can take years to finish and cost upwards of $14,000.

Frequently Asked Questions about Petition For Summary Assignment

What is probate, exactly?

Probate is the government’s way of making sure that when a person dies, the right stuff goes to the right people (including the taxes the government wants). All of that stuff is collectively known as someone’s “estate”, and it’s the job of the executor or personal representative to fill out all the forms and complete all the required steps to formally dissolve the estate. To get instant clarity on the entire probate process and get an idea of the steps, timeline, and best practices, read the Atticus Beginner’s Guide to Probate .

Where can I get help with Probate?

The best place? Create an account in Atticus to start getting estate-specific advice. You may need a lawyer, you may not, and paying for one when you didn’t need it really hurts. Atticus makes sure you make the best decisions (plus you can write it off as an executor expense). We’ve also created a list of other probate services . Be sure to check it out!

What does a MN executor or personal representative have to do?

An executor is named in someone’s will, and if the deceased didn’t have a will, then the spouse or other close family relative usually steps up to fulfill the role. If no one wants to do it, then a judge will appoint someone. The executor is responsible for the complete management of the probate process, including major responsibilities such as:

Creating an inventory of all probate assets .

Filling out all necessary forms

Paying off all estate debts and taxes

Submitting reports to the court and beneficiaries as requested

And much more. This process often stretches longer than a year. For an idea of what separates executors who succeed from those who make this way harder than it should be, visit our article, Executors of an Estate: What they do & secrets to succeeding .

