- EssayBasics.com

- Pay For Essay

- Write My Essay

- Homework Writing Help

- Essay Editing Service

- Thesis Writing Help

- Write My College Essay

- Do My Essay

- Term Paper Writing Service

- Coursework Writing Service

- Write My Research Paper

- Assignment Writing Help

- Essay Writing Help

- Call Now! (USA) Login Order now

- EssayBasics.com Call Now! (USA) Order now

- Writing Guides

How I Spent My Pocket Money (Essay Sample)

Table of Contents

Introduction

If you had your own pocket money, how would you spend it?

This essay focuses on how to spend money, and how to do so wisely. In this piece, we share a person’s experience of being taught to spend money wisely and what he would buy when he was given a regular allowance.

Writing an essay on what you would spend your money on? We can help. Go to EssayBasics.com to learn more about our essay writing services . We can help you express yourself by pairing you with a writer who has some experience in your chosen topic.

How I Spend My Money essay

One of the most exciting events in a young one’s life is when their parents give them an allowance. No matter the amount, an allowance gives us the opportunity to spend on small things that make us happy as a child.

The joy that an allowance brings is more than just the amount itself. It’s really rooted in the experience one gets in choosing how to spend it. First, there’s the anticipation of receiving an allowance. Next, there’s the excitement of thinking about all the things you’ve been wanting to get for yourself. Third, there’s the delight of actually receiving the allowance. Finally, there’s the sheer thrill of choosing what to buy and taking it home.

How and when an allowance is given, and how much is gifted to the child, depends on the guardians’ principles. There are those who provide an allowance for children to buy basic needs. But there are some who might give a little extra to give the child an opportunity to learn how to handle money well.

It must be said that not all children are privileged to have an allowance to spend on themselves. If they come from a poor family, the guardians may not have any extra finances to give. They may save up for this just once in a while.

I am very blessed that my parents gave me an allowance on a regular basis. My allowance has really taught me financial stewardship at a very young age. They also allowed me to make decisions regarding my finances, even if I made mistakes.

Saving Money at a Young Age

While my allowance isn’t a fixed amount, I have since learned that the first thing I should do is set aside a portion of it for savings. I get a third of whatever amount I get and earmark it for saving.

To make sure that I won’t be tempted to use it, my mom helped me open a bank account where I deposit the money. They opened a time deposit account, which means I cannot just withdraw from it anytime. Whenever I hesitated to go to the bank, my dad would remind me that my small deposits would turn into one big bulk of cash that could someday be used for a rainy day, or for strategic investments.

How I Spend Money with Whatever is Left

With what’s left of my allowance, I usually buy books. These are mainly documentary magazines, which I read during my leisure time. It is actually one of my hobbies. I have made it a personal tradition to always purchase a documentary magazine each time I get my regular allowance. I particularly enjoy news magazines and feature magazines. I am a lover of general knowledge. I love knowing about everything, how and why things are the way they are – whether about nature, politics, science, or geography. It is always a first on my list of hobbies.

The other bit of my regular allowance goes towards the purchase of snacks. I love yogurt and ice cream. The refrigerator at home always has a shelf specifically reserved for my yogurts.

The remainder of my allowance goes towards others. These include my family and friends. I try to buy them something nice as a way of thanking them for taking good care of me.

I also go out of the way to purchase some gifts for my siblings as well as my parents. I want to gift them with simple things, even if they were the ones who gave me my allowance. Doing this for them gives me so much satisfaction since I love making them happy. After all, what is life without happy family and friends?

Regular allowances taught me how to make wise spending decisions. I know how to handle and spend my cash, whatever amount it might be. Therefore, I am confident that when I start handling larger amounts of money in the future, I won’t be as overwhelmed. I will make it a point to remember the financial lessons I’ve learned as a child. I hope to also be able to teach others who to use their money wisely.

Short Essay About What You Would Spend Your Money On

Did you grow up being taught about the value of saving money? If you were like me, your mom and dad probably gave you a regular allowance. They also probably gave you free rein to use your money in whatever way.

Growing up, I deposited regular amounts into my savings account the moment my allowance was handed to me. I did not want to be tempted to splurge on all the food I was craving for while holding all of my money. Personally, apart from fast food, I enjoyed treating myself to books. In fact, I made it a regular tradition to purchase a book every time I got my allowance.

I remember being taught how to make a personal budget out of my allowance. Exactly how much money was given to me didn’t matter as much as the main principle they passed on: save money. They didn’t care if I used the rest of my allowance on junk food or other types of impulse buying. All that mattered to them was whether or not I set aside a portion to put in a savings account. And so I did.

How To Write An Essay About Money

There are so many ways to write a piece about finances. It depends on the lens you are viewing the topic from. Are you an adult looking back at your childhood and remembering important lessons learned? Are you a financial expert looking to give some advice on how to maximize your cash? Are you a student wanting to teach people how to set aside an amount in case of an emergency? Are you a parent who discovered creative hacks in your finances to make ends meet? Find your angle and work it.

How To Spend Money Wisely As A Teenager

When you are young and still living under your guardians’ roof, thinking about contingencies or other things you may be needing to buy before your next allowance comes may not come naturally to you. It is so important to learn how to handle your personal finances even at that age because that sets the direction of your spending in the future. When you start getting a monthly income, the weight of the responsibility is even greater as you start to live independently. Even as a teenager, learn to set financial goals and think of the long game. Even if you have to put money inside a piggy bank to avoid temptation, do so. Track your expenses and make adjustments according to your level of contentment. Learn the art of investing from an expert. Finally, don’t shop ’till you drop. It’s a trap.

Test Resources

TOEFL® Resources by Michael Goodine

Sample toefl essay – spending money, the question.

Some people like to spend their money as soon as they earn it, while others think it is better to save their money for some time in the future. Which do you prefer? Use specific reasons and examples to support your opinion. Do not use memorized examples.

Special Offer: TOEFL Essay Evaluation and Scoring

You can now sign up to have your practice essays evaluated and scored by a TOEFL expert. Learn how you will do on test day… and learn how to do better! Sign up today .

The Sample Essay

Money concerns are a major cause of stress and anxiety in the modern world. In my opinion, it is a really wise idea to save money for the future. I feel this way for two main reasons, which I will explore in the following essay.

To begin with, older people are able to make better financial decisions than youngsters due to their experience and maturity. Young people, who have very little worldliness, are prone to spending their money on products that are mostly useless and which they quickly tire of. Older people, on the other hand, know which purchases will result in long-term happiness and satisfaction. My own experience is a compelling example of this. When I was young, I spent a tremendous amount of money on video games and comic books which I enjoyed only for a short time. Later, when I enrolled in university, I did not have enough savings to pay for my tuition, and was forced to take out a significant number of student loans. Even today, several years after graduation, I regret not saving much money as a teenager. These days I am a lot more conservative when it comes to spending, and carefully consider all of my future expenses.

Secondly, life is full of unexpected emergencies which can cause a lot of anxiety if we do not have a lot of money saved up. According to reports in the media, more than seventy-five percent of all bankruptcies in my country are the result of medical bills. I am totally aware that it is humiliating to lose our financial independence in this way. For example, last year my uncle suffered a major heart attack which required him to undergo very expensive cardiac surgery. He did not have enough money to pay for this procedure, so he had to ask his elderly parents for a loan. They were able to help him because they had resisted the urge to spend and saved money through their entire lives. He felt extremely embarrassed about begging his parents for assistance, especially as he could have avoided the situation by emulating their frugal behavior.

In conclusion, I believe that it is better to save money for the future rather than spend it right away. I feel this way because we gain the ability to make better financial decisions as we mature, and because saving money helps us avoid the humiliating effects of unexpected financial emergencies. (405 words)

This is a sample TOEFL paired choice essay written by a native speaker. It follows our TOEFL writing templates for independent essays. If you find it useful, please remember that we have many more sample essays for you to read!

