How to Do Market Research: The Complete Guide

Learn how to do market research with this step-by-step guide, complete with templates, tools and real-world examples.

Access best-in-class company data

Get trusted first-party funding data, revenue data and firmographics

Market research is the systematic process of gathering, analyzing and interpreting information about a specific market or industry.

What are your customers’ needs? How does your product compare to the competition? What are the emerging trends and opportunities in your industry? If these questions keep you up at night, it’s time to conduct market research.

Market research plays a pivotal role in your ability to stay competitive and relevant, helping you anticipate shifts in consumer behavior and industry dynamics. It involves gathering these insights using a wide range of techniques, from surveys and interviews to data analysis and observational studies.

In this guide, we’ll explore why market research is crucial, the various types of market research, the methods used in data collection, and how to effectively conduct market research to drive informed decision-making and success.

What is market research?

The purpose of market research is to offer valuable insight into the preferences and behaviors of your target audience, and anticipate shifts in market trends and the competitive landscape. This information helps you make data-driven decisions, develop effective strategies for your business, and maximize your chances of long-term growth.

Why is market research important?

By understanding the significance of market research, you can make sure you’re asking the right questions and using the process to your advantage. Some of the benefits of market research include:

- Informed decision-making: Market research provides you with the data and insights you need to make smart decisions for your business. It helps you identify opportunities, assess risks and tailor your strategies to meet the demands of the market. Without market research, decisions are often based on assumptions or guesswork, leading to costly mistakes.

- Customer-centric approach: A cornerstone of market research involves developing a deep understanding of customer needs and preferences. This gives you valuable insights into your target audience, helping you develop products, services and marketing campaigns that resonate with your customers.

- Competitive advantage: By conducting market research, you’ll gain a competitive edge. You’ll be able to identify gaps in the market, analyze competitor strengths and weaknesses, and position your business strategically. This enables you to create unique value propositions, differentiate yourself from competitors, and seize opportunities that others may overlook.

- Risk mitigation: Market research helps you anticipate market shifts and potential challenges. By identifying threats early, you can proactively adjust their strategies to mitigate risks and respond effectively to changing circumstances. This proactive approach is particularly valuable in volatile industries.

- Resource optimization: Conducting market research allows organizations to allocate their time, money and resources more efficiently. It ensures that investments are made in areas with the highest potential return on investment, reducing wasted resources and improving overall business performance.

- Adaptation to market trends: Markets evolve rapidly, driven by technological advancements, cultural shifts and changing consumer attitudes. Market research ensures that you stay ahead of these trends and adapt your offerings accordingly so you can avoid becoming obsolete.

As you can see, market research empowers businesses to make data-driven decisions, cater to customer needs, outperform competitors, mitigate risks, optimize resources and stay agile in a dynamic marketplace. These benefits make it a huge industry; the global market research services market is expected to grow from $76.37 billion in 2021 to $108.57 billion in 2026 . Now, let’s dig into the different types of market research that can help you achieve these benefits.

Types of market research

- Qualitative research

- Quantitative research

- Exploratory research

- Descriptive research

- Causal research

- Cross-sectional research

- Longitudinal research

Despite its advantages, 23% of organizations don’t have a clear market research strategy. Part of developing a strategy involves choosing the right type of market research for your business goals. The most commonly used approaches include:

1. Qualitative research

Qualitative research focuses on understanding the underlying motivations, attitudes and perceptions of individuals or groups. It is typically conducted through techniques like in-depth interviews, focus groups and content analysis — methods we’ll discuss further in the sections below. Qualitative research provides rich, nuanced insights that can inform product development, marketing strategies and brand positioning.

2. Quantitative research

Quantitative research, in contrast to qualitative research, involves the collection and analysis of numerical data, often through surveys, experiments and structured questionnaires. This approach allows for statistical analysis and the measurement of trends, making it suitable for large-scale market studies and hypothesis testing. While it’s worthwhile using a mix of qualitative and quantitative research, most businesses prioritize the latter because it is scientific, measurable and easily replicated across different experiments.

3. Exploratory research

Whether you’re conducting qualitative or quantitative research or a mix of both, exploratory research is often the first step. Its primary goal is to help you understand a market or problem so you can gain insights and identify potential issues or opportunities. This type of market research is less structured and is typically conducted through open-ended interviews, focus groups or secondary data analysis. Exploratory research is valuable when entering new markets or exploring new product ideas.

4. Descriptive research

As its name implies, descriptive research seeks to describe a market, population or phenomenon in detail. It involves collecting and summarizing data to answer questions about audience demographics and behaviors, market size, and current trends. Surveys, observational studies and content analysis are common methods used in descriptive research.

5. Causal research

Causal research aims to establish cause-and-effect relationships between variables. It investigates whether changes in one variable result in changes in another. Experimental designs, A/B testing and regression analysis are common causal research methods. This sheds light on how specific marketing strategies or product changes impact consumer behavior.

6. Cross-sectional research

Cross-sectional market research involves collecting data from a sample of the population at a single point in time. It is used to analyze differences, relationships or trends among various groups within a population. Cross-sectional studies are helpful for market segmentation, identifying target audiences and assessing market trends at a specific moment.

7. Longitudinal research

Longitudinal research, in contrast to cross-sectional research, collects data from the same subjects over an extended period. This allows for the analysis of trends, changes and developments over time. Longitudinal studies are useful for tracking long-term developments in consumer preferences, brand loyalty and market dynamics.

Each type of market research has its strengths and weaknesses, and the method you choose depends on your specific research goals and the depth of understanding you’re aiming to achieve. In the following sections, we’ll delve into primary and secondary research approaches and specific research methods.

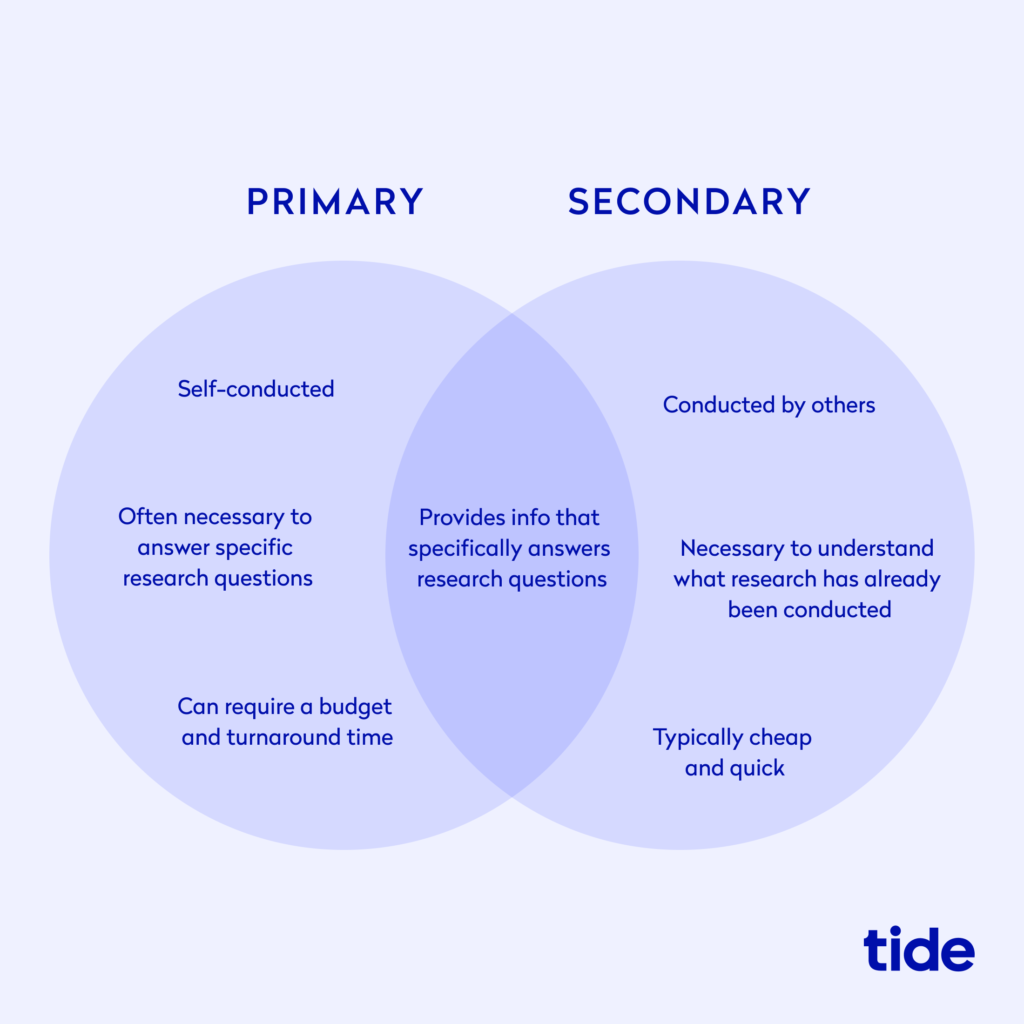

Primary vs. secondary market research

Market research of all types can be broadly categorized into two main approaches: primary research and secondary research. By understanding the differences between these approaches, you can better determine the most appropriate research method for your specific goals.