The Exact Text on Form Petition For Summary Assignment

Here’s the text, verbatim, that is found on Minnesota Form Petition For Summary Assignment. You can use this to get an idea of the context of the form and what type of information is needed. M NCLE © 2007 P800 Minn. Stat. 524.3-1203 P800 Petition for Form al Summary Assignment or Distribution and Formal Probate of Will ( Non-Exempt Estate Exempt Estate) STAT E OF MINNESOTA COUNTY OF ______________________ ______________________ JUDICIAL DISTRICT DISTRICT COURT PROBATE DIVISION Estate of ______________________, Decedent Court File No. ______________________ PETITION FOR FORMAL SUMMARY AS SIGNMENT OR DISTRIBUTION AND FORMAL PROBATE OF WILL ( NON-EXEMPT ESTATE EXEMPT ESTATE) I, ___________________________________________________________, state: 1. My address is: __________________________________________________________________________. 2. I am an interested person as defined by Minnesota law because I am: _______________________________. 3. Decedent was born on ______________________, at (city, state) __________________________________. 4. Decedent died on ______________________, at (city, state) ______________________________________. 5. Decedent’s domicile at the time of death was in __________________________________ County, State of _____________________ at (address): _______________________________________________________. 6. The names and addresses of Decedent’s spouse, children, heirs, devisees and other persons interested in this proceeding so far as known or ascertainable with reasonable diligence by the Petitioner are: Name and Mailing Address Familial Relationship AND Legal Interest (List all) Birthdate Of Minors (Attach separate schedule, if necessary) 7 .Negative Allegation Statement (see Minn. Gen. R. Prac. 409(a)): 8.All persons identified as heirs have survived the Decedent by at least 120 hours, except for: _______________________________________________________________________________________. 9 .(Check appropriate boxes): Decedent left no surviving spouse. Decedent left no surviving issue. All issue of Decedent are issue of Decedent’s surviving spouse. There are issue of the Decedent that are not issue of the surviving spouse. There are issue of the surviving spouse who are not issue of the Decedent. MNCLE © 2007 P800 Minn. Stat. 524.3-1203 P800 Petition for Formal Summary Assignment or Distribution and Formal Probate of Will ( Non-Exempt Estate Exempt Estate) 10. Venue for this proceeding is in this County of the State of Minnesota because: The Decedent was domiciled in this County at the time of death, and was the owner of property located in the State of Minnesota. or Though not domiciled in the State of Minnesota, the Decedent was the owner of property located in this County at the time of death. 11. (Check appropriate boxes) Testate Decedent’s Will is comprised of the following: Last will dated ______________________. Codicil( ) dated ______________________ Separate writing( ) under Minn. Stat. 524.2-513 dated ______________________. The Will refers to a separate writing but none has been found. The Will is in the possession of the Court or accompanies this Petition. Intestate – Having conducted a reasonably diligent search, I am unaware of any testamentary instrument under Minnesota law and believe that the Decedent died leaving no will. 12 No personal representative of the Decedent has been appointed in Minnesota or elsewhere whose appointment has not been terminated. 13. I have not received a demand for notice and am not aware of any demand for notice of any probate or appointment proceeding concerning the Decedent that may have been filed in Minnesota or elsewhere. or Proper notice has been given to those persons who have filed a demand for notice. 14. Decedent, at the time of death, was the owner of certain property described and valued at date of death (“Property”) as follows: INSTRUCTIONS for Schedule A: 1. Use legal description. If urban property show street address. If rural property show acreage. 2. Contract for Deed: If Decedent owned the vendor’s/seller’s interest describe the land on Schedule A, value it at zero and show the remaining contract balance on Schedule B. If Decedent owned the vendee’s/buyer’s interest, describe the property on Schedule A and value it at its fair market value. MNCLE © 2007 P800 Minn. Stat. 524.3-1203 P800 Petition for Formal Summary Assignment or Distribution and Formal Probate of Will ( Non-Exempt Estate Exempt Estate) SCHEDULE A – Real Estate Item Number Description of Property (specify liens, if any) County Assessor's Market Value Fair Market Value 1 Homestead in the County of ______________________, Minnesota ___________________________________________ ___________________________________________ ___________________________________________ ___________________________________________ ___________________________________________ ___________________________________________ $_____________ $_____________ 2 Other Real Estate:____________________________ ___________________________________________ ___________________________________________ ___________________________________________ ___________________________________________ ___________________________________________ ___________________________________________ $_____________ $_____________ TOTAL $_____________ SCHEDULE B – Personal Property Item Number Description of Property (fully describe, specify liens, if any) Fair Market Value 1 ____________________________________________________________ $_____________ 2 ____________________________________________________________ $_____________ 3 ____________________________________________________________ $_____________ TOTAL $_____________ MNCLE © 2007 P800 Minn. Stat. 524.3-1203 P800 Petition for Formal Summary Assignment or Distribution and Formal Probate of Will ( Non-Exempt Estate Exempt Estate) 15. Decedent’s spouse is minor child or children are entitled to the following allowances provided for by Minn. Stat. 525.15: Household goods $_______________________ Wearing apparel $_______________________ Other personal property $_______________________ Automobile (see Minn. Stat. 525.15(2)) $_______________________ Maintenance at $________________ per month for _______ months $_______________________ TOTAL $________________________ 16. _______________________________________________________________ is entitled to reimbursement for the following: Expenses of Administration: Court Filing Fee $_______________________ Publication Fees $_______________________ Appraiser Fees $_______________________ Attorney Fees $_______________________ Copy & Recording Fees $_______________________ Other (Explain) $_______________________ Total $_______________________ Funeral Expenses: Funeral $_______________________ Cemetery $_______________________ Other $_______________________ Total $_______________________ Expenses of Last Illness: Hospital $_______________________ Physician $_______________________ Medicine $_______________________ Other $_______________________ Total $_______________________ Debts Having Preference Under the Laws of the United States: __________________________ $_______________________ __________________________ $_______________________ Total $_______________________ Taxes: __________________________ $_______________________ __________________________ $_______________________ Total $_______________________ Other Debts Paid: __________________________ $_______________________ __________________________ $_______________________ __________________________ $_______________________ Total $_______________________ TOTAL $__________________________ MNCLE © 2007 P800 Minn. Stat. 524.3-1203 P800 Petition for Formal Summary Assignment or Distribution and Formal Probate of Will ( Non-Exempt Estate Exempt Estate) 17. Other debts of Decedent remaining unpaid in the amount of $______________________ are listed on a separate schedule attached to this Petition. or There are no other debts of Decedent remaining unpaid. 18. There is no unsatisfied claim against Decedent’s Estate for state hospital care or medical assistance benefits described in Minn. Stat. 524.2-402(c). 19. (Check if appropriate). There is no need for the appointment of a Personal Representative. 20. Decedent’s Estate consists solely of the Property described in this Petition. It should be summarily assigned or distributed to the persons entitled to the Property because: (check appropriate boxes) All Property is exempt from all debts and charges. The sum of all allowances under Paragraph 16 and reimbursements under Paragraph 17 exceed the total value of all the Property other than Decedent’s exempt homestead. The total value of all Property, other than Decedent’s exempt homestead, is $30,000 or less and there are no unpaid debts of Decedent. WHEREFORE, I request the Court: 1. Fix a time and place for a hearing on this Petition; 2. (Check if applicable) Enter an Order probating the Decedent’s Will; 3. Determine the amount of a bond, if any, required by Minn. Stat. 524.3-1203, subd. 4 or 5; 4. Enter its decree summarily assigning and distributing the Property to all persons entitled to the Property according to law; 5. Grant such other and further relief as may be proper. Under penalties for perjury, I declare or affirm that I have read this document and I know or believe its representations are true and complete. Dated: __________________ ________________________________________________ Petitioner Attorney for Petitioner Name ________________________________ Firm _________________________________ Street ________________________________ City, State, ZIP _________________________ Attorney License No: ____________________ Telephone: ____________________________ FAX: _________________________________ Email: ________________________________ NOTE: Before using a Summary Procedure in a NON-EXEMPT estate, review Minn. Stat. 524.3-1203. Practitioners should also consider whether procedures under Minn. Stat. 524.3-1201 would be available and preferable when the estate is exempt and under $20,000. NOTE: If formal probate of will is not desired, modify the title.

Need help finding the rest of your Minnesota Probate forms?

Atticus has probate and estate settlement forms for your State.

How to Probate a Will Without a Lawyer: 7 Short Steps

3 Valuable Tips for Settling a Family Member’s Estate

Letters Testamentary vs. Letters of Administration: Key Differences

Losing a loved one isn't just hard emotionally, it also means filling out a ton of forms & paperwork. Here's what to do next.