New Essay Templates

Sample TOEFL Speaking Answers

New Speaking Templates

TOEFL Reading Samples

Sign up for express essay evaluation today!

Submit your practice essays for evaluation by the author of this website. Get feedback on grammar, structure, vocabulary and more. Learn how to score better on the TOEFL. Feedback in 48 hours.

Sign Up Today

- Search Search Please fill out this field.

- Managing Your Debt

10 Simple Ways to Manage Your Money Better

Why Is Money Management Important?

:max_bytes(150000):strip_icc():format(webp)/bio_LaToyaIrby-d7b87e77d6c441e5a61deecedbb3861a.png)

Being good with money is about more than just making ends meet. Don't worry that you're not a math whiz; great math skills aren't really necessary—you just need to know basic addition and subtraction.

Life is much easier when you have good financial skills. How you spend your money impacts your credit score and the amount of debt you end up carrying. If you’re struggling with money management issues, such as living paycheck to paycheck despite making more than enough money, then here are some tips to improve your financial habits.

When you’re faced with a spending decision, especially a large purchase decision, don’t just assume you can afford something. Confirm that you can actually afford it and that you haven’t already committed those funds to another expense.

That means using your budget and the balance in your checking and savings accounts to decide whether you can afford a purchase. Remember that just because the money is there doesn't mean you can make the purchase. You have also to consider the bills and expenses you'll have to pay before your next payday.

How to Manage Your Money Better

1. have a budget.

Many people don’t budget because they don’t want to go through what they think will be a boring process of listing out expenses, adding up numbers, and making sure everything lines up. If you’re bad with money, you don’t have room for excuses with budgeting. If all it takes to get your spending on track is a few hours working a budget each month, why wouldn’t you do it? Plus, you can use several tools to make the process as easy as possible—maybe even fun.

Instead of focusing on the process of creating a budget, focus on the value that budgeting will bring to your life.

2. Use the Budget

Your budget is useless if you make it and then let it collect dust in a folder tucked away in your file cabinet or never open it again on your computer. Refer to it often throughout the month to help guide your spending decisions. Update it as you pay bills and spend on other monthly expenses. At any given time during the month, you should have an idea of how much money you’re able to spend, considering any expenses you have left to pay.

3. Limit Unbudgeted Spending

A critical part of your budget is the net income or the amount of money left after you subtract your expenses from your income. If you have any money left over, you can use it for fun and entertainment, but only up to a certain amount. You can’t go crazy with this money, especially if it’s not a lot and has to last the entire month. Before you make any big purchases, make sure it won’t interfere with anything else you have planned.

4. Track Your Spending

Small purchases here and there add up quickly, and before you know it, you’ve overspent your budget. Start tracking your spending to discover places where you may be unknowingly overspending. Save your receipts and write your purchases in a spending journal, categorizing them so you can identify areas where you have a hard time keeping your spending in check.

5. Don’t Commit to New Recurring Monthly Bills

Just because your income and credit qualify you for a certain loan, doesn’t mean you should take it. Many people naively think the bank wouldn’t approve them for a credit card or loan they can’t afford. The bank only knows your income, as you’ve reported, and the debt obligations included on your credit report , not any other obligations that could prevent you from making your payments on time. It’s up to you to decide whether a monthly payment is affordable based on your income and other monthly obligations.

6. Make Sure You Pay the Best Prices

You can make the most of your money comparison shopping , ensuring you’re paying the lowest prices for products and services. Look for discounts, coupons, and cheaper alternatives whenever you can.

7. Save Up for Big Purchases

The ability to delay gratification will go a long way in helping you be better with money. When you put off large purchases, rather than sacrificing more important essentials or putting the purchase on a credit card, you give yourself time to evaluate whether the purchase is necessary and even more time to compare prices. By saving up rather than using credit, you avoid paying interest on the purchase. And if you save rather than skipping bills or obligations, well, you don’t have to deal with the many consequences of missing those bills .

8. Limit Credit Card Purchases

Credit cards are a bad spender's worst enemy. When you run out of cash, you simply turn to your credit cards without considering whether you can afford to pay the balance. Resist the urge to use your credit cards for purchases you can’t afford, especially on items you don’t really need.

9. Contribute to Savings Regularly

Depositing money into a savings account each month can help you build healthy financial habits . You can even set it up so the money is automatically transferred from your checking account to your savings account. That way, you don’t have to remember to make the transfer.

10. Practice, Practice, Practice

In the beginning, you may not be used to planning ahead and putting off purchases until you can afford them. The more you make these habits part of your daily life, the easier it is to manage your money, and the better off your finances will be.

Frequently Asked Questions (FAQs)

Why is money management important.

Without money management, personal finances are a bit of a mystery. This can lead to overspending and living paycheck-to-paycheck. Money management can help you have a better handle on your income and spending so you can make decisions that improve your financial status.

How do you improve money management?

You can improve your money management by regularly evaluating what you're doing with money and making changes that make sense for you. For example, if you don't have a budget, you could start by developing one. If you have a budget, you could track your spending and see how it lines up with your budget. Once you have an idea of your income and spending, you could choose to increase your savings, pay off debt, or start investing based on your financial goals.

Consumer Financial Protection Bureau. " Budgeting: How to Create a Budget and Stick With It ."

Federal Trade Commission. " Making a Budget ."

FiftyThirtyTwenty.com. " Income + Financial Stability in America ."

Consumer Financial Protection Bureau. " Spending Tracker ."

Consumer Financial Protection Bureau. " Bill Calendar: Know What You Owe and When It's Due ."

WSFS Bank. " 5 Ways to Save for a Big Purchase ."

Discover. " Six Tips On How To Stay Out of Debt ."

Consumer Financial Protection Bureau. " Looking for An Easy Way to Save Money? Make It Automatic ."

How to spend your money

What should you do with your paycheck? These talks offer reframes to help you save, spend and give — with intention.

A monkey economy as irrational as ours

The battle between your present and future self

Saving for tomorrow, tomorrow

Does money make you mean?

How to buy happiness

Should you donate differently?

How behavioral science can lower your energy bill

IELTS Essay: Money

by Dave | Real Past Tests | 1 Comment

This is my IELTS writing task 2 sample answer essay on the topic of talking about money from the real IELTS exam.

Be sure to sign up for my full IELTS EBooks here to support my efforts to keep writing these essays for students:

Patreon Ebooks

In many countries, people increasingly talk about money such as how much they earn or how much they pay for things in their daily conversations.

Is this a positive or negative trend?

It has become increasingly pervasive in recent years for individuals to discuss money matters on a daily basis. In my opinion, this is due to changes in what individuals consider polite and is a decidedly negative trend on the whole.

The reason people now talk about money is that it is socially acceptable. In past generations, discussing money was considered “in poor taste” and most people were reserved in order to not appear arrogant or desperate. Today, many social norms from the past have disappeared and this includes ones related to the discussion of one’s finances. This enables the average person to discuss money with friends and family as a way of coping with anxieties about the future or insecurities about their own status in society. For instance, it is common for some wealthy individuals to show off by talking about their investments, property, and so on to impress friends and elevate their own self-esteem.

Discussing money is overall a negative trend as it exacerbates an unhealthy mindset. There are situations where it can be positive, such as when discussing potential investments and helping friends. These contexts are the exceptions, however, as most people simply talk about money to relieve their own nervousness or as a form of bragging. Once a person becomes addicted to the minor dopamine bursts that accompany seeking self-pity or self-aggrandizement, they will have a difficult time transitioning to more productive and fun topics of conversation. Over time, a person may ironically increase their anxieties and insecurities by seeking to cope with them.

In conclusion, people talk about their finances as it is no longer considered rude and it is an unhealthy habit. It is better to talk about to more important topics.

