Smart. Open. Grounded. Inventive. Read our Ideas Made to Matter.

Which program is right for you?

Through intellectual rigor and experiential learning, this full-time, two-year MBA program develops leaders who make a difference in the world.

A rigorous, hands-on program that prepares adaptive problem solvers for premier finance careers.

A 12-month program focused on applying the tools of modern data science, optimization and machine learning to solve real-world business problems.

Earn your MBA and SM in engineering with this transformative two-year program.

Combine an international MBA with a deep dive into management science. A special opportunity for partner and affiliate schools only.

A doctoral program that produces outstanding scholars who are leading in their fields of research.

Bring a business perspective to your technical and quantitative expertise with a bachelor’s degree in management, business analytics, or finance.

A joint program for mid-career professionals that integrates engineering and systems thinking. Earn your master’s degree in engineering and management.

An interdisciplinary program that combines engineering, management, and design, leading to a master’s degree in engineering and management.

Executive Programs

A full-time MBA program for mid-career leaders eager to dedicate one year of discovery for a lifetime of impact.

This 20-month MBA program equips experienced executives to enhance their impact on their organizations and the world.

Non-degree programs for senior executives and high-potential managers.

A non-degree, customizable program for mid-career professionals.

Teaching Resources Library

Formula 1: Unleashing the Greatest Spectacle on the Planet

Ben Shields

Cate Reavis

Apr 2, 2021

In 2017, U.S.- based Liberty Media, owner of the Atlanta Braves baseball team and streaming music provider SiriusXM among other properties, purchased Formula 1, the commercial organization behind the motorsport of F1 from CVC, a Luxembourg private equity firm. The well-seasoned management team that took over inherited a sport that, while profitable, had only a small business organization supporting it. In addition to building out a business infrastructure, the team’s goal was to evolve F1 from a motorsport into a global entertainment brand, akin to the National Basketball Association (NBA). In short, they wanted to create the greatest spectacle on the planet. The question was how to do this? On the sporting side, races had become predictable and lacked consistent wheel-to-wheel action. On the commercial side, the sport needed a younger, more diverse fan base which would inevitably engage with the sport differently than generations past. In addition to its sporting and commercial obligations, F1 played a critically important role as a technology leader for the automotive industry. Would Formula 1’s new management be able to find the right balance between these three important albeit, at times conflicting, roles.

Learning Objectives

- Explore the sporting, commercial, and societal challenges facing a professional sports organization and how these challenges are interrelated.

- Understand the role of data in strategy development on both the sporting and commercial sides of a professional sports organization.

- Assess the strategies used to transform a sport into a global entertainment brand.

- Examine how a professional sports organization balances retaining the traditional fan base while also attracting new fans.

- Discuss the roles and responsibilities of a professional sports organization within the global society.

Appropriate for the Following Course(s)

strategy, leadership, sports management, business of sports, sports analytics

THERE IS NO TEACHING NOTE FOR THIS CASE STUDY.

- Material Detail: Formula 1: Unleashing the Greatest Spectacle on the Planet: Case Study

Material Detail

Formula 1: Unleashing the Greatest Spectacle on the Planet: Case Study

In 2017, U.S.- based Liberty Media, owner of the Atlanta Braves baseball team and streaming music provider SiriusXM among other properties, purchased Formula 1, the commercial organization behind the motorsport of F1 from a private equity firm. The well-seasoned management team that took over, inherited a sport that, while profitable, had only a small business organization supporting it. In addition to building out a...

- Business / Management / Org Behavior and Development

- Under Review

- User Rating

- Learning Exercises

- Bookmark Collections

- Course ePortfolios

- Accessibility Info

- Report Broken Link

- Report as Inappropriate

More about this material

Disciplines with similar materials as Formula 1: Unleashing the Greatest Spectacle on the Planet: Case Study

People who viewed this also viewed.

Other materials like Formula 1: Unleashing the Greatest Spectacle on the Planet: Case Study

Full Description

In 2017, U.S.- based Liberty Media, owner of the Atlanta Braves baseball team and streaming music provider SiriusXM among other properties, purchased Formula 1, the commercial organization behind the motorsport of F1 from a private equity firm. The well-seasoned management team that took over, inherited a sport that, while profitable, had only a small business organization supporting it. In addition to building out a business infrastructure, the team’s goal was to evolve F1 from a motorsport into a global entertainment brand, akin to the National Basketball Association (NBA). In short, they wanted to create the greatest spectacle on the planet. The question was how to do this? On the sporting side, races had become predictable and lacked consistent wheel-to-wheel action. On the commercial side, the sport needed a younger, more diverse fan base which would inevitably engage with the sport differently than generations past. In addition to its sporting and commercial obligations, F1 played a critically important role as a technology leader for the automotive industry. Would Formula 1’s new management be able to find the right balance between these three important albeit, at times conflicting, roles.

Learning Objectives:

- Explore the sporting, commercial, and societal challenges facing a professional sports organization and how these challenges are interrelated.

- Understand the role of data in strategy development on both the sporting and commercial sides of a professional sports organization.

- Assess the strategies used to transform a sport into a global entertainment brand.

- Examine how a professional sports organization balances retaining the traditional fan base while also attracting new fans.

- Discuss the roles and responsibilities of a professional sports organization within the global society.

A watermarked copy of the case can be viewed here. If you are an instructor, you can complete the form to obtain an educator's copy. Note: You can obtain multiple educator copies with one form.

Edit Comment

Edit comment for material Formula 1: Unleashing the Greatest Spectacle on the Planet: Case Study

Delete Comment

This will delete the comment from the database. This operation is not reversible. Are you sure you want to do it?

Report a Broken Link

Thank you for reporting a broken "Go to Material" link in MERLOT to help us maintain a collection of valuable learning materials.

Would you like to be notified when it's fixed?

Do you know the correct URL for the link?

Link Reported as Broken

Link report failed, report an inappropriate material.

If you feel this material is inappropriate for the MERLOT Collection, please click SEND REPORT, and the MERLOT Team will investigate. Thank you!

Material Reported as Inappropriate

Material report failed, comment reported as inappropriate, leaving merlot.

You are being taken to the material on another site. This will open a new window.

Do not show me this again

Rate this Material

Search by ISBN?

It looks like you have entered an ISBN number. Would you like to search using what you have entered as an ISBN number?

Searching for Members?

You entered an email address. Would you like to search for members? Click Yes to continue. If no, materials will be displayed first. You can refine your search with the options on the left of the results page.

Special Situation Investing

Liberty Media spin-out

You can enjoy the Special Situation Investing Podcast on Fountain or wherever you listen.

Welcome to Episode 61 of Special Situation Investing where today we will cover Liberty Media’s spin-out of Braves Inc. To begin, let’s cover some history surrounding Liberty Media and its founder, and current Chairmen of the Board, John Malone.

John Malone has a storied history in the business world and elevated himself to self-made billionaire status largely through cable and media deals made over many decades. For those interested in his career, I highly recommend the book Cable Cowboy . The book gives some fascinating insights into Malone’s unique approach to value creation and justified the entire book even though it only covers his early life and business deals through 2005.

From 2006 on, Malone’s Liberty Media has handily outperformed the S&P 500 with a combined annual growth rate of 18%. The combined performance of Liberty Media’s spin-offs and separations over the last decade have returned an additional 16% above the S&P 500 for the 12 months following the spin-off date.

We believe that two factors drive the excess returns of Liberty Media. First, John Malone is an owner operator with a proven track record and has skin-in-the-game. At the time of this writing, Malone owns 48.4% of Liberty Media and is active in the companies operations through his role as Chairmen of the Board.

Second, the owner mentality drives the company to incubate value in a way that most professionally managed companies can not. Rather than see themselves as in the xyz business, Liberty’s leadership see themselves as capital allocators and this leads them to follow value wherever they find it.

For those of you looking for even more examples of John Malone’s business prowess, you can revisit Joel Greenblatt’s 1999 investing classic, You Can Be a Stock Market Genius . Greenblatt’s Liberty Media case study begins with the question “How do you make a half billion dollars in less than two years?,” answer, “Start with $50 million and ask John Malone. He did it.”

With that very broad background out of the way, lets delve into the current structure of Liberty Media. Broadly speaking, Liberty is divided into three sections which are Sirius XM, Formula 1, and the Atlanta Braves. Each of the three sections is represented in the market by a myriad of ticker symbols that include LSXMA, LSXMB, LSXMK, BATRA, BATRK, FWONA, and FWONK. To further confound the situation, the ticker symbols are tracker stocks and not your typical publicly traded stock. The difference between a standard stock and a tracker is that the tracker means to represent the performance of the underlying asset but doesn’t come with the same ownership claim that a typical stock would represent for the investor. John Malone is probably as well know for business complexity as he is for outstanding performance so I must admit that I wasn’t surprised to find needless complexity from the outset of my research.