Click to get help with Probate & settling an estate

- Find a Lawyer

- Ask a Lawyer

- Research the Law

- Law Schools

- Laws & Regs

- Newsletters

- Justia Connect

- Pro Membership

- Basic Membership

- Justia Lawyer Directory

- Platinum Placements

- Gold Placements

- Justia Elevate

- Justia Amplify

- PPC Management

- Google Business Profile

- Social Media

- Justia Onward Blog

Q: Do I need to go to probate or Can I do summary of assignment

My mom passed away 4/4/2015 with no will. She has land amd a poll barn that is paid for. She has a few cars paid in full but a lot of credit card debt. Can I do a summary of assignment or does this go to probate? Do I have become the executor since I'm the only child of hers and her husband passed away before she did. Am I responsible to pay the credit card debt even if her property isn't worth but maybe 16,000 her credit card debt is almost 30,000? The only debt she has is credit cards no loans out there. Do I sell her 3 cars piad in full amd the motorcycle and put that toward the credit card debt or do I keep the money? Thank you

- Estate Planning Lawyer

- Fowlerville, MI

- (810) 299-5222

- Email Lawyer

- View Website

A: Short answer: You need to see a probate attorney ASAP and BEFORE you do anything more. If the estate is 'upside down' (more debt that total assets) it may make no sense for you to do anything. Just 'walk away' and let the creditors fight over the scraps. You don't want to spend your own money settling your mother's debts. If indeed the land, cars and other property is worth MORE than the debts, then going through the probate process may make sense. Without facts that are missing from this description it is impossible to know for sure. The REAL problem is if the death was almost two years ago, who has been paying taxes on the land, and does your Mom's estate even still have an interest in it? The ONLY way to know what you should be doing is to seek local legal counsel and explore ALL the facts. Good luck! -- This answer is offered for informational purposes only and does not constitute legal advice or create an attorney/client relationship. I am licensed to practice in Michigan only. Please seek competent local legal help if you feel you need legal advice

Justia Ask a Lawyer is a forum for consumers to get answers to basic legal questions. Any information sent through Justia Ask a Lawyer is not secure and is done so on a non-confidential basis only.

The use of this website to ask questions or receive answers does not create an attorney–client relationship between you and Justia, or between you and any attorney who receives your information or responds to your questions, nor is it intended to create such a relationship. Additionally, no responses on this forum constitute legal advice, which must be tailored to the specific circumstances of each case. You should not act upon information provided in Justia Ask a Lawyer without seeking professional counsel from an attorney admitted or authorized to practice in your jurisdiction. Justia assumes no responsibility to any person who relies on information contained on or received through this site and disclaims all liability in respect to such information.

Justia cannot guarantee that the information on this website (including any legal information provided by an attorney through this service) is accurate, complete, or up-to-date. While we intend to make every attempt to keep the information on this site current, the owners of and contributors to this site make no claims, promises or guarantees about the accuracy, completeness or adequacy of the information contained in or linked to from this site.

- Bankruptcy Lawyers

- Business Lawyers

- Criminal Lawyers

- Employment Lawyers

- Estate Planning Lawyers

- Family Lawyers

- Personal Injury Lawyers

- Estate Planning

- Personal Injury

- Business Formation

- Business Operations

- Intellectual Property

- International Trade

- Real Estate

- Financial Aid

- Course Outlines

- Law Journals

- US Constitution

- Regulations

- Supreme Court

- Circuit Courts

- District Courts

- Dockets & Filings

- State Constitutions

- State Codes

- State Case Law

- Legal Blogs

- Business Forms

- Product Recalls

- Justia Connect Membership

- Justia Premium Placements

- Justia Elevate (SEO, Websites)

- Justia Amplify (PPC, GBP)

- Testimonials

- Live Seminars

- Institutes & Conferences

- Live In-Person Seminars

- Live Online Seminars

- On Demand Seminars

- eResources & Publications

- LinkedLaw Deskbooks

- LinkedLaw Library Subscriptions

- InFORMed Annotated Documents

- Summary Guides & Legal Quicksheets

- Automated Document Systems

- eCoursebook Collection

- Discounts & Season Passes

- Season Passes

- On Demand Bundles

- Webcast Packages

- Create Account

- Publication List

- ZMN Estate Administration Deskbook with eFormbook

Minnesota Estate Administration Deskbook with e Formbook, 6th Edition

Edited by Susan J. Link

The 6th Edition of the Minnesota Estate Administration Deskbook puts all of the latest and best information on administrating an estate in Minnesota from start to finish in one place. Editor Susan J. Link and our outstanding roster of expert attorneys and paralegals have raised the standard for Minnesota’s premier probate and estate practice manual, sharing their best practice tips and commentary to help you better serve your clients. The Deskbook also comes with a companion e Formbook that includes more than 260 downloadable and editable probate forms.

BONUS BENEFIT All current subscribers to the Minnesota Estate Administration Deskbook, hard copy or LinkedLaw, receive special reduced pricing on Minnesota CLE's automated CLEPro Probate Document System . Purchasers of the hard copy Deskbook will receive a coupon code for CLEPro with their Deskbook. Subscribers of the LinkedLaw version of the Deskbook should call Minnesota CLE at 800-759-8840 to receive their code.

BUNDLE AND SAVE! Purchase the hard copy and receive a coupon code to purchase the corresponding LinkedLaw e Deskbook for only $50! Code will be sent to you with your hard copy.

CHAPTER 1 Getting Started Introduction; Minnesota Statutes; Glossary of Terms; Engagement Letters; Fees of Attorney for Personal Representative; Death Certificates; The Personal Representative; Jurisdiction, Venue, and Pleadings; Probate Versus Non-Probate Assets; Attorney Tasks for Non-Probate Assets; Intestate Succession; Appendix A – Client Intake Form; Appendix B – Attorney-Client Agreement for Probate Administration; Appendix C – Checklist of Initial Questions; Appendix D – Minnesota Attorney General’s Table of Minnesota Heirship; Appendix E – Minnesota Death Certificate Application; Appendix F – Wills for Deposit or Withdrawal – Fourth Judicial District – Andrea S. Breckner