1. It has become increasingly pervasive in recent years for individuals to discuss money matters on a daily basis. 2. In my opinion, this is due to changes in what individuals consider polite and is a decidedly negative trend on the whole.

- Paraphrase the overall essay topic.

- Write a clear opinion. Read more about introductions here .

1. The reason people now talk about money is that it is socially acceptable. 2. In past generations, discussing money was considered “in poor taste” and most people were reserved in order to not appear arrogant or desperate. 3. Today, many social norms from the past have disappeared and this includes ones related to the discussion of one’s finances. 4. This enables the average person to discuss money with friends and family as a way of coping with anxieties about the future or insecurities about their own status in society. 5. For instance, it is common for some wealthy individuals to show off by talking about their investments, property, and so on to impress friends and elevate their own self-esteem.

- Write a topic sentence with a clear main idea at the end.

- Explain your main idea.

- Develop it with specific or hypothetical examples.

- Keep developing it fully.

- Finish the paragraph strong.

1. Discussing money is overall a negative trend as it exacerbates an unhealthy mindset. 2. There are situations where it can be positive, such as when discussing potential investments and helping friends. 3. These contexts are the exceptions, however, as most people simply talk about money to relieve their own nervousness or as a form of bragging. 4. Once a person becomes addicted to the minor dopamine bursts that accompany seeking self-pity or self-aggrandizement, they will have a difficult time transitioning to more productive and fun topics of conversation. 5. Over time, a person may ironically increase their anxieties and insecurities by seeking to cope with them.

- Write a new topic sentence with a new main idea at the end.

- Explain your new main idea.

- Include specific details and examples.

- Add as much information as you can and make sure it links logically.

- Keep adding in the result to develop your ideas more.

1. In conclusion, people talk about their finances as it is no longer considered rude and it is an unhealthy habit. 2. It is better to talk about to more important topics.

- Summarise your main ideas.

- Include a final thought. Read more about conclusions here .

What do the words in bold below mean? Make some notes on paper to aid memory and then check below.

It has become increasingly pervasive in recent years for individuals to discuss money matters on a daily basis . In my opinion, this is due to changes in what individuals consider polite and is a decidedly negative trend on the whole .

The reason people now talk about money is that it is socially acceptable . In past generations , discussing money was considered “in poor taste” and most people were reserved in order to not appear arrogant or desperate . Today, many social norms from the past have disappeared and this includes ones related to the discussion of one’s finances . This enables the average person to discuss money with friends and family as a way of coping with anxieties about the future or insecurities about their own status in society . For instance, it is common for some wealthy individuals to show off by talking about their investments , property , and so on to impress friends and elevate their own self-esteem .

Discussing money is overall a negative trend as it exacerbates an unhealthy mindset . There are situations where it can be positive, such as when discussing potential investments and helping friends. These contexts are the exceptions , however, as most people simply talk about money to relieve their own nervousness or as a form of bragging . Once a person becomes addicted to the minor dopamine bursts that accompany seeking self-pity or self-aggrandizement , they will have a difficult time transitioning to more productive and fun topics of conversation . Over time , a person may ironically increase their anxieties and insecurities by seeking to cope with them .

For extra practice, write an antonym (opposite word) on a piece of paper to help you remember the new vocabulary:

It has become increasingly pervasive in recent years for it is more common now

discuss money matters on a daily basis talk about finances every day

this is due to changes in this is mostly because of

consider polite think is nice

decidedly negative trend on the whole bad overall

socially acceptable good for society

In past generations before

considered “in poor taste” not a polite thing to say

reserved in order to not appear arrogant or desperate polite so that you don’t seem prideful or needy

social norms what is considered polite by society

disappeared went away

discussion of one’s finances talking about your money

enables allows

average person normal citizen

coping with anxieties about dealing with nervous feelings related to

insecurities doubts

status in society how you are perceived in the world

wealthy individuals rich people

show off brag

investments money put into

property things you own

impress friends show off to friends

elevate their own self-esteem feel better about themselves

overall a negative trend on the whole is bad

exacerbates makes worse

unhealthy mindset not a health way to think about it

situations contexts

potential investments possible places to put your money

These contexts are the exceptions these situations are rare

relieve their own nervousness less their anxiety

as a form of bragging a way of showing off

addicted to the minor dopamine bursts that accompany seeking self-pity or self-aggrandizement get used to the pleasure that comes from feeling bad about yourself or bragging

difficult time transitioning to hard time changing

productive useful

fun topics of conversation interesting things to talk about

Over time as life goes on

ironically surprisingly

by seeking to cope with them trying to deal with them

no longer considered rude not impolite any more

Pronunciation

Practice saying the vocabulary below and use this tip about Google voice search :

ɪt hæz bɪˈkʌm ɪnˈkriːsɪŋli pɜːˈveɪsɪv ɪn ˈriːsnt jɪəz fɔː dɪsˈkʌs ˈmʌni ˈmætəz ɒn ə ˈdeɪli ˈbeɪsɪs ðɪs ɪz djuː tuː ˈʧeɪnʤɪz ɪn kənˈsɪdə pəˈlaɪt dɪˈsaɪdɪdli ˈnɛɡətɪv trɛnd ɒn ðə həʊl ˈsəʊʃəli əkˈsɛptəbᵊl ɪn pɑːst ˌʤɛnəˈreɪʃᵊnz kənˈsɪdəd “ ɪn pʊə teɪst “ rɪˈzɜːvd ɪn ˈɔːdə tuː nɒt əˈpɪər ˈærəʊɡənt ɔː ˈdɛspərɪt ˈsəʊʃəl nɔːmz ˌdɪsəˈpɪəd dɪsˈkʌʃᵊn ɒv wʌnz faɪˈnænsɪz ɪˈneɪbᵊlz ˈævərɪʤ ˈpɜːsn ˈkəʊpɪŋ wɪð æŋˈzaɪətiz əˈbaʊt ˌɪnsɪˈkjʊərɪtiz ˈsteɪtəs ɪn səˈsaɪəti ˈwɛlθi ˌɪndɪˈvɪdjʊəlz ʃəʊ ɒf ɪnˈvɛstmənts ˈprɒpəti ˈɪmprɛs frɛndz ˈɛlɪveɪt ðeər əʊn sɛlf-ɪsˈtiːm ˈəʊvərɔːl ə ˈnɛɡətɪv trɛnd ɪɡˈzæsəbeɪts ʌnˈhɛlθi ˈmaɪndsɛt ˌsɪtjʊˈeɪʃᵊnz pəʊˈtɛnʃəl ɪnˈvɛstmənts ðiːz ˈkɒntɛksts ɑː ði ɪkˈsɛpʃᵊnz rɪˈliːv ðeər əʊn ˈnɜːvəsnəs æz ə fɔːm ɒv ˈbræɡɪŋ əˈdɪktɪd tuː ðə ˈmaɪnə ˈdəʊpəmiːn bɜːsts ðæt əˈkʌmpəni ˈsiːkɪŋ sɛlf-ˈpɪti ɔː sɛlf-əˈɡrændɪzmənt ˈdɪfɪkəlt taɪm trænˈzɪʃᵊnɪŋ tuː prəˈdʌktɪv fʌn ˈtɒpɪks ɒv ˌkɒnvəˈseɪʃᵊn . ˈəʊvə taɪm aɪˈrɒnɪkəli baɪ ˈsiːkɪŋ tuː kəʊp wɪð ðɛm nəʊ ˈlɒŋɡə kənˈsɪdəd ruːd

Vocabulary Practice

I recommend getting a pencil and piece of paper because that aids memory. Then write down the missing vocabulary from my sample answer in your notebook:

I__________________________________________r individuals to d_________________________________s . In my opinion, t___________________________n what individuals c_________________e and is a d_________________________________e .