Primary market research

Primary research involves the collection of original data straight from the source. Typically, this involves communicating directly with your target audience — through surveys, interviews, focus groups and more — to gather information. Here are some key attributes of primary market research:

- Customized data: Primary research provides data that is tailored to your research needs. You design a custom research study and gather information specific to your goals.

- Up-to-date insights: Because primary research involves communicating with customers, the data you collect reflects the most current market conditions and consumer behaviors.

- Time-consuming and resource-intensive: Despite its advantages, primary research can be labor-intensive and costly, especially when dealing with large sample sizes or complex study designs. Whether you hire a market research consultant, agency or use an in-house team, primary research studies consume a large amount of resources and time.

Secondary market research

Secondary research, on the other hand, involves analyzing data that has already been compiled by third-party sources, such as online research tools, databases, news sites, industry reports and academic studies.

Here are the main characteristics of secondary market research:

- Cost-effective: Secondary research is generally more cost-effective than primary research since it doesn’t require building a research plan from scratch. You and your team can look at databases, websites and publications on an ongoing basis, without needing to design a custom experiment or hire a consultant.

- Leverages multiple sources: Data tools and software extract data from multiple places across the web, and then consolidate that information within a single platform. This means you’ll get a greater amount of data and a wider scope from secondary research.

- Quick to access: You can access a wide range of information rapidly — often in seconds — if you’re using online research tools and databases. Because of this, you can act on insights sooner, rather than taking the time to develop an experiment.

So, when should you use primary vs. secondary research? In practice, many market research projects incorporate both primary and secondary research to take advantage of the strengths of each approach.

One rule of thumb is to focus on secondary research to obtain background information, market trends or industry benchmarks. It is especially valuable for conducting preliminary research, competitor analysis, or when time and budget constraints are tight. Then, if you still have knowledge gaps or need to answer specific questions unique to your business model, use primary research to create a custom experiment.

Market research methods

- Surveys and questionnaires

- Focus groups

- Observational research

- Online research tools

- Experiments

- Content analysis

- Ethnographic research

How do primary and secondary research approaches translate into specific research methods? Let’s take a look at the different ways you can gather data:

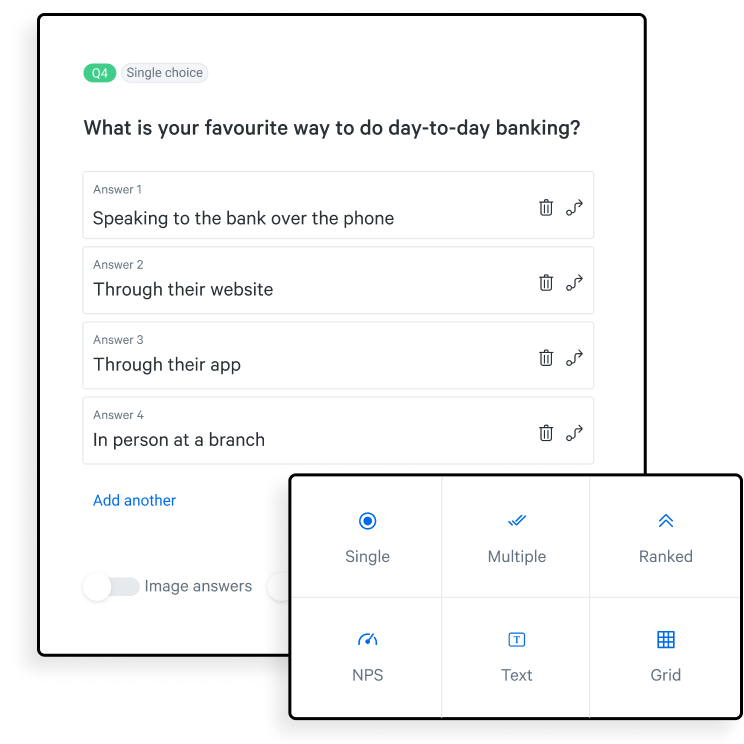

1. Surveys and questionnaires

Surveys and questionnaires are popular methods for collecting structured data from a large number of respondents. They involve a set of predetermined questions that participants answer. Surveys can be conducted through various channels, including online tools, telephone interviews and in-person or online questionnaires. They are useful for gathering quantitative data and assessing customer demographics, opinions, preferences and needs. On average, customer surveys have a 33% response rate , so keep that in mind as you consider your sample size.

2. Interviews

Interviews are in-depth conversations with individuals or groups to gather qualitative insights. They can be structured (with predefined questions) or unstructured (with open-ended discussions). Interviews are valuable for exploring complex topics, uncovering motivations and obtaining detailed feedback.

3. Focus groups

The most common primary research methods are in-depth webcam interviews and focus groups. Focus groups are a small gathering of participants who discuss a specific topic or product under the guidance of a moderator. These discussions are valuable for primary market research because they reveal insights into consumer attitudes, perceptions and emotions. Focus groups are especially useful for idea generation, concept testing and understanding group dynamics within your target audience.

4. Observational research

Observational research involves observing and recording participant behavior in a natural setting. This method is particularly valuable when studying consumer behavior in physical spaces, such as retail stores or public places. In some types of observational research, participants are aware you’re watching them; in other cases, you discreetly watch consumers without their knowledge, as they use your product. Either way, observational research provides firsthand insights into how people interact with products or environments.

5. Online research tools

You and your team can do your own secondary market research using online tools. These tools include data prospecting platforms and databases, as well as online surveys, social media listening, web analytics and sentiment analysis platforms. They help you gather data from online sources, monitor industry trends, track competitors, understand consumer preferences and keep tabs on online behavior. We’ll talk more about choosing the right market research tools in the sections that follow.

6. Experiments

Market research experiments are controlled tests of variables to determine causal relationships. While experiments are often associated with scientific research, they are also used in market research to assess the impact of specific marketing strategies, product features, or pricing and packaging changes.

7. Content analysis

Content analysis involves the systematic examination of textual, visual or audio content to identify patterns, themes and trends. It’s commonly applied to customer reviews, social media posts and other forms of online content to analyze consumer opinions and sentiments.

8. Ethnographic research

Ethnographic research immerses researchers into the daily lives of consumers to understand their behavior and culture. This method is particularly valuable when studying niche markets or exploring the cultural context of consumer choices.

How to do market research

- Set clear objectives

- Identify your target audience

- Choose your research methods

- Use the right market research tools

- Collect data

- Analyze data

- Interpret your findings

- Identify opportunities and challenges

- Make informed business decisions

- Monitor and adapt

Now that you have gained insights into the various market research methods at your disposal, let’s delve into the practical aspects of how to conduct market research effectively. Here’s a quick step-by-step overview, from defining objectives to monitoring market shifts.

1. Set clear objectives

When you set clear and specific goals, you’re essentially creating a compass to guide your research questions and methodology. Start by precisely defining what you want to achieve. Are you launching a new product and want to understand its viability in the market? Are you evaluating customer satisfaction with a product redesign?

Start by creating SMART goals — objectives that are specific, measurable, achievable, relevant and time-bound. Not only will this clarify your research focus from the outset, but it will also help you track progress and benchmark your success throughout the process.

You should also consult with key stakeholders and team members to ensure alignment on your research objectives before diving into data collecting. This will help you gain diverse perspectives and insights that will shape your research approach.