CHAPTER 2 Opening an Estate, Inventory, and Disclaimers Introduction; Choosing Formal or Informal Proceedings; Informal or Formal Proceedings; Informal Commencement – Minn. Stat. §§ 524.3-301–524.3-311; Formal Administration – Minn. Stat. §§ 524.3-401–524.3-505; The Personal Representative; The Initial Documentation; “eFiling” with the Court; Inventory and Record-Keeping; Distribution of Assets; Non-Ademption; Interim Orders; Disclaimers; Minor Heirs and Devisees; Conclusion; Appendix A – Foreign Consul List; Appendix B – Certificate of Representation; Appendix C – Sample Forms – Susan J. Link & Kevin J. Rockwell

CHAPTER 3 Creditors’ Claims Introduction; Definition of “Claims” – Minn. Stat. § 524.1-201(8); Assets Subject to Claims; Procedural Issues – William R. Asp

CHAPTER 4 Real Estate Introduction; Powers of a Personal Representative with Respect to Interests in Real Estate; Management of Real Estate; Sale of Real Estate; Distribution of Interests in Real Estate; Special Situations for Real Estate; Environmental Issues for the Fiduciary – Christopher B. Hunt

CHAPTER 5 Taxation Issues Final Individual Income Tax Return; Gift Tax Returns; Generation Skipping Transfer Tax; Fiduciary Income Tax Preliminaries; Fiduciary Income Tax Calculation; Estate Tax Returns; Portability; Section 6166 Deferral; Disposition of a Decedent’s Interest in a Closely Held Business Activity; The Minnesota Estate Tax Return; Assessment and Discharge; Additional Resources; Conclusion; Appendix A – Sample Income Allocation Statement for Year of a Taxpayer’s Death – Michael P. Sampson & Robert E. Lynn

CHAPTER 6 Estate Litigation Introduction; Litigation Basics Applicable to Probate Disputes; Disputes Concerning the Construction of a Testamentary Instrument; Disputes Concerning the Validity of a Testamentary Instrument; Disputes Involving Surviving Spouse’s Right to an Elective Share; Resolving Contested Matters Through Settlement; Litigation By and Against a Personal Representative; Alternative Dispute Resolution in Contested Matters; Forms – Katherine A. Charipar

CHAPTER 7 Closing and Distribution Introduction; General Considerations; The Final Account; Informal Closing Procedures; Procedures in Formal Closings; Distribution of Assets; Distributions to Persons Under Disability, to Trustees, and to Devisees Refusing to Accept the Distribution or Unknown Devisees; Discharge of Personal Representative; Correction of Errors; Appendix A – Minnesota Department of Public Safety – Assignment of a Vehicle to a Surviving Spouse/Not Subject to Probate Form; Appendix B – Acceptance of Appointment as Successor Trustee; Appendix C – Minnesota Uniform Conveyancing Forms, Form 90.1.4 – Affidavit of Trustee (Testamentary Trust); Appendix D – Minnesota Uniform Conveyancing Forms, Form 90.1.1 – Certificate of Trust; Appendix E – eFormbook Sample Forms – Alison J. Midden

CHAPTER 8 Miscellaneous Procedures Introduction; Collection of Personal Property by Affidavit; Special Administration; Summary Proceedings; Subsequent Administration; Determination of Descent; Appendix A: Notice of Homestead Claim – Tina M. Johnson

CHAPTER 9 Professional Responsibility Introduction; Competence; Scope of Representation; Diligence and Communication; Attorney’s Fees; Conflicts of Interest; The Attorney as Witness; Dealing with the Court; Dealing with Unrepresented Persons; Compliance with Rules for Tax Practitioners – Julian Zebot & Diana L. Marianetti

CHAPTER 10 Ancillary Administration Introduction; Domiciliary Personal Representative Acting Without Local Qualification; Foreign Personal Representative Bringing Civil Actions in Minnesota; Qualification by Domiciliary Representative as a Foreign Personal Representative in Minnesota; Local Administration in Minnesota of the Estate of a Nonresident Decedent; Tax Aspects of Ancillary Administration; Jurisdiction Over Ancillary and Foreign Personal Representatives; Effect of Adjudication; Index of Forms – James R. Thomson

CHAPTER 11 Review of Recommended Orders, Post-Trial Motions, and Appeals in Estate Litigation Introduction; Review of a Referee’s Recommended Order; Post-Trial Motions to Amend and for a New Trial; Appeals to the Minnesota Court of Appeals; Appeals to the Minnesota Supreme Court; Conclusion – Julian C. Zebot & Diana L. Marianetti

Table of Authorities Subject Index eFormbook Minnesota CLE’s Automated Document Systems

099 SERIES: General Forms

- P-001 Acceptance of Appointment as Personal Representative and Oath by Individual

- P-002 Acceptance of Appointment as Personal Representative and Oath by Corporation

- P-005 Nomination of Personal Representative and Renunciation of Priority for Appointment

- P-006 Renunciation of Priority for Appointment and Right to Nominate Personal Representative

- P-007 Petition Objecting to Appointment of Personal Representative

- P-008 Certificate of Representation

- P-010 Letters Testamentary/of General Administration

- P-011 Successor Letters Testamentary/of General Administration

- P-012 Application/Petition for Amended Letters of General Administration/Testamentary (to Correct Date of Death/to Add or Correct a Name)

- P-013 Order for Amended Letters

- P-015 Affidavit of Mailing Order or Notice

- P-016 Notice to Spouse and Children and Affidavit of Mailing

- P-017 Proof of Personal Service of Order or Notice

- P-018 Affidavit of Publication

- P-020 Confidential Information Form (MGRP Form 11.1)

- P-021 Cover Sheet for Non-Public Documents (MGRP Form 11.2)