The reason people now talk about money is that it is s_________________________e . I______________________s , discussing money was c_______________________e” and most people were r_______________________________________________e . Today, many s_______________s from the past have d_____________d and this includes ones related to the d______________________s . This e__________es the a_______________n to discuss money with friends and family as a way of c___________________________t the future or i________________s about their own s_______________y . For instance, it is common for some w__________________s to s____________f by talking about their i_______________s , p___________y , and so on to i______________s and e______________________________m .

Discussing money is o_____________________d as it e_______________s an u___________________t . There are s_____________s where it can be positive, such as when discussing p___________________s and helping friends. T_________________________s , however, as most people simply talk about money to r________________________s or a_____________________g . Once a person becomes a___________________________________________________________________________________________________________________t , they will have a d_________________________o more p___________e and f__________________________n . O_________e , a person may i____________y increase their anxieties and insecurities b________________________________m .

In conclusion, people talk about their finances as it is n______________________________e and it is an unhealthy habit. It is better to talk about to more important topics.

Listening Practice

Learn more about this topic by watching from YouTube below and practice with these activities :

Reading Practice

Read more about this topic and use these ideas to practice :

https://www.cnbc.com/2009/07/22/The-Worlds-Most-Beautiful-Currencies.html

Speaking Practice

Practice with the following speaking questions from the real IELTS speaking exam :

- How important is it for people to set goals?

- Do people set different goals at different stages of life?

- Are personal goals more important than professional goals?

- What sort of goals do young people today set?

- Are people becoming more pessimistic about their life goals?

Writing Practice

Practice with the related IELTS essay topics below:

Older people often choose to spend money on themselves (e.g. on holidays) rather than save money for their children after retirement.

Is this a positive or negative development?

https://howtodoielts.com/ielts-ebook-money/

Recommended For You

Latest IELTS Writing Task 1 2024 (Graphs, Charts, Maps, Processes)

by Dave | Sample Answers | 147 Comments

These are the most recent/latest IELTS Writing Task 1 Task topics and questions starting in 2019, 2020, 2021, 2022, 2023, and continuing into 2024. ...

Recent IELTS Writing Topics and Questions 2024

by Dave | Sample Answers | 342 Comments

Read here all the newest IELTS questions and topics from 2024 and previous years with sample answers/essays. Be sure to check out my ...

Find my Newest IELTS Post Here – Updated Daily!

by Dave | IELTS FAQ | 18 Comments

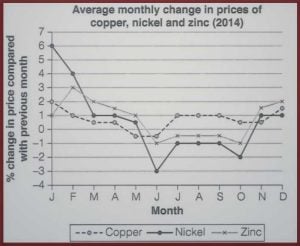

IELTS Cambridge 18: Average Monthly Change Line Chart

by Dave | Cambridge 18 | 0 Comment

This is an IELTS writing task 1 sample answer essay from the new IELTS Cambridge 18 book of past tests on the topic of average monthly ...

IELTS Essay: Car Ownership

by Dave | Real Past Tests | 4 Comments

This is my IELTS writing task 2 sample answer essay on the topic of car ownership from the real IELTS exam. Be sure ...

IELTS Essay: Traditional Ideas and Young people

by Dave | Real Past Tests | 6 Comments

This is an IELTS writing task 2 sample answer essay on the topic of the traditional ideas and how helpful they are for young people in ...

Submit a Comment Cancel reply

You must be logged in to post a comment.

amazing essay

Exclusive Ebooks, PDFs and more from me!

Sign up for patreon.

Don't miss out!

"The highest quality materials anywhere on the internet! Dave improved my writing and vocabulary so much. Really affordable options you don't want to miss out on!"

Minh, Vietnam

Hi, I’m Dave! Welcome to my IELTS exclusive resources! Before you commit I want to explain very clearly why there’s no one better to help you learn about IELTS and improve your English at the same time... Read more

Patreon Exclusive Ebooks Available Now!

Essay on Money for Students and Children

500+ words essay on money.

Money is an essential need to survive in the world. In today’s world, almost everything is possible with money. Moreover, you can fulfill any of your dreams by spending money. As a result, people work hard to earn it. Our parents work hard to fulfill our dreams .

Furthermore various businessmen , entrepreneurs have startup businesses to earn profits. They have made use of their skills and intelligence in getting an upper hand in earning. Also, the employee sector works day and night to complete their tasks given to them. But still, there are many people who take shortcuts to success and get involved in corruption.

Black Money

Black money is the money that people earn with corruption . For your information corruption involves the misuse of the power of high posts. For instance, it involves taking bribes, extra money for free services, etc. Corruption is the main cause of the lack of proper growth of the country .

Moreover, money that people having authority earns misusing their powers is black money. Furthermore, these earnings do not have proper documentation. As a result, the people who earn this do not pay income tax . Which is a great offense and the person who does this can be behind bars.

Money Laundering

In simple terms, money laundering is converting black money into white money. Also, this is another illegal offense. Furthermore, money laundering also encourages various crimes. Because it is the only way criminal can use their money from illegal sources. Money laundering is a crime, and the people who practice it are liable to go to jail.

Therefore the Government is taking various preventive measures to abolish money laundering. The government is linking bank accounts to AADHAR Card. To get all the transaction detail of each bank account. As a result, the government comes to know if any transaction is from an illegal source .

Also, every bank account has its own KYC (Know your Customer) this separates different categories of income of people. Businessmen are in the high-risk category. Then comes the people who are on a high post they are in the medium-risk category. Further, the last category is of the Employee sector they are at the lowest risk.

Get the huge list of more than 500 Essay Topics and Ideas

White Money

White money is the money that people earn through legal sources. Moreover, it is the money on which the people have already paid the tax. The employee sector of any company always has white money income.

Because the tax is already levied on their income. Therefore the safest way to earn money is in the employment sector. But your income will be limited here. As a result, many people take a different path and choose entrepreneurship. This helps them in starting their own company and make profitable incomes .

Every person in this world works hard to earn money. People try different methods and set of skills to increase their incomes. But it is always not about earning money, it’s about saving and spending it. People should spend money wisely. Moreover, things should always be bought by judging their worth. Because money is not precious but the efforts you make for it are.

Q1. What is Black Money?

A1. Black money is the money that people earn through illegal ways. It is strictly prohibited in our country. And the people who have it can go to jail.

Q2. What is the difference between Black money and White money?

A2. The difference between black money and white money is, Black money comes from illegal earnings. But white money comes from legal sources with taxation levied on it.

Customize your course in 30 seconds

Which class are you in.

- Travelling Essay

- Picnic Essay

- Our Country Essay

- My Parents Essay

- Essay on Favourite Personality

- Essay on Memorable Day of My Life

- Essay on Knowledge is Power

- Essay on Gurpurab

- Essay on My Favourite Season

- Essay on Types of Sports

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Download the App

- PRO Courses Guides New Tech Help Pro Expert Videos About wikiHow Pro Upgrade Sign In

- EDIT Edit this Article

- EXPLORE Tech Help Pro About Us Random Article Quizzes Request a New Article Community Dashboard This Or That Game Happiness Hub Popular Categories Arts and Entertainment Artwork Books Movies Computers and Electronics Computers Phone Skills Technology Hacks Health Men's Health Mental Health Women's Health Relationships Dating Love Relationship Issues Hobbies and Crafts Crafts Drawing Games Education & Communication Communication Skills Personal Development Studying Personal Care and Style Fashion Hair Care Personal Hygiene Youth Personal Care School Stuff Dating All Categories Arts and Entertainment Finance and Business Home and Garden Relationship Quizzes Cars & Other Vehicles Food and Entertaining Personal Care and Style Sports and Fitness Computers and Electronics Health Pets and Animals Travel Education & Communication Hobbies and Crafts Philosophy and Religion Work World Family Life Holidays and Traditions Relationships Youth