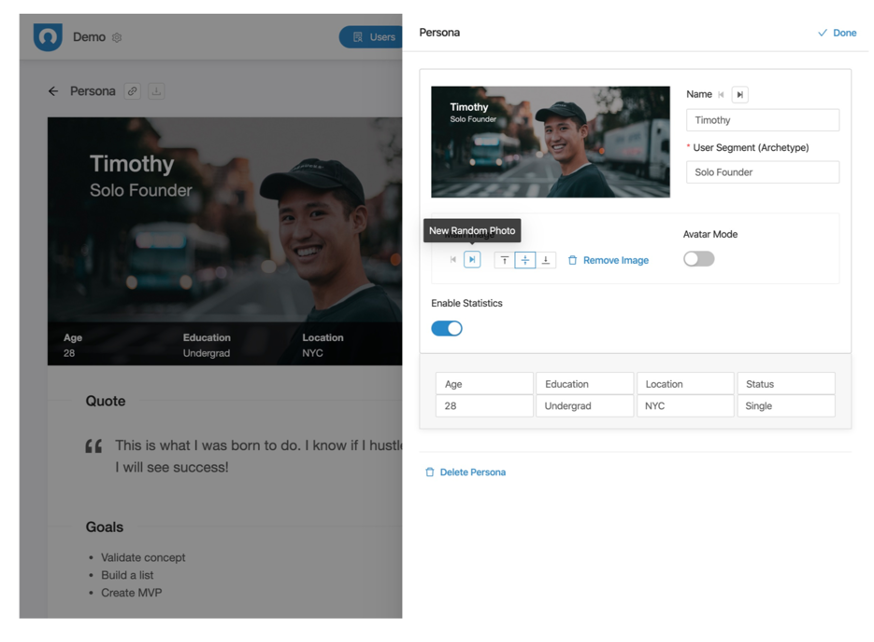

2. Identify your target audience

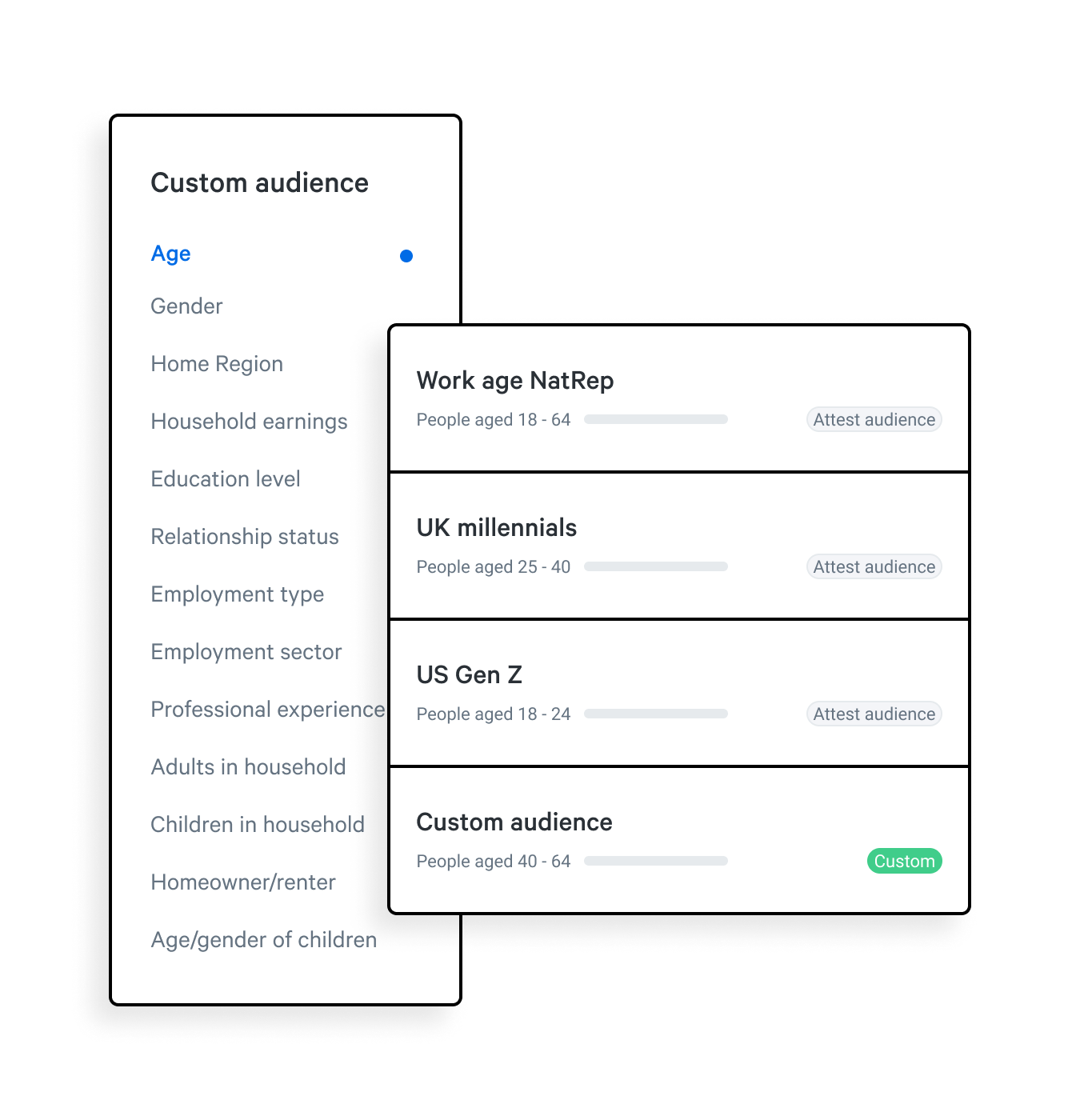

Next, you’ll need to pinpoint your target audience to determine who should be included in your research. Begin by creating detailed buyer personas or stakeholder profiles. Consider demographic factors like age, gender, income and location, but also delve into psychographics, such as interests, values and pain points.

The more specific your target audience, the more accurate and actionable your research will be. Additionally, segment your audience if your research objectives involve studying different groups, such as current customers and potential leads.

If you already have existing customers, you can also hold conversations with them to better understand your target market. From there, you can refine your buyer personas and tailor your research methods accordingly.

3. Choose your research methods

Selecting the right research methods is crucial for gathering high-quality data. Start by considering the nature of your research objectives. If you’re exploring consumer preferences, surveys and interviews can provide valuable insights. For in-depth understanding, focus groups or observational research might be suitable. Consider using a mix of quantitative and qualitative methods to gain a well-rounded perspective.

You’ll also need to consider your budget. Think about what you can realistically achieve using the time and resources available to you. If you have a fairly generous budget, you may want to try a mix of primary and secondary research approaches. If you’re doing market research for a startup , on the other hand, chances are your budget is somewhat limited. If that’s the case, try addressing your goals with secondary research tools before investing time and effort in a primary research study.

4. Use the right market research tools

Whether you’re conducting primary or secondary research, you’ll need to choose the right tools. These can help you do anything from sending surveys to customers to monitoring trends and analyzing data. Here are some examples of popular market research tools:

- Market research software: Crunchbase is a platform that provides best-in-class company data, making it valuable for market research on growing companies and industries. You can use Crunchbase to access trusted, first-party funding data, revenue data, news and firmographics, enabling you to monitor industry trends and understand customer needs.

- Survey and questionnaire tools: SurveyMonkey is a widely used online survey platform that allows you to create, distribute and analyze surveys. Google Forms is a free tool that lets you create surveys and collect responses through Google Drive.

- Data analysis software: Microsoft Excel and Google Sheets are useful for conducting statistical analyses. SPSS is a powerful statistical analysis software used for data processing, analysis and reporting.

- Social listening tools: Brandwatch is a social listening and analytics platform that helps you monitor social media conversations, track sentiment and analyze trends. Mention is a media monitoring tool that allows you to track mentions of your brand, competitors and keywords across various online sources.

- Data visualization platforms: Tableau is a data visualization tool that helps you create interactive and shareable dashboards and reports. Power BI by Microsoft is a business analytics tool for creating interactive visualizations and reports.

5. Collect data

There’s an infinite amount of data you could be collecting using these tools, so you’ll need to be intentional about going after the data that aligns with your research goals. Implement your chosen research methods, whether it’s distributing surveys, conducting interviews or pulling from secondary research platforms. Pay close attention to data quality and accuracy, and stick to a standardized process to streamline data capture and reduce errors.

6. Analyze data

Once data is collected, you’ll need to analyze it systematically. Use statistical software or analysis tools to identify patterns, trends and correlations. For qualitative data, employ thematic analysis to extract common themes and insights. Visualize your findings with charts, graphs and tables to make complex data more understandable.

If you’re not proficient in data analysis, consider outsourcing or collaborating with a data analyst who can assist in processing and interpreting your data accurately.

7. Interpret your findings

Interpreting your market research findings involves understanding what the data means in the context of your objectives. Are there significant trends that uncover the answers to your initial research questions? Consider the implications of your findings on your business strategy. It’s essential to move beyond raw data and extract actionable insights that inform decision-making.

Hold a cross-functional meeting or workshop with relevant team members to collectively interpret the findings. Different perspectives can lead to more comprehensive insights and innovative solutions.

8. Identify opportunities and challenges

Use your research findings to identify potential growth opportunities and challenges within your market. What segments of your audience are underserved or overlooked? Are there emerging trends you can capitalize on? Conversely, what obstacles or competitors could hinder your progress?

Lay out this information in a clear and organized way by conducting a SWOT analysis, which stands for strengths, weaknesses, opportunities and threats. Jot down notes for each of these areas to provide a structured overview of gaps and hurdles in the market.

9. Make informed business decisions

Market research is only valuable if it leads to informed decisions for your company. Based on your insights, devise actionable strategies and initiatives that align with your research objectives. Whether it’s refining your product, targeting new customer segments or adjusting pricing, ensure your decisions are rooted in the data.