So what is Liberty Media planning to do through the recently announced spin-out? In short, they plan to fully separate the Atlanta Braves and its associated real estate development into its own stock that will be called Atlanta Braves Holdings. The remaining assets of the company will themselves be streamlined into three distinct and newly issued tracking stocks. These tracking stocks along with the Braves spin-out will replace the existing business structure. The Atlanta Braves spin-out is what initially attracted us to the stock but seeing what was included in the three remaining trackers has us equally excited about the entire transaction.

To keep things clear, however, let’s first focus on the Braves spin-out. The spin-out will include 100% ownership of the Atlanta Braves along with The Battery Atlanta, which is a 1.5 mm square foot collection of leasable space surrounding the Braves new stadium. The real estate properties include office, hotel, dinning, and entertainment space that enhance the area with concerts, conferences, UFC fights and other events.

The current market cap for the Braves and Battery Park sits at about 1.8 billion with 1$.6 billion in assets, $142 million in cash and $700 million in debt. Last year the Braves generated $496 million in revenue and the Battery generated $39 million in revenue. Several qualitative factors influence the valuation of Braves Holdings including the longstanding success of the team, the breadth of the fan base and the high level of sellout games that the team generates. On the Battery side of the spin-out you have a property that garners over 10mm visitors per year placing it just below Disney's Epcot center in terms of annual visitors as well as the fact that Atlanta is now the 6th largest urban market in the US.

So how does this part of the transaction make money for holders of the spin-out? We think there are two catalysts with one being a much bigger driver than the other. The biggest value driver is the team itself. Owning a team is a bit of a trophy for the world’s billionaires and the teams themselves sell for higher and higher prices with each passing year. Here are a few recent comps to give you an idea of the valuations we’re seeing, the Minnesota Timberwolves sold to Alex Rodriguez for $1.5 billion, The Utah Jazz sold for $1.6 billion and the Denver Broncos sold to a member of the Walton family for $4.65 billion. With those prices in mind you can see the potential buyout value of the oldest team in baseball that is also a recent winner of the World Series.

The second, and much less important value driver, would be a separate, post spin-out, buyout of the team and The Battery real estate development. The Battery property could fit nicely into Brookfield’s top tier real estate portfolio or some other similar corporation and even if The Battery isn’t bought out in the near term it would offer a profitable stub style remainder following an Atlanta Braves purchase and resultant payout to shareholders.

After covering the spin-out, lets now go through the three remaining tracker stocks one by one. Beginning with Sirius XM (and we admit it’s the piece we know the least about) you have a profitable company that dominates an admittedly niche market. Nested inside Sirius XM is 100% owned Pandora and Stitcher which produced a surprising amount of subscriber and add revenue given what we think their industry market share is.

Next up you have 100% owned Formula 1 which monetizes ticket sales, add revenue, experiences, and media rights surrounding the global race series. Here we believe the valuation thesis is similar to the baseball team as owning a race brand like Formula 1 is more than a business and serves as status symbol.

This was illustrated by recent news of a Saudi Arabian sovereign wealth fund bid for the Formula 1 franchise that offered well over $20 billion for the current $16 billion market cap company. Liberty Media was not interested in selling which likely indicated that they value Formula 1 at some number above what the Saudis offered. As you can see by the offer, however, when a group of people has more money than god they’re looking for both an investment and the status that goes with ownership of an iconic brand.

Finally the third tracking stock will represent Liberty Media’s 31% ownership of Live Nation. Live Nation is a stock that we’ve been looking at separately so discovering that Liberty owned a 31% stake and that the stake in the company was part of the spin-out was an exciting two-for-one discovery.

The investment thesis for Live Nation stems from three things. First, the COVID lock-downs severely damaged Live Nations earnings in 2020 and 2021 as the business model is essentially ticket sales to live events. Next, the record sales business model for entertainers is being disrupted by low cost streaming services. Artist can no longer rely on record sales to make their money and as such are headed back out on the concert circuit to monetize in person events. Third, the Department of Justice began a probe regarding Live Nation anti-trust allegations. Essentially, Live Nations ownership of Ticketmaster raised questions surrounding a possible monopoly on live events.

Now, either the threat of a breakup will pass or Live Nation will be forced to split but either way the DOJ probe has pushed the stock down into the low $70 dollar range off of its recent $120 per share high. In summary, you have two massive, but temporary, blows to Live Nations stock price and earnings against a backdrop of a business that’s actually improving as more artist go on tour.

Okay, a few more hodgepodge items before we wrap up. The first is that Liberty Media has several small stakes in unrelated ventures that could one day create value for shareholders. For a complete list see the company’s recent investor presentation but to just name a few you have a 1% stake in Clear Secure, a 4% stake in INRX, a 7% stake in Denver’s Kroenke Arena, and a 30% stake in Meyer Shank Racing. The company also holds a 33% stake in Associated Partners, a 20% Stake in Liberty Media Acquisition Corp, and an 80% stake in Liberty Technology Venture Fund. The second list is essentially Liberty Media owned corporate structures tasked to identify and incubate future investments.

Insider and institutional ownership of Liberty Media also turned up some interesting things. For starters, and as stated before, John Malone owns 48.4% of the company, Berkshire Hathaway owns 8.4% of the company, and Seth Klarmin’s Baupost Group owns 1.9% of the company. Mario Gabelli’s Gabelli fund also had significant holdings in the Braves and Formula 1 portion of Liberty Media and have recently touted the businesses potential as a buyout target.

Because Liberty Media is currently represented by seven tracker stocks that encompass four major underlying business entities and because those business entities are spread among the existing three major divisions of Sirius XM, Braves, and Formula 1, we believe that investors will have to purchase a representative sample of the three current business segments if they want to receive Braves holdings stock along with the newly created three tracker stocks. I fully expect more details to be announced as the spin-out approaches but we do recommend that investors begin to build up their positions opportunistically as the spin-out details are announced and the transaction date approach.

We like that this spin-out has multiple success vectors including Malone’s track record, the company’s spin-off track record, and the distinct and compelling value propositions encapsulated in the various distinct business lines. The multiple paths to success approach is appealing when compared to spin-offs whose value stems from a single catalyst that if thwarted leaves the investor in the lurch.

With that we wrap up Episode 61 of Special Situation Investing. As always we’ll keep you posted as this and other investment opportunities develop. We thank you for your support and for the boosts you’ve sent our way over Fountain . Our Fountain account was down for several weeks in early January so we may have missed a boost or two during that time, but we’re back up and running now, and again thank you for any boosts you send our way.

Ready for more?

Marketing Strategy that Revived the fate of Formula One

When Lewis Hamilton first came to F1 racing in 2007, he had a 14-inch collar size. Today, that collar size is approximately 18-inch. In a sport where bodies go from 300kph to a standstill in mere moments, G-forces are so high that drivers need to train their neck muscles to insane levels. In fact, Fernando Alonso has a fan-favorite party trick – he can crush a walnut between the side of his head and shoulder!

F1 is an excruciating sport for drivers. Over the 90+ minutes of racing, each driver sweats over 3kg body weight , withstands constant temperatures of over 55 degrees Celcius, and loses an average of 40% brain function by the end. In fact, drivers are so weak by the end of the race that there are rules about how heavy the trophies can be!

Why do the drivers keep subjecting themselves to such inhuman conditions every weekend? Is it the passion for the sport? Is it the promise of everlasting glory? Or is it the money?

Sports Are a Business

Sports generate incredible amounts of passion, in the athletes and in the fans. And they generate money too. Every team, every organizer, and every sports league (at some level) is doing what they do for the revenues. But most fans and spectators don’t think of business when they think of sports. Even so, sports are serious business. The global sports market has a value of somewhere between $500 to 600 billion.

MBA schools, obviously, have recognized this business side. They have not only analyzed sports for parallels to the world of business but also understood the fact that sports themselves are a business. Case in point, the HEC MBA Tournament is hosted by HEC Paris every year. By organizing the tournament, students learn the intricacies of hosting a sports event where 15 leading international B-schools participate.

The Beginning of F1 Racing

Automobile racing began as soon as the internal combustion engine came into existence in the 1880s. The first true race was reportedly held in 1895 from Paris to Bordeaux and back. It covered a distance of 1178km with cars going at an average speed of 24.15kph.