- Browse Articles

- Learn Something New

- Quizzes Hot

- Happiness Hub

- This Or That Game

- Train Your Brain

- Explore More

- Support wikiHow

- About wikiHow

- Log in / Sign up

- Finance and Business

- Managing Your Money

- Keeping Track of Your Spending

How to Spend Money Wisely

Last Updated: August 26, 2024 Approved

This article was co-authored by Andrew Lokenauth . Andrew Lokenauth is a Finance Executive who has over 15 years of experience working on Wall St. and in Tech & Start-ups. Andrew helps management teams translate their financials into actionable business decisions. He has held positions at Goldman Sachs, Citi, and JPMorgan Asset Management. He is the founder of Fluent in Finance, a firm that provides resources to help others learn to build wealth, understand the importance of investing, create a healthy budget, strategize debt pay-off, develop a retirement roadmap, and create a personalized investing plan. His insights have been quoted in Forbes, TIME, Business Insider, Nasdaq, Yahoo Finance, BankRate, and U.S. News. Andrew has a Bachelor of Business Administration Degree (BBA), Accounting and Finance from Pace University. There are 10 references cited in this article, which can be found at the bottom of the page. wikiHow marks an article as reader-approved once it receives enough positive feedback. This article received 22 testimonials and 91% of readers who voted found it helpful, earning it our reader-approved status. This article has been viewed 753,746 times.

Do you hate it when you really need money, but your wallet is empty? No matter how little or how much money you have, spending it wisely is a good idea; it enables you to get the most bang for your buck. Follow these tips to reduce expenditures in key areas and adopt a safer overall approach to shopping.

Spending Basics

- Organize your purchases by category (food, clothing, entertainment, etc.). Categories with the highest monthly amounts (or monthly amounts you consider surprisingly high) may be good targets for saving money.

- We'll cover ways to save cash wisely later.

- Make a preliminary trip before you go on your real shopping trip. Note the prices of several alternatives at one or more stores. Return home without buying anything and decide which products to buy on your second, "real" expedition. The more focused you are and the less time you spend in the store, the less you'll spend.

- If you are motivated to treat each purchase as an important decision, you will make better decisions.

- Do not accept free samples or try something on just for fun. Even if you don't plan on purchasing it, the experience can convince you to make a decision now instead of considering it carefully in advance.

- Don't browse store windows or shop for fun. If you're only buying something because you find the act of shopping fun, you'll likely end up spending too much on stuff you don't need. [2] X Research source

- Don't make purchasing decisions when your judgment is impaired. Alcohol, other drugs, or sleep deprivation [3] X Research source can harm your ability to make sensible decisions. Even shopping while hungry or listening to loud can be a bad idea if you don't stick to your shopping list.

- Jump to our advice on spending on clothing .

- Do not take advice from store employees. If you need a question answered, politely listen to their response but ignore any advice on purchasing decisions. If they won't leave you alone, leave the store and return later to make your decision.

- Don't bring more cash with you than you need. If you don't have the extra money, you can't spend it. [5] X Research source Similarly, withdraw your weekly budget from an ATM once a week rather than filling up your wallet whenever you run out.

- Don't buy something on the basis of an advertisement. Whether on television or the product's packaging, treat ads with skepticism [6] X Research source . They are designed to encourage you to spend money and will not provide an accurate portrayal of your options.

- Don't purchase something just because it's reduced price. Coupons and sales are great for products you were already planning to buy; purchasing something you don't need just because it's 50% off does not save money!

- Be aware of pricing tricks. Translate that "$1.99" price into "$2". Judge the price of an item on its own merits, not because it's a "better deal" than another option by the same company. (By making the "worse deal" atrocious value, someone can trick you into paying more for add-ons you don't need).

- Don't automatically buy the mid priced product within a category. Marketers know that if they want you to buy a high-priced product instead of a low-priced product, they can influence your decision by adding an outrageously expensive product to make the high-priced product intermediate in price and look reasonable in comparison.

- Only use a coupon or take advantage of a discount for an item you absolutely need or decided to buy before the discount occurred. The attraction of a cheaper price is an easy way to get customers to buy something they don't need.

- Buy products only useful at particular times of year during the offseason. A winter coat should be cheap during summer weather.

- Don't be fooled by lower monthly payments. Calculate the total amount you'll spend (monthly payments x number of months until fully paid) to find out what the cheapest option is.

- If you're taking out a loan, calculate how much total interest you'll have to pay.

- Jump to info on spending on food and beverages .

- Set aside a very limited amount of money in your budget for these treats. The goal is to give yourself a small reward to keep your spirits up and prevent a giant splurge later.

- If your usual methods of treating yourself are expensive, find cheaper alternatives. Take a bubble bath at home instead of going to the spa, or borrow a movie from the library instead of going to the theater.

Spending on Clothing

- Clearing out your closet is not an excuse to buy replacements. The goal is to find out what types of clothing you have enough of, and which you actually need more of.

- Remember that price doesn't guarantee quality. Research what the longest lasting brands are rather than assume the most expensive option is best.

- Similarly, wait until the item you need goes on sale when possible. Remember not to use sales an excuse to purchase items you don't require.

- Thrift stores in more affluent neighborhoods usually receive higher-quality donations.

Spending on Food and Beverages

- This will not only prevent you from making impulse buys at the grocery store, but also prevent wasting money due to food waste, a major expenditure for many people. [8] X Research source If you find yourself throwing away food, reduce the size of your planned meals.

- Pack a lunch at home instead and bring it with you to work or class.

- Fill a water bottle using your tap at home instead of buying expensive bottled water.

- Similarly, if you drink coffee frequently, buy a cheap French press and save money by preparing it at home.

Saving Cash Wisely

- Establish an emergency fund.

- Avoid unnecessary fees.

- Meal plan your meals for the week

- Will I use this item regularly? Make sure you'll drink all that milk before it goes bad, or that you have enough summer months left to wear that skirt more than a couple times.

- Do I lack something that serves the same purpose? Beware specialized products whose role can be performed by basic items you already have. [12] X Research source You probably don't need ultra-specialized kitchen equipment, or a special workout outfit when sweatpants and a T-shirt will work just as well. [13] X Research source

- Will this item change my life for the better? This is a tricky question, but purchases that encourage "bad habits" or cause you to neglect important parts of your life should be avoided.

- Will I miss this item if I don't buy it?

- Will this item make me happy?

Community Q&A

- When comparing two cars, calculate how much more you'll spend in gas money if you buy the less efficient (lower MPG) model. [14] X Research source Thanks Helpful 0 Not Helpful 0

- Avoid dry-clean only clothing. Check the tags before you purchase any clothing. You don't want to repeatedly spend money on dry cleaning. [15] X Research source Thanks Helpful 0 Not Helpful 0

- Following a budget will be much easier if the entire household is committed. Thanks Helpful 6 Not Helpful 1

Tips from our Readers

- Do your research before buying something new: is it worth spending the money? What's the best value you can find? Resist automatically going for the cheapest item you can find, though, since cheap stuff is usually low-quality, meaning you'll likely have to spend more money replacing it in the long run.

- You can still enjoy a nice meal out while saving money. For instance, instead of paying for a drink, stick to water or hot tea and lemon, since it's typically free. Skip the appetizer, or split your food with a friend, since restaurant portions tend to be pretty big anyway.

- Be cautious about who you loan money to, and try not to loan what you can't afford to lose. If friends or relatives ask you if they could borrow some money, try to keep track of what you've loaned them, and maybe come up with a payment plan with them if it's a large sum.

You Might Also Like

- ↑ Trent Larsen, CFP®. Certified Financial Planner. Expert Interview. 22 July 2020.