- P-025 Petition for Removal of Demand for Notice

- P-026 Order Removing Demand for Notice

- P-030 Petition for Formal Proceedings to ________

- P-031 Notice and Order of Hearing on Petition for Formal Proceedings to ________

- P-032 Order for ________

- P-034 Verification under Oath

- P-040 Petition for Order Appointing Guardian Ad Litem

- P-041 Consent to Act as Guardian Ad Litem

- P-042 Order Appointing Guardian Ad Litem

- P-050 Petition to Stay, Dismiss, or Amend Formal Proceedings (Conflicting Claims of Domicile)

- P-051 Order Setting Hearing on Petition to Stay, Dismiss or Amend Formal Proceedings (Conflicting Claims of Domicile)

- P-052 Order for Continuation of Hearing

- P-060 Affidavit in Support of Search of Decedent-Lessee’s Safe Deposit Box

- P-062 Testimony of Witness to Will/Codicil

- P-070 Demand for Bond by Interested Person

- P-071 Order for Excusing or Requiring Bond after Demand

- P-072 Bond of Personal Representative Corporate Surety

- P-073 Bond of Personal Representative Personal Surety(ies)

- P-074 Request for Waiver of Bond

- P-075 Petition to/Excuse Bond/Increase Bond/Reduce Bond

- P-076 Order to/Excuse Bond/Increase Bond/Reduce Bond

- P-080 Demand for Jury Trial in Formal Proceedings

- P-081 Petition Requesting Jury Trial

- P-082 Petition for Order Appointing Appraisers

- P-083 Order Appointing Appraisers

- P-084 Disclaimer (Probate)

- P-085 Disclaimer (Non-Probate)

- P-086 Affidavit of Domicile

- P-087 Irrevocable (Stock) (Bond) Power

- P-088A Affidavit of Identity and Survivorship

- P-088B Affidavit of Identity and Survivorship for Transfer on Death Deed

- P-089 Testimony of Heirship

- P-090A Application for Certificate of Clearance for Medical Assistance Claim

- P-090B Application for Certificate of Clearance for Medical Assistance Claim (Transfer on Death Deed)

- P-091A Certificate of Clearance for Medical Assistance Claim

- P-091B Certificate of Clearance for Medical Assistance Claim (Transfer on Death Deed)

- P-092 Certificate of Consent to an Early Distribution of Assets Pursuant to Minn. Stat. § 524.3-801(d)(6)

- P-093 Notice to Commissioner of Human Services Regarding Possible Claims under Minn. Stat. §§ 246.53, 256B.25, 256D.16, or 261.04

- P-094 Affidavit of Service of Notice to Commissioner of Human Services Regarding Possible Claims under Minn. Stat. §§ 246.53, 256B.15, 256D.16, or 261.04

- P-095 Amendment to Notice to Commissioner of Human Services Regarding Possible Claims under Minn. Stat. §§ 246.53, 256B.25, 256D.16, or 261.04 Prior to Closing of Estate

- P-096 Affidavit of Service of Amendment to Notice to Commissioner of Human Services Regarding Possible Claims Under Minn. Stat. §§ 246.53, 256B.15, 256D.16, or 261.04 Prior to Closing of Estate

- P-097 Amendment to Notice to Commissioner of Human Services Regarding Possible Claims Under Minn. Stat. §§ 246.53, 256B.25, 256D.16, or 261.04 After Closing of Estate

- P-098 Affidavit of Service of Amendment to Notice to Commissioner of Human Services Regarding Possible Claims Under Minn. Stat. §§ 246.53, 256B.15, 256D.16, or 261.04 After Closing of Estate

100 SERIES: Informal Probate

- P-100 Application for Informal Probate of Will and for Informal Appointment of Personal Representative

- P-101 Application for Informal Probate of Will

- P-102 Application for Informal Appointment of Personal Representative (Testate – Split Proceeding)

- P-103 Application for Informal Appointment of Personal Representative (Intestate)

- P-105 Application for Informal Appointment of Successor Personal Representative

- P-110 Statement of Informal Probate of Will and Order of Informal Appointment of Personal Representative

- P-111 Statement of Informal Probate of Will

- P-112 Order of Informal Appointment of Personal Representative (Testate – Split Proceeding)

- P-113 Order of Informal Appointment of Personal Representative (Intestate)

- P-115 Order for Informal Appointment of Successor Personal Representative

- P-117 Declination of Application for Informal Appointment of Personal Representative and/or Informal Probate

- P-120 Notice of Informal Probate of Will and Appointment of Personal Representative and Notice to Creditors

- P-121 Notice of Informal Probate of Will

- P-122 Notice of Informal Appointment of Personal Representative, Notice and Order of Hearing for Formal Probate of Will and Notice to Creditors

- P-123 Notice of Informal Appointment of Personal Representative and Notice to Creditors (Intestate)

- P-124 Notice of Informal Appointment of Personal Representative, Notice of Hearing for Formal Adjudication of Intestacy, Determination of Heirship and Notice to Creditors

- P-145 Application to Registrar for Determination

- P-146 Registrar’s Determination

200 SERIES: Formal Probate

- P-200 Petition for Formal Probate of Will and for Formal Appointment of Personal Representative

- P-201 Petition for Formal Probate of Will and Confirming Appointment of Personal Representative

- P-203 Petition for Formal Probate of Will Previously Probated Informally and for Formal Appointment of Personal Representative