F1 itself has its roots in the Grand Prix races from the 1920s and 1930s. It officially began in 1950 when the definition for the single-seat racing event was put in place. But mostly, the event was less a business than a racing festival.

The incredible rise of the sport is credited to Bernie Ecclestone , a British business tycoon who turned F1 into a stable business operation. He took over the operation in the 1970s. As such, he was commonly described in journalism as ‘F1 Supremo’.

He brought in the money and safety which have trickled down into all levels of motor racing. With cars now hitting speeds of 370kph, taking pit stops under two seconds, and the sport itself having a turnover of $4 billion annually and employing over 50,000 people in 30 countries, F1 has become the pinnacle of prestige, glamour, technology, and speed.

The Problem

But, by the time the sport reached 2016, the sheen was somewhat fading away. The 2010 and 2015 F1 global fan surveys had revealed significant dissatisfactions in the fan base .

Formula One essentially had an image and a reach problem. There was no direct relationship with fans and third-party digital services were siphoning off fan attention rapidly.

The small team essentially ran F1 as a 68-year-old start-up. It was mostly focused on securing media rights and promoters while ignoring digital, marketing, communications, strategy, research, and fans. It was ironic that the most technologically advanced sport in the world was stubbornly out of touch with the digital world. In short Formula One had a big problem with its marketing strategy.

I’m not interested in tweeting, Facebook and whatever this nonsense is. I’d rather get to the 70-year-old guy who’s got plenty of cash. So, there’s no point trying to reach these kids because they won’t buy any of the products here and if marketers are aiming at this audience, then maybe they should advertise with Disney. Bernie Ecclestone once famously said in an interview

F1 was clearly failing to enter the 21st century.

It was time for a change. And that came in the form of Liberty Media taking overall commercial operations in 2017. Since the company came from a media background, it treated F1 as a media rather than a sports problem.

The new owners asked Chase Carey to lead the organization. Through his 30-year career in media, Carey had been COO of Fox, Inc., CEO of DirectTV, president and COO of News Corporation, and, most recently, former vice-chairman of 21st Century Fox. At that time the organization also had no formal marketing, promotion, sponsorship, or research departments.

And in media, it is all about the eyeballs. Liberty Media took F1 from a perceived billionaire’s playspace to an accessible ultra-competitive entertainment event dominated by performance and data.

Data First Marketing Strategy of Formula One

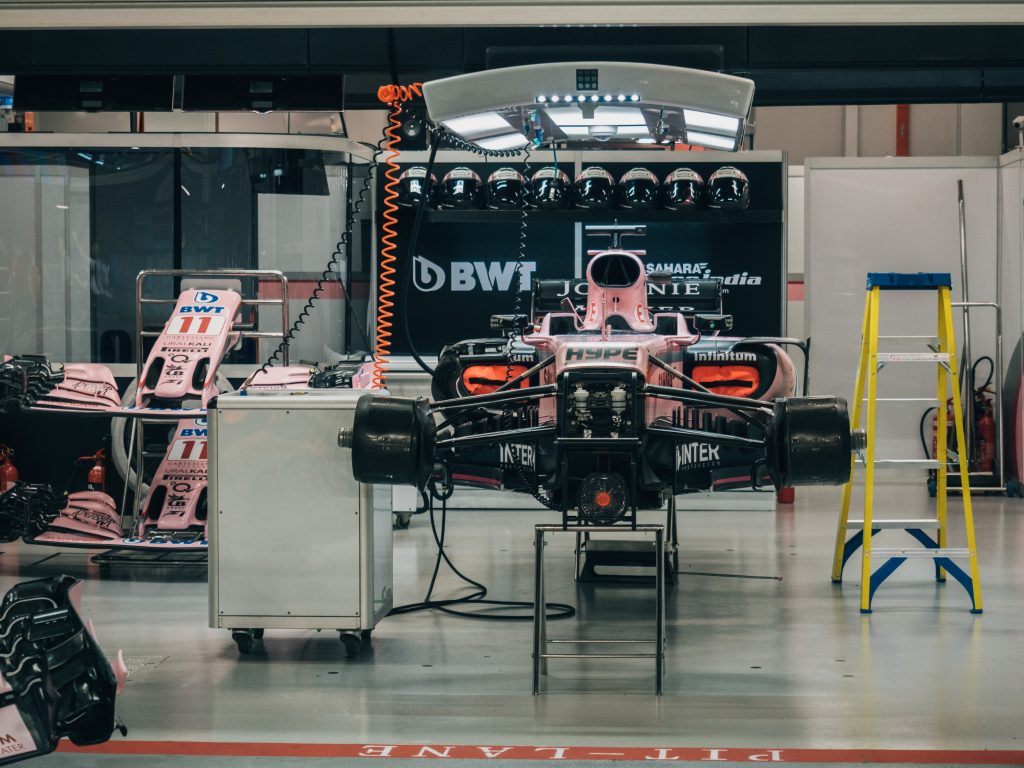

Liberty Media leveraged the insane amount of data that F1 holds to tell new off-track stories and generate fan engagement. This data is not just already present content in the form of video and data points from the previous six decades of F1 racing, but also over 1.1 million data points each F1 car pushes out per second through 300 sensors!

While earlier this data was being used by the teams to make better cars and improve strategy, it could now be used by fans to understand the races better. Using this treasure trove of data allowed F1 to bring better content to the hardcore fans.

F1 partnered with AWS to use this data to create a better fan experience, enabling them to analyze race strategy, compare competitors, and interpret car/driver performance in real-time. For the hardcore F1 fan, this means there are a lot more points to discuss in that debate of Verstappen vs Hamilton. (Full disclosure: The author is a Red Bull Racing fan.)

Further, this incredible power of data brings in previously never thought about avenues for fan engagement. Imagine racing with your PS/Xbox in real-time while a race is going on!

There’s something fascinating about people being under pressure and being forced to make decisions. James Allen, the president of Motorsport Network, who had covered F1 as a journalist for 30 years

Modern Marketing Strategy of Formula One

Despite the seemingly simple surface-level assumption that the best car and the best driver with the best strategy wins, F1 is not a self-evident sport. Watching the race can be confusing even with all the stats and commentary shooting off the screen. Terms like ‘chequered flag’ and ‘aerodynamics’ might be common, but ‘downforce’, ‘hot lap’, or ‘apex’ might leave people scratching their heads.

To solidify the casual viewers into regular fans, F1 utilized forms of digital outreach that not only kept the fans entertained, but also educated them about the intricacies of the sport.

There was a concerted effort to connect with younger fans and build a strong digital presence. It started with simple things like YouTube videos delving into the drivers’ personalities, behind-the-scenes action, and listicles.

Further, to address the problem of fans’ disconnectedness, F1 released campaigns with unique viewpoints to target potential fans. Engineered Insanity, F1’s first campaign after Liberty Media took over, showed what F1 feels like from the driver’s seat by putting fans at the heart of the action. The second campaign Man vs Machine paid tribute to all the engineering teams that make the cutting-edge technology of F1 possible.

Add to this a mix of F1 podcasts, F1 apps, and F1TV, a one of its kind over-the-top streaming platform. And fans can tune into F1 content wherever, whenever, and however, they want.

Meaningful Connections

The biggest change in the marketing strategy of Formula One from the Ecclestone era to Liberty Media’s approach is, that all fans are treated with respect and given equal importance. There is a difference between a customer and a fan, and that is passion. Liberty Media understands that passion, especially in sports, ultimately drives sales.

Audiences want to watch an exciting sport, but they also want it to feel relevant to their lives and issues that matter to them. Until recently, drivers were not allowed to be on social media or to interact with fans outside of approved avenues. But now, the opening up of social media has given fans a window into the worlds of their favorite drivers and teams. This gives fans a chance to see their driving heroes as real people instead of just rich dudes in fast cars.

View this post on Instagram A post shared by Lewis Hamilton (@lewishamilton)

A shining example of these efforts to generate passion for the sport is the Netflix series F1: Drive to Survive. It focuses on behind-the-scenes action and driver/team rivalries as much as on-track racing. And in a very short time, it has become not only an indispensable part of the F1 ecosystem but has also added a whole new horde of fans.

These efforts have also allowed important current issues to be a part of the F1 discussion. For example Hamilton’s stand on racial injustice, We Race As One to acknowledge the global fight against COVID, or the commitment to have a net-zero carbon footprint by 2030. In the modern world, values matter as much as the product, and F1 is embracing the new world with aplomb.