- ↑ http://mywifequitherjob.com/how-to-build-wealth-by-spending-money-wisely/

- ↑ http://www.sltrib.com/sltrib/money/56846293-79/sleep-shopping-deprivation-foods.html.csp

- ↑ http://www.moneycrashers.com/psychology-of-money-saving-spending-habits/

- ↑ http://money.howstuffworks.com/personal-finance/budgeting/10-tips-for-staying-on-budget.htm#page=2

- ↑ http://pbskids.org/itsmylife/money/spendingsmarts/article8.html

- ↑ http://www.moneycrashers.com/importance-splurging-avoid-frugal-fatigue-splurges/

- ↑ http://www.lifehack.org/articles/money/7-ways-spend-money-wisely.html

- ↑ http://www.csmonitor.com/Business/Saving-Money/2012/0510/23-ways-to-save-money-on-clothes

- ↑ http://financialplan.about.com/od/savingmoney/a/newcarmistakes.htm

About This Article

If you want to spend money wisely, create a budget to track how much money you spend on each category, such as food, clothing, entertainment, and living expenses. Then, try to plan each purchase in advance so you know how much money you will be spending and will be able to avoid impulse purchases. When you do spend money, pay in cash to prevent overspending or interest charges for unpaid credit card balances. Whenever possible, wait for a sale to purchase big-ticket items, like a new laptop, at a discount. For tips on spending less for food and clothing and starting a savings fund, scroll down! Did this summary help you? Yes No

- Send fan mail to authors

Reader Success Stories

Zenha Ajmal

Nov 18, 2017

Did this article help you?

Gayla Thoms

Oct 9, 2016

Oct 3, 2016

Jul 20, 2019

Oct 15, 2017

Featured Articles

Trending Articles

Watch Articles

- Terms of Use

- Privacy Policy

- Do Not Sell or Share My Info

- Not Selling Info

Don’t miss out! Sign up for

wikiHow’s newsletter

- Skip to main content

- Skip to secondary menu

- Skip to primary sidebar

- Skip to footer

A Plus Topper

Improve your Grades

Pocket Money Essay | Essay on Pocket Money for Students and Children in English

February 13, 2024 by sastry

Pocket Money Essay: ‘Pocket Money’ is the term for the money that parents give to their children to spend every month. In America, they call it ‘allowance’. A child can spend this money in anyway he or she likes. Sometimes parents guide their children and help them decide how the money should be spent.

You can read more Essay Writing about articles, events, people, sports, technology many more.

Short Essay on Pocket Money 200 Words for Kids and Students in English

Below we have given a short essay on Pocket Money is for Classes 1, 2, 3, 4, 5 and 6. This short essay on the topic is suitable for students of class 6 and below.

I also get a fixed amount of pocket money every month from my parents.

I don’t spend all my pocket money. I put some of it in my piggy bank. Since I love chess, I use my pocket money to buy books about the game. Now I have a very good collection of books on chess. Sometimes, I go out to watch a film with my friends. Often we go out for lunch to some restaurant. If I like some music, I use my pocket money to buy tapes and CDs.

Since my sister is still too young, she does not get any pocket money. So, sometimes, I give her some money to spend or buy some things for her. During some months, I’m able to save most of my pocket money. At times I’m not able to save anything at all.

Overall, the concept of pocket money is good. It helps children understand the value of money and how one should plan for the entire month. It is important that parents are strict and do not give children more money once they have finished their pocket money.

- Picture Dictionary

- English Speech

- English Slogans

- English Letter Writing

- English Essay Writing

- English Textbook Answers

- Types of Certificates

- ICSE Solutions

- Selina ICSE Solutions

- ML Aggarwal Solutions

- HSSLive Plus One

- HSSLive Plus Two

- Kerala SSLC

- Distance Education

Home — Essay Samples — Economics — Money — How Students Can Manage Their Money

How to Manage Your Money as a Student

- Categories: Money Personal Finance

About this sample

Words: 824 |

Published: Feb 8, 2022

Words: 824 | Pages: 2 | 5 min read

Cite this Essay

Let us write you an essay from scratch

- 450+ experts on 30 subjects ready to help

- Custom essay delivered in as few as 3 hours

Get high-quality help

Verified writer

- Expert in: Economics Law, Crime & Punishment

+ 120 experts online

By clicking “Check Writers’ Offers”, you agree to our terms of service and privacy policy . We’ll occasionally send you promo and account related email

No need to pay just yet!

Related Essays

1 pages / 451 words

2 pages / 890 words

2 pages / 795 words

2 pages / 703 words

Remember! This is just a sample.

You can get your custom paper by one of our expert writers.

121 writers online

Still can’t find what you need?

Browse our vast selection of original essay samples, each expertly formatted and styled

Related Essays on Money

Money, often described as the lifeblood of modern society, plays a pivotal role in our lives. Its importance extends far beyond the mere acquisition of material possessions. In this essay, we will explore the multifaceted [...]

Credit cards are dangerous, especially for new credit card users who may be interested by what seems like “free” money. Some credit card users fall into credit card traps. If you’re thinking about getting a credit card, [...]

Money can't buy love or happiness. This assertion is a reminder of the profound truth that material wealth, while important for meeting basic needs, cannot replace the intangible and deeply fulfilling aspects of human life. In a [...]

Money is a crucial aspect of life, and saving it is a necessary practice that everyone should embrace. According to a recent survey, only 41% of Americans have saved enough money to cover unexpected expenses. This statistic [...]

Money is power, nothing can surmount the value of money, or so people say. When I heard the remark, thoughts ceaselessly fluttered throughout my mind, trying to assess the concept of money. Money tends to turn humans into peons. [...]

My financial situation is not stable right now. My mother sends me money every month so I can cover my expenses and buy whatever I need. I don’t have that much of monthly expenses, mostly my phone bill expenses, groceries, [...]

Related Topics

By clicking “Send”, you agree to our Terms of service and Privacy statement . We will occasionally send you account related emails.

Where do you want us to send this sample?

By clicking “Continue”, you agree to our terms of service and privacy policy.

Be careful. This essay is not unique

This essay was donated by a student and is likely to have been used and submitted before

Download this Sample

Free samples may contain mistakes and not unique parts

Sorry, we could not paraphrase this essay. Our professional writers can rewrite it and get you a unique paper.

Please check your inbox.

We can write you a custom essay that will follow your exact instructions and meet the deadlines. Let's fix your grades together!

Get Your Personalized Essay in 3 Hours or Less!

We use cookies to personalyze your web-site experience. By continuing we’ll assume you board with our cookie policy .

- Instructions Followed To The Letter

- Deadlines Met At Every Stage

- Unique And Plagiarism Free

Essay on Ways to Save Money

Students are often asked to write an essay on Ways to Save Money in their schools and colleges. And if you’re also looking for the same, we have created 100-word, 250-word, and 500-word essays on the topic.

Let’s take a look…

100 Words Essay on Ways to Save Money

Importance of saving money.

Saving money is a crucial life skill. It helps us prepare for unexpected expenses, achieve financial goals, and secure our future.

Creating a Budget

One of the best ways to save money is by creating a budget. It helps track income and expenses, allowing us to identify areas where we can save.

Limiting Unnecessary Spending

Avoiding impulse buying and unnecessary expenses can significantly increase savings. Always ask, “Do I really need this?”

Using Discounts and Coupons

Using discounts, sales, and coupons can help save a lot of money. They reduce the cost of items, allowing us to save more.

Saving Small Amounts

250 words essay on ways to save money, introduction.

Money management is a critical skill, especially for college students who often operate on tight budgets. The ability to save money can contribute to financial independence and stability. Here are a few ways to save money.

Create a Budget

The first step towards saving money is creating a budget. It allows you to understand where your money is going and how much you can save. Prioritize your needs over wants and make adjustments accordingly.

Automate Savings

Automate a portion of your income to go directly into a savings account. This ensures you save before you start spending. It’s a simple, yet effective way to build your savings over time.

Utilize Student Discounts

Many businesses offer student discounts. Use these to save on everything from meals to textbooks. It’s a small step that can add up to significant savings.