- P-204 Petition for Formal Probate of Will Previously Probated Informally

- P-205 Petition for Formal Adjudication of Intestacy, Determination of Heirs and Appointment of Personal Representative

- P-206 Petition for Formal Adjudication of Intestacy and Determination of Heirs

- P-208 Petition for Formal Appointment of Successor Personal Representative

- P-209 Petition for Formal Probate of Will, Determination of Partial Testacy, Determination of Heirs, and for Formal Appointment of Personal Representative

- P-217 Petition for Formal Adjudication of Intestacy and Determination of Heirs and Confirmation of Previously Informally Appointed Personal Representative or Appointment of Successor Personal Representative

- P-220 Notice and Order of Hearing on Petition for Probate of Will and Appointment of Personal Representative and Notice to Creditors

- P-221 Notice and Order of Hearing on Petition for Probate of Will

- P-224 Notice and Order of Hearing on Petition for Probate of Will Previously Probated Informally

- P-225 Notice and Order of Hearing on Petition for Formal Adjudication of Intestacy, Determination of Heirship, Appointment of Personal Representative and Notice to Creditors

- P-226 Notice and Order of Hearing on Petition for Formal Adjudication of Intestacy and Determination of Heirship

- P-227 Notice and Order of Hearing on Petition for Formal Adjudication of Intestacy and Determination of Heirs and Confirmation of Previously Informally Appointed Personal Representative or Appointment of Successor Personal Representative

- P-228 Notice and Order of Hearing on Petition for Appointment of Successor Personal Representative

- P-229 Notice and Order of Hearing on Petition for Probate of Will, Determination of Partial Testacy, Determination of Heirs, and Appointment of Personal Representative

- P-230 Order of Formal Probate of Will and Formal Appointment of Personal Representative

- P-231 Order of Formal Probate of Will

- P-233 Order of Formal Probate of Will Previously Probated Informally and Formal Appointment of Personal Representative

- P-234 Order of Formal Probate of Will Previously Probated Informally

- P-235 Order of Formal Adjudication of Intestacy, Determination of Heirs, and Formal Appointment of Personal Representative

- P-236 Order of Formal Adjudication of Intestacy and Determination of Heirs

- P-237 Order of Formal Adjudication of Intestacy and Determination of Heirs and Confirmation of Previously Informally Appointed Personal Representative or Appointment of Successor Personal Representative

- P-238 Order of Formal Appointment of Successor Personal Representative

- P-239 Order of Formal Probate of Will, Determination of Partial Testacy, Determination of Heirs, and Appointment of Personal Representative

- P-270 Statement of Contents of Lost, Destroyed, or Otherwise Unavailable Will

- P-271 Petition for Commission to Take Deposition of Witness to Will

- P-272 Commission to Take Deposition of Witness to Will

- P-273 Affidavit Identifying Signature of Testator (Witness not Available)

- P-280 Petition to Set Aside Informal Probate of Will

- P-281 Order Setting Aside Informal Probate of Will

- P-282 Objection to Formal Probate of Will

- P-283 Order Denying Probate of Will

- P-285 Petition for Modification of Prior Order

- P-286 Order Modifying Prior Order

- P-287 Petition for Vacation of Prior Order

- P-288 Order Vacating Prior Order

300 SERIES: Interim and Partial Distribution Forms

- P-301 Petition for Interim Order

- P-302 Interim Order for __________

- P-305 Petition for Protective Order for Investment of Minor’s Funds

- P-306 Protective Order for Investment of Minor’s Funds

- P-307 Acknowledgement of Notice and Consent: Minor’s Funds

- P-321 Petition for Interim Order for Partial Distribution

- P-322 Interim Order for Partial Distribution

- P-331 Petition for Interim Order Approving Partial Distribution Previously Made

- P-332 Interim Order Approving Partial Distribution Previously Made

- P-335 Petition for Order Approving Sale of Property to Personal Representative or Person/Entity Related to Personal Representative

- P-336 Consent to Sale of Decedent’s Property to Personal Representative or to Person/Entity Related to Personal Representative

- P-337 Notice and Order of Hearing on Petition for Order Approving Sale of Property to Personal Representative or to Person/Entity Related to Personal Representative

- P-338 Order Approving Sale of Property to Personal Representative or Person/Entity Related to Personal Representative

400 SERIES: Special Administration and Personal Representative

- P-400 Application for Informal Appointment of Special Administrator

- P-401 Order of Informal Appointment of Special Administrator

- P-405 Petition for Formal Appointment of Special Administrator

- P-406 Order of Formal Appointment of Special Administrator

- P-410 Letters of Special Administration

- P-412 Acceptance of Appointment as Special Administrator and Oath by Individual

- P-414 Acceptance of Appointment as Special Administrator by Corporation

- P-420 Inventory in Special Administration

- P-425 Final Account in Special Administration Original Amended Supplemental

- P-427 Inventory, Final Account, Petition for Allowance of Final Account And Discharge of Special Administrator