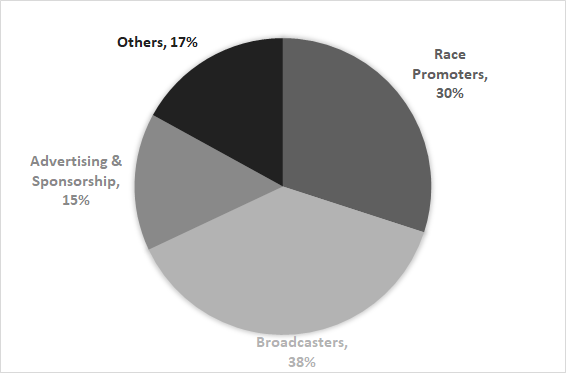

How does F1 make money?

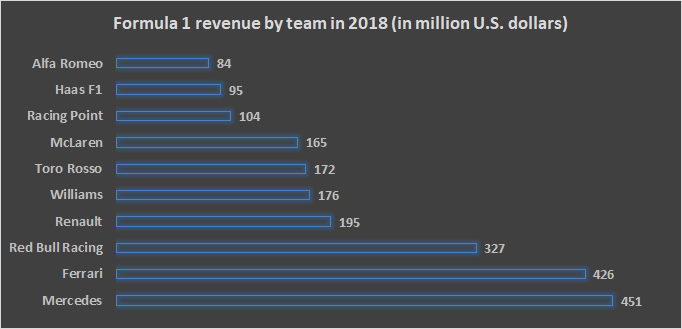

By the start of 2019, Formula 1 had four revenue-generating business units , with each having its own P&L:

- Annual Fee from Race Promoters : Race promoters (typically circuit owners or automotive clubs) pay Formula 1 an annual fee averaging $30 Million. While promoters were responsible for providing the necessary infrastructure, they kept the revenue generated from ticket sales and local sponsorships. Promotions accounted for 30% of revenues in 2019.

- Fee from Broadcasters : Broadcasters like ESPN take the license from F1 to show F1 events on TV and other platforms. Broadcasting accounted for 38% of revenues in 2019.

- Advertising and Sponsorships : F1 generated revenues by selling trackside advertising and race sponsorship packages to companies. Off-late companies are less caring about branding and more demanding of data of their customers. This stream accounted for 15% revenues in 2019.

- Others : The Paddock Club, the official exclusive VIP hospitality for every Formula One Grand Prix, and F1 TV Pro service accounted for the remainder 17% revenue.

In the last few years, Formula One has come a long way, especially with its marketing strategy. The sport has increased TV and digital viewership and added a significant number of fans in critical demographics. 61% of new fans are under the age of 35 and 25% are between 16-24 years of age .

There were many ways in which fans could engage with the sport beyond watching races on TV or attending them live. The content was becoming more portable and personalized. These fans will potentially support the sport for decades to come.

Liberty Media understood that in F1 they have the best technology, the best engineers, and one of the most innovative sports in the world. The only thing missing was the connection with the fans. And as F1’s ex-commercial boss Sean Bratches said in a 2018 interview, “We are myopically focused on serving the Formula 1 fan.”

View this post on Instagram A post shared by FORMULA 1® (@f1)

-AMAZONPOLLY-ONLYWORDS-START-

Also, check out our most loved stories below

Why did Michelin, a tire company, decide to rate restaurants?

Is ‘Michelin Star’ by the same Michelin that sells tires, yes, it is! But Why? How a tire company evaluations became most coveted in the culinary industry?

Johnnie Walker – The legend that keeps walking!

Johnnie Walker is a 200 years old brand but it is still going strong with its marketing strategies and bold attitude to challenge the conventional norms.

Starbucks prices products on value not cost. Why?

In value-based pricing, products are price based on the perceived value instead of cost. Starbucks has mastered the art of value-based pricing. How?

Nike doesn’t sell shoes. It sells an idea!!

Nike has built one of the most powerful brands in the world through its benefit-based marketing strategy. What is this strategy and how Nike has used it?

Domino’s is not a pizza delivery company. What is it then?

How one step towards digital transformation completely changed the brand perception of Domino’s from a pizza delivery company to a technology company?

BlackRock, the story of the world’s largest shadow bank

BlackRock has $7.9 trillion worth of Asset Under Management which is equal to 91 sovereign wealth funds managed. What made it unknown but a massive banker?

Why does Tesla’s Zero Dollar Budget Marketing Strategy work?

Touted as the most valuable car company in the world, Tesla firmly sticks to its zero dollar marketing. Then what is Tesla’s marketing strategy?

The Nokia Saga – Rise, Fall and Return

Nokia is a perfect case study of a business that once invincible but failed to maintain leadership as it did not innovate as fast as its competitors did!

Yahoo! The story of strategic mistakes

Yahoo’s story or case study is full of strategic mistakes. From wrong to missed acquisitions, wrong CEOs, the list is endless. No matter how great the product was!!

Apple – A Unique Take on Social Media Strategy

Apple’s social media strategy is extremely unusual. In this piece, we connect Apple’s unique and successful take on social media to its core values.

-AMAZONPOLLY-ONLYWORDS-END-

Aditya is a project manager with experience in technology and consulting. He received his MBA from HEC Paris with a focus on strategy. He reads, travels, writes, and works, in that order. His career aspirations include becoming a Chief Meme Officer and gathering enough free time to finally write that book he’s always thinking about!

Related Posts

Dior Marketing Strategy: Redefining Luxury

Dunkin-licious marketing mix and Strategy of Dunkin Donuts

Healthy business model & marketing strategy of HelloFresh

Twist, Lick, and Dunk- Oreo’s Marketing Strategy

Nestle’s Marketing Strategy of Expertise in Nutrition

How does Vinted make money by selling Pre-Owned clothes?

N26 Business Model: Changing banking for the better

Sprinklr Business Model: Managing Unified Customer Experience

How does OpenTable make money | Business model

How does Paytm make money | Business Model

How does DoorDash make money | Business Model

Innovation focused business strategy of Godrej

How does Robinhood make money | Business Model

How does Venmo work & make money | Business Model

How does Etsy make money | Business Model & Marketing Strategy

How does Twitch make money | Business Model

Write a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

- Advanced Strategies

- Brand Marketing

- Digital Marketing

- Luxury Business

- Startup Strategies

- 1 Minute Strategy Stories

- Business Or Revenue Model

- Forward Thinking Strategies

- Infographics

- Publish & Promote Your Article

- Write Article

- Testimonials

- TSS Programs

- Fight Against Covid

- Privacy Policy

- Terms and condition

- Refund/Cancellation Policy

- Master Sessions

- Live Courses

- Playbook & Guides

Type above and press Enter to search. Press Esc to cancel.

Justice Department opens investigation into Liberty Media over F1 Andretti clash

The U.S. Department of Justice has opened an antitrust investigation into Liberty Media, the American company that owns the commercial rights to Formula 1 , over its refusal to admit the U.S. racing team Andretti Global into the sport.

That’s according to Liberty Media, which notified investors about the inquiry in an official form.

Liberty Media said in the form that it “has received notification from the Department of Justice, Antitrust Division that an investigation has been opened with respect to Formula 1’s conduct concerning the application by Andretti Formula Racing to enter the FIA Formula One World Championship.”

Liberty Media President and CEO Greg Maffei also discussed it on an earnings call Thursday morning.

“We intend to fully cooperate with that investigation, including any related request for information. We believe our determination or F1’s determination was in compliance with all applicable U.S. antitrust laws,” Maffei said on the call.

“And we’ve detailed the rationale for this decision vis-a-vis Andretti in prior statements. We are certainly not against the idea that any expansion is wrong,” he said. “There is a methodology for expansion that requires approval of the FIA and the F1 and both groups have to meet find the criteria met. And we’re certainly open to new entrants making applications and potentially being approved if those requirements are met.”

The Justice Department declined to comment.

The investigation was requested in May by a group of senators , led by Amy Klobuchar, D-Minn., who said they were “concerned” that Formula 1 may be violating U.S. antitrust law by helping the largely European rival teams, “including foreign automakers,” to block competition from Andretti Global, which has teamed up with the Michigan-based GM and Cadillac to build its power unit.

The backstory: Late last year F1’s governing body, the FIA, approved Andretti’s application to join the sport, saying it met the “stringent criteria” required of a new team. But F1’s commercial side, owned by Liberty Media, blocked it in January, saying it didn’t believe the team would be competitive or boost the value of the F1 championship in 2025 or 2026.