At this point, it’s also crucial to keep your team aligned and accountable. Create an action plan that outlines specific steps, responsibilities and timelines for implementing the recommendations derived from your research.

10. Monitor and adapt

Market research isn’t a one-time activity; it’s an ongoing process. Continuously monitor market conditions, customer behaviors and industry trends. Set up mechanisms to collect real-time data and feedback. As you gather new information, be prepared to adapt your strategies and tactics accordingly. Regularly revisiting your research ensures your business remains agile and reflects changing market dynamics and consumer preferences.

Online market research sources

As you go through the steps above, you’ll want to turn to trusted, reputable sources to gather your data. Here’s a list to get you started:

- Crunchbase: As mentioned above, Crunchbase is an online platform with an extensive dataset, allowing you to access in-depth insights on market trends, consumer behavior and competitive analysis. You can also customize your search options to tailor your research to specific industries, geographic regions or customer personas.

- Academic databases: Academic databases, such as ProQuest and JSTOR , are treasure troves of scholarly research papers, studies and academic journals. They offer in-depth analyses of various subjects, including market trends, consumer preferences and industry-specific insights. Researchers can access a wealth of peer-reviewed publications to gain a deeper understanding of their research topics.

- Government and NGO databases: Government agencies, nongovernmental organizations and other institutions frequently maintain databases containing valuable economic, demographic and industry-related data. These sources offer credible statistics and reports on a wide range of topics, making them essential for market researchers. Examples include the U.S. Census Bureau , the Bureau of Labor Statistics and the Pew Research Center .

- Industry reports: Industry reports and market studies are comprehensive documents prepared by research firms, industry associations and consulting companies. They provide in-depth insights into specific markets, including market size, trends, competitive analysis and consumer behavior. You can find this information by looking at relevant industry association databases; examples include the American Marketing Association and the National Retail Federation .

- Social media and online communities: Social media platforms like LinkedIn or Twitter (X) , forums such as Reddit and Quora , and review platforms such as G2 can provide real-time insights into consumer sentiment, opinions and trends.

Market research examples

At this point, you have market research tools and data sources — but how do you act on the data you gather? Let’s go over some real-world examples that illustrate the practical application of market research across various industries. These examples showcase how market research can lead to smart decision-making and successful business decisions.

Example 1: Apple’s iPhone launch

Apple ’s iconic iPhone launch in 2007 serves as a prime example of market research driving product innovation in tech. Before the iPhone’s release, Apple conducted extensive market research to understand consumer preferences, pain points and unmet needs in the mobile phone industry. This research led to the development of a touchscreen smartphone with a user-friendly interface, addressing consumer demands for a more intuitive and versatile device. The result was a revolutionary product that disrupted the market and redefined the smartphone industry.

Example 2: McDonald’s global expansion

McDonald’s successful global expansion strategy demonstrates the importance of market research when expanding into new territories. Before entering a new market, McDonald’s conducts thorough research to understand local tastes, preferences and cultural nuances. This research informs menu customization, marketing strategies and store design. For instance, in India, McDonald’s offers a menu tailored to local preferences, including vegetarian options. This market-specific approach has enabled McDonald’s to adapt and thrive in diverse global markets.

Example 3: Organic and sustainable farming

The shift toward organic and sustainable farming practices in the food industry is driven by market research that indicates increased consumer demand for healthier and environmentally friendly food options. As a result, food producers and retailers invest in sustainable sourcing and organic product lines — such as with these sustainable seafood startups — to align with this shift in consumer values.

The bottom line? Market research has multiple use cases and is a critical practice for any industry. Whether it’s launching groundbreaking products, entering new markets or responding to changing consumer preferences, you can use market research to shape successful strategies and outcomes.

Market research templates

You finally have a strong understanding of how to do market research and apply it in the real world. Before we wrap up, here are some market research templates that you can use as a starting point for your projects:

- Smartsheet competitive analysis templates : These spreadsheets can serve as a framework for gathering information about the competitive landscape and obtaining valuable lessons to apply to your business strategy.

- SurveyMonkey product survey template : Customize the questions on this survey based on what you want to learn from your target customers.

- HubSpot templates : HubSpot offers a wide range of free templates you can use for market research, business planning and more.

- SCORE templates : SCORE is a nonprofit organization that provides templates for business plans, market analysis and financial projections.

- SBA.gov : The U.S. Small Business Administration offers templates for every aspect of your business, including market research, and is particularly valuable for new startups.

Strengthen your business with market research

When conducted effectively, market research is like a guiding star. Equipped with the right tools and techniques, you can uncover valuable insights, stay competitive, foster innovation and navigate the complexities of your industry.

Throughout this guide, we’ve discussed the definition of market research, different research methods, and how to conduct it effectively. We’ve also explored various types of market research and shared practical insights and templates for getting started.

Now, it’s time to start the research process. Trust in data, listen to the market and make informed decisions that guide your company toward lasting success.

Related Articles

- Entrepreneurs

- 15 min read

What Is Competitive Analysis and How to Do It Effectively

Rebecca Strehlow, Copywriter at Crunchbase

17 Best Sales Intelligence Tools for 2024

- Market research

- 10 min read

How to Do Market Research for a Startup: Tips for Success

Jaclyn Robinson, Senior Manager of Content Marketing at Crunchbase

Search less. Close more.

Grow your revenue with Crunchbase, the all-in-one prospecting solution. Start your free trial.

Root out friction in every digital experience, super-charge conversion rates, and optimise digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered straight to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Meet the operating system for experience management

- Free Account

- Product Demos

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Employee Exit Interviews

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Artificial Intelligence

Market Research

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

- Experience Management

- Ultimate Guide to Market Research

Market research definition

Market research – in-house or outsourced, market research in the age of data, when to use market research, types of market research, different types of primary research, how to do market research (primary data), how to do secondary market research, communicating your market research findings, choose the right platform for your market research, try qualtrics for free, your ultimate guide to market research and how to conduct it like a pro.

26 min read Wondering how to do market research? Or even where to start learning about it? Use our ultimate guide to understand the basics and discover how you can use market research to help your business.

Market research is the action or activity of gathering information about market needs and preferences. This affects every aspect of the business – including brand , product , customer service , marketing and sales. By understanding how your audience feels and behaves, you can then take steps to meet those needs and mitigate the risk of an experience gap – which is what your audience expects you deliver versus what you actually deliver.

Market research helps marketers look like rock stars by helping them avoid mistakes, stay on message, and predict customer needs . It’s marketing’s job to leverage research to reach the best possible solution based on the research available. Then, they must implement the solution, modify the solution, and successfully deliver that solution to the market.

Market research often focuses on understanding:

- The consumer (current customers, past customers, non-customers, influencers))

- The company (product or service design, promotion, pricing, placement, service, sales)

- The competitors (and how their market offerings interact in the market environment)

- The industry overall (whether it’s growing or moving in a certain direction)

Why is market research important?

A successful business relies on understanding what like, what they dislike, what they need and what messaging they will respond to. Businesses also need to understand their competition to identify opportunities to differentiate their products and services from other companies.

Today’s business leaders face an endless stream of decisions around target markets, pricing, promotion, distribution channels, and product features and benefits . They must account for all the factors involved, and there are market research studies and methodologies strategically designed to capture meaningful data to inform every choice. It can be a daunting task.

Market research allows companies to make data-driven decisions to drive growth and innovation.

What happens when you don’t do market research?

Without market research, business decisions are based at best on past consumer behavior, economic indicators, or at worst, on gut feel. Decisions are made in a bubble without thought to what the competition is doing. An important aim of market research is to remove subjective opinions when making business decisions. As a brand you are there to serve your customers, not personal preferences within the company. You are far more likely to be successful if you know the difference, and market research will help make sure your decisions are insight-driven.

eBook: Guide to unlocking research efficiency with AI and automation

Traditionally there have been specialist market researchers who are very good at what they do, and businesses have been reliant on their ability to do it. Market research specialists will always be an important part of the industry, as most brands are limited by their internal capacity, expertise and budgets and need to outsource at least some aspects of the work.

However, the market research external agency model has meant that brands struggled to keep up with the pace of change. Their customers would suffer because their needs were not being wholly met with point-in-time market research.

Businesses looking to conduct market research have to tackle many questions –

- Who are my consumers, and how should I segment and prioritize them?

- What are they looking for within my category?

- How much are they buying, and what are their purchase triggers, barriers, and buying habits?

- Will my marketing and communications efforts resonate?

- Is my brand healthy ?

- What product features matter most?

- Is my product or service ready for launch?

- Are my pricing and packaging plans optimized?

They all need to be answered, but many businesses have found the process of data collection daunting, time-consuming and expensive. The hardest battle is often knowing where to begin and short-term demands have often taken priority over longer-term projects that require patience to offer return on investment.