Limit Eating Out

Eating out frequently can significantly impact your budget. Opt for cooking at home or using meal plans provided by the college. It’s healthier and more cost-effective.

Buy Second-Hand

Saving money in college might seem challenging, but with a few strategic changes, it’s achievable. Remember, every penny saved today is a step towards a financially secure future.

500 Words Essay on Ways to Save Money

Financial management is a crucial life skill, especially for college students who are just beginning to navigate their own financial waters. With increasing expenses and limited income, it becomes essential to identify effective ways to save money. This essay explores some advanced strategies to manage finances better and save money.

Automating Savings

One of the best ways to ensure regular savings is by automating the process. Most banks offer automatic transfers from checking to savings accounts. By setting up a monthly transfer, one can ensure they save a portion of their income before they get a chance to spend it. This method is often referred to as ‘paying yourself first’.

Embracing Minimalism

Minimalism is a lifestyle choice that focuses on reducing unnecessary possessions and living with only what is needed. By embracing minimalism, college students can significantly reduce their expenses. This approach allows them to save money by avoiding impulsive purchases and focusing on quality over quantity.

Utilizing Student Discounts

Investing in education.

While this may seem counterintuitive, investing in one’s education can lead to long-term financial benefits. Acquiring skills that are in high demand can lead to better job opportunities and higher income in the future. Online courses, certifications, and workshops can provide these skills at a fraction of the cost of traditional education.

Cooking at Home

Eating out or ordering in can quickly add up. Cooking at home not only saves money but also promotes healthier eating habits. Learning to cook basic meals and prepping meals in advance can significantly reduce food expenses.

Saving money as a college student may seem challenging, but with careful planning and discipline, it is achievable. By creating a budget, automating savings, embracing minimalism, utilizing student discounts, investing in education, and cooking at home, students can significantly improve their financial health. These strategies not only help in saving money but also inculcate valuable financial management skills that will serve them throughout their lives.

If you’re looking for more, here are essays on other interesting topics:

Apart from these, you can look at all the essays by clicking here .

Leave a Reply Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Sample Essay on How to Save Money: How to Be in Good Funds When You Are a Student

Students are always looking for ways to save money. Some turn to part-time jobs while others resort to reducing their expenditure. This is a sample essay on how to save money that could inspire you to write a masterpiece on this issue.

The life of a college student is not as rosy as most people imagine it to be. Well, there are amazing parties and all sorts of fun things to do when in college, but that’s just it. Students have societal expectations to deal with. They have assignments and projects to deliver and exams to ace. This is no easy task since some of the courses in college are tough and ever-absent professors don’t make things easier as well. There is also the issue of student finances to deal with. Without a steady income, college students are forced to rely on student loans and funds from their parents to see out a semester. These funds, however, are not always enough and students are forced to turn to unorthodox means to make sure they have enough for their education. Students are forced to reduce their spending on certain items, and this usually comes with harsh consequences.

In an attempt to save more, students would resort to cheap meals or even skip some of them altogether. These cheap meals are usually very unhealthy, and the students miss out on the vital nutrients that are needed for healthy growth and development. Some of the cheap meals that students turn to in an attempt to save money include fast foods such as French fries and burgers. These meals are unhealthy, and their regular consumption has a bad impact on people’s health.

Cutting out on entertainment is another ‘luxury’ that students do away with to save money. Movies and music concerts cost money and students avoid them so as to save as much as they can. Some even avoid going out with their friends and spend most of their time in their rooms. Entertainment, however, is very important for the emotional development of a human being, and students are advised to take time for entertainment. A lack of entertainment among college students may cause depression and other emotional issues since all that the students will be thinking about is books and their academic assignments.

Students also turn to free software and applications so as to save money. These non-premium versions, however, come with a lot of bugs and students are at risk of virus attacks to the minimum.

Some would even terminate their gym membership to save money. Most colleges have gyms on campus, but they are usually in a poor state and that is why students visit gyms that are off campus. When times get tough, most students would terminate their membership so as to save as much as they can. Without working out, students get unhealthy, and this brings a lot of challenges.

Tough times call for tough measures. Students resort to the above-mentioned activities to save money, but these methods have some harsh consequences attached to them.

References:

- Boatman, A., Evans, B., & Soliz, A. (2014). Applying the lessons of behavioral economics to improve the federal student loan programs: Six policy recommendations. Policy report written for the Lumina Foundation .

- Buckley, A., Soilemetzidis, I., & Hillman, N. (2015). The 2015 student academic experience survey. The Higher Education Policy Institute and Higher Education Academy .

- Duclos, R., & Khamitov, M. (2016). Is Cash Almighty? Effects of Hard vs. Soft Money on Saving/Investment Behavior.

- Fagerstrøm, A., & Hantula, D. A. (2013). Buy it now and pay for it later: An experimental study of student credit card use. The Psychological Record , 63 (2), 323.

- Garbinsky, E. N., Klesse, A. K., & Aaker, J. (2014). Money in the bank: Feeling powerful increases saving. Journal of Consumer Research , 41 (3), 610-623.

- Karlan, D., & Linden, L. L. (2014). Loose knots: strong versus weak commitments to save for education in Uganda (No. w19863). National Bureau of Economic Research.

- Thompson, S., Cross, W., Rigling, L., & Vickery, J. (2017). Data-informed open education advocacy: A new approach to saving students money and backaches. Journal of Access Services , 14 (3), 118-125.

Our statistics

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

5 Easy Ways to Take Control of Your Personal Finances

- Kiara Taylor

Managing your money doesn’t have to be overwhelming.

Don’t let your finances stress you out to the point of inaction. Instead, take back control by following the steps below:

- Start budgeting. But here’s the key: Don’t use your budget to set unrealistic goals about how much you are going to save and how much extra money you will earn. Instead, aim to make it an accurate description of how your finances work. See where you could be spending more or spending less.

- Create an emergency fund. Putting aside $50 a month can really add up. You should aim to have at least $1,000 in your fund until you are out of debt.

- Be honest with yourself. The financial gap resulting in your debt might be caused by a number of factors – you may not be earning enough, or you may be spending too much. You need to name the problem to figure out the right long term solution.

- Ask for help. There are plenty of services out there that can help you take back control — from financial planning services to debt management advisors to credit counseling services.

The last year has been a very difficult one. Not only have we had to deal with travel restrictions, lockdown orders, and fears of getting sick — many of us have also been struggling financially. In fact, research suggests that financial stress is at an all-time high in America, a phenomenon explained by the numerous hiring freezes and layoffs brought on by the pandemic.

- KT Kiara Taylor has more than 10 years of experience in finance, ranging from fixed income to emerging markets. She enjoys writing on the impact of both micro and macro trends on global finance, and has contributed to Investopedia , The Balance , and Crunchbase .

Partner Center

I thought I was giving my kids the best childhood ever until my 4-year-old asked why we didn't own a 'bigger golf cart'

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate products and services to help you make smart decisions with your money.

- My family lives in an affluent area, but I don't want my kids to take money for granted.

- I'm taking four steps to teach them good financial habits, including introducing chores early.

- I'm also transparent with them, and sometimes say no to things they want even if we can afford it.

My parents didn't put a lot of focus on teaching me about money growing up. Instead, learning about finances and budgeting just sort of happened. I was aware from a young age, for example, that sometimes the family budget didn't have wiggle room that month for the pair of shoes I so desperately wanted or a night out for pizza. In general, I knew we were middle class.

Today, my husband and I live in an affluent area and are lucky enough to have disposable income each month. Our community also has well-maintained parks, pools, and water parks. We even have a golf cart, much to my chagrin.

I thought I was giving my kids the best childhood ever until my 4-year-old asked why we didn't own a "bigger golf cart." A few weeks later, he asked me what it meant to be rich. I thought I had time to teach my two young kids about money, but I was wrong.