Andretti Global declined to comment.

The team’s bid to enter F1 is helmed by Michael Andretti. His father, Mario Andretti, the patriarch of the racing dynasty, has been outspoken in his criticism of the decision, even accusing Liberty Media of making it personal , a charge the company denies.

F1’s growing fanbase , and the potential for an American automaker to compete in the popular sport, has sparked interest from members of Congress in recent months. The six senators told the Justice Department in May that they “have serious concerns that the rejection of Team Andretti-Cadillac was based on a desire to exclude a rival from the racetrack, marketing opportunities, and prestige that competing in F1 can lend to a car manufacturer competing to sell cars across the globe.”

Sahil Kapur is a senior national political reporter for NBC News.

More From Forbes

How f1’s former owner outperformed liberty media in just two years.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

The private equity firm CVC takes the trophy when it comes to F1's financial performance (GERARD ... [+] JULIEN/AFP/Getty Images)

Liberty Media’s true performance at the wheel of Formula One has been revealed in new research which reveals that its predecessor outperformed it in all but one of its core revenue streams over its first two years.

Liberty got the keys to F1 in 2017 when it bought the auto racing series for $4.6 billion from the private equity firm CVC. Since then it has burned up $105 million of combined operating losses driven by increased costs.

After nearly 40 years in the driving seat, Liberty replaced F1’s chief executive Bernie Ecclestone with 21st Century Fox vice chairman Chase Carey who stamped its mark on the business through a number of costly developments. They included re-branding F1, commissioning a theme tune, starting an Esports series, organizing street demonstrations, moving to a plush new office and doubling the headcount.

F1 justified this spending on the grounds that it had pursued profits over investment for many years. Sean Bratches, the commercial boss who was also hired by Liberty, even described his role as “managing a start-up” despite F1 being 69 years-old and having annual revenue of $1.8 billion.

The accelerating costs make it hard to judge Liberty by F1’s bottom line performance. This shouldn’t affect its revenue but that too has been stuck in the slow lane.

F1’s latest results show that even though there was one more Grand Prix on the calendar in 2018 than the previous year, revenue from race hosting fees increased by just 1.4% to $616.7 million. It was fueled by a change in the line-up.

iPhone 16 Release: Apple Confirms Special Event, On A Surprise New Date

Trump signals he may skip abc news debate after bashing network, officials confirm arrest of billionaire telegram ceo pavel durov in france: here’s what we know.

Last year F1 added races in France and Germany but dropped the Malaysian Grand Prix which was one of the biggest payers with an annual fee estimated at $46.7 million. This gave F1 a total of 21 races and led to the modest increase in its fees from race organizers. It is a particularly poor performance given that many of F1’s Grand Prix contracts contain escalators which drive up the hosting fees by 5% annually regardless of how successful the race is.

Compared to the year before Liberty bought F1, its revenue from hosting fees has crashed by $36.3 million. In contrast, it increased $16.5 million between the year before CVC’s acquisition and the second year of its tenure. During that time, from 2005 to 2007, F1 actually lost two races leaving it with just 17 on the calendar. However, the escalators more than made up for this which is why the revenue from hosting fees rose.

It is a similar story with F1’s broadcasting revenue which only rose by 0.4% to $603.9 million in 2018. Liberty explained that the driving force behind this was “the early termination of one contract with a failing broadcast rights broker.”

Giving further detail, Carey added that “it was essentially a middleman that controlled our rights and sold them on so when the broker went broke the agreements were eliminated as part of the process.” Despite this, F1’s broadcasting revenue increased by $16.9 million when compared to the total from 2016. It may sound like a solid performance but CVC’s results leave it in the dust.

Thanks in part to new television contracts with ITV in Britain and Telecinco in Spain, F1’s broadcasting revenue increased by $82.4 million between 2005 and 2007. Likewise, in its first two years CVC managed to boost F1’s miscellaneous revenue, which largely comes from corporate hospitality, more than Liberty has done over the same period. It contributed to F1's overall revenue surging by $149.9 million in the first two years that CVC was in charge compared to just $31 million under Liberty as shown in the table below.

CVC boosted F1's revenue in its first two years far more than Liberty Media has done

Ironically, the only revenue stream which has grown more under Liberty than CVC is sponsorship. It actually reversed by $10 million during CVC’s first two years as the loss of two races dented the total. However, it increased by $4.4 million between 2016 and 2018 as sponsor fees are now less dependent on the number of events.

The increase is ironic as Carey has repeatedly stressed that it has been harder than he expected to secure sponsorship. The day after Liberty’s acquisition got the green light, Carey was asked by CNBC which of F1’s revenue streams had the greatest growth potential.

In response he forecast that “probably the one that grows the fastest, you know, is probably sponsorships. Realistically today, we have a one-man sponsorship operation. There are many categories we’re not even selling into. Putting an organization in place that enables us to execute on that probably is the most immediate impact.” Liberty did just that but Carey has said it didn’t pay off.

In an interview with the Financial Times in November Carey said “the perception was just there are sponsors waiting...They were lined up out there and as soon as we had somebody to go call on them, they were just going to sign up. The world’s not that simple.”

More recently Carey added that “the challenge in the sponsorship world is probably tougher than it was a few years ago. For anybody who is not Google or Facebook, the broader advertising world is more challenging...I think it is fair to say that the sponsorship world has probably been more challenging than we would have expected it to be a couple of years ago.” Given that this is the one area where Liberty outperformed CVC F1 has clearly been anything but an easy ride.

It’s a game of inches — and dollars. Get the latest sports news and analysis of valuations, signings and hirings, once a week in your inbox, from the Forbes SportsMoney Playbook newsletter. Sign up here .

- Editorial Standards

- Reprints & Permissions

A formula for success: How Formula One racing embraced digital and social media to engage fans

- 11(1):43-59

- Saint Joseph's University (PA, USA)

Discover the world's research

- 25+ million members

- 160+ million publication pages

- 2.3+ billion citations

No full-text available

To read the full-text of this research, you can request a copy directly from the authors.

- Mary Grace Antony

- Lynn Johnson Ware

- J SOC CLIN PSYCHOL

- Rachel Marx

- Courtney Lipson

- INTERNET RES

- J SERV RES-US

- Katherine N. Lemon

- J Strat Market

- PSYCHOL MARKET

- J Retailing Consum Serv

- Masayuki Yoshida

- Joshua J. Clarkson

- Walter Gantz

- Lawrence A. Wenner

- A. Waldburger

- Michelle Brunette

- J Serv Market

- Kenneth A. Hunt

- Terry Bristol

- R. Edward Bashaw

- A Christovich

- K Collantine

- Flow Racers

- T V Broadband

- New York Times

- B Schoenfeld

- E Blackstock

- J N Burkhalter

- Recruit researchers

- Join for free

- Login Email Tip: Most researchers use their institutional email address as their ResearchGate login Password Forgot password? Keep me logged in Log in or Continue with Google Welcome back! Please log in. Email · Hint Tip: Most researchers use their institutional email address as their ResearchGate login Password Forgot password? Keep me logged in Log in or Continue with Google No account? Sign up

- Live on Sky

- Get Sky Sports

- Sky Mobile App

- Kick It Out

- Black Lives Matter

- British South Asians in Football

Liberty Media's F1 takeover unanimously approved by FIA

Sport's governing body vote in favour of takeover in Geneva; Deal expected to be formally completed by the end of January

Wednesday 18 January 2017 20:21, UK

The takeover of Formula 1 is nearing completion after the FIA approved Liberty Media's purchase of the sport.

In a meeting of the World Motor Sport Council in Geneva on Wednesday, F1's governing body unanimously voted through the US media company's company's takeover.

Representatives from Liberty made "a detailed presentation of their strategy" for the sport with WMSC members describing F1's prospective new owners as "clearly well positioned to ensure the continued development" of F1.

"Liberty, Formula One Group and the FIA intend to collaborate to create a constructive relationship that will ensure the continued success and the development of the FIA Formula One World Championship in the long term," an FIA statement read.

The news comes a day after Liberty Media shareholders agreed to proposals related to the £6 billion takeover and a change of name to the Formula One Group.