- P-430 Demand by Personal Representative for Delivery of Property

- P-440 Notice of Intent to Resign

- P-441 Resignation of Personal Representative

- P-442 Delivery to and Receipt by Successor Personal Representative

- P-443 Delivery To And Receipt By General Personal Representative

- P-450 Petition for Order Restraining Personal Representative

- P-460 Petition for Removal of Personal Representative

- P-461 Order Removing Personal Representative

500 SERIES: Claims and Elections

- P-500 Supplementary Notice to Known and Identified Creditors

- P-501 Demand for Notice

- P-502 Withdrawal of Demand For Notice

- P-503 Notice of Intention to File Document After Demand for Notice

- P-504 Waiver of Notice

- P-505 Limited Waiver of Notice

- P-506 Petition for Removal of Demand for Notice

- P-507 Order Removing Demand for Notice

- P-508 Written Statement of Claim

- P-509 Notice of Claim Made in Proceeding Against Decedent Before Death

- P-510 Notice of Allowance of Claim

- P-511 Notice of Allowance of Claim by Judgment Entered in Another Court

- P-512 Notice of Disallowance or Partial Allowance of Claim

- P-514 Change of Decision Concerning Claim

- P-515 Consent and Waiver of Defense of Statute of Limitations

- P-517 Consent to Extension of Time to Claimant

- P-518 Claimant’s Petition for Order Extending Time

- P-519 Order Extending Time to Claimant

- P-524 Claimant’s Petition for Allowance of Claim Previously Disallowed

- P-526 Order for Allowance of Claim Previously Disallowed

- P-530 Petition to Present and Allow a Late Claim

- P-531 Notice and Order for Hearing on Claim

- P-532 Order Allowing Late Claim

- P-534 Personal Representative’s Petition for Late Disallowance of Claim

- P-536 Order Authorizing Late Disallowance of Claim

- P-540 Petition for Order Directing Personal Representative to Pay Claim

- P-542 Order Directing Personal Representative to Pay Claim

- P-545 Satisfaction of Claim and Withdrawal of Demand for Notice

- P-550 Notice of Statutory Selection

- P-554 Petition to Award Property with Sentimental Value

- P-555 Order Awarding Property with Sentimental Value

- P-556 Petition to Allow Selection of Personal Property

- P-557 Order Allowing Selection of Personal Property

- P-560 Petition for Family Maintenance

- P-562 Order for Family Maintenance

- P-564 Petition for Elective Share of Augmented Estate

- P-565 Notice and Order of Hearing on Petition for Elective Share of Augmented Estate

- P-566 Order Granting Elective Share of Augmented Estate

- P-567 Petition for Election of Homestead Rights

- P-568 Notice and Order of Hearing on Petition for Election of Homestead Rights

- P-569 Order Granting Election of Homestead Rights

- P-570 Surviving Spouse’s/Respondent’s Augmented Estate Computation Worksheet

600 SERIES: Inventory and Closing

- P-600 Inventory

- P-601 Affidavit of Appraiser

- P-605 Final Account

- P-606 Consent to Final Account, Distribution of Estate and Waiver of Notice and Hearing

- P-610 Petition to Allow Final Account, Settle and Distribute Estate

- P-611 Notice and Order for Hearing on Petition for Formal Settlement of Estate

- P-612 Order Allowing Account

- P-613 Order Allowing Final Account and Settling Estate and Decree Of Distribution

- P-614 Order Allowing Final Account and Settling Estate and Order Of Distribution

- P-615 Receipt for Assets by Distributee

- P-616 Petition to Formally Adjudicate Intestacy, Determine Heirship, Confirm Appointment and Acts of Personal Representative Previously Appointed Informally, Allow Final Account, Settle and Distribute Estate

- P-617 Notice and Order of Hearing on Petition to Formally Adjudicate Intestacy, Determine Heirship, Confirm Appointment and Acts of Personal Representative Previously Appointed Informally, Allow Final Account, Settle and Distribute Estate

- P-618 Order Formally Adjudicating Intestacy, Determining Heirship, Confirming Appointment and Acts of Personal Representative, Allowing Final Account, Settling and Distributing Estate

- P-620 Proposal for Distribution

- P-621 Waiver by Distributee of Right to Object to Proposed Distribution

- P-622 Objection to Proposed Distribution

- P-624 Consent to Sale

- P-625 Objection to Final Account and Petition to Settle Estate

- P-627 Petition to Formally Probate Will Previously Probated Informally, Confirm Appointment and Acts of Personal Representative Previously Appointed Informally, Allow Final Account, Settle and Distribute Estate

- P-628 Notice and Order for Hearing on Petition to Formally Probate Will Previously Probated Informally, Confirm Appointment and Acts of Personal Representative Previously Appointed Informally, Allow Final Account, Settle and Distribute Estate

- P-629 Order Formally Probating Will Previously Probated Informally, Confirming Appointment and Acts of Personal Representative, Allowing Final Account, Settling and Distributing Estate

- P-630 Petition for Order Apportioning Estate Taxes

- P-631 Order Apportioning Estate Taxes

- P-634 Demand for Qualification of Trustee

- P-635 Order Requiring Qualification of Trustee

- P-636 Petition for Order Directing Deposit of Distributive Share with County Treasurer

- P-637 Order Directing Deposit of Distributive Share with County Treasurer

- P-638 Petition for Order Directing County Auditor to Authorize Distribution of Funds

- P-639 Order Directing County Auditor to Authorize Distribution of Funds

- P-640 Petition for Discharge of Personal Representative

- P-642 Order Discharging Personal Representative

- P-644 Petition for Extension of Time for Settlement of Estate

- P-646 Order and Citation to Settle and Close Estate

- P-648 Order Extending Time for Settlement of Estate

- P-660 Petition for Determination of Descent of Omitted Property

- P-661 Decree of Descent of Omitted Property

- P-665 Petition for Determination of Descent of Incorrectly Described Property

- P-666 Decree of Descent of Incorrectly Described Property

- P-670 Petition for Determination of Descent

- P-671 Notice and Order for Hearing on Petition for Descent of Property

- P-672 Notice and Order for Hearing on Petition for Descent of Property (Multiple Decedents)