Today however, the industry is making huge strides, driven by quickening product cycles, tighter competition and business imperatives around more data-driven decision making. With the emergence of simple, easy to use tools , some degree of in-house market research is now seen as essential, with fewer excuses not to use data to inform your decisions. With greater accessibility to such software, everyone can be an expert regardless of level or experience.

How is this possible?

The art of research hasn’t gone away. It is still a complex job and the volume of data that needs to be analyzed is huge. However with the right tools and support, sophisticated research can look very simple – allowing you to focus on taking action on what matters.

If you’re not yet using technology to augment your in-house market research, now is the time to start.

The most successful brands rely on multiple sources of data to inform their strategy and decision making, from their marketing segmentation to the product features they develop to comments on social media. In fact, there’s tools out there that use machine learning and AI to automate the tracking of what’s people are saying about your brand across all sites.

The emergence of newer and more sophisticated tools and platforms gives brands access to more data sources than ever and how the data is analyzed and used to make decisions. This also increases the speed at which they operate, with minimal lead time allowing brands to be responsive to business conditions and take an agile approach to improvements and opportunities.

Expert partners have an important role in getting the best data, particularly giving access to additional market research know-how, helping you find respondents , fielding surveys and reporting on results.

How do you measure success?

Business activities are usually measured on how well they deliver return on investment (ROI). Since market research doesn’t generate any revenue directly, its success has to be measured by looking at the positive outcomes it drives – happier customers, a healthier brand, and so on.

When changes to your products or your marketing strategy are made as a result of your market research findings, you can compare on a before-and-after basis to see if the knowledge you acted on has delivered value.

Regardless of the function you work within, understanding the consumer is the goal of any market research. To do this, we have to understand what their needs are in order to effectively meet them. If we do that, we are more likely to drive customer satisfaction , and in turn, increase customer retention .

Several metrics and KPIs are used to gauge the success of decisions made from market research results, including

- Brand awareness within the target market

- Share of wallet

- CSAT (customer satisfaction)

- NPS (Net Promoter Score)

You can use market research for almost anything related to your current customers, potential customer base or target market. If you want to find something out from your target audience, it’s likely market research is the answer.

Here are a few of the most common uses:

Buyer segmentation and profiling

Segmentation is a popular technique that separates your target market according to key characteristics, such as behavior, demographic information and social attitudes. Segmentation allows you to create relevant content for your different segments, ideally helping you to better connect with all of them.

Buyer personas are profiles of fictional customers – with real attributes. Buyer personas help you develop products and communications that are right for your different audiences, and can also guide your decision-making process. Buyer personas capture the key characteristics of your customer segments, along with meaningful insights about what they want or need from you. They provide a powerful reminder of consumer attitudes when developing a product or service, a marketing campaign or a new brand direction.

By understanding your buyers and potential customers, including their motivations, needs, and pain points, you can optimize everything from your marketing communications to your products to make sure the right people get the relevant content, at the right time, and via the right channel .

Attitudes and Usage surveys

Attitude & Usage research helps you to grow your brand by providing a detailed understanding of consumers. It helps you understand how consumers use certain products and why, what their needs are, what their preferences are, and what their pain points are. It helps you to find gaps in the market, anticipate future category needs, identify barriers to entry and build accurate go-to-market strategies and business plans.

Marketing strategy

Effective market research is a crucial tool for developing an effective marketing strategy – a company’s plan for how they will promote their products.

It helps marketers look like rock stars by helping them understand the target market to avoid mistakes, stay on message, and predict customer needs . It’s marketing’s job to leverage relevant data to reach the best possible solution based on the research available. Then, they can implement the solution, modify the solution, and successfully deliver that solution to the market.

Product development

You can conduct market research into how a select group of consumers use and perceive your product – from how they use it through to what they like and dislike about it. Evaluating your strengths and weaknesses early on allows you to focus resources on ideas with the most potential and to gear your product or service design to a specific market.

Chobani’s yogurt pouches are a product optimized through great market research . Using product concept testing – a form of market research – Chobani identified that packaging could negatively impact consumer purchase decisions. The brand made a subtle change, ensuring the item satisfied the needs of consumers. This ability to constantly refine its products for customer needs and preferences has helped Chobani become Australia’s #1 yogurt brand and increase market share.

Pricing decisions

Market research provides businesses with insights to guide pricing decisions too. One of the most powerful tools available to market researchers is conjoint analysis, a form of market research study that uses choice modeling to help brands identify the perfect set of features and price for customers. Another useful tool is the Gabor-Granger method, which helps you identify the highest price consumers are willing to pay for a given product or service.

Brand tracking studies

A company’s brand is one of its most important assets. But unlike other metrics like product sales, it’s not a tangible measure you can simply pull from your system. Regular market research that tracks consumer perceptions of your brand allows you to monitor and optimize your brand strategy in real time, then respond to consumer feedback to help maintain or build your brand with your target customers.

Advertising and communications testing

Advertising campaigns can be expensive, and without pre-testing, they carry risk of falling flat with your target audience. By testing your campaigns, whether it’s the message or the creative, you can understand how consumers respond to your communications before you deploy them so you can make changes in response to consumer feedback before you go live.

Finder, which is one of the world’s fastest-growing online comparison websites, is an example of a brand using market research to inject some analytical rigor into the business . Fueled by great market research, the business lifted brand awareness by 23 percent, boosted NPS by 8 points, and scored record profits – all within 10 weeks.

Competitive analysis

Another key part of developing the right product and communications is understanding your main competitors and how consumers perceive them. You may have looked at their websites and tried out their product or service, but unless you know how consumers perceive them, you won’t have an accurate view of where you stack up in comparison. Understanding their position in the market allows you to identify the strengths you can exploit, as well as any weaknesses you can address to help you compete better.

Customer Story

See How Yamaha Does Product Research

Although there are many types market research, all methods can be sorted into one of two categories: primary and secondary.

Primary research

Primary research is market research data that you collect yourself. This is raw data collected through a range of different means – surveys , focus groups, , observation and interviews being among the most popular.

Primary information is fresh, unused data, giving you a perspective that is current or perhaps extra confidence when confirming hypotheses you already had. It can also be very targeted to your exact needs. Primary information can be extremely valuable. Tools for collecting primary information are increasingly sophisticated and the market is growing rapidly.

Historically, conducting market research in-house has been a daunting concept for brands because they don’t quite know where to begin, or how to handle vast volumes of data. Now, the emergence of technology has meant that brands have access to simple, easy to use tools to help with exactly that problem. As a result, brands are more confident about their own projects and data with the added benefit of seeing the insights emerge in real-time.

Secondary research

Secondary research is the use of data that has already been collected, analyzed and published – typically it’s data you don’t own and that hasn’t been conducted with your business specifically in mind, although there are forms of internal secondary data like old reports or figures from past financial years that come from within your business. Secondary research can be used to support the use of primary research.

Secondary research can be beneficial to small businesses because it is sometimes easier to obtain, often through research companies. Although the rise of primary research tools are challenging this trend by allowing businesses to conduct their own market research more cheaply, secondary research is often a cheaper alternative for businesses who need to spend money carefully. Some forms of secondary research have been described as ‘lean market research’ because they are fast and pragmatic, building on what’s already there.

Because it’s not specific to your business, secondary research may be less relevant, and you’ll need to be careful to make sure it applies to your exact research question. It may also not be owned, which means your competitors and other parties also have access to it.

Primary or secondary research – which to choose?

Both primary and secondary research have their advantages, but they are often best used when paired together, giving you the confidence to act knowing that the hypothesis you have is robust.

Secondary research is sometimes preferred because there is a misunderstanding of the feasibility of primary research. Thanks to advances in technology, brands have far greater accessibility to primary research, but this isn’t always known.

If you’ve decided to gather your own primary information, there are many different data collection methods that you may consider. For example:

- Customer surveys

- Focus groups

- Observation

Think carefully about what you’re trying to accomplish before picking the data collection method(s) you’re going to use. Each one has its pros and cons. Asking someone a simple, multiple-choice survey question will generate a different type of data than you might obtain with an in-depth interview. Determine if your primary research is exploratory or specific, and if you’ll need qualitative research, quantitative research, or both.

Qualitative vs quantitative

Another way of categorizing different types of market research is according to whether they are qualitative or quantitative.

Qualitative research

Qualitative research is the collection of data that is non-numerical in nature. It summarizes and infers, rather than pin-points an exact truth. It is exploratory and can lead to the generation of a hypothesis.

Market research techniques that would gather qualitative data include:

- Interviews (face to face / telephone)

- Open-ended survey questions

Researchers use these types of market research technique because they can add more depth to the data. So for example, in focus groups or interviews, rather than being limited to ‘yes’ or ‘no’ for a certain question, you can start to understand why someone might feel a certain way.

Quantitative research

Quantitative research is the collection of data that is numerical in nature. It is much more black and white in comparison to qualitative data, although you need to make sure there is a representative sample if you want the results to be reflective of reality.