- Transfer Centre: Sterling, Merino, Ugarte latest

- Beckham 'forever grateful': Tributes pour in for Sven-Goran Eriksson

- Arsenal transfers: Palace in talks over £30m Nketiah move

- Liverpool transfers: Mamardashvili to have medical

- Man Utd transfers: Sancho, McTominay, Ugarte latest

- Former England boss Sven-Goran Eriksson dies

- Chelsea transfers: Osimhen, Lukaku latest as deadline looms

- US Open Tennis LIVE! Opening day with Brit Choinski battling back

- Brighton complete record deal to sign O'Riley from Celtic

- Transfer news: Premier League ins and outs

- Latest News

Liberty Media bought an initial 18.7 per cent stake in the sport in September and since then have been working to clear the relevant hurdles in order to take a controlling stake in F1.

In December, Liberty received the required approvals from anti-trust authorities for the deal to go ahead.

F1 in 2017: All the details and dates

The Formula 1 Gossip Column

'Mercedes still be 2017 favourites'

Get Sky F1: Every 2017 race live

The company now expects to complete the takeover by the end of January.

Full FIA statement

"During the meeting, the representatives of the prospective new owner made a detailed presentation of their strategy. The members of the World Motor Sport Council then had the opportunity to ask questions about the specifics of the agreement, the ongoing working relationship with the FIA and Liberty's plans for the sport.

"Liberty, Formula One Group and the FIA intend to collaborate to create a constructive relationship that will ensure the continued success and the development of the FIA Formula One World Championship in the long term.

"The World Motor Sport Council's decision confirms the FIA's belief that Liberty, as a renowned media organisation with expertise in both sport and entertainment, is clearly well positioned to ensure the continued development of its pinnacle Championship.

"The FIA holds a one per cent shareholding in Delta Topco. As part of the sale by CVC to Liberty Media Corporation, and in line with the agreements between the FIA and the Formula One Group, the FIA will be dragged along in the sale process under the same conditions as CVC and all the other shareholders.

"The FIA looks forward to working with the new owners of the Formula One Group on further developing the unrivalled global spectacle that is the FIA Formula One World Championship for all stakeholders."

The only place to watch every race live in 2017

- Upgrade Now

Stream the Premier League and 1000+ EFL games this season with NOW!

Product details

Teaching and learning

- Work & Careers

- Life & Arts

Liberty Media thinks digital to attract younger Formula One fans

To read this article for free, register now.

Once registered, you can: • Read free articles • Get our Editor's Digest and other newsletters • Follow topics and set up personalised events • Access Alphaville: our popular markets and finance blog

Explore more offers.

Then $75 per month. Complete digital access to quality FT journalism. Cancel anytime during your trial.

FT Digital Edition

Today's FT newspaper for easy reading on any device. This does not include ft.com or FT App access.

- Global news & analysis

- Expert opinion

Standard Digital

Essential digital access to quality FT journalism on any device. Pay a year upfront and save 20%.

- FT App on Android & iOS

- FT Edit app

- FirstFT: the day's biggest stories

- 20+ curated newsletters

- Follow topics & set alerts with myFT

- FT Videos & Podcasts

Terms & Conditions apply

Explore our full range of subscriptions.

Why the ft.

See why over a million readers pay to read the Financial Times.

Press Releases

Liberty media corporation agrees to acquire formula one.

- Transaction price represents enterprise value for Formula One of $8.0b

- Chase Carey appointed as Chairman; Bernie Ecclestone to remain CEO

- Initial sale of 18.7% minority stake in Formula One, with 100% sale subject to satisfaction of conditions

ENGLEWOOD, Colo. & LONDON--(BUSINESS WIRE)-- Liberty Media Corporation (“Liberty Media”) (Nasdaq: LSXMA, LSXMB, LSXMK, BATRA, BATRK, LMCA, LMCK) and CVC Capital Partners (“CVC”) announced today that Liberty Media has agreed to acquire Formula One, the iconic global motorsports business, from a consortium of sellers led by CVC.

Liberty Media owns interests in a broad range of media, communications and entertainment businesses. Those interests are attributed to three tracking stock groups: the Liberty SiriusXM Group, the Liberty Braves Group, and the Liberty Media Group.

The consideration comprises cash and newly issued shares in the Liberty Media Group tracking stock (LMCK) and a debt instrument exchangeable into shares of LMCK. The transaction price represents an enterprise value for Formula One of $8.0 billion and an equity value of $4.4 billion (1) .

The acquisition will be effected by Liberty Media acquiring 100% of the shares of Delta Topco, the parent company of Formula One (Delta Topco herein referred to as “Formula One”) (2) . The acquisition is subject to the satisfaction of certain conditions and is described in more detail below.

Concurrent with the execution of the agreement to effect the acquisition, Liberty Media has completed the acquisition of an 18.7% minority stake in Formula One for $746 million, funded entirely in cash (which is equal to $821 million in consideration less a $75 million discount to be repaid by Liberty Media to selling stockholders upon completion of the acquisition). Prior to completion, CVC Funds will continue to be the controlling shareholder of Formula One.

After completion of the acquisition, Liberty Media will own Formula One and it will be attributed to the Liberty Media Group which will be renamed the Formula One Group. The consortium of sellers led by CVC will own approximately 65% (1)(3) of the Formula One Group’s equity and will have board representation at Formula One to support Liberty Media in continuing to develop the full potential of the sport. In addition, a CVC representative will be joining the Liberty Media Board of Directors.

Chase Carey has been appointed by Delta Topco and will serve as the new Chairman of Formula One, succeeding Peter Brabeck-Letmathe, who will remain on Formula One’s board as a non-executive director. Bernie Ecclestone will remain Formula One’s CEO.

Greg Maffei, President and Chief Executive Officer of Liberty Media, said: “We are excited to become part of Formula One. We think our long-term perspective and expertise with media and sports assets will allow us to be good stewards of Formula One and benefit fans, teams and our shareholders. We look forward to working closely with Chase Carey and Bernie Ecclestone to support the next phase of growth for this hugely popular global sport.”

Chase Carey, Chairman of Formula One, said: “I am thrilled to take up the role of Chairman of Formula One and have the opportunity to work alongside Bernie Ecclestone, CVC, and the Liberty Media team. I greatly admire Formula One as a unique global sports entertainment franchise attracting hundreds of millions of fans each season from all around the world. I see great opportunity to help Formula One continue to develop and prosper for the benefit of the sport, fans, teams and investors alike.”

Bernie Ecclestone, Chief Executive Officer of Formula One, said: “I would like to welcome Liberty Media and Chase Carey to Formula One and I look forward to working with them.”

Donald Mackenzie, Co-Chairman of CVC, commented: “We are delighted Chase Carey is joining Formula One as its new Chairman and that he will be working alongside Bernie Ecclestone. Chase’s experience and knowledge of sport, media and entertainment is as good as it gets and we are very pleased to secure his services. Bernie has been a wonderful CEO for us over the last 10 years. There have been many successes and the occasional challenge but there has never been a dull moment and we have had a lot of fun. The combined skills of Chase and Bernie mean that the successes should continue and we wish them well. We would like to thank Peter Brabeck-Letmathe for his outstanding contribution during his tenure as Chairman. His leadership has served the company well, and we are pleased that he will remain on the board as a non-executive director.”

In the acquisition the selling stockholders will receive a mix of consideration comprising: $1.1 billion in cash, 138 million newly issued shares of LMCK and a $351 million exchangeable debt instrument to be issued by Formula One and exchangeable into shares of LMCK. Funding for the cash component of the acquisition is expected to come from cash on hand at the Liberty Media Group. The newly issued LMCK shares will be subject to market co-ordination and lock-up agreements.

The Teams will be given the opportunity to participate in the investment in Formula One, and the detailed terms of that investment will be agreed in due course. Certain teams have already expressed an interest in investing after completion of the acquisition.

The interest in Formula One already acquired by Liberty Media, and the remaining interest to be acquired upon the closing of the acquisition, along with $4.1 billion of existing Formula One debt (which will be non-recourse to Liberty Media) and $0.7 billion in Formula One cash, is being attributed to the Liberty Media Group tracking stock.

Upon completion of the acquisition, the Liberty Media Group will be renamed the Formula One Group and the ticker symbols for the Series A, Series B and Series C Liberty Media Group tracking stocks will be changed from LMC (A/B/K), respectively, to FWON (A/B/K), respectively. Formula One will remain based in London.

The completion of the acquisition is subject to certain conditions, including the receipt of: (i) certain clearances and approvals by antitrust and competition law authorities in various countries, (ii) certain third-party consents and approvals, including that of the Fédération Internationale de l’Automobile, the governing body of Formula One, and (iii) the approval of Liberty Media’s stockholders of the issuance of LMCK shares in connection with the acquisition and the name change of the Liberty Media Group to the Formula One Group, and is expected to close by the first quarter of 2017. Additional information regarding the acquisition and Formula One will be included in a proxy statement to be filed by Liberty Media with the Securities and Exchange Commission relating to the matters to be voted upon by Liberty Media’s stockholders described above.