- P-673 Decree of Descent

- P-680 Affidavit for Collection of Personal Property

- P-682 Unsupervised Personal Representative’s Statement to Close

- P-684 Application for Certificate from Registrar

- P-686 Certificate of Registrar

- P-688 Small Estate: Closing by Sworn Statement of Personal Representative

700 SERIES: Real Estate Deeds

- P-701 Deed of Distribution by Individual Personal Representative

- P-702 Deed of Distribution by Business Entity Personal Representative

- P-703 Deed of Sale by Individual Personal Representative to Individual(s)

- P-705 Deed of Sale by Individual Personal Representative to Business Entity

- P-706 Deed of Sale by Business Entity Personal Representative to Individuals

- P-708 Deed of Sale by Business Entity Personal Representative Deed to Business Entity

- P-709 Consent of Spouse for Sale

- P-710 Consent of Spouse for Distribution

800 SERIES: Summary Procedure

- P-800 Petition for Formal Summary Assignment or Distribution and Formal Probate of Will

- P-802 Notice and Order of Hearing on Petition for Summary Assignment or Distribution and for Formal Probate of Will

- P-805 Request for Waiver of Bond for Summary Assignment or Distribution

- P-807 Bond in Summary Proceedings – Corporate Surety

- P-810 Decree of Summary Assignment or Distribution and Formal Probate of Will

- P-812 Receipt for Assets Under Summary Assignment or Distribution

900 SERIES: Ancillary Proceeding

- P-900 Foreign Personal Representative’s Notice of Intention to Exercise all Powers of a Local Personal Representative as to Assets in Minnesota

- P-902 Notice to Creditors: Foreign Personal Representative Acting in Minnesota

- P-910 Application for Informal Probate of Will and Appointment of Personal Representative (Ancillary Proceeding)

- P-912 Statement of Informal Probate of Will and Order of Informal Appointment of Personal Representative (Ancillary Proceeding)

- P-914 Notice of Informal Probate of Will and Appointment of Personal Representative and Notice to Creditors (Ancillary Proceeding)

- P-920 Application for Informal Appointment of Personal Representative (Intestate Ancillary Proceeding)

- P-922 Order of Informal Appointment of Personal Representative (Intestate Ancillary Proceeding)

- P-924 Notice of Informal Appointment of Personal Representative and Notice to Creditors (Intestate Ancillary Proceeding)

- P-930 Petition for Formal Probate of Will and for Formal Appointment of Personal Representative (Ancillary Proceeding)

- P-932 Notice and Order of Hearing on Petition for Probate of Will and Appointment of Personal Representative and Notice to Creditors (Ancillary Proceeding)

- P-934 Order for Formal Probate of Will and Formal Appointment of Personal Representative (Ancillary Proceeding)

- P-940 Petition for Formal Adjudication of Intestacy, Determination of Heirs and Appointment of Personal Representative (Ancillary Proceeding)

- P-942 Notice and Order of Hearing on Petition for Formal Adjudication of Intestacy, Determination of Heirship, Appointment of Personal Representative and Notice to Creditors (Ancillary Proceeding)

- P-944 Order of Formal Adjudication of Intestacy, Determination of Heirs, and Appointment of Personal Representative (Ancillary Proceeding)

- P-950 Ancillary Letters Testamentary/of General Administration

HARD COPY + eFORMBOOK: $249 LINKEDLAW + eFORMBOOK: $125 for 1-year subscription

Bundle and save! Purchase the hard copy and receive a coupon code to purchase the corresponding LinkedLaw e Deskbook for only $50! Code will be sent to you with your hard copy.

Other discounts that may apply:

- Season Pass Discount

- New Lawyer Discount

Quantity discount: Please email [email protected] or call 800-759-8840 to inquire about bulk orders.

Owners of Hard Copy: Access the e Formbook through your account on the Minnesota CLE website under My Account > eResources & Publications .

Owners of LinkedLaw: Access the e Formbook directly from within your LinkedLaw book. (LinkedLaw books can be accessed through your account on the Minnesota CLE website under My Account > eResources & Publications .)

Do all Deskbooks have a companion eFormbook?

No, but as Deskbooks are updated, eFormbooks, if applicable, are included.

Once I’ve purchased a Deskbook that includes an eFormbook, how do I access it?

Access the eFormbook through your account on the Minnesota CLE website under My Account > eResources & Publications

Will I always have access to the Deskbook eFormbook?

Yes, you will always have access to the eFormbook as long as your Deskbook subscription is up-to-date.

Can I download the forms in my eFormbook?

Yes, and we recommend that you download all of the forms in your eFormbook so you can use them without Internet access.

Why won't my eforms download when using Google Chrome? What should I do?

Google has started to block the download of certain types of content in its latest versions of Chrome. One option you have is to switch to a different browser. To continue using Chrome, you can try the following:

Copy and paste chrome://settings/content/insecureContent into your Chrome browser address bar. In the "Allow" section, click the Add button. An "Add a Site" pop-up box should appear. Enter www.minncle.org in the box and click the Add button. You should now be able to open and download your eforms.

I understand and acknowledge the following:

This Deskbook is a hard copy product that will be shipped to me.

This Deskbook purchase opens a subscription for future Updates.

Minnesota CLE will notify me of a pending Update prior to shipping and invoicing me for the Update. I may opt out upon receiving the notification.

With my open subscription, future Updates will be offered to me at a discounted subscriber-only price.

With my open subscription, future new editions of this Deskbook will be offered to me at a discounted subscriber-only price.