Here's how I'm teaching my kids about money, finances, and how to appreciate what you have.

1. I'm limiting gifts

I'll be the first to admit I love holidays. I've always thrown myself headfirst into the decor, themed birthday parties, and, yes, even gifts. But as my kids have gotten older, I've realized that I'm not doing them any favors by having a towering stack of gifts on every holiday.

That's why my husband and I set a limit for gifts for the two major holidays — five for birthdays and 10 for Christmas. While our gift limits may not work for everyone, it's what works best for our family. An added bonus? It helps take some of the stress out of the holidays.

2. I'm introducing chores early

My 4-year-old feeds the dogs, puts his dirty laundry away, and helps pick up the playroom. The 2-year-old has mastered putting his dirty dishes in the sink, and they both think it's fantastically exciting to take out the trash. We also recently did a lemonade stand. While I helped my older son with a bit of social media marketing, he did the majority of the work himself and pocketed $26.

3. I'm saying no, even if we can afford a yes

Have you ever been to a Build-A-Bear with two children? I'm here to tell you that you won't escape that place for less than $40 per kid, and that's if you opt for the most bare-bones bear package. My husband recently splurged on this for our two boys one rainy Saturday, and now they ask to go there every single time we're at the mall.

Sure, we could swing another stuffed animal or perhaps some accessories for our current bear residents, Fluffaduck and Wilder. But I always say no. We also rarely buy toys unless it's for a holiday or the kids use their own money. I think it's good for kids to know that they can't always get what they want and that just because you have the money doesn't mean you should spend it.

4. I'm transparent with them about our money

I used to try to shield my kids from tricky subjects. But kids, as they inevitably do, always ask the hard questions.

Recently, on a trip downtown, one of my boys noticed a homeless person and asked what they were doing and why they had so much stuff with them. I had to explain that they probably didn't have enough money for a house or an apartment and that they slept outside or in a shelter. But I made it a point to explain that while sometimes being homeless can be a result of not making good choices, sometimes it's a result of not having good choices.

"Not everyone is lucky enough to live in a nice house with lots of toys like you and your brother," I explained. While I'm not quite sure he grasped the societal complexities, socioeconomic inequities, and mental illness stigma that contribute to homelessness, I do think he now understands that he's luckier than others in terms of material possessions.

As for his question about what it means to be rich, I explained that being rich can mean many different things, from making lots of money and living in a large house to having lots of friends and a house full of loved ones. I hope that's one money lesson that really sticks.

This article was originally published in May 2022.

- Main content

IMAGES

VIDEO

COMMENTS

It's really rooted in the experience one gets in choosing how to spend it. First, there's the anticipation of receiving an allowance. Next, there's the excitement of thinking about all the things you've been wanting to get for yourself. Third, there's the delight of actually receiving the allowance.

In a nutshell, I'd spend my money on guitar because that's what I need to play a new instrument. They said money can't buy happiness but it can surely help me achieve my goals. Your class has been discussing how to spend their money. Your teacher asked you to write an essay about what you would spend your money on.

In your essay, you should write about: the things you spend your money on where you buy these things how you save money while shopping. Impulsive buying is a widespread inappropriate shopping behaviour. We must manage our hard-earned money wisely so we will not overspend. Therefore, all Malaysian must have good financial planning. I usually ...

For example, last year my uncle suffered a major heart attack which required him to undergo very expensive cardiac surgery. He did not have enough money to pay for this procedure, so he had to ask his elderly parents for a loan. They were able to help him because they had resisted the urge to spend and saved money through their entire lives.

Other research shows there are specific ways to spend your money to promote happiness, such as spending on experiences, buying time, and investing in others. Spending choices that promote ...

2. Use the Budget. Your budget is useless if you make it and then let it collect dust in a folder tucked away in your file cabinet or never open it again on your computer. Refer to it often throughout the month to help guide your spending decisions. Update it as you pay bills and spend on other monthly expenses.

This lack of savings can hinder individuals from pursuing their aspirations and lead to financial stress. By saving money consistently, individuals can build the financial resources necessary to achieve their goals and secure their future. Debt Reduction. Saving money can also help individuals reduce and avoid debt.

250 Words Essay on Money Management What is Money Management? Money management means taking care of your money. It's like knowing how to use your pocket money wisely. You plan how to spend it, save some, and make sure you have enough for things you need. Saving Money. Saving is putting money aside for later. Imagine you want a new toy or a book.

1. Approaches to Saving Money. Saving money involves a combination of disciplined strategies and prudent decision-making. Several approaches can help individuals build a solid financial foundation: Budgeting: Creating a budget is a fundamental step in effective money management. It allows individuals to track their income and expenses, identify ...

In conclusion, saving money is an essential skill that can lead to financial security and the ability to achieve life goals. By budgeting, creating an emergency fund, investing, and practicing discipline and consistency, college students can lay a solid foundation for their financial future. 500 Words Essay on Saving Money Introduction

How to spend your money. What should you do with your paycheck? These talks offer reframes to help you save, spend and give — with intention. Watch now. Add to list. 19:28. Laurie Santos. A monkey economy as irrational as ours. 19 minutes 28 seconds. 15:42. Daniel Goldstein. The battle between your present and future self.

Published: May 19, 2020. Using emotional intelligence, being organized and disciplined, saving and being informed about the economic environment are some of the recommendations made by experts. By Alejandra Clavería Managing personal finances can be a headache for many. Divide the income to pay bills, invest, save or allocate for extra ...

Paraphrase the overall essay topic. Write a clear opinion. Read more about introductions here. 1. The reason people now talk about money is that it is socially acceptable. 2. In past generations, discussing money was considered "in poor taste" and most people were reserved in order to not appear arrogant or desperate.

500+ Words Essay on Money. Money is an essential need to survive in the world. In today's world, almost everything is possible with money. Moreover, you can fulfill any of your dreams by spending money. As a result, people work hard to earn it.

Yes, it's ok to shop and buy nice things, but you want to make sure you can afford what you are buying, and it's not at the expense of your financial goals or obligations. 6. Shopping when you're upset or bored. A common bad money habit to watch is shopping when you're bored or upset.

4. Shop alone. Children, friends who love shopping, or even just a friend whose tastes you respect can influence you to spend extra money. Do not take advice from store employees. If you need a question answered, politely listen to their response but ignore any advice on purchasing decisions.

Pocket Money Essay: 'Pocket Money' is the term for the money that parents give to their children to spend every month. In America, they call it 'allowance'. ... I give her some money to spend or buy some things for her. During some months, I'm able to save most of my pocket money. At times I'm not able to save anything at all ...

1. Don't Spend it All. It seems pretty simple, but spending less than you earn is an essential first step to stabilizing your situation and having something left over at the end of the month. The easiest way to track this is on a monthly basis. Chances are you already know how much money you earn in a month.

Get original essay. First and foremost, students can manage their money by creating a budget that includes everything. Students should list out the source of income, such as parents' allowance, part-time job, study loans or any grants. Then, they can map out the estimated expenses for a week or a month including expenses like food, travel ...

Automating Savings. One of the best ways to ensure regular savings is by automating the process. Most banks offer automatic transfers from checking to savings accounts. By setting up a monthly transfer, one can ensure they save a portion of their income before they get a chance to spend it. This method is often referred to as 'paying yourself ...

1. Set savings goals-. The first step to take before jumping into the process of saving your money is setting your saving goal. If you have something …show more content…. Cut some expenses-. If you're having problem managing your budget to save, you might want to cut off some of your expenses. The first thing you can do is remove ...

This is a sample essay on how to save money that could inspire you to write a masterpiece on this issue. The life of a college student is not as rosy as most people imagine it to be. Well, there are amazing parties and all sorts of fun things to do when in college, but that's just it. Students have societal expectations to deal with.