Liberty Media’s President and CEO, Greg Maffei and Formula One’s Chairman, Chase Carey will host an investor conference call at 6:00pm ET / 4:00pm MT on Wednesday, September 7, 2016 to discuss the acquisition in more detail. The call can be accessed by dialing: (i) (844) 838-8043 (U.S. / Canada), (ii) (678) 509-7480 (International) or (iii) 0800-028-8438 (U.K.) at least 10 minutes prior to the start time. The call will also be broadcast live across the internet and archived on Liberty Media’s website. Presentation materials to be used during the investor call have been posted to the Liberty Media website. To access the webcast and the accompanying presentation materials go to http://www.libertymedia.com/events . An archive of the webcast will also be available on Liberty Media’s website for one year after appropriate filings have been made with the SEC. Relevant images for media use will be posted to Liberty Media’s website under the “What’s New” section of the Liberty Media homepage.

Morgan Stanley is serving as exclusive financial advisor and Baker Botts LLP is serving as legal advisor to Liberty Media. Goldman Sachs International is serving as exclusive financial advisor and Freshfields Bruckhaus Deringer and Weil, Gotshal & Manges are serving as legal advisers to Delta Topco.

Forward-Looking Statements

This press release includes certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements relating to the proposed acquisition of Formula One, the expected benefits of the transaction, other potential third party investments in Formula One, the renaming of the Liberty Media Group and the corresponding change in ticker symbols and other matters that are not historical facts. These forward-looking statements involve many risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements, including, without limitation, the satisfaction of conditions to the proposed acquisition of Formula One. These forward looking statements speak only as of the date of this press release, and Liberty Media expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in Liberty Media’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Please refer to the publicly filed documents of Liberty Media, including its most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, for risks and uncertainties related to Liberty Media’s business which may affect the statements made in this press release.

Additional Information

Nothing in this press release shall constitute a solicitation to buy or an offer to sell shares of Liberty Media’s Series C Liberty Media common stock or any other series of its common stock. Liberty Media stockholders and other investors are urged to read the proxy statement to be filed with the SEC because it will contain important information relating to the proposed acquisition of Formula One. Copies of Liberty Media's SEC filings are available free of charge at the SEC's website ( http://www.sec.gov ). Copies of the filings together with the materials incorporated by reference therein will also be available, without charge, by directing a request to Investor Relations, (720) 875-5420.

Participants in a Solicitation

The directors and executive officers of Liberty Media and other persons may be deemed to be participants in the solicitation of proxies in respect of any proposals relating to the proposed acquisition of Formula One. Information regarding the directors and executive officers of Liberty Media and other participants in the proxy solicitation and a description of their respective direct and indirect interests, by security holdings or otherwise, will be available in the proxy materials regarding the foregoing to be filed with the SEC.

About Liberty Media Corporation

Liberty Media Corporation operates and owns interests in a broad range of media, communications and entertainment businesses. Those businesses are attributed to three tracking stock groups: the Liberty SiriusXM Group, the Liberty Braves Group and the Liberty Media Group. The businesses and assets attributed to the Liberty SiriusXM Group (Nasdaq: LSXMA, LSXMB, LSXMK) include our interest in SiriusXM. The businesses and assets attributed to the Liberty Braves Group (Nasdaq: BATRA, BATRK) include our subsidiary Braves Holdings, LLC. The businesses and assets attributed to the Liberty Media Group (Nasdaq: LMCA, LMCK) consist of all of Liberty Media Corporation's businesses and assets other than those attributed to the Liberty SiriusXM Group and the Liberty Braves Group, including its interests in Live Nation Entertainment and Formula One, and minority equity investments in Time Warner Inc. and Viacom.

About CVC Capital Partners

CVC Capital Partners is one of the world's leading private equity and investment advisory firms. Founded in 1981, CVC today has a network of 24 offices and over 400 employees throughout Europe, Asia and the US. To date, CVC has secured commitments of over US$85 billion in funds from a diverse and loyal investor base, completing over 300 investments in a wide range of industries and countries across the globe, with an aggregate enterprise purchase value of over US$250 billion.

For further information about CVC, please visit: www.cvc.com .

| 1) | Calculated at time of transaction announcement. | ||

| 2) | Other than a nominal number of shares held by certain Formula One teams. | ||

| 3) | 65% based on the undiluted share count as of 7/31/2016 and is inclusive of the dilutive impact of the $351 million exchangeable debt instrument. |

View source version on businesswire.com: http://www.businesswire.com/news/home/20160907006870/en/

Liberty Media Corporation Courtnee Chun, 720-875-5420 or CVC Capital Partners Carsten Huwendiek, 44(0) 20 7420 4200

Source: Liberty Media Corporation

Released September 7, 2016

- Email Alerts

- RSS News Feed

Looking For

Selected Case Outcomes

Liberty media v. iac/interactivecorp..

In a widely reported trial, IAC/InterActiveCorp. succeeded in securing the right to proceed with its plan to split the company into five separate entities. IAC was represented by Wachtell, Lipton, Rosen & Katz, a client of Analysis Group. At issue in the matter was a dispute between IAC CEO Barry Diller and majority shareholder Liberty Media over control of the company and its board. Liberty Media challenged Mr. Diller's breakup plan, alleging that the proxy that Liberty had granted to Mr. Diller over Liberty's majority voting stake could not be voted in favor of the breakup plan. The case was decided by a Delaware Chancery Court judge following a five-day trial.

IAC's counsel Wachtell, Lipton retained Analysis Group to assist in the presentation of expert testimony regarding the proposed transaction. Co-Founder Bruce E. Stangle led an Analysis Group team including Managing Principal Michael Holland and Senior Advisor David W. Sosa in providing consulting support to Yale School of Management Professor Andrew Metrick, an expert in corporate governance. Professor Metrick analyzed the positive impact on shareholder value of IAC's proposed spin-offs, and provided rebuttal testimony critiquing Liberty Media's expert's testimony. The Analysis Group team also supported telecommunications policy expert Harold Furchtgott-Roth , who examined issues related to FCC cross-ownership regulations.

In his ruling, Vice Chancellor Stephen P. Lamb wrote that "Liberty Media has failed to demonstrate that Diller has breached or threatened to breach any contractual duty he owes Liberty," and that "Liberty does not have a right to consent to the proposed spin-off."

Associated Experts & Consultants

- Harold W. Furchtgott-Roth

- Michael Holland

- David W. Sosa

- Bruce E. Stangle

A Case Study: How Liberty Media Turned Around Formula One with Strategic Marketing Partnerships

With a new Brad Pitt movie about Formula One underway, “Apex” (produced by Lewis Hamilton and Apple Original Films), Liberty Media Corporation, the new American owner of Formula One, is looking to marketing partnerships as a meaningful way to reach untapped markets and opportunities. Here are several strategies LMC has taken to build F1’s new burgeoning cultural cachet, and how brands are cashing in.

Constant Evolution and Adaptation

Founded in the 50s as a niche and exclusive racing event with a mostly European fanbase, LMC realized the need to move away from its pay-per-view model and embrace live broadcasting on ESPN and Sky to broaden access and awareness across markets. LMC’s exclusive ticketed events limited their reach. By staying abreast of changing consumer preferences, market trends, and technological advancements, they also saw an opportunity to be featured in a Netflix docuseries, “ Drive to Survive ,” similar to the NFL’s “All or Nothing.” The series, now in its fifth season, grants access to behind-the-scenes insights into the industry and its drivers, catering to the evolving needs of the F1 audience, who want to be part of their team’s journey. Employing these strategies allows F1 to maintain its relevance, ensuring it remains top-of-mind for fans, attracts new audiences, and stays connected to the ever-changing world of TV entertainment.

Digital and Social Media Presence

Maintaining an active and engaging presence on digital and social media platforms is crucial for any brand and especially important for F1. Once banning drivers and teams from using such platforms, LMC lifted the restriction . Now, Lewis Hamilton can be seen on Instagram sharing behind-the-scenes content in the paddock before entering the British Grand Prix, which received one million likes. They leverage these platforms to trend material and encourage viewers to share content.