Quantitative researchers often start with a hypothesis and then collect data which can be used to determine whether empirical evidence to support that hypothesis exists.

Quantitative research methods include:

- Questionnaires

- Review scores

Exploratory and specific research

Exploratory research is the approach to take if you don’t know what you don’t know. It can give you broad insights about your customers, product, brand, and market. If you want to answer a specific question, then you’ll be conducting specific research.

- Exploratory . This research is general and open-ended, and typically involves lengthy interviews with an individual or small focus group.

- Specific . This research is often used to solve a problem identified in exploratory research. It involves more structured, formal interviews.

Exploratory primary research is generally conducted by collecting qualitative data. Specific research usually finds its insights through quantitative data.

Primary research can be qualitative or quantitative, large-scale or focused and specific. You’ll carry it out using methods like surveys – which can be used for both qualitative and quantitative studies – focus groups, observation of consumer behavior, interviews, or online tools.

Step 1: Identify your research topic

Research topics could include:

- Product features

- Product or service launch

- Understanding a new target audience (or updating an existing audience)

- Brand identity

- Marketing campaign concepts

- Customer experience

Step 2: Draft a research hypothesis

A hypothesis is the assumption you’re starting out with. Since you can disprove a negative much more easily than prove a positive, a hypothesis is a negative statement such as ‘price has no effect on brand perception’.

Step 3: Determine which research methods are most effective

Your choice of methods depends on budget, time constraints, and the type of question you’re trying to answer. You could combine surveys, interviews and focus groups to get a mix of qualitative and quantitative data.

Step 4: Determine how you will collect and analyze your data.

Primary research can generate a huge amount of data, and when the goal is to uncover actionable insight, it can be difficult to know where to begin or what to pay attention to.

The rise in brands taking their market research and data analysis in-house has coincided with the rise of technology simplifying the process. These tools pull through large volumes of data and outline significant information that will help you make the most important decisions.

Step 5: Conduct your research!

This is how you can run your research using Qualtrics CoreXM

- Pre-launch – Here you want to ensure that the survey/ other research methods conform to the project specifications (what you want to achieve/research)

- Soft launch – Collect a small fraction of the total data before you fully launch. This means you can check that everything is working as it should and you can correct any data quality issues.

- Full launch – You’ve done the hard work to get to this point. If you’re using a tool, you can sit back and relax, or if you get curious you can check on the data in your account.

- Review – review your data for any issues or low-quality responses. You may need to remove this in order not to impact the analysis of the data.

A helping hand

If you are missing the skills, capacity or inclination to manage your research internally, Qualtrics Research Services can help. From design, to writing the survey based on your needs, to help with survey programming, to handling the reporting, Research Services acts as an extension of the team and can help wherever necessary.

Secondary market research can be taken from a variety of places. Some data is completely free to access – other information could end up costing hundreds of thousands of dollars. There are three broad categories of secondary research sources:

- Public sources – these sources are accessible to anyone who asks for them. They include census data, market statistics, library catalogs, university libraries and more. Other organizations may also put out free data from time to time with the goal of advancing a cause, or catching people’s attention.

- Internal sources – sometimes the most valuable sources of data already exist somewhere within your organization. Internal sources can be preferable for secondary research on account of their price (free) and unique findings. Since internal sources are not accessible by competitors, using them can provide a distinct competitive advantage.

- Commercial sources – if you have money for it, the easiest way to acquire secondary market research is to simply buy it from private companies. Many organizations exist for the sole purpose of doing market research and can provide reliable, in-depth, industry-specific reports.

No matter where your research is coming from, it is important to ensure that the source is reputable and reliable so you can be confident in the conclusions you draw from it.

How do you know if a source is reliable?

Use established and well-known research publishers, such as the XM Institute , Forrester and McKinsey . Government websites also publish research and this is free of charge. By taking the information directly from the source (rather than a third party) you are minimizing the risk of the data being misinterpreted and the message or insights being acted on out of context.

How to apply secondary research

The purpose and application of secondary research will vary depending on your circumstances. Often, secondary research is used to support primary research and therefore give you greater confidence in your conclusions. However, there may be circumstances that prevent this – such as the timeframe and budget of the project.

Keep an open mind when collecting all the relevant research so that there isn’t any collection bias. Then begin analyzing the conclusions formed to see if any trends start to appear. This will help you to draw a consensus from the secondary research overall.

Market research success is defined by the impact it has on your business’s success. Make sure it’s not discarded or ignored by communicating your findings effectively. Here are some tips on how to do it.

- Less is more – Preface your market research report with executive summaries that highlight your key discoveries and their implications

- Lead with the basic information – Share the top 4-5 recommendations in bullet-point form, rather than requiring your readers to go through pages of analysis and data

- Model the impact – Provide examples and model the impact of any changes you put in place based on your findings

- Show, don’t tell – Add illustrative examples that relate directly to the research findings and emphasize specific points

- Speed is of the essence – Make data available in real-time so it can be rapidly incorporated into strategies and acted upon to maximize value

- Work with experts – Make sure you’ve access to a dedicated team of experts ready to help you design and launch successful projects

Trusted by 8,500 brands for everything from product testing to competitor analysis, DesignXM is the world’s most powerful and flexible research platform . With over 100 question types and advanced logic, you can build out your surveys and see real-time data you can share across the organization. Plus, you’ll be able to turn data into insights with iQ, our predictive intelligence engine that runs complicated analysis at the click of a button.

Get started with our free survey software

Related resources

Market intelligence 9 min read, qualitative research questions 11 min read, ethnographic research 11 min read, business research methods 12 min read, qualitative research design 12 min read, business research 10 min read, qualitative research interviews 11 min read, request demo.

Ready to learn more about Qualtrics?

RESOURCE CENTER

How to conduct thorough market research for your startup or small business, market research empowers and helps you make the best decisions for you and your business..

Starting a new business venture is exciting. When you’re thinking about launching and promoting your service, it can be easy to get caught up in the fun details, like creating your website, getting the word out, building your social media presence, and making sales.

Before you get to the fun, though, you need to do some homework. Market research must be done for your company to know your competition — and beat it.

Market research is gathering consumer feedback on your product or service and collecting pertinent information on the marketplace. This information includes what your competitors are doing and how they’re pricing themselves. It’s an essential step when putting together your business plan .

You need to have a clear idea of your customers and competitors, as well as the landscape . After all, if there isn’t a demand for your product or service, or the space is too crowded, you may decide to pivot before entering the market.

Before you move forward with your small business or startup , you need to do the behind-the-scenes work.

How to make a success of your first steps with a CRM?

Why you need to conduct market research.

You can’t operate a business based on a ‘gut feeling’ or ‘passion’ and hope for the best. That’s not a plan.

Market research helps you determine whether there’s a fit for your idea and whether it’s something people will pay you for. You want to get a lay of the land and address the following questions:

- Who is your customer?

- What are their spending habits?

- What is the market like?

- Who are your competitors?

- What are your opportunities to grow, build out and possibly shift your business?

Those questions are just the start. Where should you open a brick-and-mortar location? Should you have one at all? What about pricing? Where is the market for your offering headed?

The more information you have upfront, the better off you’ll be and the better business decisions you can make.

How to Do Market Research for a Startup or Small Business

Jumping off the questions in the previous section, you want to get clear on a couple more items before getting started.

Figure out a budget. You don’t need a large budget, but you always want to be mindful of where and how you spend your money.

Inform your team. If you have a staff, get them on board and make sure everyone knows their role in any market research task. Consider appointing a lead person or team to manage and store all related data.

Get specific about next steps. You want to act on market research quickly, not several months after you collect it, because consumer insights could change. For example, you probably shouldn’t use January survey results to make decisions about the next peak winter shopping season, which starts as early as November in the UK. Determine how and when you will use this data, then use it promptly. Consider building out a V2MOM , an organisational system for creating and executing goals, to help nail down the specifics.

There are lots of ways you can conduct market research. It doesn’t have to cost a lot of money. For instance, you can use social media for cost-effective analysis, such as gathering feedback on a new product with Twitter polls, testing ads on Facebook, and even finding brand ambassadors on Instagram.

What about conducting market research for your business idea?

If you’re in the very early stages of planning an operation — perhaps you’ve mentioned your idea over drinks with friends or you’ve started scouring the internet for 101-types of articles to find out how to get it off the ground — market research is key. You may find that your idea is not something worth pursuing before you invest too much time or money. Your market research may also lead you to pivot one idea into an even better one.

The bottom line: Market research is important for your business plan and execution.

Gather Data on Your Business and Industry

Before going to market, gather data on everything from your ideal customer to the competitive landscape. According to Startup Nation , you want to collect primary data and secondary data.