Aligning with Stylish and Trendy Designs

LMC’s modernized media strategy particularly appeals to F1’s soaring Gen-Z audience, creating a fashion brand gold rush. Fashion brands eager to stay in touch with the latest trends saw a booming opportunity, that could be capitalized with Chanel. The collaboration featuring a sequined racecar on a T-shirt from Chanel’s 2023 Cruise Collection went viral, surpassing the $1,000 Prada tank top with a $4,500 price tag. By consistently offering stylish and trendy designs in F1-related products, such as team merchandise or fashion collections inspired by the sport, fashion brands resonate with the increasingly fashion-conscious F1 audience, ensuring their offerings remain desirable and on-trend.

Fashion-Forward Events and Initiatives

Fashion brands have the chance to immerse themselves in the world of F1 by participating in or supporting fashion-focused events and initiatives within the racing calendar. This involvement may encompass captivating fashion shows, exclusive fashion events during electrifying race weekends, or immersive experiences that blend the realms of fashion and motorsport. A prominent example is the recent collaboration between Italian streetwear brand, Palm Angels , and American team Haas F1. Palm Angels orchestrated captivating dinners, parties, and other enthralling events throughout the season, giving rise to a highly coveted collection of Haas co-branded apparel. By building these supplemental partnerships, fashion brands solidify their relevance within the F1 fashion landscape, establishing themselves as indispensable contributors to this thriving world.

Celebrity and Influencer Collaborations

LMC understood the glamorous appeal A-list celebrities bring to any enterprise, adding a touch of star-studded allure to the F1 circuits. Notably, Shakira graced the recent British Grand Prix, accompanied by an entourage of actors and athletes, while luminaries like Michelle Obama and Michael Jordan served as special guests at the May Miami Grand Prix . The upcoming inaugural Las Vegas race promises to be an unparalleled pop culture extravaganza, setting a new standard for F1’s influence on the world stage. These well-crafted collaborations generate fervent buzz and ensure F1 takes center stage in ongoing pop cultural discussions. LMC sees the yield on their investment through 28 percent year-on-year surges in US viewership, viewers who are also looking to see who else is attending the races, and one million views according to ESPN .

Partnerships Unlock Untapped Potential

With a growing number of marketing partnerships that accompany the steady stream of sponsorships and fashion deals, Formula One is steadily ascending to the top tier of global sports and joining the ranks of football, basketball, and tennis. F1 offers prime marketing opportunities, and the sport’s biggest stars have the proven power to drive global fashion trends. By adding strategic marketing partnerships to the mix, Liberty Media Corporation successfully turned around Formula One, unlocking its untapped potential and propelling it to new heights in the worlds of sports, entertainment, and fashion. We look forward to seeing Brad Pitt in the races.

Related Posts

May 15, 2024

The Gift that Keeps on Giving: The Barbie Collaborations

With the recent partnership between Olipop and Barbie, it seems we are truly living in the Barbie world. The Barbie movie, released in the latter half of last year, has expanded the brand beyond toys and entertainment. Collaborations with brands such as Olipop, Zara, and Airbnb have captivated new audiences from various industries. As Barbie to this day continues to introduce new collaborations, the significance of brand partnerships becomes increasingly evident.

April 9, 2024

Lessons from Reddit’s IPO: Leveraging Partnerships as a Contextual Alternative to Platform Advertising

As the popular social media platform Reddit made its highly anticipated debut on the New York Stock Exchange, the advertising industry is facing a dramatic shift. This IPO signals a move towards more innovative, targeted advertising strategies - most notably the growing importance of contextual advertising.

March 15, 2024

Pixels and Popcorn: Disney-Epic Games Revamping Entertainment

In a groundbreaking move that blends the realms of movies and gaming, The Walt Disney Company and Epic Games have partnered to create a new type of interactive entertainment. This collaboration saw a $1.5 billion investment from Disney, aiming to bring innovation to the entertainment landscape through gaming giant Epic Games, specifically Fortnite.

Privacy Preference Center

Privacy preferences.

Liberty Media Corporation agrees to acquire Formula One

Latest news.

The latest news from around the CVC network

IMAGES

COMMENTS

In 2017, U.S.- based Liberty Media, owner of the Atlanta Braves baseball team and streaming music provider SiriusXM among other properties, purchased Formula 1, the commercial organization behind the motorsport of F1 from a private equity firm. The well-seasoned management team that took over, inherited a sport that, while profitable, had only a small business organization supporting it.

In 2017, U.S.- based Liberty Media, owner of the Atlanta Braves baseball team and streaming music provider SiriusXM among other properties, purchased Formula 1, the commercial organization behind the motorsport of F1 from a private equity firm. The well-seasoned management team that took over, inherited a sport that, while profitable, had only a small business organization supporting it. In ...

Greenblatt's Liberty Media case study begins with the question "How do you make a half billion dollars in less than two years?," answer, "Start with $50 million and ask John Malone. He did it." With that very broad background out of the way, lets delve into the current structure of Liberty Media.

And that came in the form of Liberty Media taking overall commercial operations in 2017. Since the company came from a media background, it treated F1 as a media rather than a sports problem. ... Yahoo's story or case study is full of strategic mistakes. From wrong to missed acquisitions, wrong CEOs, the list is endless. No matter how great ...

Challenge: Liberty Media, the parent of Formula 1, was planning an ambitious new racing event and a hub of support venues for Las Vegas. Their intention to bring Formula 1 racing to town meant creating an appropriate racetrack and locating, purchasing, and developing linchpin sites for hospitality and more along the famed Las Vegas Resort Corridor.

Aug. 8, 2024, 2:26 PM PDT. By Sahil Kapur. The U.S. Department of Justice has opened an antitrust investigation into Liberty Media, the American company that owns the commercial rights to Formula ...

It contributed to F1's overall revenue surging by $149.9 million in the first two years that CVC was in charge compared to just $31 million under Liberty as shown in the table below. CVC boosted ...

In January 2017, Liberty Media finalised its purchase of the world's premier motor racing series, Formula 1. ... This case study highlights the importance of data-informed decision making ...

Liberty Media's President and CEO, Greg Maffei and Formula 1's Chairman and CEO, Chase Carey will be appearing on the CNBC television program "Squawk Box" from 7:00 am ET to 9:00 am ET on Tuesday, January 24, 2017 to discuss the completion of the acquisition in more detail. During their appearance, Mr. Maffei and Mr. Carey may make ...

The news comes a day after Liberty Media shareholders agreed to proposals related to the £6 billion takeover and a change of name to the Formula One Group. Liberty Media bought an initial 18.7 ...

Liberty Media Corporation and Delta Topco, the parent company of Formula 1 announced today that Liberty Media has completed its previously announced acquisition of F1, the iconic global motorsports business, from a consortium of sellers. F1 has appointed Chase Carey as Chief Executive Officer of F1, in addition to his existing role as Chairman, and Bernie Ecclestone as Chairman Emeritus of F1.

Product details. Intangible Asset Valuation at Liberty Media and Formula One. Case. -. Reference no. W31821. Subject category: Finance, Accounting and Control. Authors: Kun Huo (Ivey Business School, Western University); Andre Sanchez (Ivey Business School, Western University) Published by: Ivey Publishing. Originally published in: 2023.

Whether it's online or events, it creates an ability to attract fans to the sport.". Analysts agree that F1 has the potential to attract new fans. "There's an opportunity to build the ...

Liberty Media's President and CEO, Greg Maffei and Formula One's Chairman, Chase Carey will host an investor conference call at 6:00pm ET / 4:00pm MT on Wednesday, September 7, 2016 to discuss the acquisition in more detail. The call can be accessed by dialing: (i) (844) 838-8043 (U.S. / Canada), (ii) (678) 509-7480 (International) or (iii ...

Liberty Media challenged Mr. Diller's breakup plan, alleging that the proxy that Liberty had granted to Mr. Diller over Liberty's majority voting stake could not be voted in favor of the breakup plan. The case was decided by a Delaware Chancery Court judge following a five-day trial.

Liberty Media Corporation (commonly referred to as Liberty Media or just Liberty) is an American mass media company founded by John C. Malone in 1991. The company has three divisions, reflecting its ownership stakes in Formula One Group, Sirius XM, Live Nation Entertainment, and by December 31, 2024, Dorna Sports.The Sirius XM Holdings segment operates two audio entertainment companies, Sirius ...

Since Liberty Media took over custodianship of Formula 1, we have transformed how we go-to-market with more open and collaborative ways of working, a solutions-focused attitude to new opportunities, and a commitment to have our fans at the heart of everything we do. We have built a 21st century organisation that supports the repositioning