Primary data: This is new data you gather from prospective customers, the general public or a mixture of both. For example, you can use focus groups and field trials, such as A/B testing two similar but different product options and recording the participants’ preferences. Primary data can help you determine your product’s plusses and minuses, as well as serve as a guide for how to price it.

Secondary data: This is existing data you can use to retrieve customer information. It can include government census data and surveys done by other companies and organisations. Secondary data serves as a larger view of the marketplace, but bear in mind that some data may be older and therefore outdated or a little misleading.

Here are three additional popular methods used to conduct market research.

Interviews: Can include conversations in the idea phase or after other analysis exercises, such as post-focus group or survey research

Experiments: Controlled testing to prove or disprove theories about your product’s utility

Observation: Monitor and record consumer behaviour and reactions

Different types of market research result in different timeframes — anywhere from an hour to months at a time — and have varying price points.

As you consider the methods you want to use, be respectful of people’s time. Look into ways to perform your research correctly and without bias. Make sure to clear any potential payments, cash or otherwise, with your legal and finance teams to stay on top of any tax liabilities.

How Much It Costs to Conduct Market Research

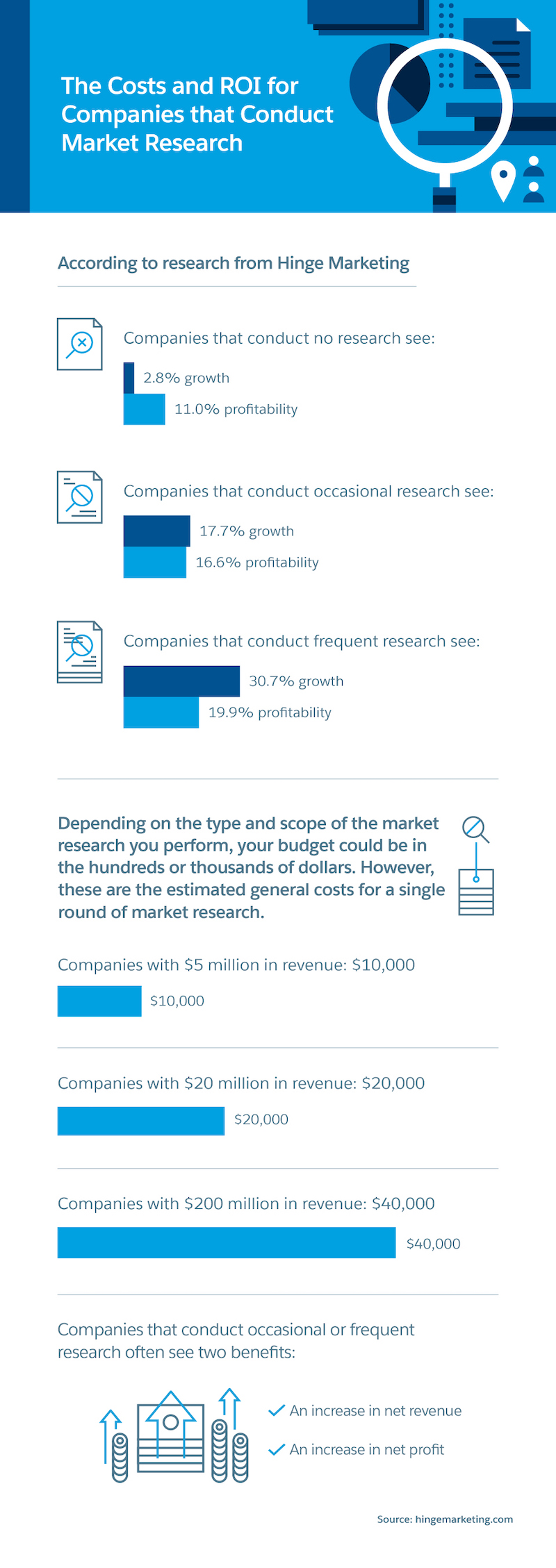

According to Vernon Research Group , generally speaking, you can expect to spend between £3,000 and £5,000 per focus group, between £10,000 and £25,000 on consumer research, and up to £40,000 for business-to-business research.

Market research typically isn’t inexpensive. It’s a budget section that can be worth hundreds to thousands of pounds. The actual amount can vary greatly depending on your industry, budget and personal preference; if you prioritise market research, you’ll likely spend more resources on it. You can pay a company that specialises in market research to collect and report on this data for you, or you can organise market research initiatives on your own.

When it comes to activities like focus groups and surveys, you can incentivise people to help with your research efforts in a number of ways. Some participants will offer their input without compensation, while others will be happy to contribute information in exchange for gift cards, financial rewards, discounts or a free product or trial of your service. Regardless of what you offer, it’s important to be upfront with what participants will receive. Be specific. Don’t tell participants they’ll get £20 if you’re offering a £20 Amazon gift card, for example.

Free and Cost-Effective Ways to Do Market Analysis

You can find free and inexpensive ways to collect customer and competitive insights, too.

GOV.UK has a roundup of business and consumer statistics on its website. You can also see if your city offers grants or assistance for small businesses that you can apply toward market research. Your local library or industry trade association may offer free or low-cost opportunities for you to conduct analysis through books and online databases.

When it comes to software, you can often sign up for free trials of many content research, SEO analysis and survey tools. Experiment with different ones and see what suits your business best, then convert to a subscription for the tools you rely on most. It’s worth making an investment in software that supports your growth , after all.

Once you have a business website, install Google Analytics . It’s a free tool that enables you to access information on your site visitors — demographics, location, the type of device they're viewing your site on and more — and get insights on the types of pages and content on your website that they’re consuming most or least. If you run an ecommerce business, Google Analytics can help you see if and where you may be losing people during the conversion process. The availability of reports (there are many you can set up) can also help you improve your landing pages, behaviour flow and more.

Don’t Skip Market Research

Your company’s success depends on how well you know and can serve your customers, and this starts before your business makes its first sale. It can be tempting to spend less time on this part of building your business, but it’s crucial that you invest the time and energy to perform quality market research.

Good market research empowers you and helps you make the best decisions for you and your business. Guesswork can cost you valuable time and money, while data-based decisions can drive your business in the right direction.

Find leads, close deals, and simplify sales with a CRM for Small Business.

Small business market research faqs, why conduct market research for your small business, how to conduct market research for your small business.

You want to get a lay of the land and address the following questions:

How to gather data for your small business or industry?

You want to gather both primary data (This is new data you gather from prospective customers) and secondary data (existing data you can use to retrieve customer information). 3 popular methods used to conduct market research are interviews, experiments and observations.

More Resources

How to Attract Customers to Your Small Business

How to Conduct Market Research for Your Startup or Small Business

How to Create a Small Business Marketing Strategy

Get timely updates and fresh ideas delivered to your inbox.

How to do market research

Your business idea is clearly inspired. But it helps to check you’re not the only one who thinks so.

Types of market research for new businesses

As a startup, you need to figure out who’s going to buy from you (customer research), and who you have to beat to get that sale (competitor analysis).

Why do customer research

By understanding your customer, you can:

- build better products and services

- learn how people make purchase decisions

Why do competitor analysis

By understanding your competitors, you can:

- copy what they do well

- work out what you can do better

It’s a good idea to figure out your customers first. That is the most important relationship for your business.

- Create a customer profile: Describe the person or business that will buy from you. For consumers, think of things like their age, location and interests. For business customers, think of things like their industry, size and location. Stuck? Start by checking out who buys from known competitors.

- Hit the internet: Search for information on the group you’ve just described. There may be existing studies into those types of people or businesses which you can use as a starting point.

- Start asking questions: Find real-life people who fit your customer description and ask them questions like: what do they need from a business like yours? where do they get that product or service now? what’s good about that current solution? and what could be better?

Read our guide to understand more about market research .

Market research methods

So how do you get information about people and their preferences? There are a few proven market research methods to try.

- Search the internet (desk research): Search for public studies into your customer group. And follow what those people say on social media and community groups.

- Have one-to-one conversations: Ask open-ended questions and let respondents do the talking.

- Host workshops or focus groups: Ask questions to a whole group of customers at once. You’ll get deeper answers because people will spark off each other.

- Run surveys: Ask tons of people the exact same questions to generate really solid insights and statistics.

- Start a community: If your customers are enthusiasts, bring them on your startup journey. Share updates, ask questions, and invite them to be beta testers.

Give something to get something

Free catering or swag will get people to your focus group. A random prize draw will encourage people to fill out your survey. A little sweetener goes a long way when doing market research.

How to do competitor analysis

Customers can tell you a lot about your competitors. So you’ll use many of the same market research methods to find out who you’re up against.

- Identify your competitors: Some competitors will be obvious from the get go. But you will find more by asking customers who they buy from now. Spare a thought for indirect competitors, which sell different things but go after the same dollar (they might sell cupcakes versus your doughnuts).

- Compare them to each other: Competing businesses often go after different parts of the market. One will be the premium option, while another will compete on price. Or perhaps they will target different age groups or locations. Map how they relate to each other.

- Find where you fit: Where on the map will you go? Measure your strengths and weaknesses against your competitors and figure out where you can give them a run for their money.

Read our guide to understand more about competitor analysis .

That’s how to do market research

You don’t need a big budget or a stats degree to go do some market research. Asking a few key questions of a few target customers and doing some competitor analysis can give you the smarts to build a winning business.

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

How to start a business

Thousands of new businesses open every day. If all those people can do it, why not you? Here’s what to do, and when.

Writing a business plan will help nail down your idea and give you a blueprint for executing it.

It’s time to run some numbers on your business idea. Budgeting and forecasting help with that.

Your prices can influence the number of sales you make and the profit you earn on each transaction.

Your business structure can affect how much tax you pay, and how you're treated by the law.

If you’re starting a business, then you’ll need to get familiar with some accounting basics.

After all the excitement of deciding to start a business, you’ll have some paperwork to do.

Treat your website like an online version of a storefront. It’s the first impression for many customers and prospects.

Now that you’re in business, you want to stay there. Xero’s got resources and solutions to help.

Download the guide to starting a business

Learn how to start a business, from ideation to launch. Fill out the form to receive this guide as a PDF.

Privacy notice .

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

- Try Xero for free

- See all features

Send us an email

How to do market research: The complete guide for your brand

Written by by Jacqueline Zote

Published on April 13, 2023

Reading time 10 minutes

Blindly putting out content or products and hoping for the best is a thing of the past. Not only is it a waste of time and energy, but you’re wasting valuable marketing dollars in the process. Now you have a wealth of tools and data at your disposal, allowing you to develop data-driven marketing strategies . That’s where market research comes in, allowing you to uncover valuable insights to inform your business decisions.

Conducting market research not only helps you better understand how to sell to customers but also stand out from your competition. In this guide, we break down everything you need to know about market research and how doing your homework can help you grow your business.

Table of contents:

What is market research?

Why is market research important, types of market research, where to conduct market research.

- Steps for conducting market research

- Tools to use for market research

Market research is the process of gathering information surrounding your business opportunities. It identifies key information to better understand your audience. This includes insights related to customer personas and even trends shaping your industry.

Taking time out of your schedule to conduct research is crucial for your brand health. Here are some of the key benefits of market research:

Understand your customers’ motivations and pain points

Most marketers are out of touch with what their customers want. Moreover, these marketers are missing key information on what products their audience wants to buy.

Simply put, you can’t run a business if you don’t know what motivates your customers.

And spoiler alert: Your customers’ wants and needs change. Your customers’ behaviors today might be night and day from what they were a few years ago.

Market research holds the key to understanding your customers better. It helps you uncover their key pain points and motivations and understand how they shape their interests and behavior.

Figure out how to position your brand

Positioning is becoming increasingly important as more and more brands enter the marketplace. Market research enables you to spot opportunities to define yourself against your competitors.

Maybe you’re able to emphasize a lower price point. Perhaps your product has a feature that’s one of a kind. Finding those opportunities goes hand in hand with researching your market.

Maintain a strong pulse on your industry at large

Today’s marketing world evolves at a rate that’s difficult to keep up with.

Fresh products. Up-and-coming brands. New marketing tools. Consumers get bombarded with sales messages from all angles. This can be confusing and overwhelming.

By monitoring market trends, you can figure out the best tactics for reaching your target audience.

Not everyone conducts market research for the same reason. While some may want to understand their audience better, others may want to see how their competitors are doing. As such, there are different types of market research you can conduct depending on your goal.

Interview-based market research allows for one-on-one interactions. This helps the conversation to flow naturally, making it easier to add context. Whether this takes place in person or virtually, it enables you to gather more in-depth qualitative data.

Buyer persona research

Buyer persona research lets you take a closer look at the people who make up your target audience. You can discover the needs, challenges and pain points of each buyer persona to understand what they need from your business. This will then allow you to craft products or campaigns to resonate better with each persona.

Pricing research

In this type of research, brands compare similar products or services with a particular focus on pricing. They look at how much those products or services typically sell for so they can get more competitive with their pricing strategy.

Competitive analysis research

Competitor analysis gives you a realistic understanding of where you stand in the market and how your competitors are doing. You can use this analysis to find out what’s working in your industry and which competitors to watch out for. It even gives you an idea of how well those competitors are meeting consumer needs.

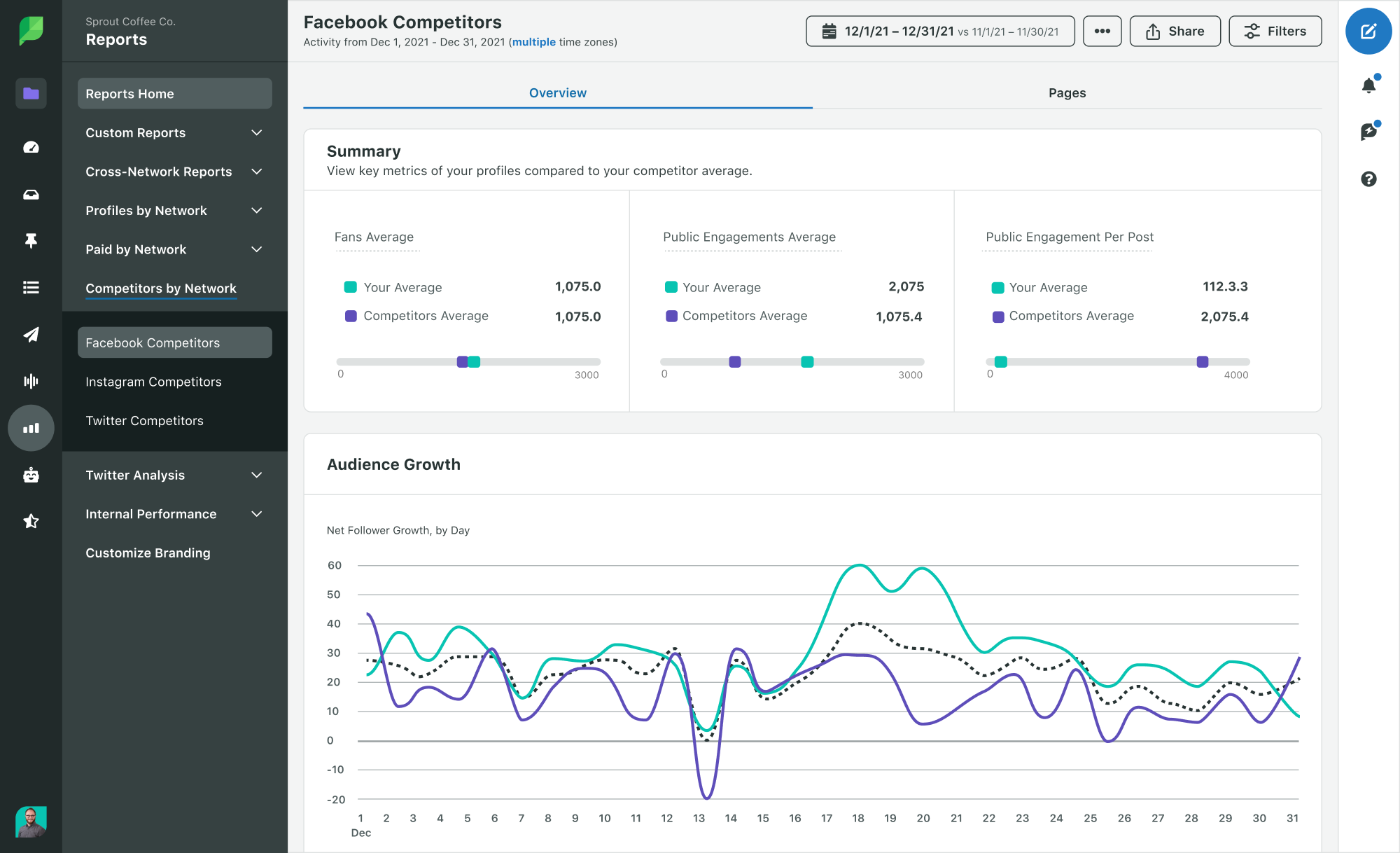

Depending on the competitor analysis tool you use, you can get as granular as you need with your research. For instance, Sprout Social lets you analyze your competitors’ social strategies. You can see what types of content they’re posting and even benchmark your growth against theirs.

Brand awareness research

Conducting brand awareness research allows you to assess your brand’s standing in the market. It tells you how well-known your brand is among your target audience and what they associate with it. This can help you gauge people’s sentiments toward your brand and whether you need to rebrand or reposition.

If you don’t know where to start with your research, you’re in the right place.

There’s no shortage of market research methods out there. In this section, we’ve highlighted research channels for small and big businesses alike.